When the market is in a bloodbath, it is the time for smart investors to start looking for undervalued gold.

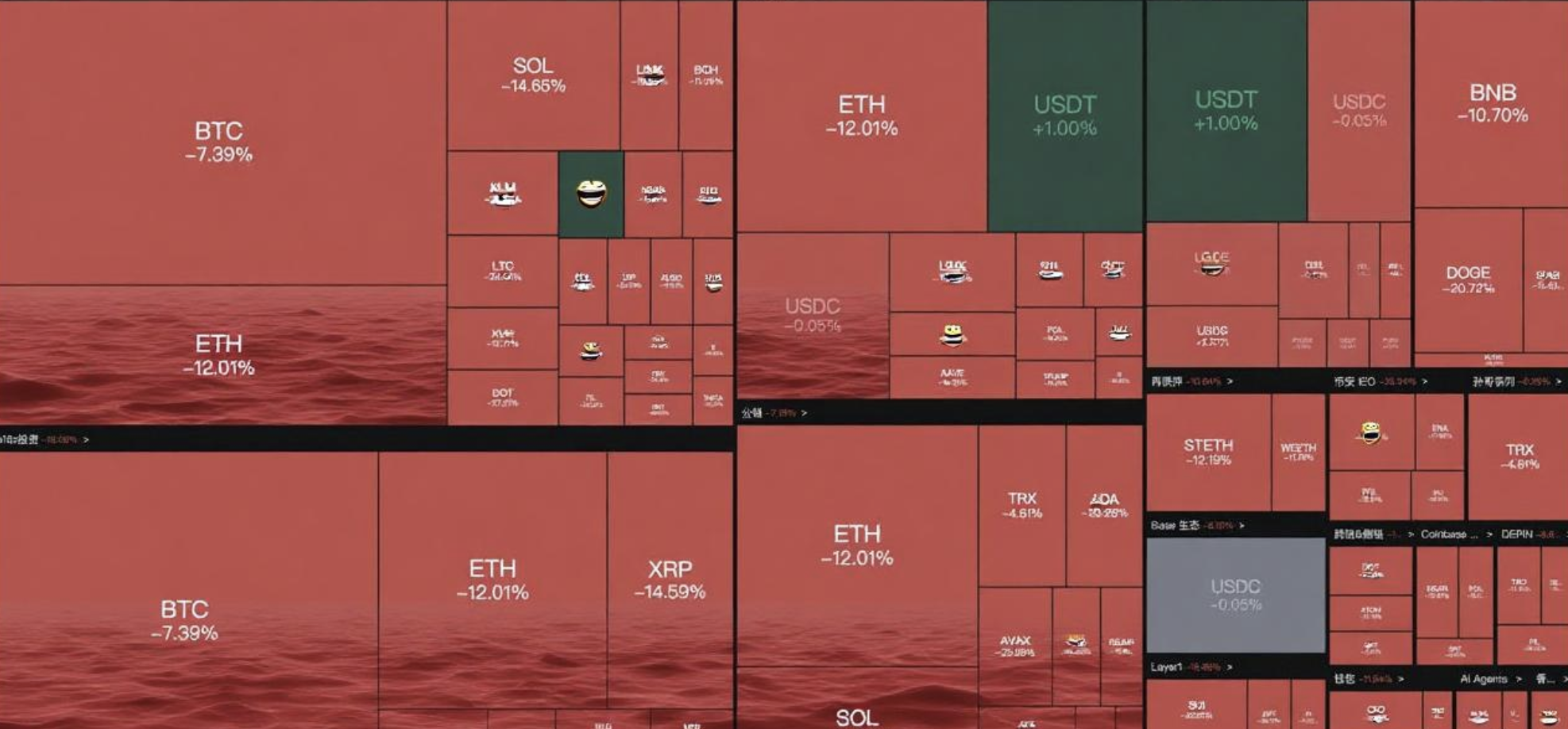

From October 10 to 11, 2025, global markets experienced a rare synchronized crash. The three major U.S. stock indices recorded their worst declines since April, with the Nasdaq Composite Index plummeting 3.56%, the S&P 500 Index falling 2.71%, and the Dow Jones Industrial Average losing the 40,000-point mark. The cryptocurrency market was even more brutal, with Bitcoin briefly dropping below $110,000, Ethereum plunging over 12%, and the total liquidation amount across the network reaching $19.1 billion, affecting more than 1.52 million people.

This global crash was directly triggered by a tariff threat issued by U.S. President Trump on the Truth Social platform, leading to a sharp escalation in U.S.-China trade tensions, with Trump threatening that the cumulative tariff rate on China would reach 145%.

01 The Core Reasons for the Market Crash: Staying Rational Amid Panic

The global market crash was the result of multiple factors resonating together. The immediate catalyst was the sharp escalation of the U.S.-China trade game. Trump threatened to impose high tariffs on China, and China announced an increase in tariffs on all U.S. goods to 125% as a countermeasure. This policy black swan triggered a panic sell-off of global risk assets.

The U.S. think tank Tax Foundation pointed out that a three-digit tariff rate would effectively sever most trade relations between the U.S. and China, posing a serious threat to global economic growth. The bursting of the tech stock valuation bubble was another significant factor.

The "Big Seven" tech stocks in the U.S. all suffered heavy losses, with Tesla leading the decline by over 5%, Amazon dropping nearly 5%, and Nvidia falling over 4%. The STAR Market's Sci-Tech 50 Index in China plummeted 5.61%, showing clear signs of valuation bubbles. The concentration of leveraged funds closing positions exacerbated the market decline. In the cryptocurrency market, high-leverage contracts triggered a chain liquidation, with 1.52 million people liquidated in the past 24 hours, with the majority being long positions.

The tightening of macroeconomic liquidity cannot be ignored either. The U.S. government shutdown entered its 10th day, and the federal employee layoff process has begun, further intensifying market concerns about the uncertainty of U.S. economic policy.

02 Three Hidden Opportunities for Wealth During the Crash

1. Cryptocurrency Oversold Rebound Opportunity

The cryptocurrency market has entered a technically oversold area. Bitcoin plummeted from its peak to below $110,000, with buying depth clearly outperforming selling, indicating that funds are stepping in at low levels. The fundamentals of the three major cryptocurrencies have not deteriorated: BTC's status as digital gold, ETH's core ecological value, and SOL's high growth potential remain solid. The RWA track within the SOL ecosystem continues to maintain a high growth rate, with no fundamental changes. By utilizing AiCoin's market anomaly monitoring feature, short-term trading opportunities can be discovered in real-time.

Click on the homepage → Popular Rankings → Anomalies to monitor coins that have risen over 3% or 5% within 5 minutes, capturing the time cycle characteristics of price fluctuations.

Discover opportunities at the first moment and place orders conveniently.

Through AiCoin's anomaly monitoring feature, short-term trading opportunities can be discovered in real-time. Click on the homepage → Popular Rankings → Anomalies to monitor coins that have risen over 3% or 5% within 5 minutes. This feature is based on AI algorithms that can identify the anomalies in spot and contract funds of cryptocurrencies, providing key data such as the first and last anomaly times and current market prices. Real-time anomaly monitoring is the first line of defense for discovering short-term opportunities, especially important in a volatile market.

2. Bottom Fishing at Low Levels

Compared to contract players, the biggest opportunity for spot users is naturally bottom fishing at low levels—if you had orders placed at low levels last night or stayed up all night, you would have had the chance to buy:

- XRP at $1.25;

- DOGE at $0.095;

- SUI at $0.55;

- IP at $1;

- XPL at $0.25 (this was $2.7 just a few days ago);

- ARB at $0.1;

- AAVE at $79;

- PENDLE at $1.65;

- JUP at $0.05;

- ENA at $0.13;

- UNI at $2;

- TRUMP at $1.5;

Yes, you read that right! Directly see the image ↓…

After the market relatively recovered, many KOLs began to share their profit situations on X, such as Vida (@Vida_BWE), who disclosed a profit of about $8 million overnight.

3. Stablecoin Decoupling

In last night's market-wide collapse, aside from those highly volatile and uncertain altcoins, the severe decoupling of USDe undoubtedly provided a typical crisis gaming opportunity for sharp investors. Due to extreme market volatility and chain liquidations, many users rushed to exchange USDe for stable assets like USDT to supplement their margin, leading to a severe liquidity crunch for USDe in the secondary market. According to AiCoin's anomaly monitoring data, its price on exchanges like Binance briefly plummeted to $0.65, with a decoupling extent of up to 35%.

For investors well-versed in arbitrage, this pricing error caused by a short-term liquidity crisis is an excellent entry opportunity. The underlying logic is that the minting and redemption mechanisms of the USDe protocol are still functioning normally, and Ethena Labs has clearly stated that its underlying assets remain over-collateralized.

This means that when market panic subsides and liquidity is restored, there is a strong intrinsic motivation for the price to return to the pegged price of $1.

Some investors used AiCoin's real-time price alerts and market cloud map features to accurately capture this momentary pricing deviation and decisively bought at the price low.

As market panic gradually eased, the USDe price quickly repaired towards the pegged price, and these investors successfully completed a high-odds "decoupling arbitrage" trade.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX Benefits Group:

https://aicoin.com/link/chat?cid=l61eM4owQ

Binance Benefits Group:

https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。