"Isn't it the same where you buy coins?" — This is a common confusion among many investors, especially beginners. They see exchanges merely as trading channels, believing that selecting the right asset is key. But is that really the case?

Recently, the AiCoin Research Institute conducted a systematic data comparison of Binance, OKX, Bitget, Gate, MEXC, Bybit, KuCoin, the seven major centralized exchanges (CEXs), focusing on profitability, risk control capability, and new coin listing speed to answer a more fundamental question: How do the underlying logic differences between exchanges affect investors' chances of making money?

Core Conclusion First: There is No "Universal Printing Machine," Only "Precise Adapters"

Data does not lie: the strategic differentiation among the seven exchanges far exceeds external perceptions. It is not simply a matter of "good vs. bad," but rather the positioning differences between "stable beta" and "high-risk alpha," "comprehensive platforms" and "vertical tracks." The essence of choosing an exchange is selecting a "wealth battlefield" that matches one's own risk preference, investment cycle, and capital attributes.

Three Dimensions Breakdown: Who is "Guaranteed Profit," Who is "Betting for High Returns"

1. Profitability: Choosing the Right Battlefield Determines the Earnings Ceiling

If we use "capturing mainstream trends + consistently outperforming the market" as the standard, Binance and OKX are undoubtedly in the top tier.

Data shows that the proportion of coins outperforming Bitcoin on their platforms has long been above the industry average, primarily due to two reasons:

- Strict project screening mechanisms, with new listings more inclined towards market-validated mid-tier quality projects;

- A large user base and ample liquidity, allowing mainstream coin trading depth to support medium to long-term strategies.

For most investors, making money here relies more on "judging trends" rather than "betting on obscure coins," essentially being a stable output of "high-quality beta returns."

In contrast, MEXC, Gate, KuCoin present a different logic: their "positive return long tail" (i.e., the probability of capturing hundredfold or thousandfold coins) is significantly higher than other platforms. These exchanges adopt a "sea of coins" strategy, listing a number of projects that is several times that of leading platforms, covering a large number of early, niche, or even experimental projects.

For small capital, there may be opportunities to "bet on a high-return asset" here, but the cost is that the negative return long tail is equally prominent (e.g., the risk of some obscure coins going to zero). In short, they are "hunting grounds for high-risk alpha," suitable for scanning the frontier with very small positions.

Bitget and Bybit exhibit differentiated characteristics:

- Bitget excels in providing liquidity support for new coins linked to spot and contracts, with early gains of some popular projects amplified by contract users;

- Bybit, due to a high proportion of institutional funds, has an advantage in capturing swing opportunities in large-cap coins.

2. Risk Control Capability: Filtering Traps, Protecting Principal Safety

Another major pain point for investors is "stepping on landmines" — buying coins that have plummeted or gone to zero.

Data reveals that Binance and OKX have the strongest risk control filtering capabilities. Their due diligence on project teams (such as team background, code openness, community activity) is stricter, and their monitoring response to abnormal fluctuations is faster, significantly reducing the probability of "unwarned crashes." These two platforms are more suitable for investors who dislike black swans and seek a "safety cushion for principal."

In contrast, MEXC and Gate rely more on "natural market elimination" for risk control: due to the large number of projects listed, the platform's review standards for individual projects are relatively lenient, requiring investors to bear the "screening costs" themselves. Without the ability to discern information, it is easy to fall into the "zero trap."

3. New Coin Listing Speed: The "Time Difference" in Capturing Frontiers

For investors keen on "new listings" and chasing early dividends, KuCoin, MEXC, Gate are the top choices.

These three platforms have more flexible coin listing processes and the fastest response times for emerging public chains, meme coins, and new application layer projects, often opening trading 1-3 days ahead of leading platforms.

However, it is important to note that "speed" also means risks of information asymmetry — some projects may go live just to "ride the wave," with actual value in doubt.

Binance and OKX focus more on "certainty" for new coin listings: they tend to choose projects that have received some market recognition, although slightly slower, the probability of "exploding upon launch" is higher;

Bitget balances speed and safety through a "following popular coins from leading platforms" strategy.

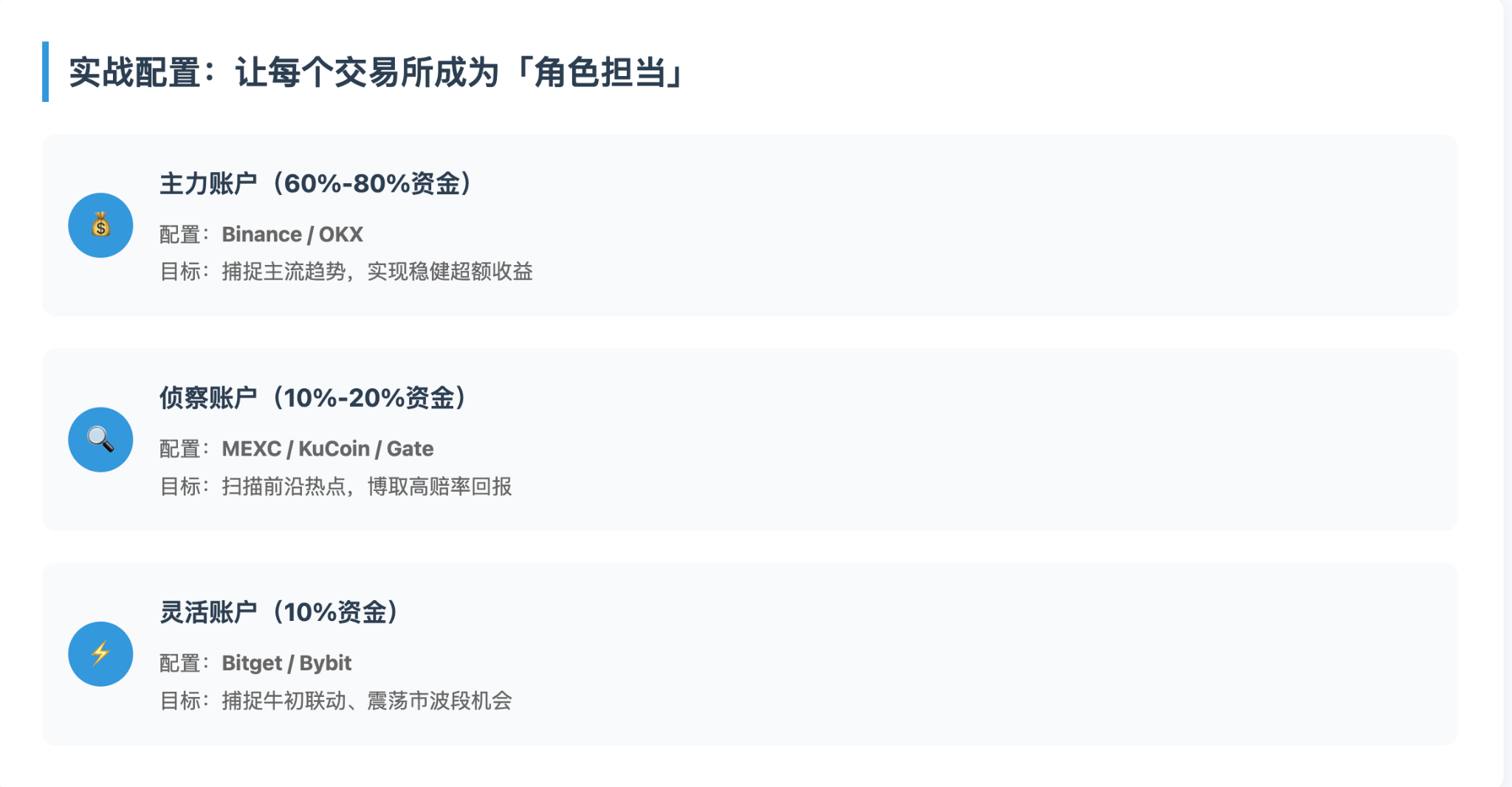

Strategic Recommendations: Combination Configuration, Making Each Exchange a "Role Player"

Returning to the initial question: who is the "printing machine"? The answer depends on your investment goals.

- Main Account (60%-80% of funds): Binance/OKX as the "core wealth holding," where you capture mainstream trends and achieve stable excess returns. Use a medium to long-term mindset to layout, relying on judgments of project fundamentals and market cycles rather than short-term speculation.

- Scout Account (10%-20% of funds): MEXC/KuCoin/Gate as the "opportunity window," using small funds to scan frontier hotspots and participate in early project speculation. Strictly adhere to "stop-loss discipline" to avoid greed eroding the main account's returns.

- Flexible Account (10% of funds): Bitget/Bybit to switch with market styles: in the early stages of a bull market, focus on Bitget's new coin linkage opportunities; in a volatile market, capture swing opportunities in large-cap coins through Bybit's institutional fund movements.

AiCoin offers exclusive discounts for binding the OKX DEX web version with the invitation code (AICOIN88), allowing low-cost participation in on-chain trading

By binding the invitation code AICOIN88 through the exclusive link below, you will receive:

✅ 20% fee discount! This means you can save 20% on every transaction on the DEX compared to others. Over time, this is a significant amount of wealth!

✅ Qualification to join our VIP benefits group! The group will periodically share wealth codes, airdrop tutorials, and whale movement analyses, keeping you one step ahead.

The operation is very simple:

Click the exclusive link below (the invitation code is automatically filled for you):

https://web3.okx.com/ul/joindex?ref=AICOIN88

In the wallet creation/import process, confirm that the invitation code AICOIN88 is bound. Done! Start enjoying the fee discount now!

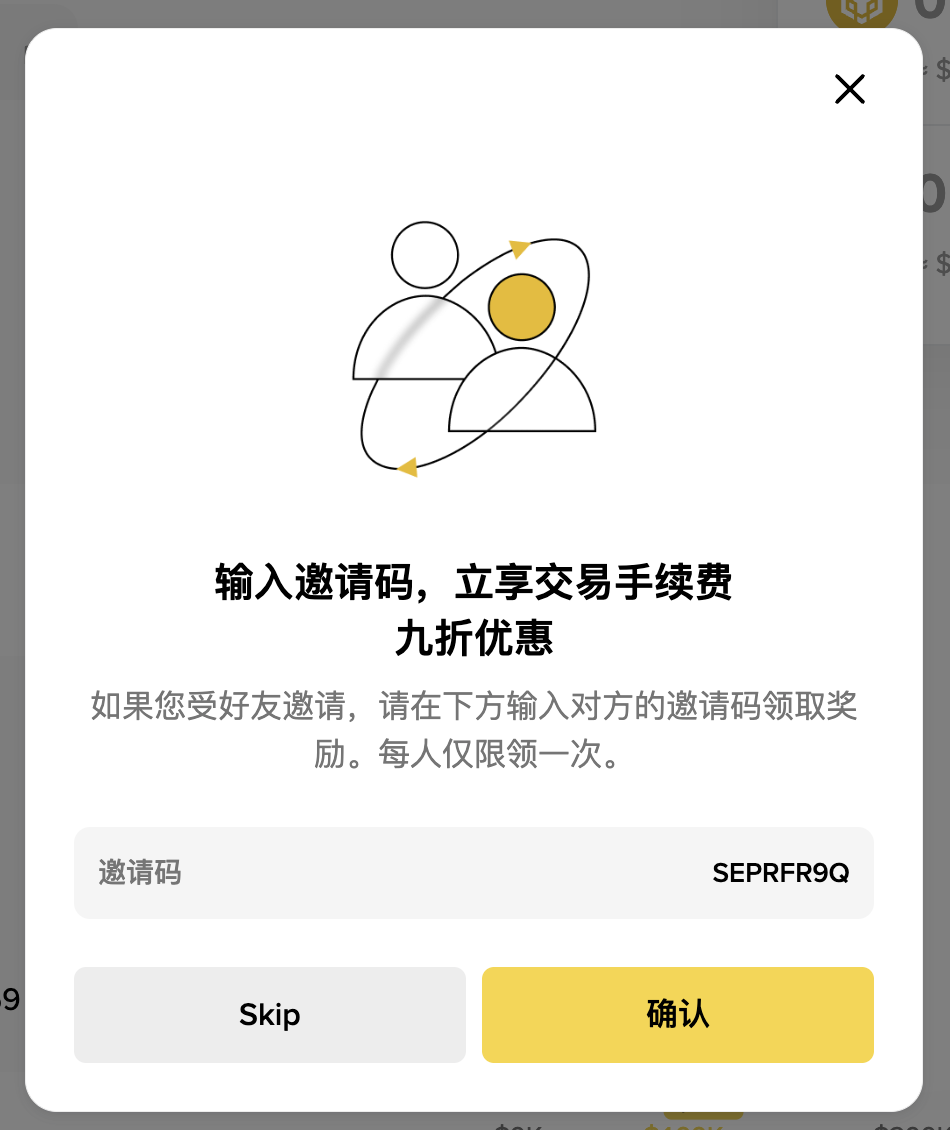

📌 Investing with Binance Wallet is very simple:

🟢 Click the exclusive link

https://web3.binance.com/referral?ref=SEPRFR9Q

(The invitation code is automatically filled)

🟢 Simple operation with the wallet: When completing the creation or import, confirm that the invitation code is SEPRFR9Q

🟢 Effective immediately: After binding, you can enjoy exclusive benefits such as fee rebates and VIP community qualifications!

You will receive:

✅ 10% permanent fee rebate! This means you can save 10% on every transaction on the DEX compared to others. Over time, this is a significant amount of wealth!

✅ Qualification to join our VIP benefits group! The group will periodically share wealth codes, airdrop tutorials, and whale movement analyses, keeping you one step ahead.

In Conclusion: The "Rotation Effect" of Exchanges and Long-Termism

Data also reveals a key phenomenon: no exchange can maintain a leading position at all stages.

For example, during the 2024 bull market, MEXC rose due to betting on multiple AI concept coins, while in 2025, when the BSC ecosystem exploded, KuCoin led with its ecological cooperation projects.

For investors, the true "printing machine" is not a single exchange, but rather the dynamic allocation capability based on data cognition — using the main account to safeguard the lower limit of returns, the scout account to push for the upper limit of returns, and the flexible account to capture structural opportunities.

AiCoin firmly believes: rational investors do not act as "casino gamblers," but rather as "battlefield commanders." The essence of choosing an exchange is selecting the "weapons" that match one's own strategy; ultimately, those who "understand the platform and understand themselves" will always win.

(This article's data comes from the AiCoin Research Institute, covering the full trading data of the seven major CEXs from Q4 2024 to Q3 2025, for reference only and does not constitute investment advice.)

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group:

https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group:

https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。