Friday brought carnage onto crypto markets as U.S.-China trade tensions ratcheted up with Trump threatening a massive increase in tariffs against Chinese goods.

Worst-hit among the crypto benchmark CoinDesk 20 Index constituents was Ethereum's native token ether (ETH), nosediving 7% from Friday's session high and hitting its weakest price since late September below $4,100. Its decline far outpaced bitcoin's (BTC) 3.5% drop below $118,000 and the index's 5% plunge.

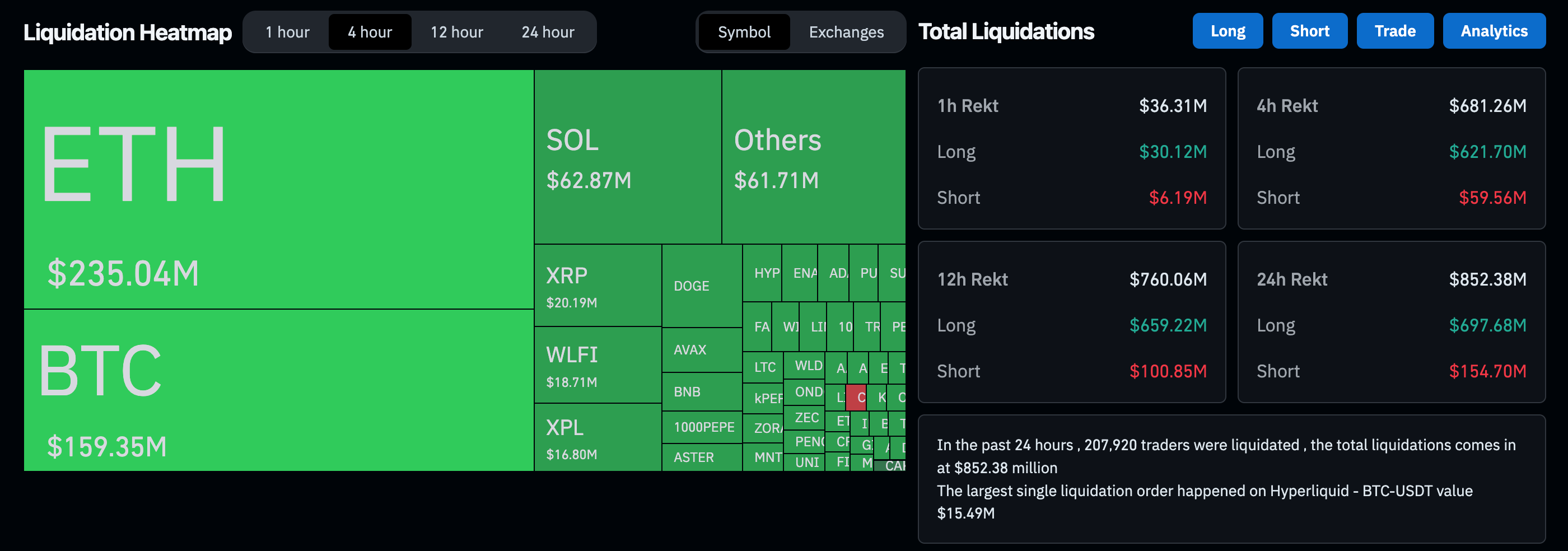

The broad-market downturn spurred a liquidation cascade across crypto derivatives markets, wiping out over $600 million of leveraged trading positions among all assets, CoinGlass data shows.

ETH also led in liquidations with over $235 million long positions wiped out through the session. Longs are leveraged bets seeking to profit from the asset's price rise.

Technical breakdown

Behind the liquidation cascade was ETH's breakdown of critical support levels, CoinDesk Research's technical analysis model suggested.

• Selling pressure materialized at around 14:00 UTC with a volume of 372,211 units, almost double than the 24-hour average of 190,747 units.

• Volume-based resistance confirmed around $4,287.

• Primary resistance identified at $4,141 during failed recovery attempt.

• Potential support forming just below $4,100 where buyers emerged.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。