After eight days of synchronized gains, the tides shifted in crypto ETF flows. Bitcoin maintained its inflow momentum alive, while ether funds saw their first red day in over a week, a rare divergence in what has been a strong institutional push into digital assets.

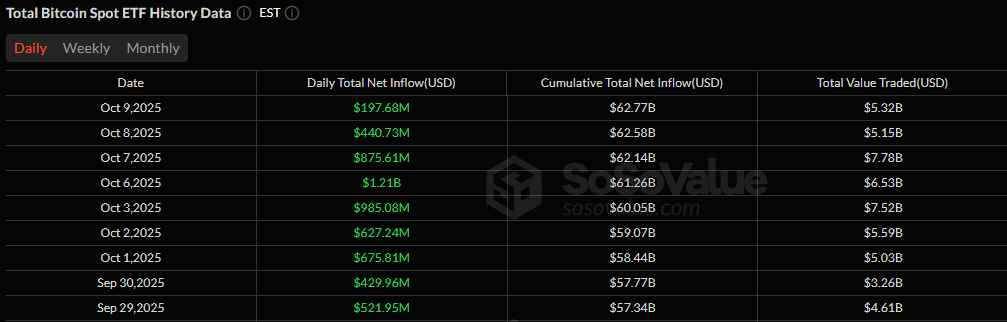

Bitcoin ETFs recorded $197.68 million in inflows, marking a ninth consecutive day of positive momentum. Blackrock’s IBIT once again led the charge, drawing in a robust $255.47 million. Bitwise’s BITB chipped in with $6.58 million, keeping the overall day positive despite some red prints elsewhere.

Grayscale’s GBTC shed $45.55 million, while Fidelity’s FBTC and Ark 21Shares’ ARKB saw outflows of $13.19 million and $5.63 million, respectively. Even with mixed flows, trading remained active at $5.32 billion, and total net assets held firm at $164.79 billion, signaling sustained market participation.

Bitcoin ETFs run continue, as ether ETFs take a breather. Source: Sosovalue

Ether ETFs, meanwhile, paused their remarkable run. After eight straight days of inflows, the group registered $8.54 million in net outflows. Blackrock’s ETHA stood out with a $39.29 million inflow, but it wasn’t enough to counter redemptions from peers.

Fidelity’s FETH (-$30.26 million), Bitwise’s ETHW (-$8.07 million), Vaneck’s ETHV (-$4.75 million), 21Shares’ TETH (-$2.59 million), and Invesco’s QETH (-$2.16 million) all saw exits that flipped the final net flow into negative territory. Trading volume came in at $2.34 billion, while net assets closed slightly lower at $29.90 billion.

The split performance could mark the start of a shift toward more allocation to bitcoin ETFs, as investor sentiment and strategy evolve.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。