A bigger fool meets a stronger dopamine.

Author: Rasheed Saleuddin

Translation: Deep Tide TechFlow

A good speculative bubble at least leaves behind infrastructure.

Yet our bubble leaves only high-priced screenshots, not even a cheap tulip bulb (Note: The 17th-century Dutch tulip mania, even this early speculative bubble had actual tulip bulbs as its underlying asset). A hollow bubble, leaving only air, untouched by any regulators. And it’s addictive.

All of this exists in a crazy, influence-driven, behavior-manic world where these euphoric self-promoters take pride in making traditional investors uncomfortable with their worthless crypto assets.

However, we seem willing to let insiders earn risk-free profits every time, while newcomers can only average unreturned risks, along with a lottery-like chance.

When headlines become investments

Marshall McLuhan once said, “The medium is the message.” A shooting hits the news, and within hours, crypto players hiring influencers launch a memecoin called RIPCharlieKirk. This is one of over 10,000 scams with the name “Charlie/Kirk.” The coin started on September 10 at nearly zero and closed that day at nearly $5 million, only to drop to about 1/15 of its peak. This is the product of now: a code that can be screenshotted, with no earnings, no value, just a name and a JPEG image.

Source: Pump.fun

A trader from Florida, Evan Rademaker, told Bloomberg that he spent $30,000 buying RIPCharlieKirk, ultimately selling at a loss of $17,000, and then chased the price again, incurring further losses.

The initiators and paid promoters lit the fuse, and market sentiment and social media did the rest. Most of these tokens are now close to zero, many will disappear. Those that barely survive rely on “hopium” and the sunk cost fallacy, while early insiders have already profited and exited.

Sometimes, “useless” is the whole point.

Useless Coin skyrocketed 40 times in just a few days, and its market cap is still close to $320 million. It has no practical use, which is precisely the definition of a memecoin: a cryptocurrency with no real application scenario.

In fact, Useless Coin has one use: to make insiders rich.

Despite the short lifespan of memecoins being like that of a fruit fly, thousands of investors, like Evan Rademaker, are still ready to gamble again through Robinhood accounts or crypto wallets. Why?

Not all bubbles are born equal

The definition of a soap bubble is filled with the air we breathe. But the meaning of an asset price bubble is entirely different.

We comfort ourselves with macroeconomic narratives: foolish money will fund real things, like canals, railroads, power facilities, Atlantic fiber optics, and perhaps the next big thing is artificial intelligence. The rocket boosters in a bubble are often true believers. And those failed rockets, like Global Crossing (Note: Global Crossing, a former telecom giant that rose during the internet bubble and quickly fell after the bubble burst, becoming one of the largest corporate bankruptcies in U.S. history), can still provide a “slingshot effect” for society.

But recently, memecoins and memestocks are in vogue. The bubble is filled with air, leaving nothing behind. No infrastructure. No intellectual property for other Silicon Valley garage startups to utilize. No future business to reorganize under Chapter 11 bankruptcy. And financial companies that only hold one asset you could buy yourself, and at a lower price.

This is merely a transfer of wealth from outsiders to insiders. The assets themselves are a joke; the exit is the business: free issuance to oneself and friends, then promotion, and finally selling to bigger fools.

The supply of these wealth-destroying machines is easily explained, and has always been so.

A Historical Review of Stock Manipulation

History is a record of stock pump and dump.

From the Vancouver Stock Exchange era (VSE) on Howe Street, filled with telemarketing scam centers, to Stratton Oakmont in "The Wolf of Wall Street."

Then to the email spam era, where emails proclaiming “APPM TO A DOLLAR!!!” would double and triple a worthless stock before lunch, only to crash.

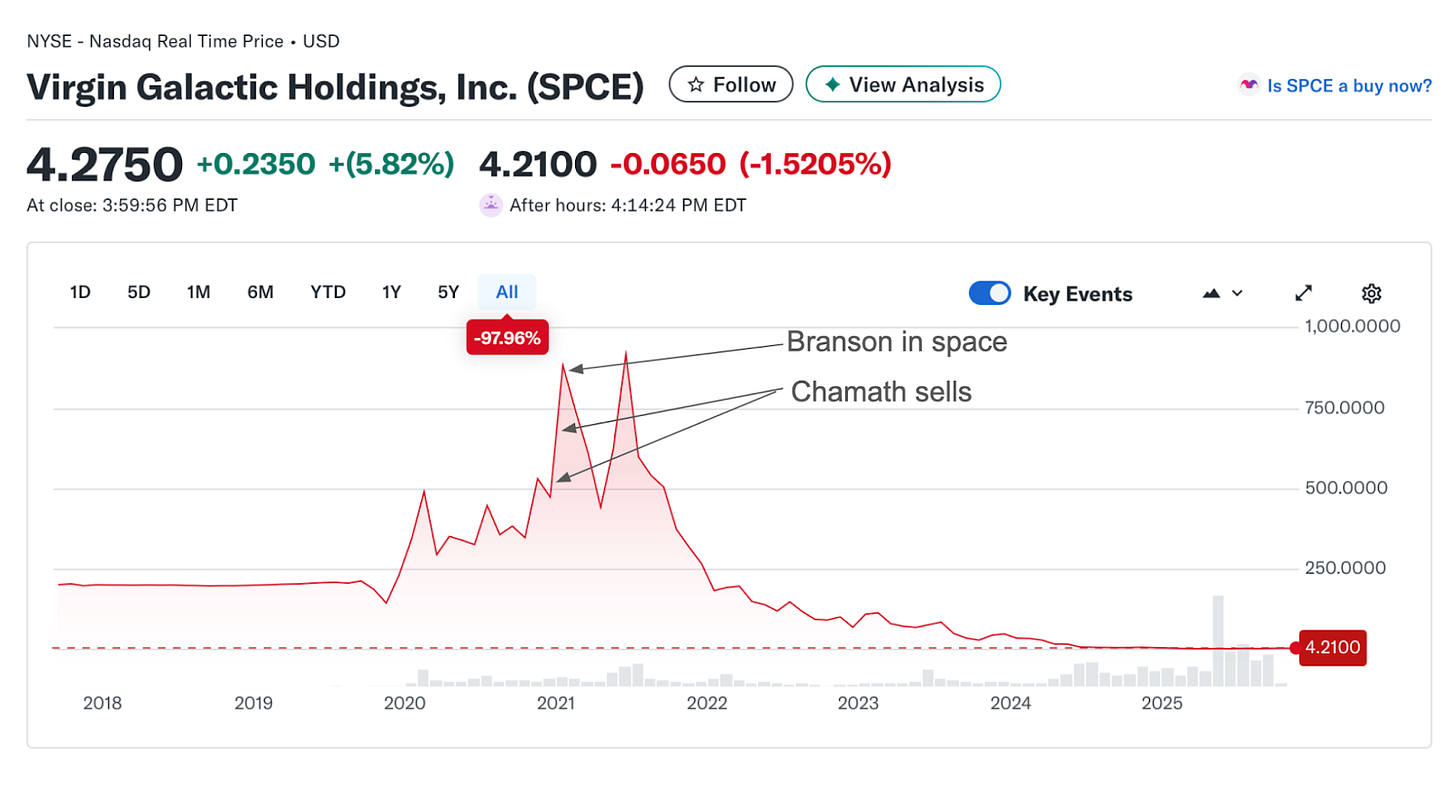

Special Purpose Acquisition Company (SPAC) sponsors earning eight-figure profits, making tens of millions while the stocks they promoted plummeted over 99%. Virgin Galactic had its shining moments when Richard Branson went to space, creating a brilliant record. Meanwhile, Chamath walked away with $315 million. Just look at the performance of ordinary shareholders:

Source: Yahoo Finance

The difference between past bubbles and the current ones is that past buyers were “suckers.” They couldn’t see their ignorance and firmly believed what they were buying had value. Some ended up in jail, and retail investors overall learned some lessons—though only temporarily.

Now they are back, where is Chamath?

SPACs are making a comeback, and now there are Crypto Treasury Companies, sometimes appearing simultaneously, like Cantor Equity Partners, whose trading price once reached 25 times its intrinsic value, but has now returned to reasonable pricing, down 96% from its peak. Meanwhile, the Bitcoin it primarily holds is at historical highs.

Source: Yahoo Finance

Are new memes the same as old memes? Not at all.

Memestocks are also making a comeback. Entering the “meme 2.0” era, there are even some of the same operators. Keith Gill, aka Roaring Kitty, returns three years after Memestock 1.0. But GameStop now has some fundamentals to anchor its price, making obvious manipulation more difficult.

Thus, promoters have adapted to the changes. Now the “investment” itself is designed to be worthless, so there will be no debate about intrinsic value.

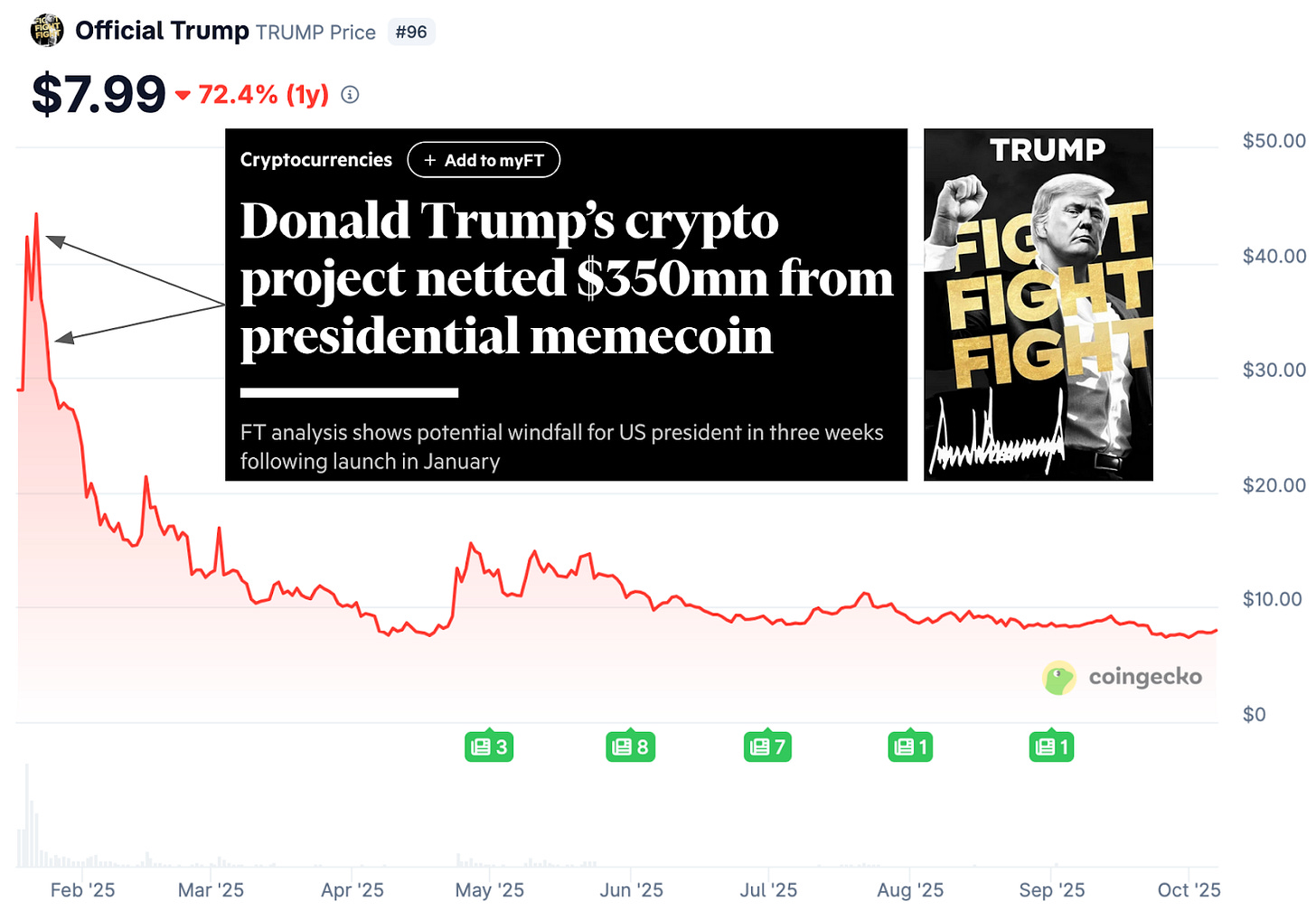

New crypto memecoins are born every day, sometimes 100, sometimes 1000. Even the White House has gotten involved. $TRUMP initially launched at under $1, skyrocketed to over $40, and then fell back to earth. Insiders still made about 8 times their investment. The Trump family cashed out early for about $350 million. It’s a so-called “upgrade” of SPACs and treasury companies.

Source: Coingecko.com

Such stories are repeatedly played out on major crypto issuance platforms. On Solana’s Pump.fun platform, multiple analyses from Dune show that over 60% of wallets are in a state of loss, only 0.4% of wallets have profits exceeding $10,000, and 81% of tokens have dropped over 90% from their historical highs. In terms of wealth loss, this even surpasses SPACs—both in quantity and proportion.

However, the ethical standards of the coin issuance industry are concerning. Solidus Labs revealed that 98.6% of Pump.fun projects and 93% of Raydium pools show signs of fraud.

Nevertheless, scams like $TRUMP remain standing. There’s also MELANIA, and LIBRA, where 86% of traders collectively lost $251 million. Dogecoin (DOGE), SHIB, and other memecoins worth billions are still active. We are in the third surge of Dogecoin, with a market cap reaching $40 billion. Will the third time be the lucky one? Meanwhile, the market cap of $TRUMP still exceeds $1.5 billion.

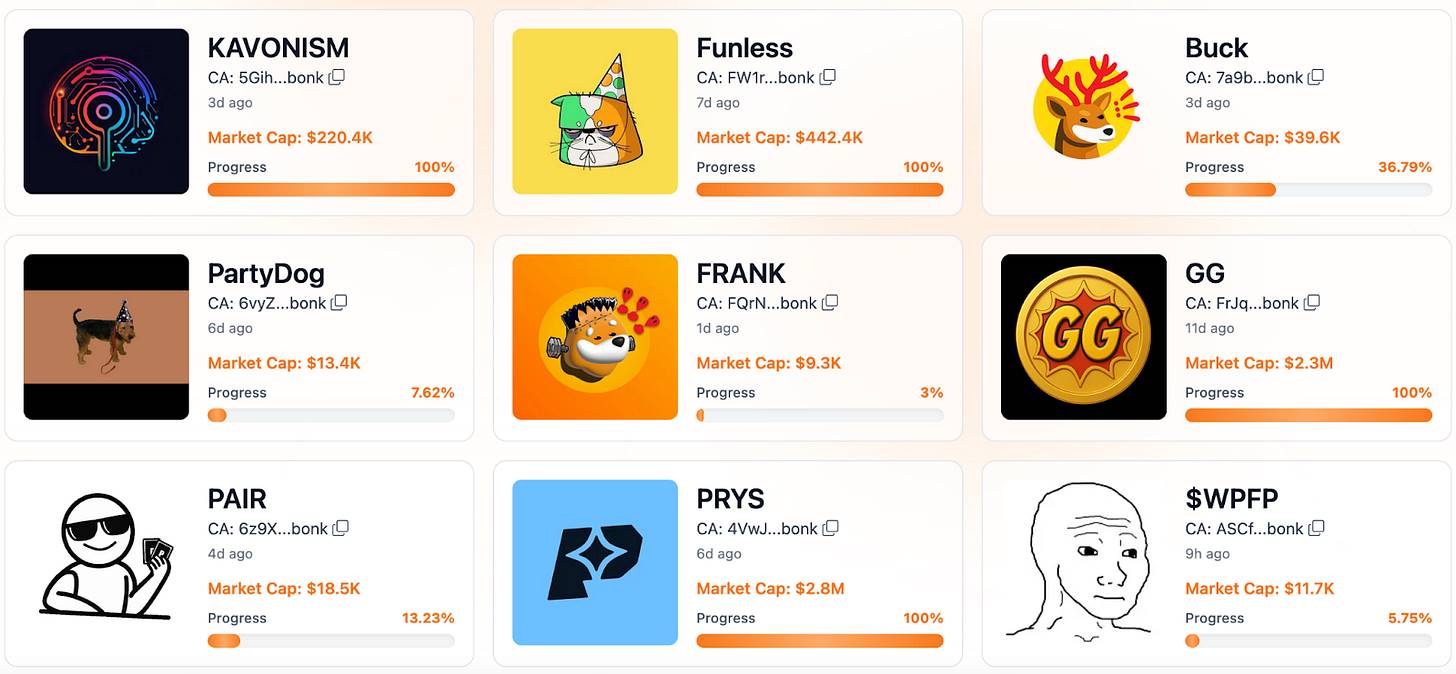

Many bubbles are small in scale and disappear quickly, like the fruit fly mentioned earlier. Most tokens' market caps can't even break $1 million. Here are some recent examples, like Bonk.fun's $FUNLESS, which seems to offer investors as little “fun” as $USELESS offers “utility.” This is truly a case of “advertising is truth.”

Source: Bonk.fun

Even small bubbles can be very profitable. For example, a student I mentored gave up his consulting job this summer to launch and "dump" a Solana memecoin.

A bigger fool meets a stronger dopamine

Why buy from insiders when prices are skyrocketing? It’s not because everyone is being deceived. Many buyers are fully aware that these tokens have no real value, but their motivations for purchasing include the following:

Momentum/Bigger Fool Theory: Riding the upward trend, trying to exit before the music stops. Sometimes it works.

Ignorance: Some people genuinely believe these stories. What?

But more often, it’s gambling addiction:

Small bets (unit bias on tokens priced at $0.0000030);

Instant “returns” (if the lifespan is as fleeting as a fly);

Lottery bias (a 20 to 1 chance can occasionally yield 20 times the return);

Addictive, gamified user experience (zero commissions, one-click swaps, round-the-clock dopamine stimulation);

Social identity and “fear of missing out (FOMO)” (someone in your group chat made “life-changing profits” with $MELANIA; can you resist joining the next round?).

No sell-off, no surge

Yes, these small bubbles do have “reasons” for existence. But with so many people losing so much money, why are they still so prevalent?

The key is that we need a “sell-off.” Because those near-success opportunities light up the same brain circuits as slot machines. Intermittent rewards keep people pulling the lever. And there are always enough winners to refill the pond. Once one opportunity disappears, another takes its place. Sell-offs fuel the next surge. If everyone can profit (like NVIDIA), there’s no need for new gambling to say let’s play again.

Like sports betting, you will lose, and often. Sports gamblers are well aware of this harsh reality, and so are crypto memecoin players.

But there are always new tables, new coins, new codes. Society pays the price: dopamine debt and financial nihilism. If you need a down payment for a house, the lottery bias seems reasonable: a $1,000 investment in an index fund won’t change much over the years; whereas a 100-fold return could happen tomorrow.

Lack of value is a feature, not a flaw

Modern bubbles require buyers to knowingly participate while waving at air. Real businesses have ceilings and the gravity of cash flow. Memecoins do not. If the only “fundamentals” are later buyers, then the limits on the rise depend solely on the influence of “celebrities” and the half-life of the joke.

Insiders, market makers, and trading platforms always profit first. But later buyers are not deceived. This is not investing, nor is it related to compound annual growth rate (CAGR). It’s about a chance for 10 times, or 100 times. If successful, you have a down payment. If it fails, there’s another surge opportunity tomorrow.

Old bets meet new bets

Casinos used to have chips, drinks, and carpets. Today, the casino is in your phone, with dazzling user interfaces and social dynamics. Expected returns haven’t improved, but the delivery method has changed. We’ve replaced velvet ropes (Note: Traditional casinos use these to delineate areas and control entry, representing the physical threshold to the gambling world) with push notifications.

Casinos need more and more betting options. Wall Street insiders and crypto players excel at providing these options.

We’ve transformed financialized memes into memefied finance. Cryptocurrencies, stocks, sports betting, even betting on who will be the next president—all the same. Every minute, every day, there are bets to participate in. Quick results, chasing the next opportunity.

This also explains why the crypto/stock platform Robinhood entered the S&P 500 on the same day Caesars Entertainment exited. That day, the two were like two ships passing in the night, with Caesars’ market cap at only $5.3 billion, while Robinhood surpassed $100 billion. And just on October 7, the world’s largest futures exchange, ICE, announced an investment in the sports betting and prediction market pioneer Polymarket.

The money is there. Because every day, every transaction seems to shout “Las Vegas.” And “better.”

Morality (if it can be called morality)

Past bubbles mispriced projects but occasionally propelled future developments unexpectedly. Today, the meme-driven, low liquidity, options speculation frenzy primarily misprices statements and builds exit channels. They dramatically transfer wealth, leaving behind a highlight reel. Insiders always make money from scratch. Just like Special Purpose Acquisition Companies (SPACs). Just like past speculative workshops and boiler rooms, except now these actions are legal.

Outsiders are merely playing a game of “whack-a-mole.”

Sounds nice. Until you realize it’s an addiction. It brings all the harms of other forms of gambling while signaling our failures in the financial realm.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。