Author: Aave

Translated by: Felix, PANews

The latest version V4 of the DeFi lending protocol Aave aims to enhance scalability, modularity, and capital efficiency through innovative architecture, transforming Aave into the operating system of DeFi, with plans to launch in Q4 of this year. Aave V4 adopts a "Hub and Spoke" architecture, separating liquidity storage from market logic by introducing Hubs and Spokes.

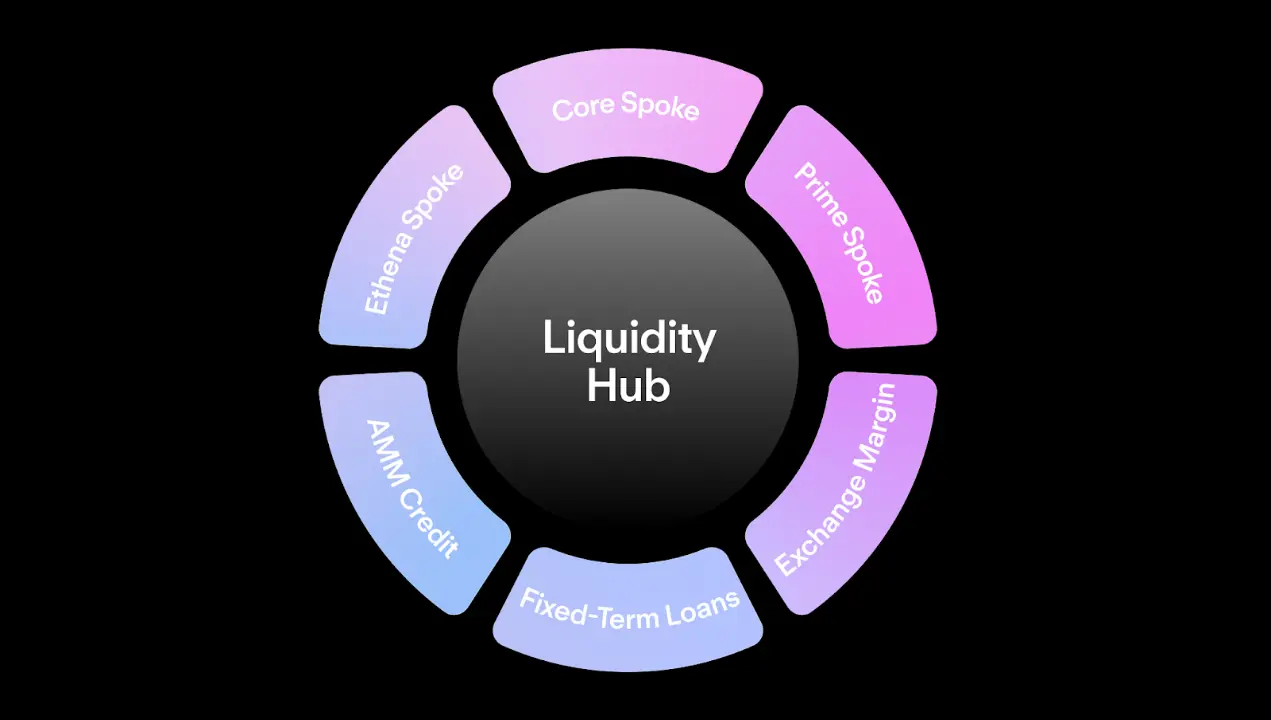

The Liquidity Hub serves as a unified liquidity center, centrally managing asset supply and borrowing permissions, ensuring that total borrowing does not exceed supply; Spokes are dedicated markets for user interaction, supporting custom risk rules and asset types. Recently, Aave's official team elaborated on how V4 works, and the following are the details.

Currently, Aave V3 operates independent markets that cannot share liquidity with each other. The core market holds approximately $60 billion, making it the primary market on Ethereum with the richest asset selection. The Prime market holds about $2 billion, catering to the lower end of the risk curve. However, each market operates independently, meaning that users in the Prime market cannot borrow the billions of USDC stored in the core market, even though they are the same asset.

This is because the system tightly links the risk allocation of the market to its liquidity. This presents a "chicken or egg" dilemma for new markets.

Although Aave has hundreds of billions of assets in other markets, each niche market still needs to build its own liquidity from scratch. V4 addresses this issue by connecting dedicated Spokes to a shared liquidity center (Liquidity Hub), allowing new markets to access Aave's existing liquidity depth from day one.

How V4 Solves This Problem

V4 separates liquidity storage from market logic by introducing a central Hub that holds assets and Spokes that execute specialized lending rules. Multiple Spokes can draw funds from the same Hub based on governance-defined needs and credit limits. Therefore, when building a Spoke, you are connecting to existing liquidity rather than starting from an empty pool.

Imagine the possibilities created by this: a Pendle market that accepts Principal tokens (PT) as collateral can allow users to borrow USDC from the same Hub that serves "core" market users. A dedicated Uniswap LP Spoke can access ETH liquidity that is simultaneously provided to other markets. Each Spoke implements its unique functions and risk parameters while sharing the underlying liquidity depth, making Aave DeFi the preferred lending network.

This eliminates the startup challenge of each new market having to compete for the same deposits as existing successful markets.

Functions of Spokes

This architecture enables markets that were simply not feasible in V3. Custom markets can serve assets like Ethena's sUSDe and related Pendle PTs without diluting Aave's overall liquidity. Institutional users can obtain the collateral they need in isolation while still leveraging the lending capabilities of the shared center.

This flexibility also extends to entirely new financial primitives. When Spokes can customize how assets are handled, secondary markets for debt positions become viable. Credit limits for AMM positions can dynamically track the composition and volatility of pools, allowing for appropriate adjustments to loan-to-value ratios. Fixed-term credit markets can match supply and borrowing intentions based on term, while allowing unmatched liquidity to continue earning returns from the underlying Hubs.

For builders, creating a Spoke allows them to focus on innovation rather than infrastructure and liquidity acquisition. Developers define their market parameters, implement specialized functions, and connect to the appropriate Hubs. They inherit Aave's proven liquidation system, governance framework, and risk management mechanisms without needing to rebuild these components or accumulate deposits from scratch.

This approach enables the broader DeFi community to build on Aave rather than compete with it. Service providers and integrators can create specialized experiences while accessing deep liquidity, thereby expanding innovation within the Aave ecosystem rather than dispersing it across different markets.

Why This Evolution is Crucial

As more Spokes connect to the shared Hub, the entire system will become more efficient. Liquidity is better utilized across different use cases. Users can access specialized functions without having to spread their assets across multiple isolated markets. Innovation occurs on a proven infrastructure rather than repeatedly starting from scratch. Each successful Spoke makes the platform more attractive to the next builder, creating a positive feedback loop rather than zero-sum competition.

V4 makes it possible to serve specific communities without diluting liquidity or forcing each new market to compete with existing successful markets for the same users and deposits.

This marks a natural evolution of Aave from multiple isolated markets to a unified liquidity infrastructure. The protocol can meet specialized needs while maintaining its capital efficiency and security.

For developers looking to create lending experiences for specific communities, V4 provides the foundation. The infrastructure and development tools are nearly ready, and a new era of DeFi innovation is about to begin.

Related reading: In-depth Analysis of Aave V4: How the Lending Leader Builds a New Moat?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。