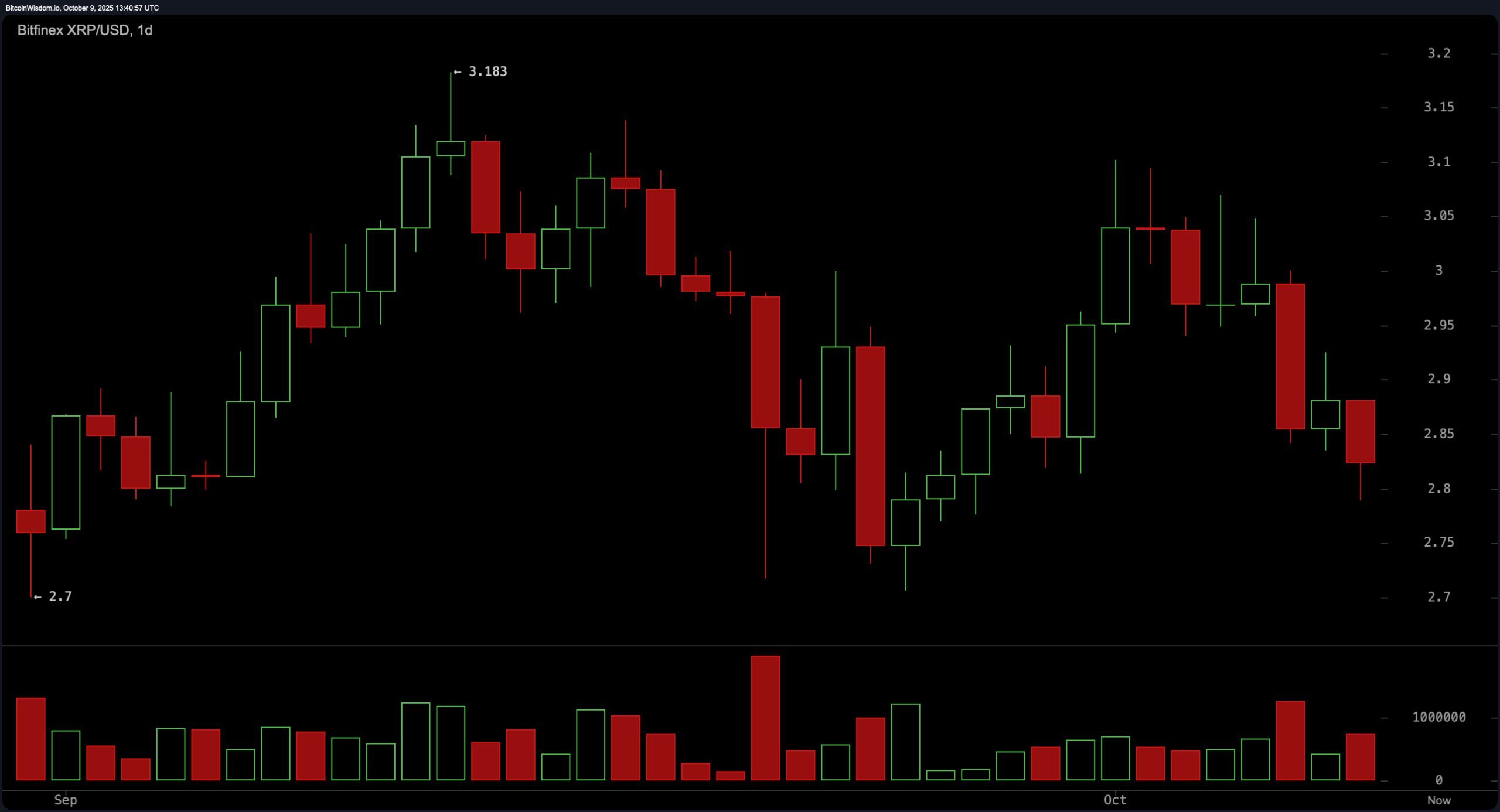

A week after peaking just under $3.10, XRP briefly fell below $2.80 on Oct. 9—its lowest level since Sept. 28. The decline pushed its market capitalization below $170 billion and triggered concern among holders, especially as XRP slipped behind BNB and USDT in market cap rankings.

Despite being one of the best-performing high-cap altcoins over the past year, XRP has generally trended downward since reaching its all-time high of $3.66 on July 18. While some critics argue that the asset may have already peaked in this cycle, crypto analyst and trader Casitrades maintains that XRP’s technical setup remains strong, with a breakout still likely.

XRP/USD chart on Oct. 9. 2025.

Although she acknowledges the lack of significant movement in recent weeks, Casitrades points to local support levels as a reason for optimism. She notes that with the consolidation pattern now complete, XRP’s next uptrend could begin “any day now.”

Technical indicators show that XRP continues to hold above the key macro support level of $2.79, reinforcing its structural strength. However, sentiment among holders has turned cautious, particularly as BNB has captured market attention with its sustained rally.

Unlike XRP, which struggled to maintain momentum after its July peak, BNB has climbed steadily from $740 on July 18 to a high of around $1,330 on Oct. 8. Although it pulled back to $1,280 the following day, BNB’s corrections have been relatively mild, allowing it to retain most of its gains.

This contrast has led some observers to speculate that XRP may be entering another extended consolidation phase before its next breakout. Casitrades, however, argues that the long buildup before XRP’s previous breakout is a sign of untapped potential.

“Let me remind you, XRP consolidated for SEVEN years before breaking out from $0.50 to $3.66. That kind of consolidation is not meaningless. I also don’t think its purpose was just to reach the previous ATH,” she wrote in a post on X. “Currently, subwaves are getting constricted, which is why extensions are being limited to $4.50 and $6.50. However, the macro targets of $8–$13 remain entirely possible if momentum continues strong.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。