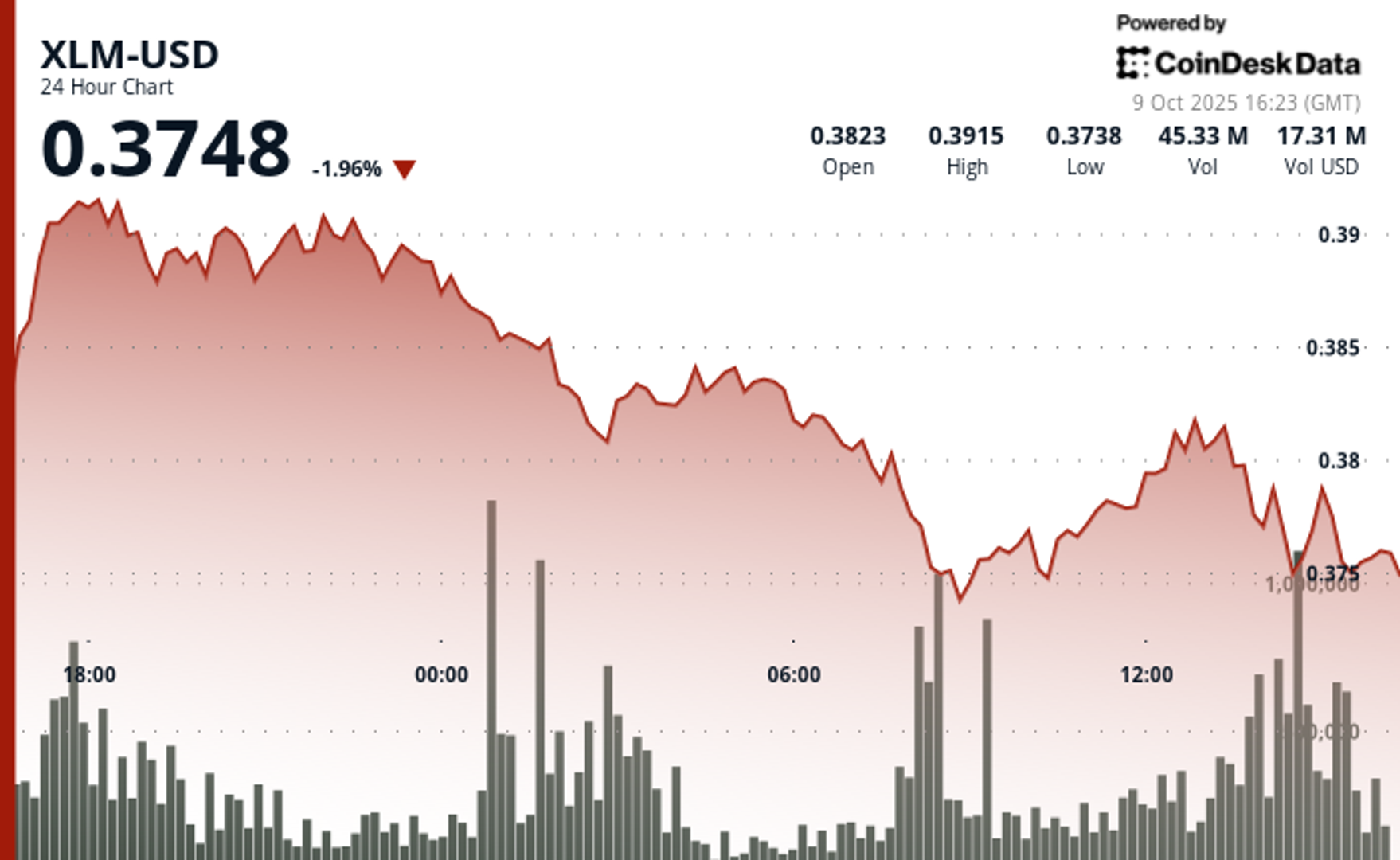

Stellar’s XLM token extended its downturn over the past day, sliding 5% from $0.39 to $0.38 between October 8 at 15:00 and October 9 at 14:00. The selloff came amid heavy institutional activity, with volumes reaching 35.51 million — well above average levels — confirming strong distribution pressure.

The breakdown below the key $0.38 support level marked a clear shift in sentiment as trading intensified within a narrow $0.019 range. Market structure analysis showed a descending channel pattern forming, with repeated rejections near $0.38 suggesting sustained bearish control.

During the final hour of trading, from 13:13 to 14:12 on October 9, XLM shed another 1%, with significant volume spikes at 13:52 and 14:01 signaling coordinated institutional selling. Analysts said the move reflected continued liquidation across professional trading desks rather than short-term retail action.

Technical Indicators Signal Further Weakness

- Critical support failure at $0.38 accompanied by institutional-grade volume of 35.51 million exceeding standard trading metrics

- Established downtrend pattern with successive lower highs indicating systematic institutional distribution

- Resistance zone established at $0.39 where institutional selling consistently emerged during recovery attempts

- Above-average volume participation during price reversals confirming coordinated institutional distribution strategies

- Technical chart pattern shows descending channel formation with lower highs at key resistance levels

- Failed recovery attempts near $0.38 consistently met with institutional supply indicating strong overhead resistance

- Volume concentration during decline phases with 1.34 million at 13:52 and 1.43 million at 14:01 confirming institutional participation

- Technical momentum indicators suggest continued downside pressure toward the $0.38 psychological support threshold

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。