DDC Enterprise Limited (NYSEAM: DDC) or “DayDayCook” pivoted from its Asian culinary business to become a bitcoin treasury firm with a $528 million investment earlier this year. Yesterday, the company announced a $124 million equity financing round to acquire even more bitcoin. Moral of the story: institutions remain bullish even with bitcoin retreating slightly from its new record high.

(DDC pivoted from Asian cuisine to bitcoin earlier this year after losing money for at least four years in a row.)

Norma Chu, chair and CEO of DDC, founded the company in 2012 and then took it public in November 2023. The firm hemorrhaged money for at least four years in a row, almost got delisted, and had trading of its shares halted after its stock tumbled 95% in April 2025. In a display of remarkable tenacity, Chu managed to weather the storm and mapped out a new direction for her company, converting it to a bitcoin treasury firm with a relatively small initial purchase of 21 BTC. Today, DDC boasts 1,058 BTC worth more than $130 million at current prices, with plans to buy even more.

“This financing round contributes not only capital, but also substantial strategic value and momentum as we advance DDC’s position as a global leader in the institutional Bitcoin space,” Chu said.

Bitcoin treasury firms aren’t the only institutions showing bullish sentiment. Bitcoin exchange-traded funds (ETFs) now hold roughly $168 billion in assets or nearly 7% of the entire BTC market cap, according to Sosovalue.com. Blackrock’s Ishares Bitcoin Trust (IBIT) is now the 19th largest ETF in the U.S. with assets under management just shy of $100 billion. In short, smart money is betting on bitcoin regardless of daily price action.

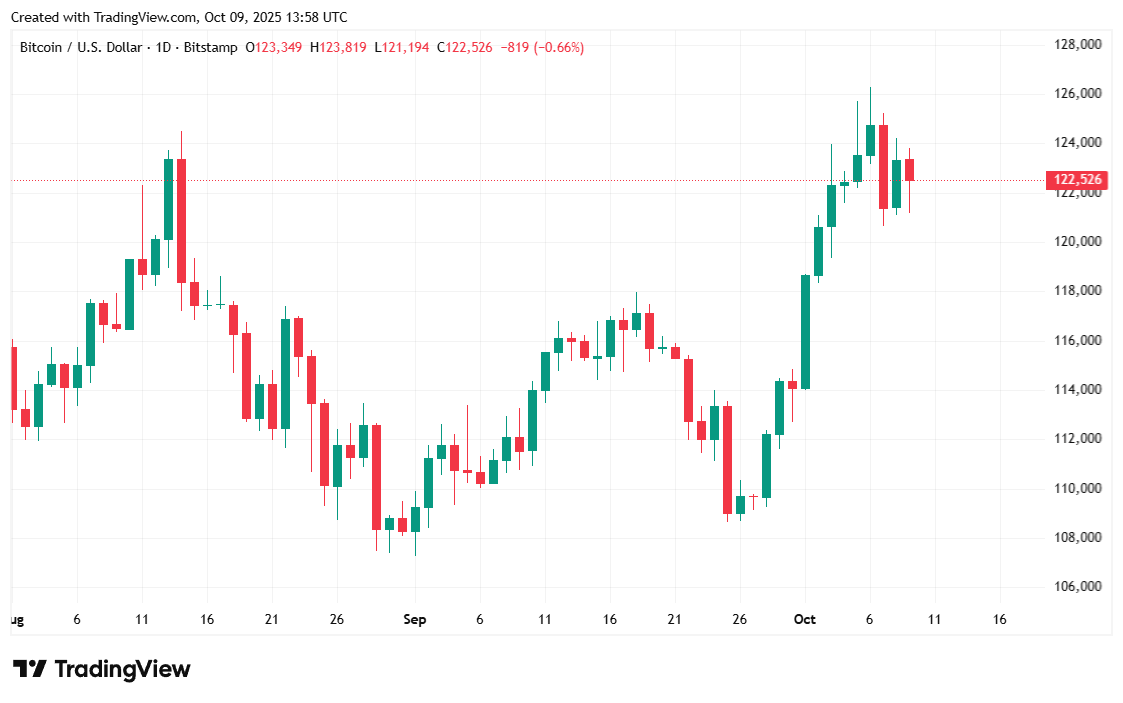

Bitcoin was up 0.31% at $122,732.44 according to Coinmarketcap at the time of reporting. The cryptocurrency was also up 2.18% for the week and has been trading between $121,191.40 and $124,167.09 since yesterday.

( BTC price / Trading View)

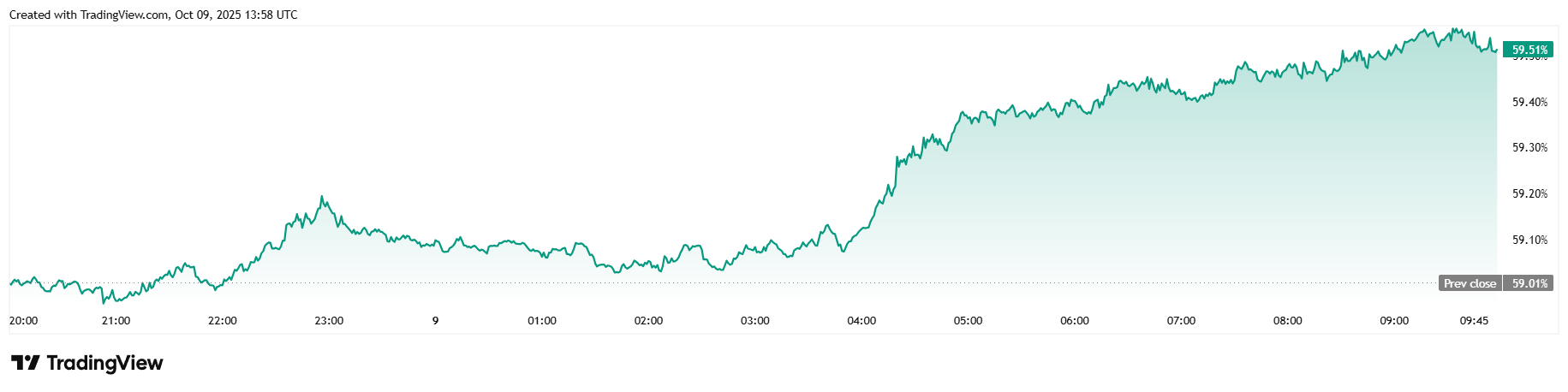

Twenty-four-hour trading volume fell 23.73% to $61.13 billion, and market capitalization inched up 0.11% to $2.44 trillion. Bitcoin dominance jumped 0.85% to 59.52% at the time of writing.

( BTC dominance / Trading View)

Total bitcoin futures open interest eased 0.91% to $89.73 billion according to data from Coinglass. Bitcoin liquidations climbed to a total of $144.69 million with a relative balance between short and long liquidations. Short sellers lost $79.55 million and long investors had $65.14 million wiped out.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。