What happens when artificial intelligence becomes both the economy's primary engine and its potential Achilles' heel? We may be about to find out.

Harvard economist Jason Furman recently said that AI investments accounted for nearly 92% of U.S. GDP growth in the first half of 2025. Basically, the entire American economy put its eggs in one algorithmic basket.

And that basket might be ready to break. Today, the Bank of England warned that market valuations for AI companies are increasingly irrational.

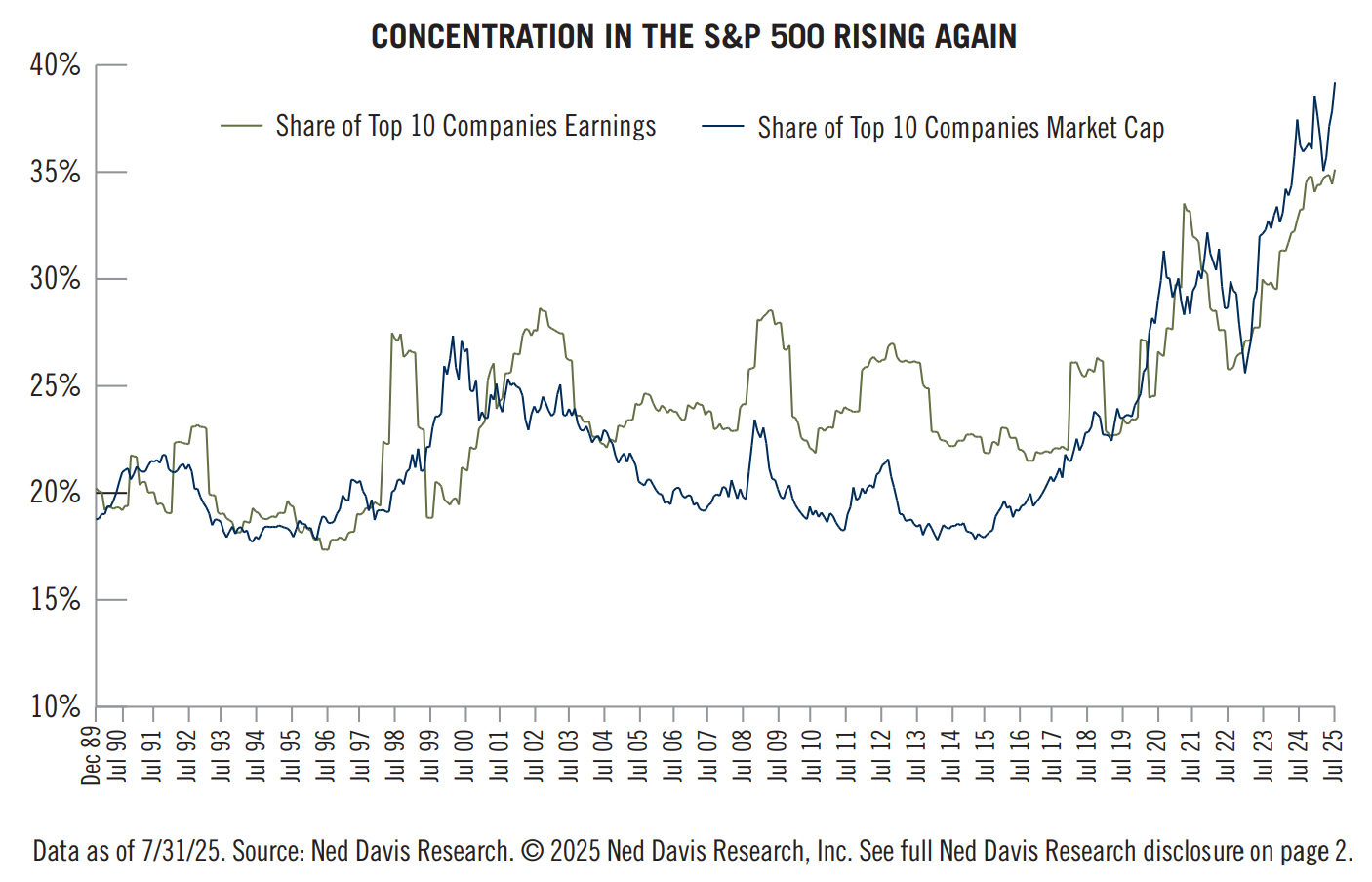

“On a number of measures, equity market valuations appear stretched, particularly for technology companies focused on Artificial Intelligence (AI)," analysts for the bank wrote. “This, when combined with increasing concentration within market indices, leaves equity markets particularly exposed should expectations around the impact of AI become less optimistic.”

If you needed more evidence of market exuberance, Elon Musk's xAI is currently raising a cool $20 billion, apparently earmarked for what amounts to the world's most expensive Nvidia shopping spree.

The company, valued at $200 billion (up from $6 billion just months ago), plans to use the funds for its "Colossus 2" data center. In a delicious bit of circular logic, Nvidia itself is reportedly investing up to $2 billion in the deal—essentially paying for priority access to its own chips.

Ruchir Sharma, chair of Rockefeller International, told Fortune that in a way, “America has become one big bet on AI,” and warned that “AI better deliver for the U.S., or its economy and markets will lose the one leg they are now standing on.”

The bulls’ defense: “This time it’s real”

So which is it—a transformative revolution or the second coming of the dot-com crash? There are arguments for any of those positions, with reputable doomers and accelerationists debating about it every single day.

The bulls have compelling ammunition. Unlike the vapor-ware companies of 1999, today's AI giants are printing money. The "Magnificent Seven" tech companies are proving to be hugely profitable. Nvidia's stock has spiked 1,700% in the last two years. OpenAI is targeting $12.7 billion in revenue for 2025. Microsoft, Google, Meta, AMD, Oracle, and all the big companies involved in AI are also exceeding expectations.

The infrastructure being built is also tangible: data centers humming with activity, power generation facilities (including those quirky nuclear deals), and software that's already transforming how businesses operate. Almost 90% of developers are using AI today, with generative AI adoption more than doubling within a year.

UBS Chief Investment Officer wrote in an analysis that this is just a big, yet healthy momentum. “There is little evidence of a market bubble at present, and we would look to benefit from AI-driven momentum in the stock market with a broadly diversified portfolio,” he said.

Financial Analyst Steven Fiorillo also argues that, despite what doomers preach, this bullish market is backed by results, not hype. “I have a newsflash for every bear, A.I. is not a bubble,” he posted on X last week.

“At the end of the day, MSFT, AMZN, GOOGL, and META generated $493.31 billion in cash from operations, allocated $291.35 billion in CapEx and generated $201.96 billion in FCF (free cash flow) in the TTM (trailing twelve months). These numbers indicate that the dot com era and the A.I. era are very different and there is no A.I. bubble to be found.”

That view is also shared by Bank of America analysts, who argue that volatility signals that markets are healthy and there are not enough signs of a market bubble in place.

The doomers’ rebuttal: “History rhymes”

But the bears have history on their side, and history has a nasty habit of rhyming. The Bank of England's comparison to dot-com valuations is based on hard metrics.

The top ten S&P 500 companies now command more than one third of the index's total valuation, a concentration not seen in half a century. When so much wealth is tied to so few companies, a stumble becomes a systemic risk.

Image: Ned Davis Research

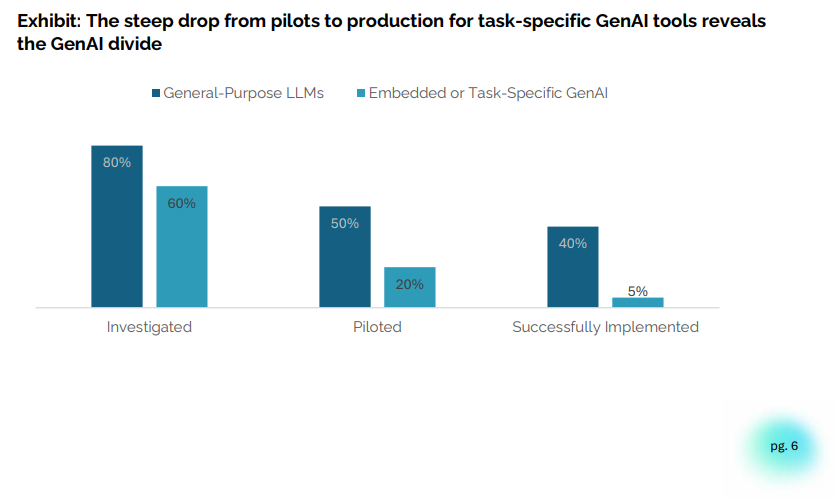

However, according to AI researchers at MIT, 95% of organizations are failing at their Generative AI investments. Are we witnessing genuine transformation or collective delusion? The practical bottlenecks—power shortages, chip supply constraints, the sheer physics of cooling all those servers—suggest that even if AI is revolutionary, the revolution might move slower than stock prices imply.

Image: MIT

Tech CEOs themselves are increasingly vocal about bubble concerns, even as they continue to raise astronomical sums.

“Are we in a phase where investors as a whole are overexcited about AI? my opinion is yes” OpenAI CEO Sam Altman said in August. “When bubbles happen, smart people get overexcited about a kernel of truth.”

Amazon’s Jeff Bezos, is also convinced: “This is a kind of industrial bubble,” he said Friday at Italian Tech Week in Turin. “There will be a reset, there will be a check at some point, there will be a drawdown.”

The truth likely inhabits that murky middle ground. AI is undoubtedly transformative—any technology that can account for 92% of economic growth isn't just hype. But the question as always with the next big thing is how much is indeed hype.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。