The crypto market downturn on Oct. 8 led to the liquidation of more than $624 million in leveraged positions, with ether ( ETH) accounting for a significant portion. ETH, which fell 5.7% on the day, represented roughly a quarter of all contracts wiped out. According to Coinglass’s 24-hour liquidation heatmap, ETH liquidations totaled $176 million—of which $142.7 million were long positions, with the remainder in shorts.

Bitcoin ( BTC) also saw substantial liquidations after falling from a new all-time high of $126,272 less than 24 hours earlier. Long BTC positions made up two-thirds of the $157.9 million in total liquidations, while short positions accounted for $43.76 million. Other notable liquidations occurred in DOGE, SOL and XRP.

However, it was BNB’s liquidation data that drew particular attention. In the 24 hours ending at 10:30 a.m. EST, BNB liquidations totaled just over $13 million—split almost evenly between long and short positions. For comparison, SOL, with a market cap of over $121 billion, saw liquidations exceeding $32 million, more than double BNB’s total despite the latter’s larger market cap of $181 billion.

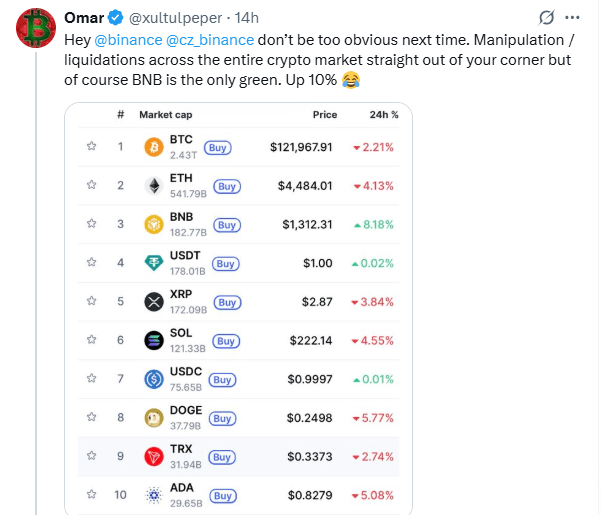

BNB’s limited liquidations and its upward price movement—while most high-cap altcoins declined—sparked heated debate on social media. Omar, a bitcoin investor and Make America Great Again (MAGA) supporter, accused Binance and its co-founder Changpeng Zhao (CZ) of market manipulation.

“Hey @binance @cz_binance don’t be too obvious next time. Manipulation/liquidations across the entire crypto market straight out of your corner but of course BNB is the only green. Up 10%,” Omar posted on X, urging the U.S. Securities and Exchange Commission (SEC) to investigate.

BNB’s price action exhibits a notable resilience, characterized by its aggressive outperformance during broader crypto bull runs and its comparatively lower volatility during market downturns. This unusual stability for a major altcoin is often attributed to its foundational ecosystem utility on the BNB Chain and its strong deflationary supply mechanics, specifically the large, quarterly token burns aimed at reducing the circulating supply to 100 million.

However, the tight correlation between these centralized actions (utility within the Binance-controlled ecosystem and strategic burns) and its market strength has perpetually fueled speculation among critics regarding potential market manipulation, lack of transparency or ‘insider-trading advantages’ that could distort its price from purely organic market fundamentals.

Beyond these allegations, Binance has faced growing scrutiny from critics skeptical of BNB’s recent surge. Ted Pillows, an investor and key opinion leader (KOL), dismissed claims of rising interest in the BNB ecosystem.

“Money keeps on flowing into the BNB ecosystem. Scam chain with scam tokens and fake volume. Yes you can ape in and earn money but it’s not going to take long,” Pillows wrote on X.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。