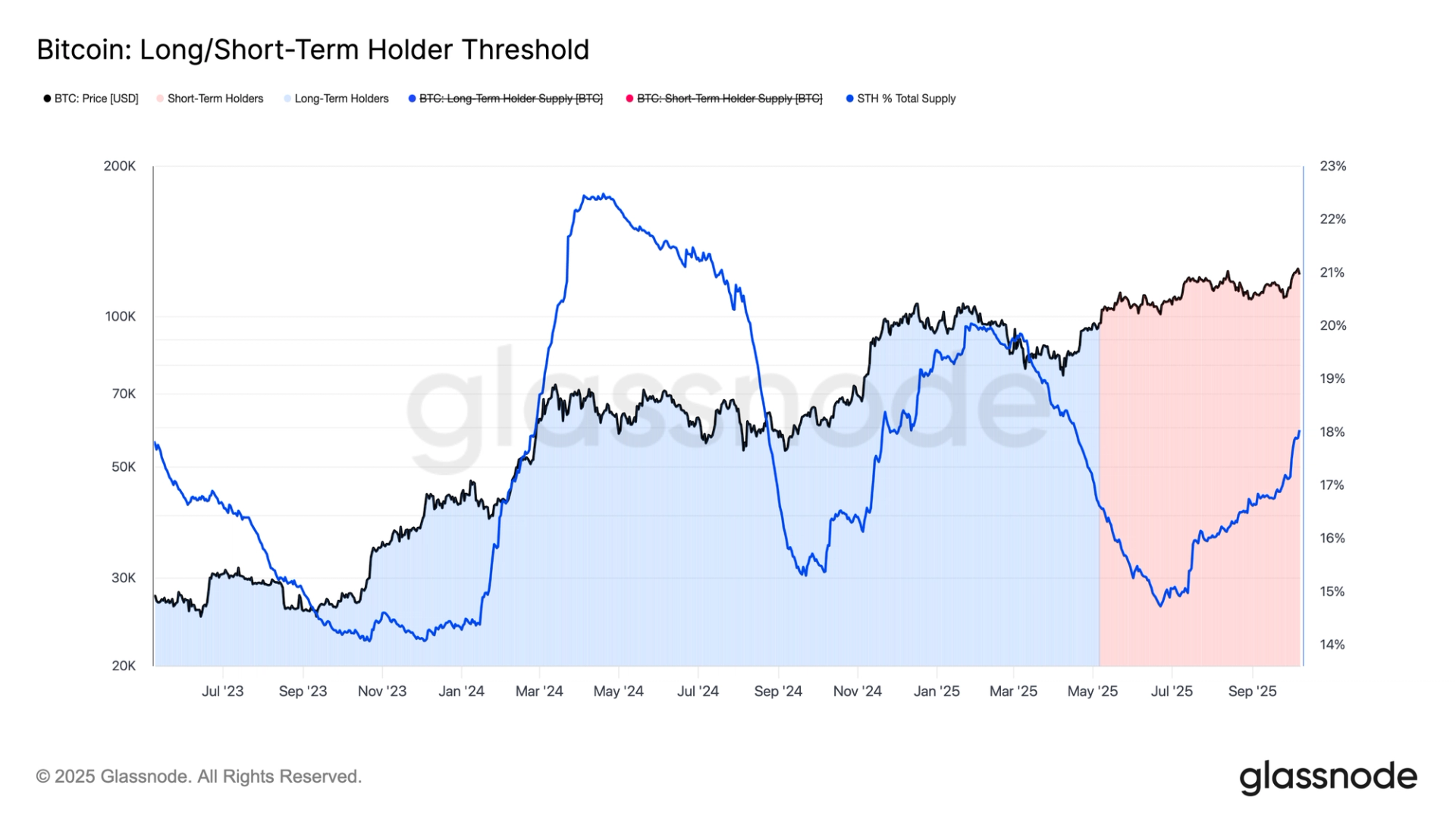

Short-term holders (STHs) have added roughly 450,000 BTC to their supply since July, now holding around 2.6 million BTC according to Glassnode data.

STHs are defined as investors who purchased bitcoin within the past 155 days.

This increase marks the third distinct cycle of rising STH activity since the start of 2024 and has typically marks a local top in the bitcoin price.

The first peak occurred in April 2024, shortly after bitcoin’s March all-time high of $73,000.

The second peak came in January 2025, aligning with the $110,000 all-time high, and the latest so far, the third peak has followed a new record of $126,000.

Each successive cycle has seen a smaller STH cohort, suggesting that overall market euphoria and speculative behavior are gradually fading.

Across these three peaks, STH supply as a share of total circulating supply has declined from 22% to 20%, and now sits at roughly 18%, according to Glassnode data.

Earlier in Q1 2025, STHs held as much as 2.8 million BTC, but their supply fell to around 2.1 million BTC as bitcoin declined to $76,000. This indicates that STHs were a major driver of the selling pressure seen in April.

In contrast, long-term holders (the inverse of STHs) started to reduce their position over the summer months, distributing roughly 250,000 BTC since July as bitcoin consolidated, now holding 14.5 million BTC.

As Bitcoin enters its historically strongest period of the quarter, the expectation is STH supply will continue to increase and make new cycle highs to over 3 million BTC.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。