The U.S. bitcoin exchange-traded funds (ETFs) recorded a $1.2 billion net inflow on Monday, marking the seventh occasion that inflows have exceeded $1 billion, according to Farside data. The majority of these inflows came from BlackRock’s iShares Bitcoin Trust (IBIT), which attracted $970 million.

Historically, when inflows reach around $1 billion, it has often coincided with a short-term top in bitcoin’s price.

The first instance occurred on March 12, 2024, when bitcoin peaked at around $74,000 two days later on March 14. The next two instances were in November 2024, when bitcoin surged above $100,000, with large inflows appearing just before the rally concluded in December. On Jan. 17, another $1 billion inflow preceded a local top near $109,000 on Jan. 20. Similarly, on July 10 and 11, consecutive $1 billion inflows were followed by a short-term peak of $123,000 on July 14.

On Monday, bitcoin climbed above $126,000, so it remains to be seen whether a new high will form in the coming days, with bitcoin around $124,000.

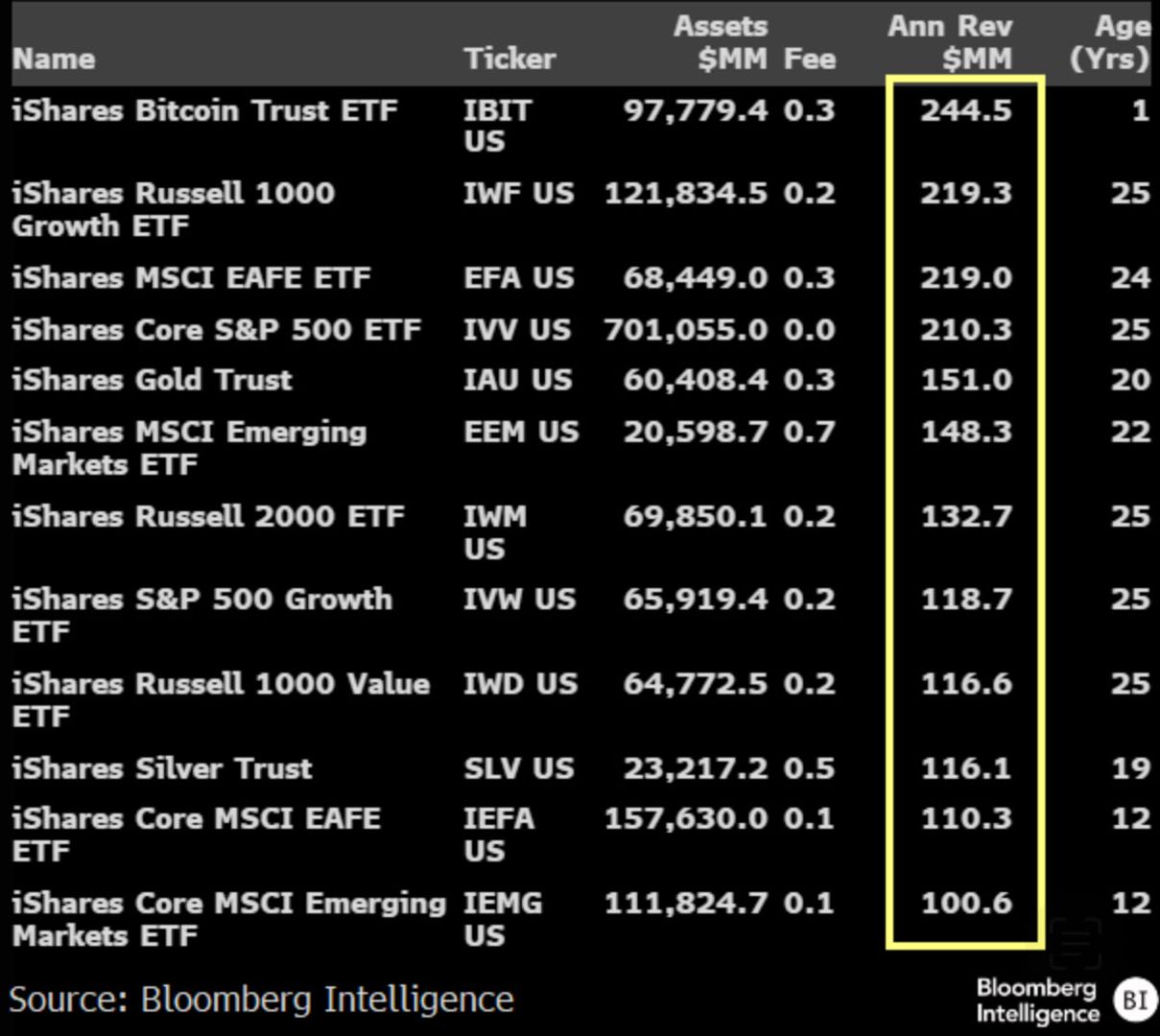

Meanwhile, Senior Bloomberg ETF Analyst Eric Balchunas noted that IBIT is now BlackRock’s most profitable ETF, with assets under management just shy of $100 billion, generating an estimated $244.5 million in annual revenue. The next closest fund by revenue is the iShares Russell 1000 Growth ETF. Balchunas also highlighted that IBIT is approaching $100 billion in AUM in just 435 days, whereas the next-fastest ETF to reach that milestone, the Vanguard S&P 500 ETF (VOO), took 2,011 days.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。