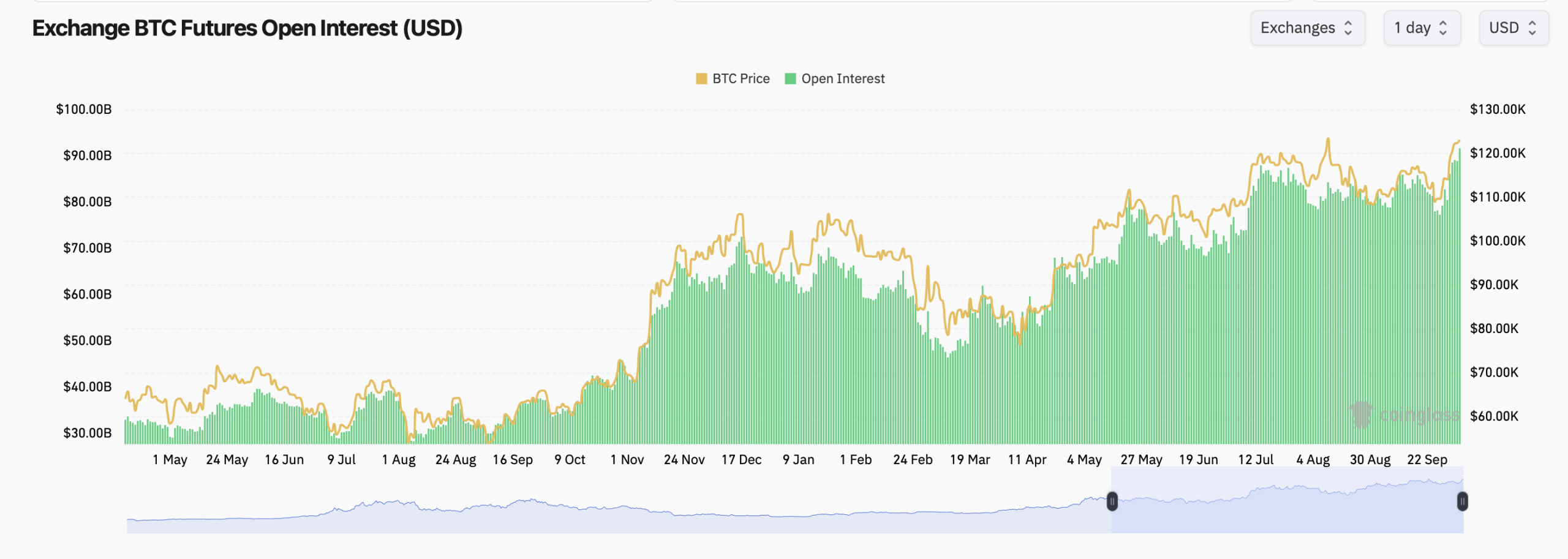

At the index level, bitcoin pushed through $125,725 this week before easing to $123,142, and the derivatives crowd didn’t blink. Aggregate futures open interest (OI) figures collected by coinglass.com touched an all-time high near $91.59 billion, up 2.04% on the day, a sign that traders added risk instead of taking profits. Translation: the casino lights are on, and the chips are stacked high.

CME still wears the crown with $18.19 billion in OI, roughly 19.85% of the pile, and 147.8K BTC worth of exposure. Binance follows with $16.44 billion (17.94%), then Bybit at $10.13 billion (11.06%) and Gate at $9.44 billion (10.3%). OKX shows $4.96 billion (5.41%), while Bitget carries $6.09 billion (6.64%). Rounding out the top ten are MEXC ($4.04 billion; 4.4%), WhiteBIT ($2.94 billion; 3.21%), BingX ($1.78 billion; 1.94%), and Kucoin ($1.24 billion; 1.35%).

The 24-hour movers add flavor. Kucoin’s OI jumped a head-turning 65.79%, Bitget added 5.95%, and WhiteBIT tacked on 4.25%. Binance climbed 3.06% and OKX 2.83%, while CME’s institutional lane edged up 0.89%. Bybit, Gate, BingX, and MEXC slipped modestly on the day. One more tell: CME’s OI-to-volume ratio near 2.47 hints at stickier, longer-tenor positions.

Options traders are leaning optimistically. Calls make up 60.26% of options OI versus 39.74% for puts, and the past 24 hours skewed similarly, with calls at 58.05% of volume. The leaderboard is stacked with upside strikes: Deribit’s Dec. 26 $140,000 call leads with about 9,893.9 BTC of OI, followed by the Dec. 26 $200,000 call at 8,522 BTC and the Oct. 31 $124,000 call at 7,210.9 BTC. December’s $120,000 and $150,000 calls also carry chunky interest.

Max pain—the level where buyers and sellers collectively feel the least joy—clusters around six figures. Near-dated expiries gravitate toward $115,000, while later in Q4 hover closer to $120,000–$125,000 on Deribit’s curve. With spot orbiting $123,000, dealers’ hedging flows around those nodes can add chop, especially as month-end rolls in.

Put together, bitcoin’s futures and options boards say participation is quite broad and funded. Bulls can point to record futures OI, call-heavy options skew, and a max-pain band that sits just beneath spot price. Bears could argue crowded upside calls and a high OI stack leave room for squeezes the other way. Either way, derivatives are still setting the stage—and bitcoin rarely misses its cue.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。