What Happened In Crypto Market Today: WLFI Token, MARA BTC Mining News

The global cryptocurrency market cap has climbed to $4.29 trillion, up 1.5% in the past 24 hours, with a trading volume of $217 billion. Bitcoin dominates at 56.8%, followed by Ethereum at 12.7%. Meanwhile, Polkadot and XRP ecosystem tokens lead the gains.

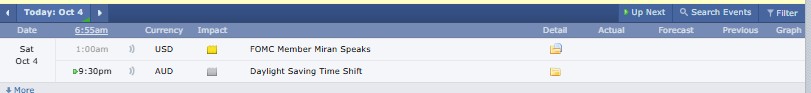

Major Crypto Market Events Today

Source: Forex Factory

24 Hour Crypto Market Update

Bitcoin (BTC) trades at $122,090 with a 1.6% daily rise, supported by $82.3 billion trading volume and a massive $2.43 trillion market cap, reflecting strong investor confidence.

Top 5 trending crypto coins:

-

EVAA Protocol (EVAA) is priced at $6.54, up 31.1%, with a trading volume of $123.79 million.

-

Adrena (ADX) is trading at $0.03964, rising slightly by 0.5%, with a trading volume of $450,004.

-

Aster (ASTER) has a price of $2.14, increasing 17.3%, with a trading volume of $1.14 billion.

-

Plasma (XPL) is at $0.8702, down 5.7%, with a trading volume of $1.71 billion.

-

PancakeSwap (CAKE) is priced at $3.65, up 20.9%, with a trading volume of $940 million.

Top 3 Gainers Today:

-

Jelly-My-Jelly (JELLYJELLY) surged 97% today, priced at $0.1005, with a TV of $138,057,840.

-

Giggle Fund (GIGGLE) rose 48.1%, trading at $79.85, with a TV of $47,413,857.

-

Polycule (PCULE) increased 49.4%, priced at $0.04746, and a TV of $7,952,924.

Top 3 Losers today

-

AtomOne (ATONE) is down 28.9%, now trading at $0.7125 with a total TV of about $538K.

-

MYX Finance (MYX) has dropped 26.4%, currently priced at $8.44 with a TV of approximately $215.6M.

-

Saros (SAROS) fell 20.3%, trading at $0.2409 with a TV of around $9.5M.

The DeFi market cap stands at $172 billion, down 0.5% in 24 hours, with a 24-hour trading volume of $11.38 billion, reflecting 4.0% dominance in the global crypto market.

The stablecoins market currently holds a $308 billion market cap, reflecting a 0.5% change in the last 24 hours, with a total trading volume of $171.64 billion.

Fear and Greed Index Today

Source: Alternative Me

The Fear & Greed Index stands at 71 (Greed), showing traders are growing confident and willing to take risks. Sentiment has sharply shifted from Fear (33) last week and Neutral (51) last month, suggesting strong bullish momentum is building in the market.

Latest Market News Today

Crypto ETF Filing News: In a sudden gold rush moment for crypto ETFs, over 30 new filings just flooded the SEC, led by REX Shares and Osprey Funds alone submitting 21 spot products for coins like XRP, ADA, and SOL—with staking rewards included. Experts say this frenzy, sparked by recent SEC rule changes, is only beginning.

Coinbase Samsung News: Coinbase just teamed up with Samsung in a big push to bring crypto to the masses. Over 75 million U.S. Galaxy users now get free access to Coinbase One perks like zero trading fees and higher staking rewards. Plus, Samsung Pay is fully integrated, letting Americans buy crypto instantly—though some users worry about surveillance.

MARA Bitcoin Mining News: MARA Holdings wrapped up September on a high note, mining 736 Bitcoins—4% more than the previous month—across 218 blocks. Its Bitcoin stash also swelled from 50,639 to 52,850, securing its position as the world’s second-largest public company holder, trailing only Strategy’s massive 640,031-Bitcoin treasury .

Trump Latest News: Just a day after President Trump proposed $1,000 to $2,000 stimulus checks funded by tariff revenue , the White House revealed plans for new $1 coins featuring his face. The surprising move has sparked conversations about the value of hard assets, with analysts urging Americans to prepare as the story unfolds.

WLFI Token News: WLFI, a crypto project linked to the Trump family , clarified community concerns after a recent token transfer. It sold existing locked tokens to Bitcoin miner Hut8 at $0.25 each—not newly issued supply—showcasing Hut8 as a strategic backer. Despite WLFI trading near $0.20, the premium signals long-term confidence.

Coinbase Regulatory Clarity: Coinbase has applied for a national trust charter from the U.S. Office of the Comptroller of the Currency, joining Circle, Paxos, and Ripple in pursuing federal oversight. While stressing it doesn’t plan to become a bank, Coinbase says regulatory clarity will help it launch more services, safeguard assets, and bridge crypto with traditional finance.

Tether Antalpha Partnership news: Tether is reportedly teaming up with Antalpha to raise over $200 million for a new digital asset venture focused on buying more of its gold-backed token, XAUt. The move builds on their expanding partnership after Tether acquired an 8.1% stake, with Antalpha also planning XAUt-backed lending and global gold vaults.

Disclaimer: Coingabbar provides informational content on cryptocurrencies, NFTs, and other decentralised assets. This is not financial advice. Users, please DYOR, understand the risks, and consult financial professionals before investing. CoinGabbar is not responsible for any financial losses. Crypto and NFTs are highly volatile—invest wisely.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。