Author: Felix, PANews

Among the many catalysts in this round of the crypto bull market, ETFs, especially spot Bitcoin and Ethereum ETFs, have played a key role as a revolutionary financial tool that significantly lowers the barrier to investing in cryptocurrencies, acting as a crucial "funding bridge." Since the approval of the Bitcoin spot ETF at the beginning of 2024, the entire industry has attracted hundreds of billions of dollars in institutional funds, driving the price of Bitcoin from $60,000 to the current approximately $113,500.

As of now, the U.S. Securities and Exchange Commission (SEC) has 92 crypto spot ETFs (including single asset and index-based) pending approval. Among them, about 69 are single asset ETFs covering 24 different cryptocurrencies. These applications mainly come from institutions like Grayscale and VanEck, with most final decision deadlines in October.

In this context, the SEC recently approved a proposal that fundamentally changes the listing method for crypto spot ETFs. Therefore, the approval situation in October will not only become a turning point for the crypto ETF wave but will also reflect the future direction of this bull market.

U.S. SEC Approves Change Proposal, Shifting from "Case-by-Case Approval" to "Standardized Clearance"

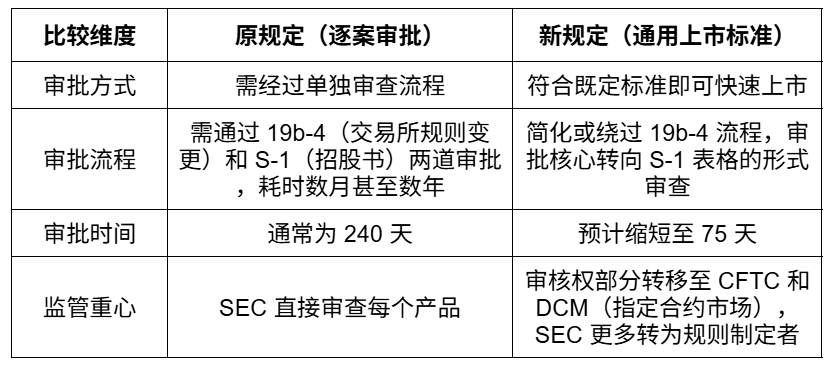

On September 7, the SEC approved a rule change proposed by three major exchanges (Nasdaq, Cboe BZX, and NYSE Arca), introducing a universal listing standard for "Commodity-Based Trust Shares." This standard mainly targets exchange-traded products (ETPs) that hold spot commodities (including digital assets), replacing the cumbersome case-by-case review process, aiming to simplify the listing process.

The SEC Chairman stated that these changes mark a shift in the SEC's regulation of digital asset ETPs from "cautious case-by-case" to "standardized and efficient," aiming to "maximize investor choice and promote innovation."

The core content of the new regulations is as follows:

The regulation proposes three listing paths:

- The commodity is traded on markets that are members of the Intermarket Surveillance Group (ISG) and have market surveillance sharing agreements.

- The commodity futures have been listed on CFTC-regulated DCM for at least 6 months and have surveillance sharing agreements.

- If an existing ETF is listed on a national securities exchange in the U.S. and allocates at least 40% of its assets to the commodity, the new ETP may be exempt from certain requirements.

In short, the new regulations open a "fast track" for crypto asset ETFs that meet specific conditions. Based on the above three paths, October may be the "explosion period" for the first batch of new ETFs, focusing on assets with CFTC-regulated futures contracts for over 6 months.

Original Decision Dates "Invalidated," ETF Issuers "Start on the Same Starting Line"

The effectiveness of the new standards directly impacts the ETF applications that were already in the queue. On September 29, the SEC requested that issuers of LTC, XRP, SOL, ADA, and DOGE spot ETFs withdraw their 19b-4 filing documents, and issuers must advance listings according to the new standards. The withdrawal of applications may begin as early as this week. This withdrawal does not mean that the ETF applications are completely denied but rather shifts to a more efficient regulatory path.

It is worth noting that after withdrawing the 19b-4 filings, the original decision dates (usually referring to the SEC's final ruling deadline on the filings, such as within 240 days after submission) may no longer hold reference value. Under the new rules, the SEC may not require strict deadlines but instead quickly assess based on the universal listing standards.

Regarding when the ETFs will be approved, although issuers need to resubmit or adjust applications according to the new universal rules, which may involve additional administrative work and a brief delay, most people are optimistic, believing that the approval speed may be "exceptionally fast," similar to how the ETH ETF went from withdrawal to approval in just a few weeks, with hopes of approval in October.

Crypto journalist Eleanor Terrett analyzed in a post that "as long as the tokens meet the existing standards, the SEC can approve cryptocurrency ETFs at any time with just the submitted S-1 documents. Therefore, even if the deadlines for these individual ETFs are imminent, the SEC theoretically can make decisions on any or all of them at any time."

However, Bloomberg ETF analyst James Seyffart cautioned, "Everything is full of uncertainty. Coupled with the possibility of a government shutdown, the situation could become very unstable." (Related reading: What Happens to Bitcoin if the U.S. Government Shuts Down?)

Currently, while it is unclear how quickly the SEC will process S-1 applications, the removal of the original decision dates eliminates predictability, but this change optimizes the process and reduces delays for more cryptocurrency ETFs to enter the market.

Which of the Five Major Candidates Will Lead the ETF Race?

Although the previously queued ETF applications have returned to the "starting line," the SEC's request for issuers to withdraw applications currently only involves LTC, XRP, SOL, ADA, and DOGE, which may indicate that the first batch of approved ETFs will emerge from these.

1. XRP ETFs

XRP ETFs are the most anticipated focus in October, with 7 XRP ETF applications, including institutions like Bitwise, 21Shares, Canary, and Grayscale. Previously, 6 applications were squeezed into the window from October 18-25, and Franklin Templeton's application was postponed to the latest decision date of November 14.

The XRP spot ETF application was submitted in January 2025, and after the easing of the Ripple lawsuit, the SEC opened comments in July. XRP futures have been listed on CME for over a year, meeting the new regulatory conditions. Previously, Bloomberg analysts James Seyffart and Eric Balchunas raised the approval probability of the XRP spot ETF to 95%. This high probability prediction stems from the increased engagement of the SEC with the application documents, and analysts believe this level of communication is a "clear green light."

Additionally, a key advantage for XRP is that it has been classified as a commodity by regulators, significantly reducing the barriers to its ETF application.

2. SOL ETFs

The SOL spot ETF is currently one of the most watched applications, with 7 major institutions involved, including VanEck, 21Shares, Bitwise, and Franklin Templeton.

On September 27, asset management companies including Fidelity, Franklin Templeton, CoinShares, Bitwise, Grayscale, Canary Capital, and VanEck successively submitted the latest versions of the S-1 form to the SEC. These revised documents revolve around the staking operation details of the Solana ETF.

After the SEC requested issuers to withdraw the 19b-4 filing documents, Bloomberg ETF analyst Eric Balchunas raised the probability of SOL ETF approval from 95% to 100%. He stated, "To be honest, the probability of approval is really 100% now… The universal listing standard has rendered the 19b-4 form meaningless. Now, only the S-1 form-related matters remain, and the SOL ETF could be approved at any time."

However, it is worth mentioning that BlackRock (the largest issuer of Bitcoin and Ethereum ETFs) has not submitted a Solana ETF application, which may reflect its cautious attitude towards Solana's regulatory risks.

3. LTC ETFs

As one of the longest-running tokens in the crypto market, LTC has maintained a high level of security and decentralization since its launch in 2011. Currently, there are three Litecoin ETF applications, including the Canary Litecoin ETF, Grayscale Litecoin Trust ETF, and CoinShares Litecoin ETF.

The October 10 deadline for the Litecoin ETF made it a "dark horse" candidate. Although the "invalidity" of the original decision dates has reduced the likelihood of the Litecoin ETF being the first to be approved, LTC's long-term market stability, strong compliance, and technology architecture similar to Bitcoin still give it a high probability of being among the first to list.

Additionally, Litecoin has not been classified as a security by the SEC like XRP or SOL, making it closer to the commodity attributes of Bitcoin, significantly reducing regulatory barriers.

4. Cardano (ADA) ETF

Grayscale's Cardano Trust plans to convert to an ETF, with the S-1 document registered in August, and the final deadline previously set for October 26. Cardano is known for its academic foundation and sustainability, and if this spot ETF is approved, it will be the first product from a non-ETH PoS platform. Notably, Grayscale's GDLC (Digital Large Cap Fund) was approved on July 1, which includes ADA, further enhancing the probability of ADA ETF approval.

5. DOGE ETFs

Currently, there are three DOGE ETF applications, including Bitwise, Grayscale, and 21Shares. The SEC was expected to make a ruling by October 12 at the latest. If the DOGE spot ETF is approved, it will become the first Meme ETF.

Conclusion

Regardless of the final outcome, the key window period in October will become an important turning point in the history of crypto ETFs, as it will not only affect the prices of related cryptocurrencies but also determine the scale and speed of institutional funds flowing into cryptocurrencies. The crypto market is maturing, and the ETF decisions in October may be a key step towards further mainstream recognition.

Related reading: SEC's New Rules Open the Floodgates for Crypto ETFs, Will 10 Spot ETFs Be Launched?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。