It’s day three of the federal government shutdown, but one couldn’t tell by looking at the markets. Stocks are mostly up, except for a few tech companies such as AI firm Palantir Technologies (Nasdaq: PLTR), which nosedived 7% on Friday. The broader crypto market has swelled to nearly $4.2 trillion, a 1.48% jump since yesterday, and bitcoin ( BTC) is less than $2,000 away from its all-time high.

The U.S. government ran out of money on Wednesday at midnight and was forced to shut down for the fifteenth time since 1980. Senate Republicans and Democrats had proposed temporary funding bills to avert the closure, but both failed to pass, leaving millions of federal employees in limbo. The previous shutdown occurred at the end of 2018, also under the Trump administration. It was the longest ever, lasting 35 days and costing an estimated $3 billion according to Democrats.

Then, mere hours after Wednesday’s closure, human resources firm ADP delivered a damning indictment of previous Fed interest rate policy by reporting that the country’s private sector had lost 32,000 jobs, startling economists who had projected a 45,000 increase. But even that didn’t spook investors, who became even more bullish in anticipation of additional rate cuts later this year, bringing us to this moment where bitcoin is on the verge of a fresh all-time high.

“ BTC will print a fresh all-time-high next week and likely hit my forecast for Q3 of USD 135,000 soon thereafter,” said Geoffrey Kendrick, head of digital assets research at Standard Chartered Bank. “The shutdown matters this time around. During the previous Trump shutdown (22 Dec 2018 to 25 Jan 2019), bitcoin was in a different place than now, so it did little.”

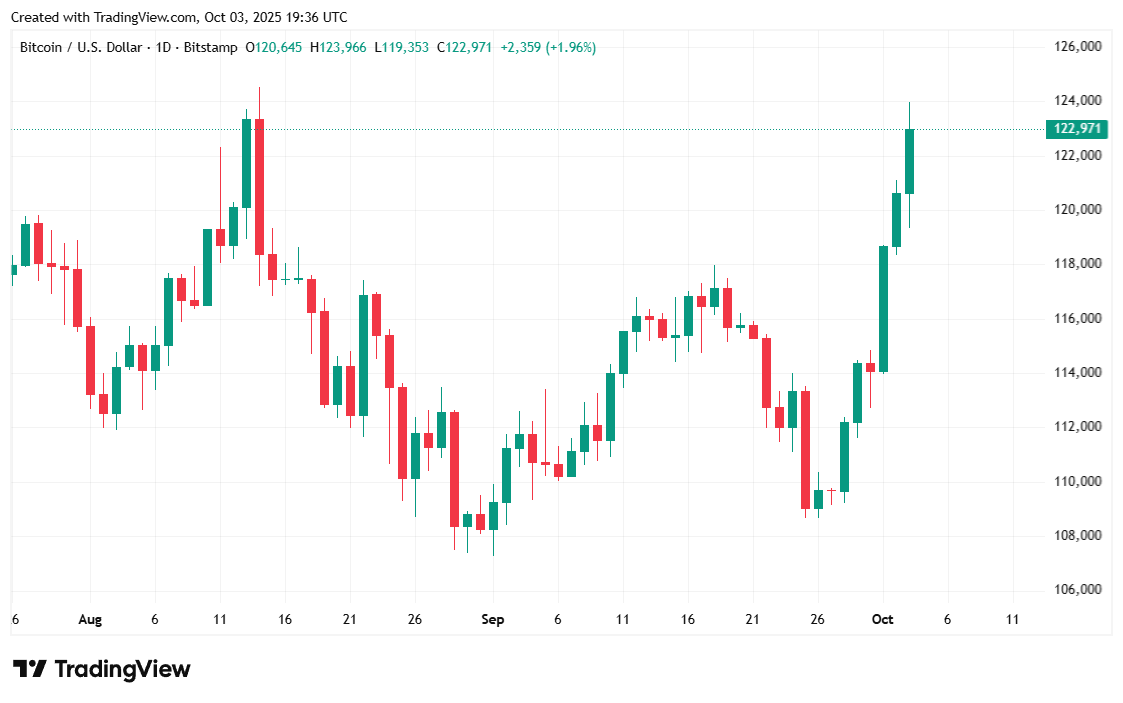

Bitcoin was priced at $122,958.26 at the time of reporting, up 1.62% over 24 hours and also up 12.55% over seven days, based on Coinmarketcap’s data. The digital asset has fluctuated between $119,344.31 and $123,944.70 since yesterday.

( BTC price / Trading View)

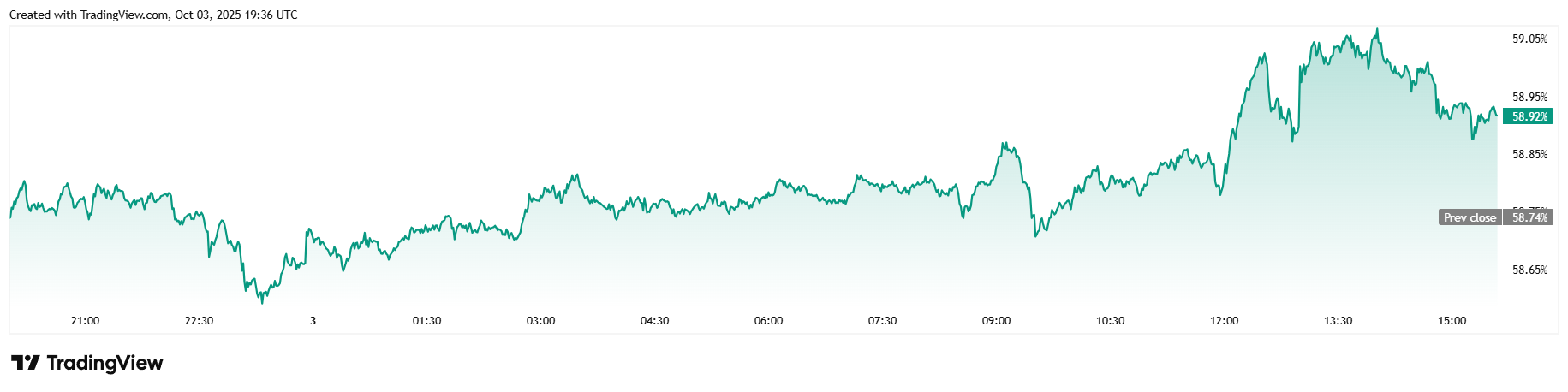

Twenty-four-hour trading volume jumped 19.25% to $87.09 billion, and market capitalization rose 1.44% to $2.44 trillion in line with prices. Bitcoin dominance inched up 0.31% to 58.91% as the cryptocurrency outperformed much of the altcoin market.

( BTC dominance / Trading View)

Total bitcoin futures open interest was up 1.03% over 24 hours at $89.63 billion as per Coinglass, and bitcoin liquidations jumped to $211.58 million since yesterday. Much of that was short liquidations, which tipped the scales at $153.36 million, and the rest came from longs, which accounted for a smaller $58.22 million of overall liquidations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。