🧐 Bluefin @bluefinapp: Is Perp DEX the "hidden winner" of the Sui ecosystem based on its rise?

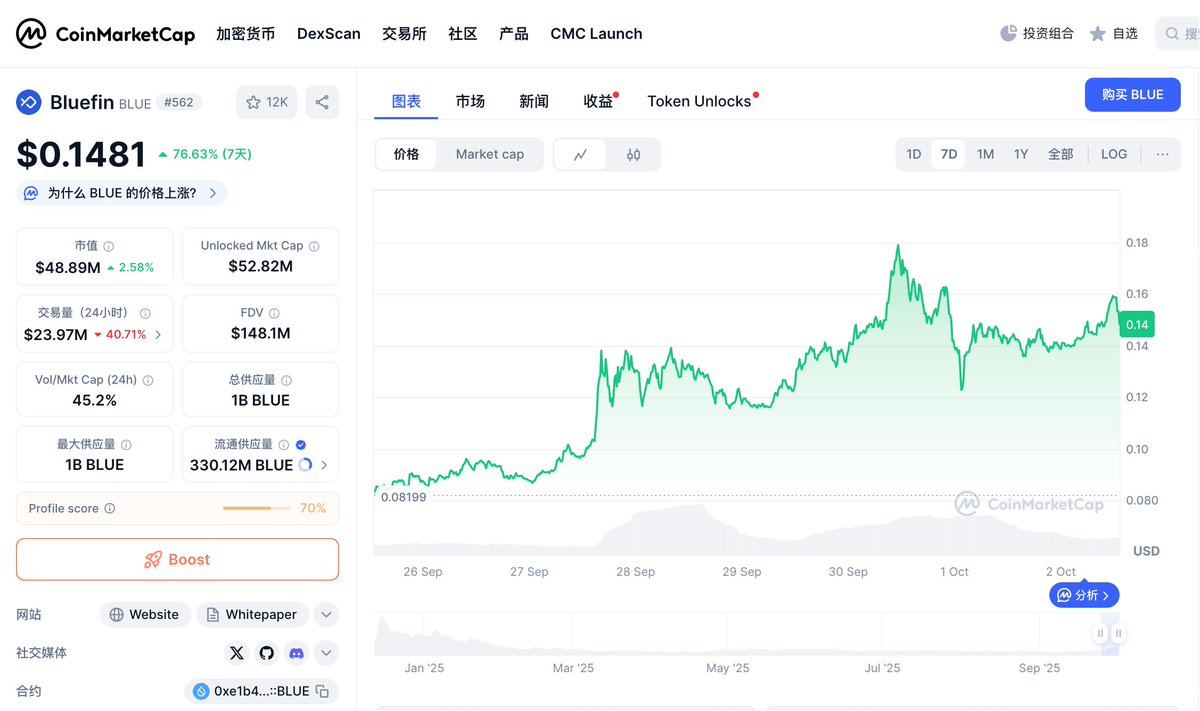

In the past week, with the explosion of the DEX sector, $BLUE has surged by as much as 85%, and in the past month, it has increased by up to 151%;

Currently, the circulating market cap is about $40 million, and it seems that the market is beginning to establish a new rhythm of its own.

A few days ago, when I wrote the analysis on Perp DEX, I mentioned: to understand this wave of DEX explosion, it cannot be seen as an isolated phenomenon:

The rise of Perp DEX is essentially the result of advancements in infrastructure, co-construction of the ecosystem, and capital expectations igniting simultaneously:

Derivatives trading requires extreme performance, and Sui just happens to provide such conditions: low latency and high throughput.

Compared to Aster and Hyperliquid, Bluefin currently has a market cap only at the $40 million level, while Aster's daily fee revenue can exceed $10 million or even higher, and Hyperliquid also has fee revenues in the millions,

Relatively speaking, this precisely means that Bluefin still has ample room to catch up.

Moreover, let's not forget that SUI is the most outstanding public chain this year; I believe it will not sit idly by regarding the ecosystem, especially the position of Bluefin as the leading Perp DEX in the ecosystem. Therefore, if the popularity of Perp DEX becomes the norm, Bluefin is likely to become a major winner in the Sui ecosystem and the next focal point.

1️⃣ Why Sui?

Bluefin's choice to start on Sui is not accidental.

Low latency, high throughput ——

For derivatives exchanges, this is a lifeline.

Move language ——

Ensures programming security while also improving efficiency.

User experience optimization ——

zkLogin + gas fee sponsorship is addressing the biggest usage barrier in Web3.

In other words, Sui has given Bluefin a dedicated "highway," allowing it to run its own story with extremely low friction.

2️⃣ Infrastructure + Data Support:

Many people underestimate the foundational base that Bluefin has already accumulated:

$230 million TVL;

$79 billion cumulative trading volume;

10,000+ DAU (daily active users);

Annual revenue of $37 million;

More critically, Bluefin's buyback plan officially launched on October 1, which means there will be a stronger correlation between token price and protocol revenue.

3️⃣ Sui's "Core Financial Infrastructure"

On Sui, Bluefin's derivatives trading volume accounts for over 97%. It is not just a Perp DEX (perpetual contract) but is also simultaneously laying out:

Perps (perpetual contracts)

Spots (spot trading)

Lending

This means Bluefin has already become the "core financial hub" of Sui DeFi, an indispensable infrastructure.

4️⃣ The Capital and Momentum Behind It:

The list of investors behind Bluefin includes Polychain, Alliance DAO,

SIG, Tower Research, Brevan Howard, Cumberland DRW, and support from Mysten Labs / Sui core team.

This makes Bluefin not just a DEX but more like a deep bet by Wall Street capital on Sui.

5️⃣ Placing It in a Larger Narrative

If we place Bluefin's explosion in a larger context, we will find that it is not an isolated event:

With the popularity of Hyperliquid and Aster, DEX is currently the hottest sector, and—

RWA needs a derivatives market as a border, and Bluefin's high leverage and high liquidity just fit that; stablecoins, during cross-chain migration, require the credit expansion scenarios provided by the derivatives market; the evolution of foundational public chains (Plasma, X-Layer, Sui) is providing a true technological highway for Perp DEX.

This is also why Bluefin's rise is not just an airdrop bonus but a product of the resonance between infrastructure and capital.

Conclusion—

Looking back at the entire derivatives sector, Aster and Hyperliquid have already proven themselves in the market.

But in the story of Sui, Bluefin is becoming the core financial infrastructure of the ecosystem: it has captured over 97% of the trading volume share, covering contracts, spot trading, and lending, and has received deep support from top capital.

In other words, the role Bluefin plays on Sui is akin to that of Aster on Base and Hyperliquid on Arbitrum.

The future bull market landscape will not have a single winner but will see the emergence of its own "aces" across different public chain sectors.

So, if you believe in the logic of Aster and Hyperliquid, there is no reason to underestimate Bluefin on Sui.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。