Author: Stablecoin Blueprint

Compiled by: Felix, PANews

Recently, the voting on the USDH token on Hyperliquid has attracted significant attention. At first glance, it seems that the winner will become the "dominant" stablecoin in the industry, with a supply exceeding $5 billion. However, Hyperliquid does not operate that way. It is open and permissionless. Anyone can deploy a stablecoin and create trading pairs. Currently, there are several stablecoins in existence, with USDC still holding a dominant position. This vote is more symbolic, but its significance cannot be overlooked.

During the voting process, various stablecoin issuers showcased their advantages to garner support, reflecting a broader trend: more platforms are beginning to recognize the economic benefits of stablecoins and are attempting to negotiate better collaboration terms. A similar phenomenon is observed in other ecosystems; for example, the Solana community pointed out that approximately $450 million in value flows from its ecosystem to Circle and Tether each year, indirectly supporting the competing chain Base. Additionally, MetaMask recently launched the mUSD stablecoin, and MegaETH has adopted a similar strategy on its new L2 network, with clear logic: if you have users, why give up the profits to others?

However, challenging the existing dominant stablecoins in an open ecosystem is not an easy task. Liquidity and convenience are key, and Circle and Tether already hold advantages in these areas. In contrast, closed systems are easier to operate; for instance, custodial platforms or wallets can directly guide user balances to their own stablecoins. But in decentralized governance or custodial models, users typically have a say in how their funds are held, making it more complex to promote the use of new stablecoins.

Despite the challenges, many teams still choose to try because they can start from a closed environment, accumulate awareness and trading volume by monetizing user balances, and then test whether their stablecoin can secure a place in a broader market.

Why Will Everyone Try?

The incentive mechanism is easy to understand: stablecoin balances generate income. The more balance you hold, the more income you earn. For financial service platforms, this represents a new source of revenue. The income you generate can be directly returned to users as rewards or used to subsidize other features.

There are two levels of "success" to consider:

- In-platform revenue: Monetizing balances within their own applications, wallets, exchanges, or fintech products. This is the easiest source of revenue to achieve because the platform already controls these balances; issuing its own stablecoin is merely a way to keep the revenue internal.

- Out-platform adoption: This is the ultimate goal, where the stablecoin circulates outside its own products and earns revenue from balances that the platform cannot directly control. Currently, only USDT and USDC have achieved this goal, and even so, most of the revenue is still captured by Tether. Circle returns a significant portion of its out-platform revenue to Coinbase.

However, even in-platform revenue depends on the platform's actual control over user funds. Out-platform adoption is even more challenging and exceeds most people's expectations. Therefore, while many attempts may emerge in the future, most stablecoins will only succeed within their own ecosystems, with very few reaching the ultimate goal.

**Why Trying *≠* Success?**

Issuing a stablecoin is easy. But getting people to actually use it (especially outside your own platform) is not straightforward.

Platforms without full custody can guide users to use their tokens through user experience design or incentives, but they often face resistance. If they push too hard, they risk damaging the user experience. For CEXs, a few basis points of additional income often cannot offset the revenue impact of maximizing wallet share and trading activity. For DEXs like Hyperliquid, replacing USDC is even more difficult because USDC already has deep liquidity across multiple trading pairs and benefits from users' ingrained behavior: traders can directly use their USDC held on other chains to fund their accounts.

Outside the "walled garden" (closed systems), adoption depends on four pillars, and it is nearly impossible to bypass them:

- Liquidity: Can users easily enter and exit other assets (BTC, ETH, SOL, other stablecoins) at scale with low slippage? Especially in trading, liquidity brings more liquidity.

- Deposit and withdrawal channels: How many entry and exit points are there between fiat and stablecoins? Without bank channels, wallet, and exchange support, users will default to the most convenient option.

- Utility: What are the actual use cases for the stablecoin? Can it be traded, lent, transferred, paid to merchants, or converted to fiat? Each integration exponentially increases utility.

- Interoperability: How universal is the stablecoin across different chains and platforms? Users are increasingly inclined to use multiple chains. A dollar trapped in a closed environment is less valuable than a dollar that can flow freely across different platforms.

USDC and USDT dominate to varying degrees across these dimensions. They have built global liquidity, possess deep fiat deposit and withdrawal channels, extensive cross-chain coverage, and near-universal availability. Because of this, even if economic benefits flow more to issuers like Circle and Tether rather than to the platforms using them, they can still continue to solidify their positions.

This presents a severe test for challengers. You can promote adoption within your own platform, but once customers want to do something elsewhere, they will revert to stablecoins with stronger liquidity. Ironically, providing this choice is often the best way to attract deposits. Making assets easier to transfer also makes it easier for them to move their assets. But every time you do this, you reinforce the network effects of existing stablecoins.

In summary: users tend to choose stablecoins that are liquid, convenient, and widely available. Unless new stablecoins can be competitive in multiple areas (or completely avoid these aspects and establish themselves in new niche markets), their adoption outside closed ecosystems will stagnate.

Who Can Promote Their Own Stablecoin Within Their System?

Let’s think about this from a different angle. Forget about open ecosystems—they are constrained by liquidity and network effects. What if you start from within your own system? You have a wallet, an exchange, or a consumer application. From these starting points, can you really cultivate your own stablecoin? Who truly has the ability to promote their own stablecoin within their system?

Perhaps the answer depends on custody and control. The greater your influence over user balances and behaviors, the more freely you can guide them to use your stablecoin.

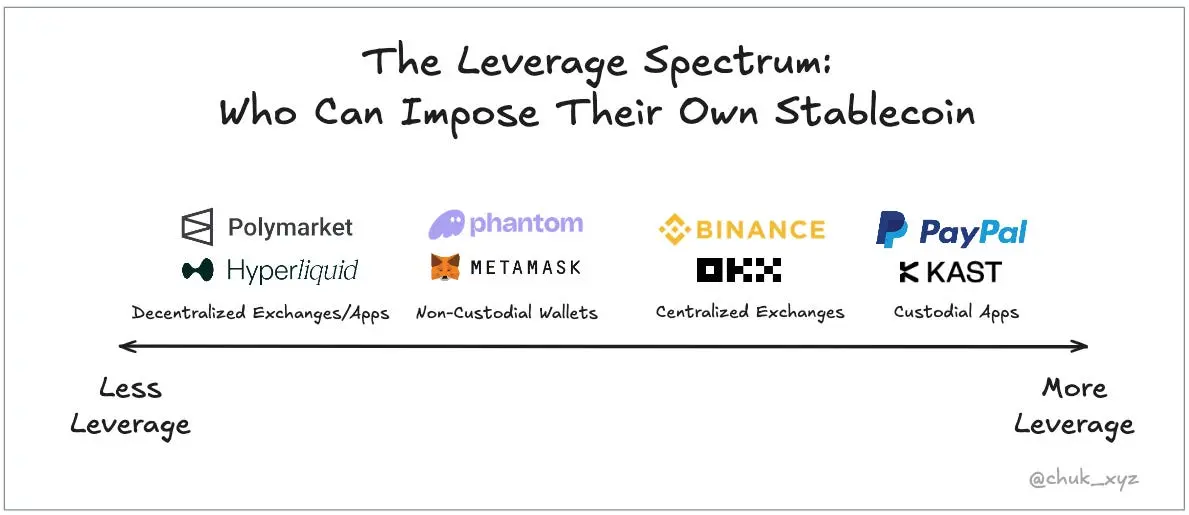

This can be categorized into a range:

- Lowest level: Non-custodial applications and DEXs. They do not hold user funds. They can only influence user behavior by highlighting their preferred stablecoin in the user interface, subsidizing trades, or running incentive programs. But they cannot enforce adoption. It can be said that DEXs find it harder to achieve this than wallets because existing stablecoin liquidity is more challenging to surpass.

- Middle level: CEXs. They hold balances, but the order book is still market-driven. Users can deposit any assets they like and build liquidity pools around the most popular assets. Exchanges can improve their odds by subsidizing liquidity for preferred trading pairs or running a unified order book (showing "dollar" balances to users while managing stablecoin balances in the background) (e.g., Binance and OKX).

- Highest level: Custodial wallets and applications. In this case, the operators hold the keys. They can display dollar balances in the application while deciding the underlying assets themselves.

The pattern is clear: the closer you are to custody and the user interface, the greater your influence; the greater your influence, the less you need to compete on liquidity. In open, market-driven ecosystems like Hyperliquid or Solana, it is extremely difficult to replace existing participants. In closed or custodial environments, operators can launch their own tokens almost overnight.

Expect Thousands of Stablecoins, but Most Will Be Limited to the "Walled Garden"

The success of stablecoins does not depend on who can issue them, but on who can exert influence. In open ecosystems, liquidity favors existing participants. In closed systems, custody and user interface control determine the outcome.

Given the advantages of issuing their own stablecoins, it is expected that a large number of stablecoins will be launched. Wallets, exchanges, L2 networks, and consumer applications will all attempt to do so.

Most stablecoins will not break through the "walled garden": they will be useful and profitable on their respective platforms but will rarely circulate outside of them.

The few stablecoins that can "break the circle" will not succeed by directly challenging USDC or USDT. They will succeed by seeking new markets with weaker network effects, with each attempt serving as a valuable experiment.

This is a way forward, but one should not underestimate the effort required.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。