Original Author: Max@IOSG

Original Source: IOSG Ventures

TL;DR

- Retail investment in traditional finance (tradfi) has become mobile (zero commission + app user experience), and this trend is spreading to the cryptocurrency space—retail users are seeking fast, familiar, low-friction mobile-native trading experiences.

- Hyperliquid's tech stack (HyperEVM + CoreWriter + builder code) significantly lowers the development threshold for mobile frontends while balancing the execution efficiency of CEXs with the advantages of DEXs (self-custody, quick token listing, fewer geographical/KYC restrictions).

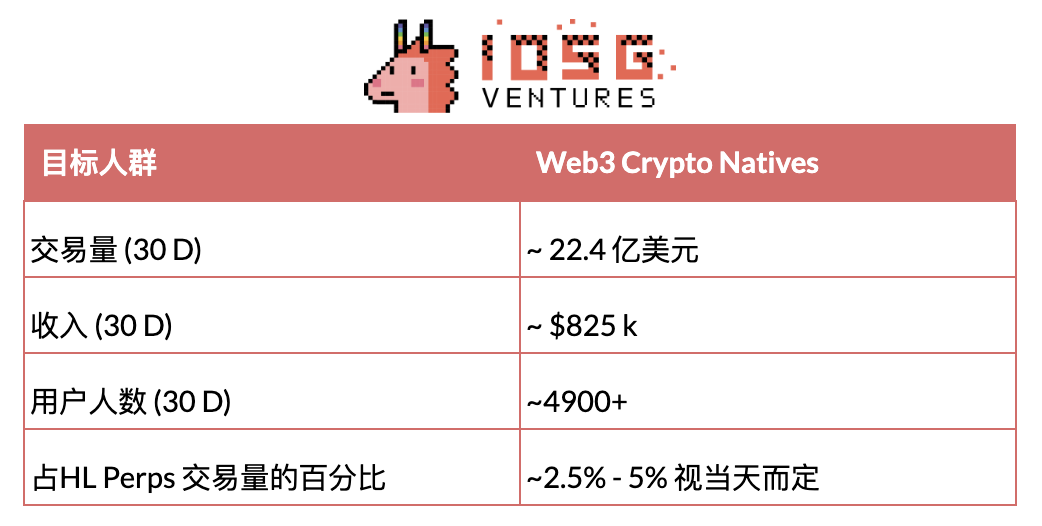

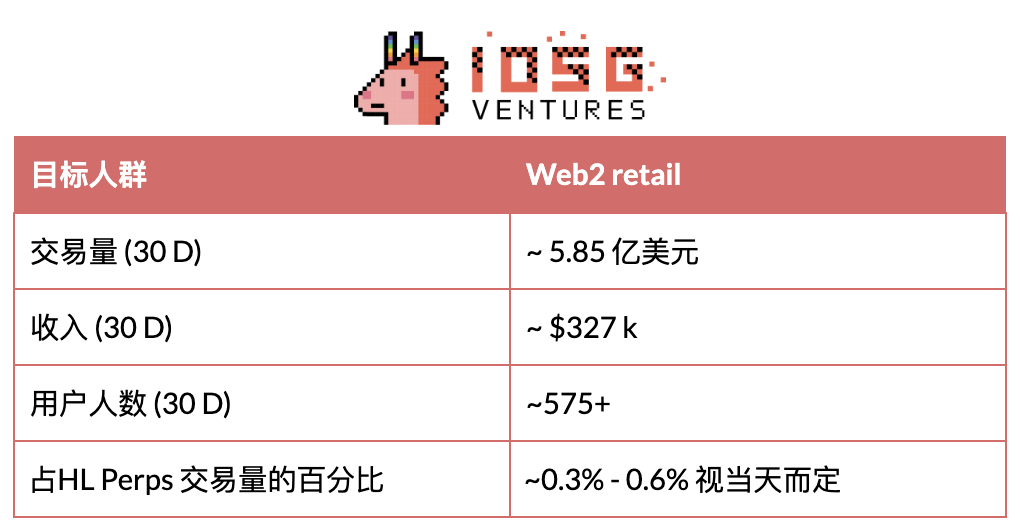

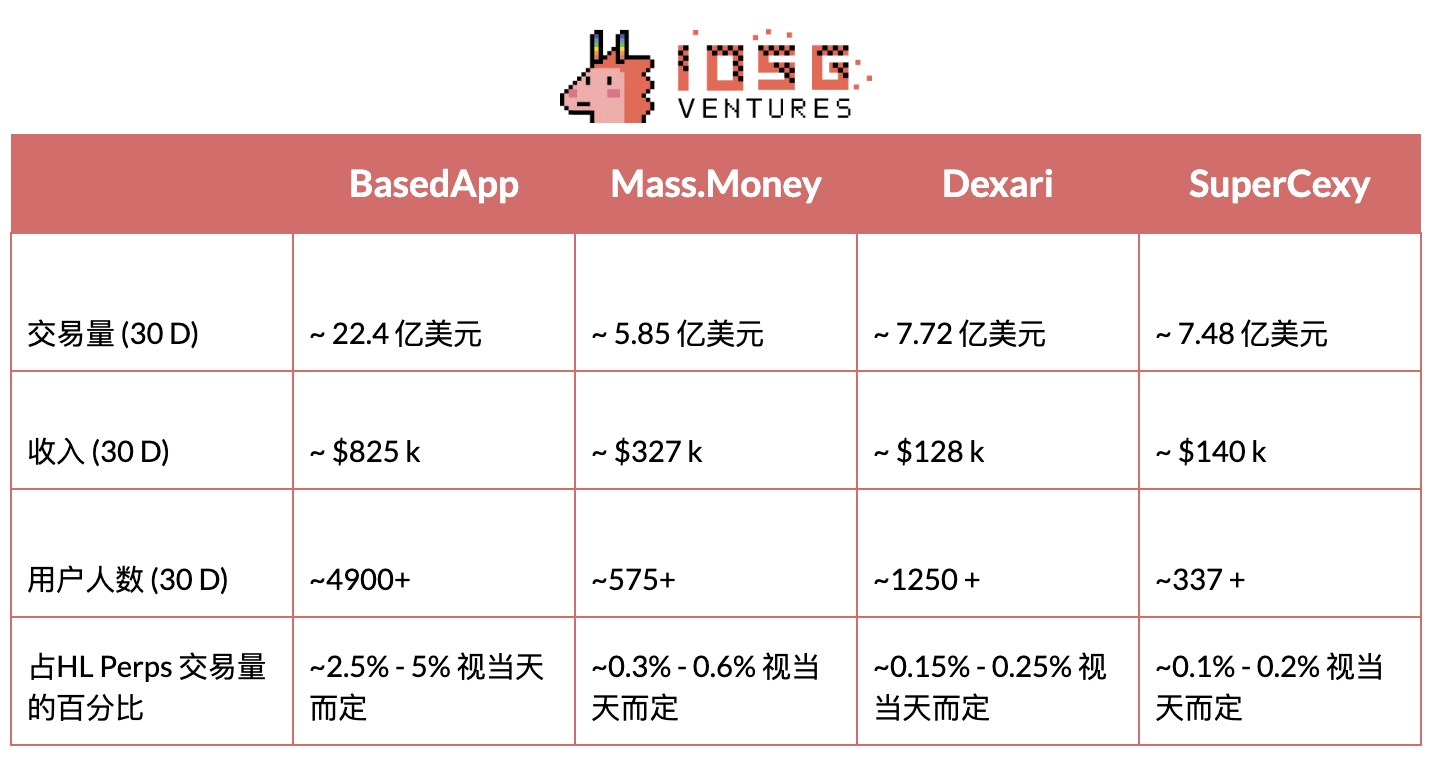

- A wave of native mobile applications based on HL has begun: BasedApp, Mass.Money, Dexari, Supercexy. These applications have an average daily trading volume of $50,000 (monthly recurring revenue of $1.5 million), accounting for about 3-6% of HL's perpetual contract trading volume, targeting diverse user groups (crypto-native users, Web 2 retail users, professional traders).

- Why now? "Hyper-speculation" + creator content cycles have heightened retail user risk appetite; mobile applications compress user onboarding time, simplify crypto complexity, and add sticky features (copy trading, fiat deposits, card payments, money markets, yield tools).

Core Argument:

- The crypto mobile trading frontend benefits from strong tailwinds from the Web 2 mass audience and retail behavior.

- For the cryptocurrency market to achieve scale and trading volume growth, it needs to provide more crypto-native mobile applications for mainstream Web 2 consumers.

- Compared to Web 3 business models, this field has true sustainable scale revenue characteristics, with extremely low marginal costs of expansion.

In recent months, there has been a significant increase in mobile trading + DeFi applications aimed at retail consumers, most of which are built on Hyperliquid infrastructure. This article aims to delve into this vertical field, analyze the currently dominant market applications, and present relevant viewpoints.

Background

Overall, the scale of retail investor participation in traditional investments has seen tremendous growth over the past decade. This trend began in 2019 when several large U.S. brokerages reduced stock trading commissions to zero to compete with Robinhood, significantly lowering trading costs for small accounts. The pandemic in 2020 accelerated this process: lockdown policies, stimulus checks, and continuously optimized mobile experiences brought millions of new entrants into the market. By 2022, the Federal Reserve's Consumer Finance Survey showed a significant increase in stock market participation—58% of U.S. households directly or indirectly held stocks, with the direct ownership ratio jumping from 15% to 21%, marking the largest increase in history.

The share of retail trading in daily market activities continues to stand out: it currently accounts for 20-30% of U.S. stock trading volume, far exceeding pre-pandemic levels. This phenomenon is not limited to the U.S.; it is also evident globally: the number of investment accounts in India surged from tens of millions before the pandemic to over 200 million by 2025. Investment channels are also continuously expanding—record inflows into ETFs in 2024-2025, along with the popularity of fractional trading and mobile brokerage services, have provided retail investors with more convenient investment tools. The cost impact of zero commissions, the channel impact of mobile trading applications, and the liquidity impact of ETFs have collectively driven retail investors to enter the public market on a large scale, making consumer-grade investment applications a significant structural force in the market.

Mobile Trading Applications

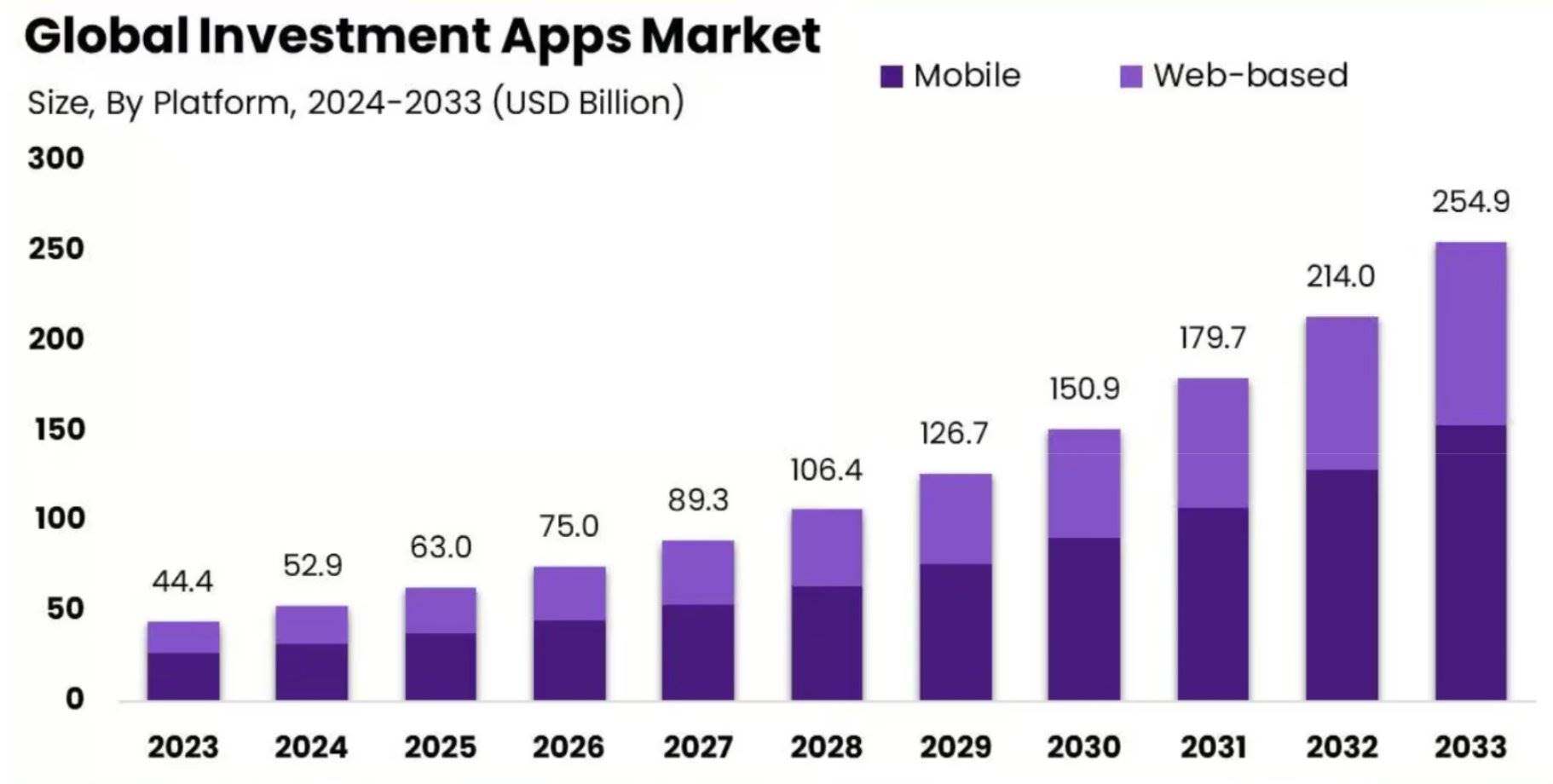

Since 2021, the vertical field of mobile trading applications in the retail trading market has been continuously expanding, driven by the increase in mobile device penetration and the rise of a new generation of self-directed investors. The global investment application market is expected to reach approximately $254.9 billion by 2033, with a compound annual growth rate (CAGR) of 19.1%.

Why are mobile trading applications so favored by retail investors? The main reasons can be summarized in two dimensions:

#Social Driven (Everything Gamified, Speculative)

Contemporary social culture is dominated by dopamine loops, gamification mechanisms, and hyper-speculative behavior. The rise of the creator economy and short video platforms (such as TikTok and YouTube Shorts) has reshaped user behavior patterns, with people seeking instant gratification, and mobile trading applications perfectly align with this demand on multiple levels.

On the social level, communities like Wall Street Bets on platforms like Reddit are filled with users showcasing massive gains and losses. The phenomenon of daily gains or losses exceeding $100,000 has become normalized, and retail users are gradually desensitized to such amounts. Many users disconnect their Robinhood account funds from real money, viewing their portfolios as game chips. Coupled with rising living costs, widening wealth gaps, and negative sentiments towards "involution," many working-class individuals believe that only through "hyper-speculation" can they achieve the American Dream—seeking excessive returns through extremely high risks.

Mobile trading applications have successfully captured this social cultural dividend. By offering short-term options, leveraged products, instant execution, and gamified interface experiences, these applications have successfully attracted users from casinos to the stock market. Users only need a smartphone to simultaneously experience dopamine stimulation, gaming excitement, and speculative experiences.

#Application Features

In terms of application features, mobile trading applications have achieved significant optimization across multiple dimensions. In the user onboarding phase, they have compressed the account opening process from cumbersome paperwork taking days to nearly instantaneous online operations. All user processes from identity verification to trade execution are integrated into a single interface, allowing users to manage their portfolios comprehensively.

In terms of trading experience, by eliminating friction points in traditional brokerage models and incorporating new value points such as fractional share purchases and regular investment, these platforms have simultaneously lowered both the financial and cognitive thresholds. By borrowing familiar consumer design language from mainstream applications, they have shortened the trading decision path, while personalized features (such as curated asset lists and portfolio performance analysis) continuously maintain user engagement.

Additionally, post-investment features such as performance breakdown reports and automated tax reporting make the experience closer to a full-service financial application where users can complete all operations, rather than just a trading terminal. On the social side, content elements further lower usage barriers by providing easily shareable interfaces, promoting social participation and incentives (e.g., usage behaviors driven by WSB forums). These features collectively explain why mobile platforms have become the default investment channel and a lasting driving force for retail market participation.

What Does This Mean for the Cryptocurrency Industry?

The mobile-first application trend has extended from traditional finance/Web 2 markets into the Web 3 space.

Over the past five years, the usage of cryptocurrency wallet applications has surged, indicating a market demand for mobile-native crypto products. Since trading and yield are inherent characteristics of cryptocurrencies, perpetual contracts and DeFi have naturally become the first areas to be transformed in the "mobilization" process.

With the rise of Hyperliquid since the end of 2024 and the launch of its modular high-performance trading infrastructure, numerous mobile perpetual contract DEX trading and DeFi frontend products have begun to be built on HL infrastructure and flood the market.

Why Hyperliquid and DEX?

From a developer's perspective, HyperEVM's infrastructure is highly attractive due to the powerful tools it provides. CoreWriter and precompiled contracts allow smart contracts on HyperEVM to interact directly with HyperCore perpetual contract positions, enabling unique use cases and near-instant execution. Builder code provides developers with a clear incentive layer, allowing them to earn fee sharing when users trade through their frontends. These features not only lower the development threshold but also make HyperEVM one of the most developer-friendly platforms, attracting top teams and talent. This is why 99% of crypto mobile trading frontends choose to build on Hyperliquid.

As for why choose DEX? Traders are generally attracted by the structural advantages of DEXs: providing broader access opportunities by eliminating KYC and jurisdictional restrictions, faster token listings, and a richer selection of tokens, along with the autonomy of fund custody. Previously, CEXs attracted retail users because they significantly reduced the complexity of market participation: offering multiple trading markets within a single mature web application, with instant execution, low slippage, and high liquidity, while integrating wallet management, stable yield, fiat channels, and other auxiliary functions. However, users had to bear significant counterparty risks and relinquish asset self-custody.

Hyperliquid perfectly integrates all of this. This on-chain decentralized exchange enjoys the structural advantages of a DEX perpetual contract platform while possessing CEX-level liquidity, execution efficiency, and overall user experience. Therefore, it has become the ideal liquidity foundation for building mobile crypto trading applications.

So, what is the connection to mobile wallet trading?

Thanks to the availability of this modular high-performance architecture, the development costs for building mobile trading frontends have become extremely low—this is why a large number of related applications are beginning to emerge in the market.

Currently, most mobile trading frontends offer similar features centered around perpetual contract trading, but some applications have begun to go beyond perpetual contracts, providing users with more auxiliary products. Overall, these applications generally have the following features:

- Fiat deposit channels: supporting various deposit methods such as credit/debit cards, bank transfers, Apple Pay, Google Pay, Venmo, etc.

- Investment strategy tools: offering dollar-cost averaging plans, stop-loss and take-profit features, and early access to new tokens.

- Money market integration: one-stop access to DeFi lending protocols.

- Yield generation: earning returns through automated compounding vaults.

- Dapp explorer: searching and connecting to emerging decentralized applications.

- Debit/credit card services: directly using self-custodied funds for spending.

The realization of these features is due to Hyperliquid infrastructure significantly simplifying the development difficulty of the perpetual contract main product, allowing teams to focus on innovations in other derivative areas. Due to the modular nature of the entire ecosystem, most HL-based projects can easily achieve parallel development across multiple domains. Many applications can offer rich functionalities, primarily due to: 1. The low development threshold of Hypercore builder code; 2. The high willingness of other protocols to integrate.

In addition, major applications are primarily competing in user experience/interface design and social brand building. Currently, the most promising representatives in the market include:

#Basedapp

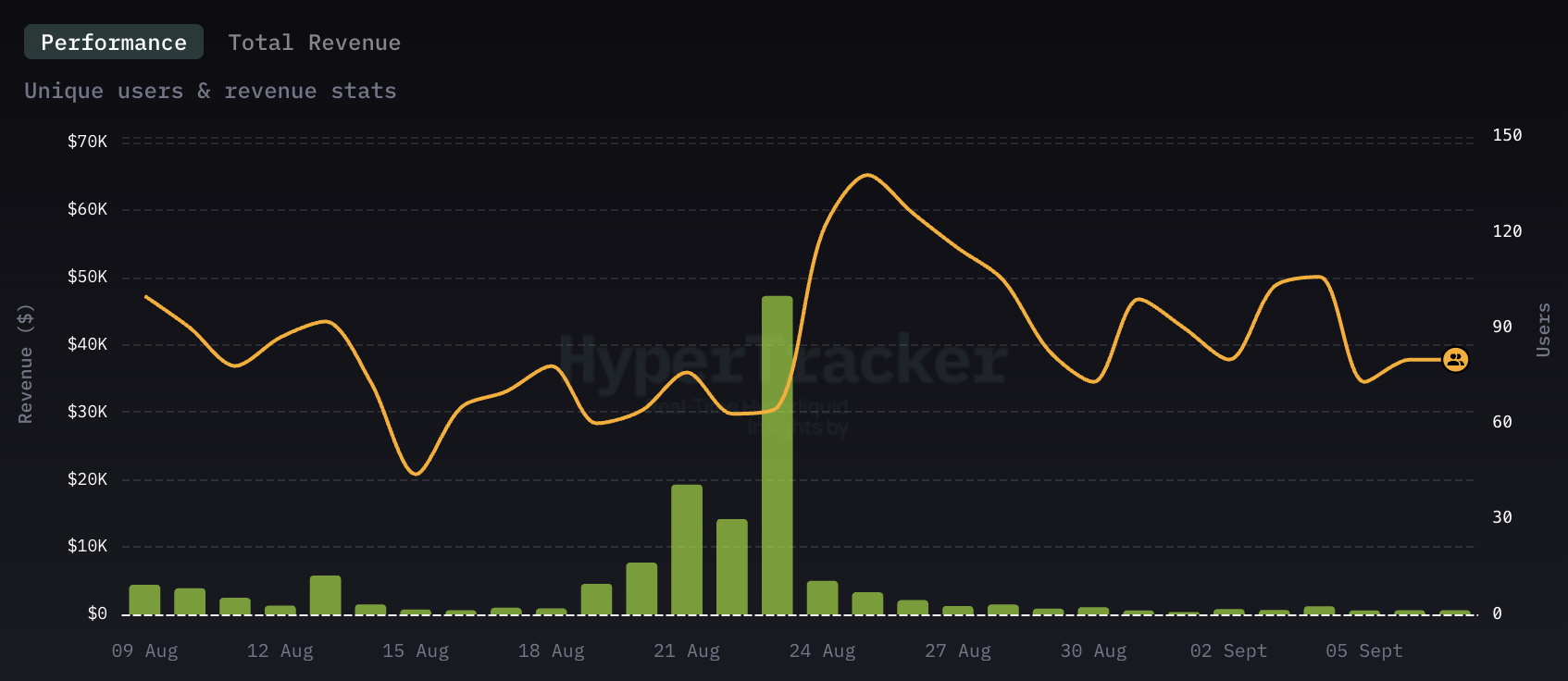

Currently, Based app is the most attention-grabbing and fastest-growing mobile trading frontend application in the market. In addition to providing perpetual contracts and spot trading, the platform has innovatively launched a debit/credit card solution directly linked to users' trading wallets, supporting payment needs in everyday consumption scenarios. Its long-term goal is to transform into an emerging digital bank similar to Etherfi.

#Mass.Money

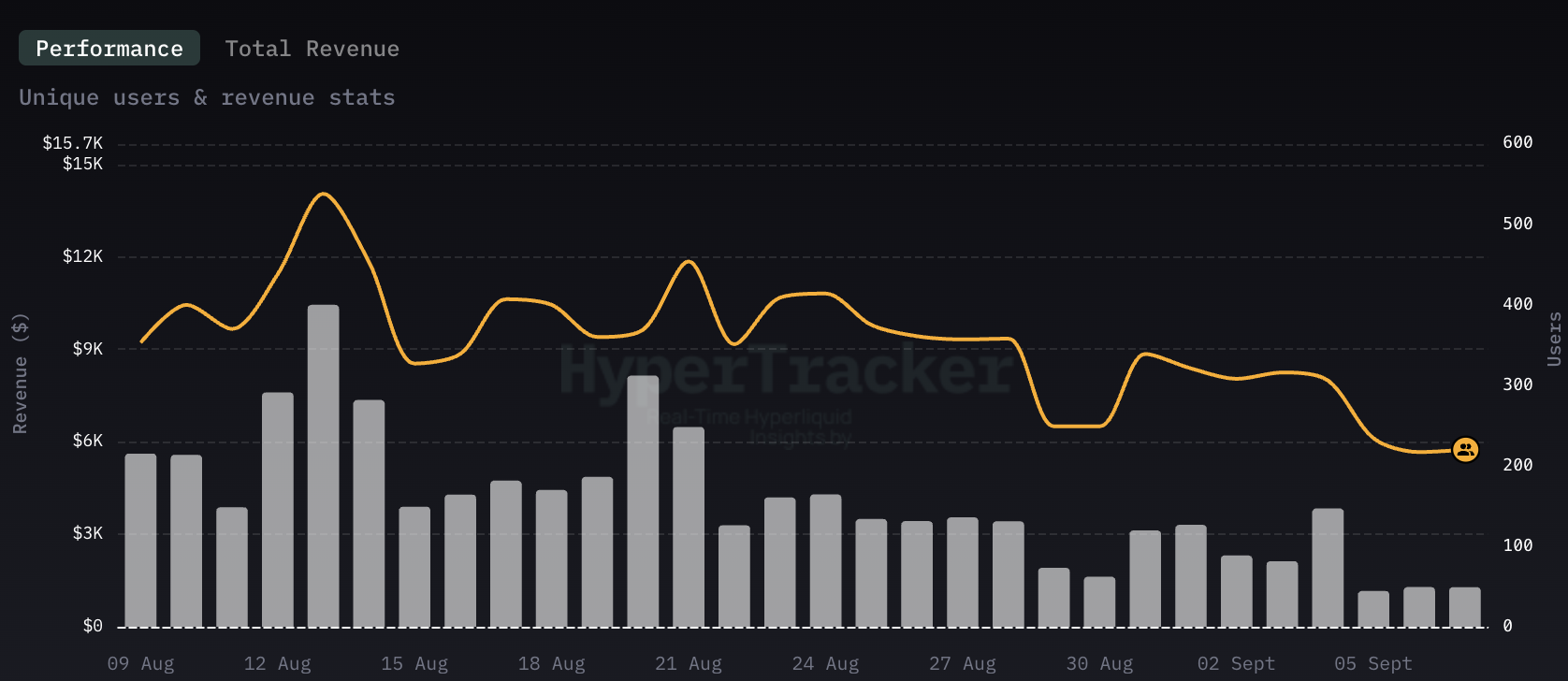

Following closely in the competition of mobile trading frontends is Mass.money. Unlike Based app, this platform focuses more on the Web 2 retail user base, a positioning that is fully reflected in its product design: in addition to standard HL perpetual contracts and spot trading, it also integrates Apple Pay deposit channels, social copy trading features, DeFi money market access, and cross-chain EVM spot exchanges, providing a full suite of services. Its interface design deeply incorporates gamification elements, heavily borrowing design language from Web 2 consumer applications.

However, due to its higher fee model and broader product offerings, their revenue per user and trading volume are significantly higher than Basedapp.

#Dexari

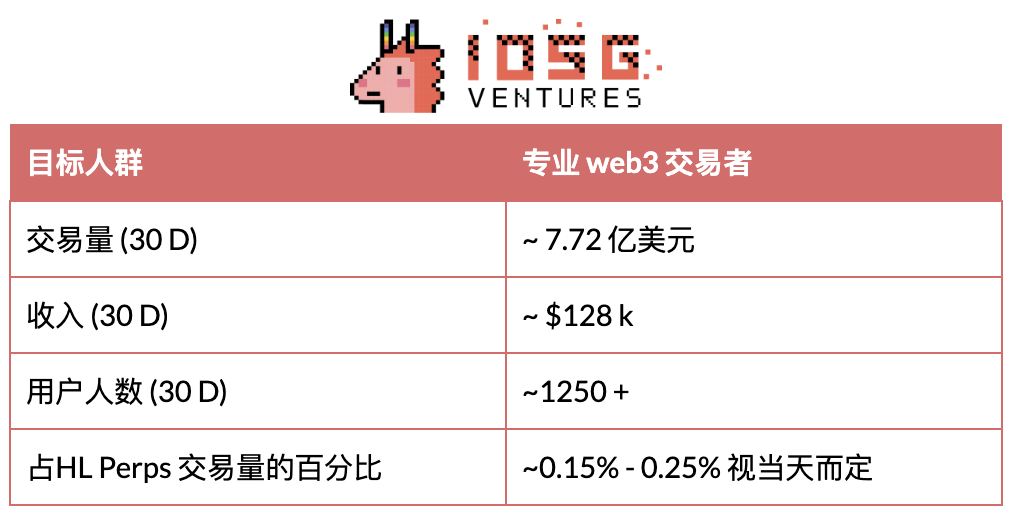

Following Mass.money is Dexari. This is a mobile trading frontend focused on professional traders, purely concentrating on trading functionalities. Therefore, its main product features include HL perpetual contracts and spot trading, with user experience and interface design emphasizing asset discovery features, analytical tools, and execution efficiency. Their goal is to become the Axiom (benchmark for professional trading) of the mobile trading frontend space.

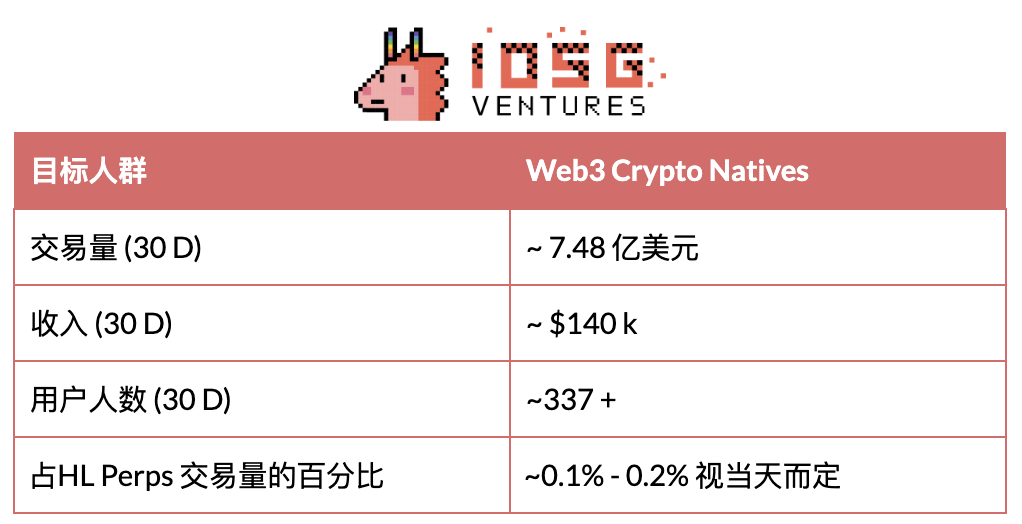

#Supercexy

Last but not least is Supercexy. This platform has not chosen a purely mobile frontend route; it is also optimizing the web-based perpetual contract DEX trading experience, aiming to provide a CEX-like user experience, but entirely based on Hyperliquid infrastructure. Its product suite integrates DeFi staking features and money market access services, thus primarily serving Web 3 native traders.

Comprehensive Perspective

Overall Overview

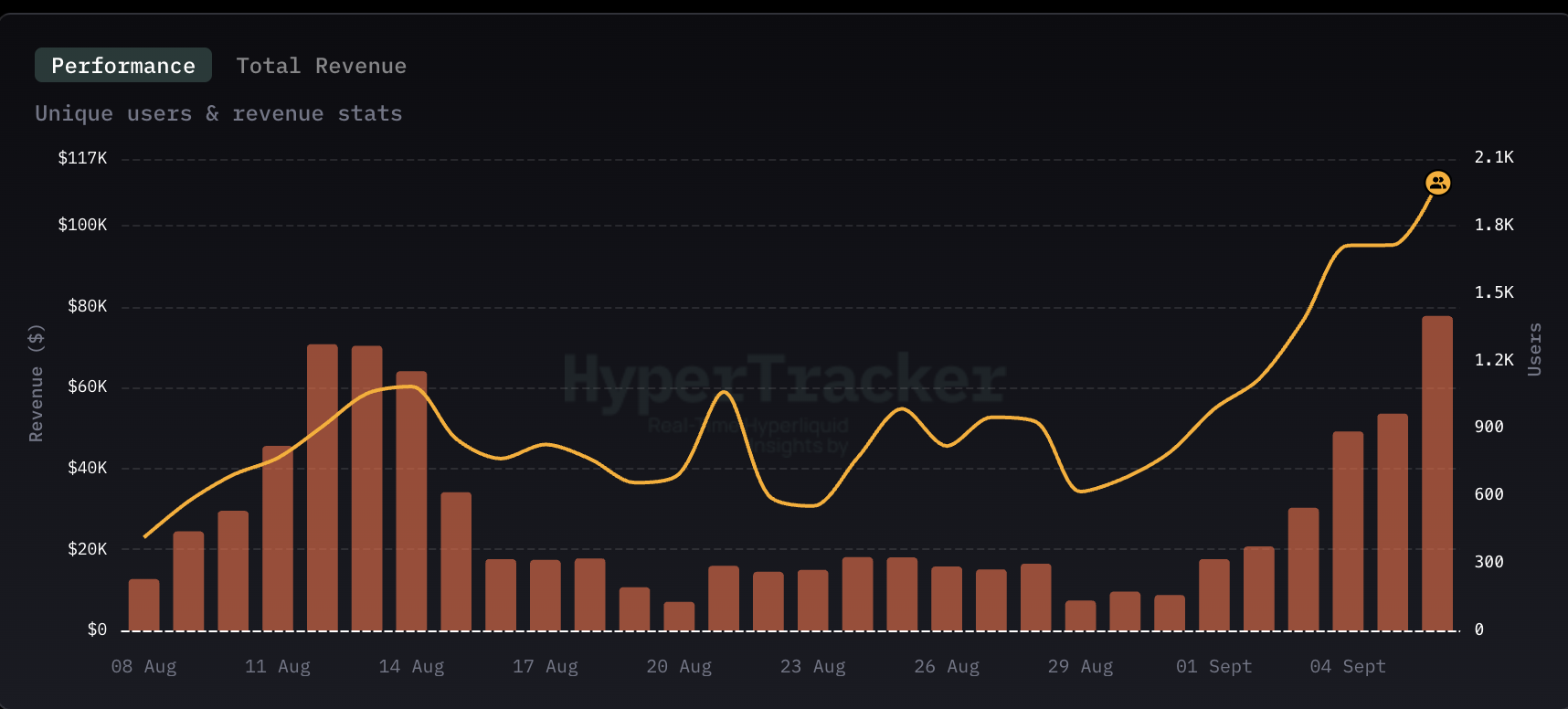

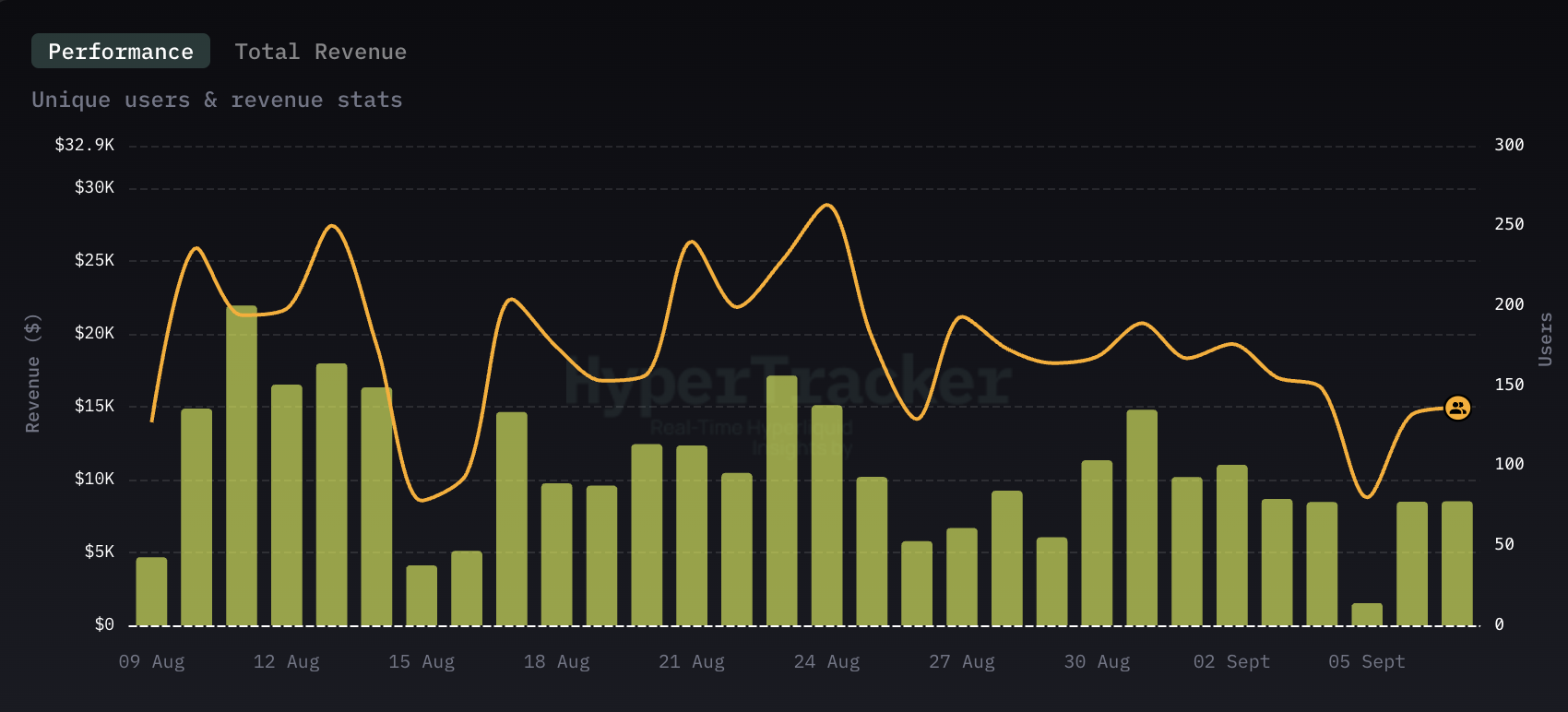

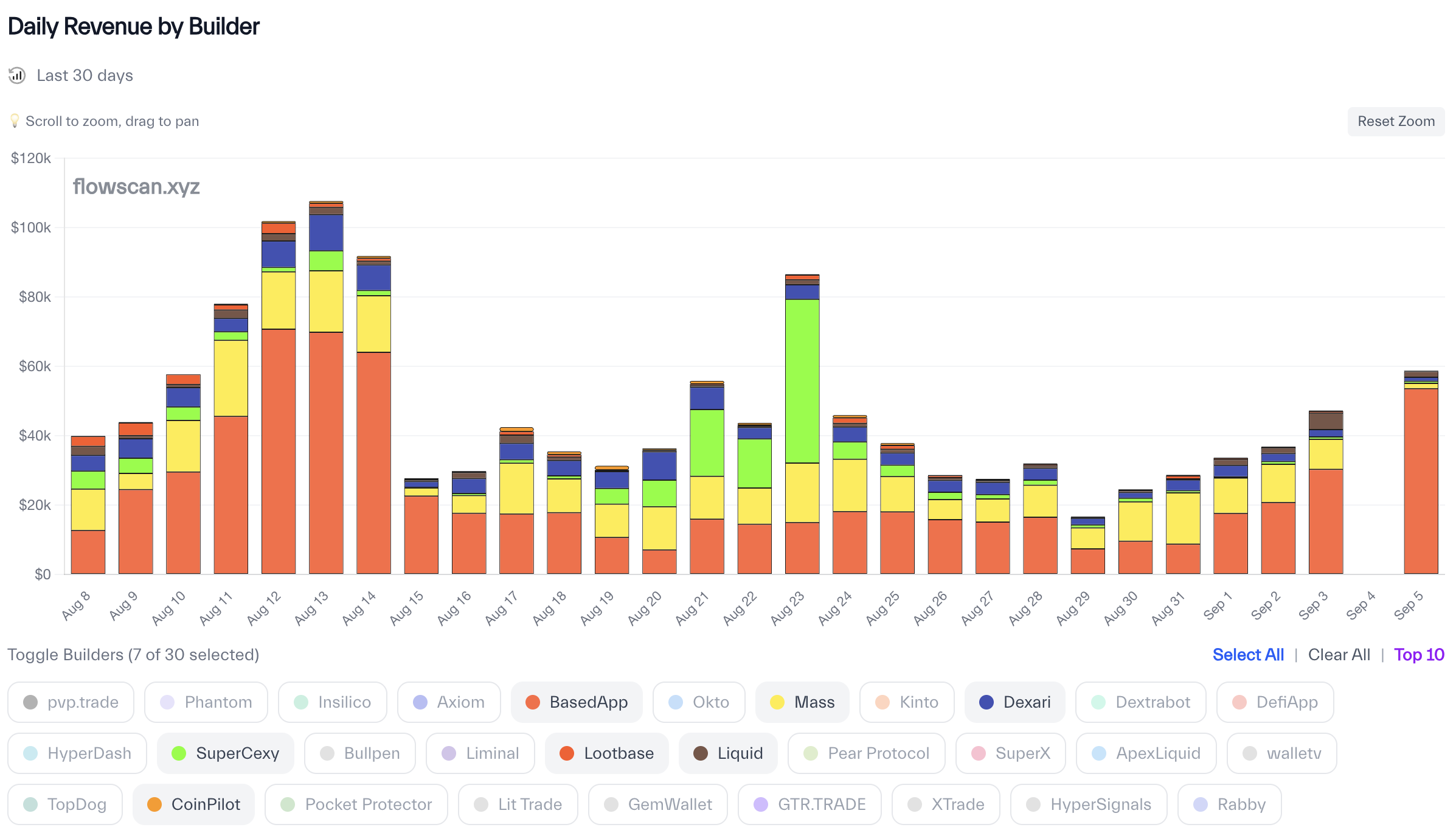

Overall, the daily combined average revenue of all related mobile trading frontends (including some applications not mentioned) is approximately $50,000, equivalent to about $1.5 million in monthly recurring revenue (MRR). These applications account for about 3%-6% of Hyperliquid's total trading volume in perpetual contracts. For reference, Hyperliquid's HLP vault accounts for about 5%.

Hyperliquid Mobile Trading Frontend Revenue

Conclusion

Core Insights

1. The cryptocurrency mobile trading frontend benefits from strong tailwinds from the Web 2 community and retail behavior.

The trend of "hyper-speculation" in society has fundamentally changed the behavior patterns of retail consumers. As evidenced by the growth of Polymarket and Kalshi, most users adopt high-risk strategies in the current environment. Against the backdrop of historically high market speculation demand, mobile trading applications have become the most directly benefited product form. As mentioned earlier, user growth and adoption rates of traditional financial mobile applications like Robinhood, Wealthsimple, and TD Ameritrade have significantly increased, primarily due to their low entry barriers and business models that are eager to promote short-term high-leverage and gambling-like products to users. Clearly, retail users need easy ways to gain risk exposure and allocate capital, making mobile trading applications the most reasonable solution.

Cryptocurrency mobile trading applications are essentially no different; if they can effectively build product discoverability, they can also benefit from these consumer behaviors. The integration of crypto products into applications like Robinhood, Wealthsimple, and Revolut is clear evidence. Even with extremely high fees, crypto products within these traditional financial applications still see significant adoption, indicating a strong demand from retail users for convenient mobile access to the crypto market. Without dedicated crypto mobile trading applications, the Web 3 market will hand over significant value capture opportunities to Web 2 competitors.

2. For the cryptocurrency market to achieve scale and trading volume growth, more crypto-native mobile applications need to be provided for mainstream Web 2 consumers.

Since 2023, there has been virtually no new retail capital inflow into the market. The current total market capitalization of stablecoins is only about 25% higher than the historical peak in 2021, which is a dismal growth rate over a four-year period for any industry—this is happening even in the most favorable regulatory environment for stablecoins and with presidential support for the crypto industry.

The market needs solutions to attract new retail liquidity, but significant barriers to entry for new retail capital remain unresolved. The main obstacles are: first, the public perceives that participating in the crypto market requires complex operational processes; second, there is a lack of accessible applications that truly understand the needs of Web 2 users. Web 2 retail users will not use complex wallets or transfer funds across multiple chains. What they need are products packaged in familiar ways, providing easy deposit channels and friendly experiences, just like Robinhood or Wealthsimple accounts.

Crypto mobile trading frontends are the solution—they package products in traditional financial ways familiar to Web 2 users, fundamentally eliminating the cognitive barriers of crypto complexity and lowering participation barriers. This is the only effective way for cryptocurrencies to break out of the Web 3 circle and gain mainstream exposure.

3. Compared to Web 3 business models, there is a real revenue model with sustainable scale effects and extremely low expansion costs.

Cryptocurrency mobile trading frontends mark the beginning of a new generation of applications in the Web 3 market—a more sustainable and compliant development path. Unlike previous traditional crypto products (whether infrastructure or DApps), most projects in the past did not focus on scale expansion or revenue generation, as this was not the core incentive direction. The North Star metric for most founders was to acquire initial users at any cost, regardless of how inefficient or extractive their growth funnel was, then raise venture capital, lock up tokens through OTC sales, or wait for vesting periods to end without improving the product. Typical examples include: Story Protocol ($IP), Blast, Sei Network ($SEI).

In contrast, crypto mobile trading frontends adopt the opposite strategy: optimizing scale using existing infrastructure, generating revenue first, and refinancing when necessary. By becoming aggregators of different products and adopting a base fee structure, these frontends have a structural advantage to integrate multiple verticals at extremely low costs while focusing on user experience interfaces to enhance user acquisition and retention rates. This combination means they can generate revenue from day one and achieve exponential growth as operations continue. The end result builds a more sustainable real business layer and value layer for Web 3, replacing the past extractive models. This will bring increasing credibility to the entire Web 3 industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。