作者:Bootly

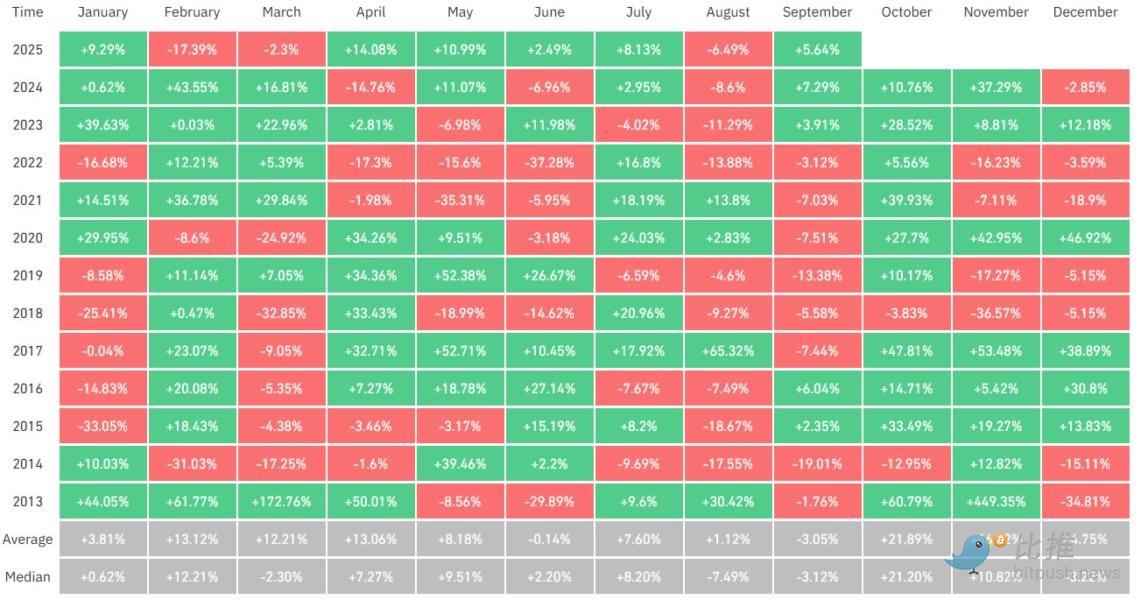

10月刚开头,加密市场便迎来强劲反弹。多项关键指标显示,这个被投资者称为「Uptober」的月份,似乎正在兑现「十月必涨」的历史规律。

市场情绪反转

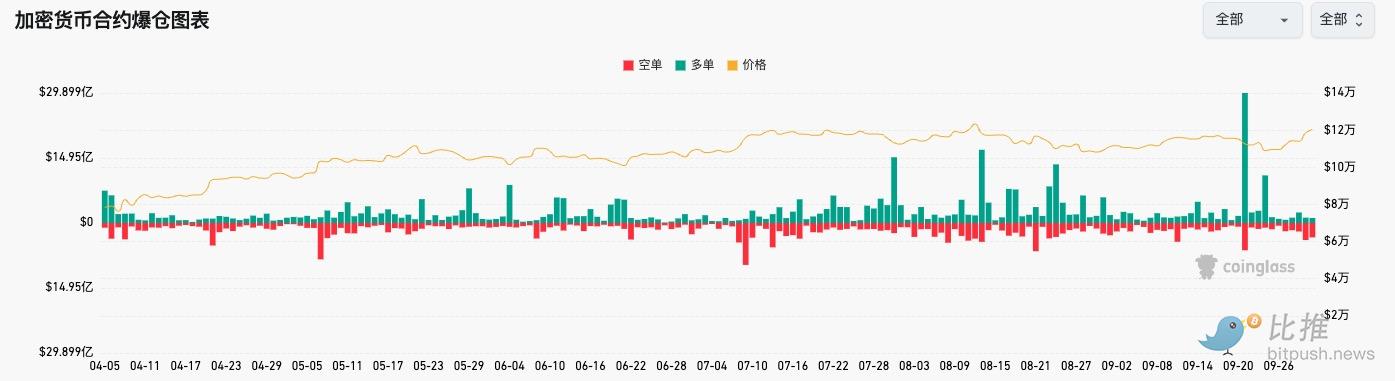

10月开局的两天内,加密市场经历了大规模空头爆仓。根据CoinGlass数据,全球共计超过7亿美元的空头仓位被强制平仓,其中包括一笔在Hyperliquid上达1161万美元的以太坊空单。

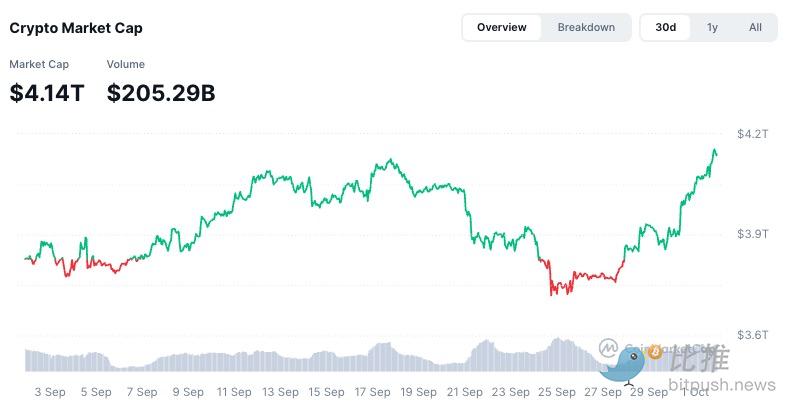

这一轮轧空行情几乎席卷整个市场,百大加密货币悉数上涨。整体加密货币总市值自9月底以来上涨超过6%,在10月2日突破4.14万亿美元,创下自8月中旬以来的新高。

这波涨势不仅一扫9月的疲软阴霾,也让投资者重新燃起了对年末行情的期待。

作为风向标的比特币(BTC)领衔本轮反弹,过去四天涨幅高达10.3%,现报12.05万美元,创下40天新高。

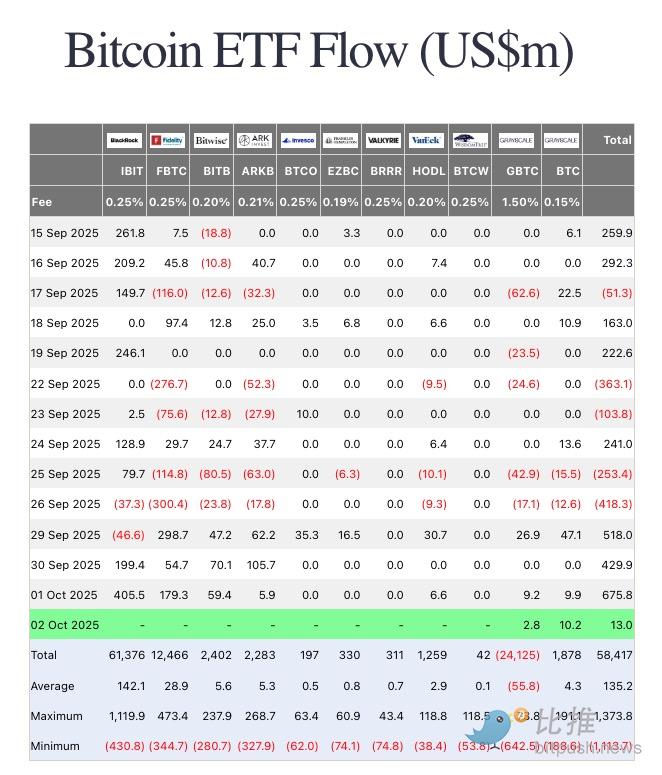

与此同时,比特币ETF资金流入创下9月中旬以来的最高纪录。根据Farside Investors数据:

比特币ETF在周三吸引6.758亿美元净流入;

其中,贝莱德(BlackRock)的IBIT基金单日吸金4.055亿美元;

富达(Fidelity)的FBTC基金吸引1.793亿美元;

Bitwise的BITB基金则吸引了5940万美元。

值得注意的是,这是连续第三个交易日比特币ETF日流入超1亿美元。仅本周前三天,累计流入金额已超过16亿美元,而在9月26日,市场还曾单日流出4.18亿美元。

降息预期升温,资金从「避险」转向「增值」

最新的ADP非农就业数据显示,美国9月就业岗位减少3.2万个,大幅低于市场预期的+5.2万。就业疲软被视为经济放缓的信号,也让市场普遍预期美联储将在10月29日的FOMC会议上再次降息。当前CME FedWatch工具显示美联储10月降息25个基点的概率为97.3%。

这意味着全球流动性环境有望进一步宽松,而「降息预期 + 美债收益率下行 + 美元走弱」的组合,正是比特币和黄金等资产走强的完美土壤。

WisdomTree数字资产研究主管Dovile Silenskyte表示:「比特币兼具‘避险属性’与‘成长资产潜力’,既像黄金一样抵御通胀,又像科技股一样具备成长性。」

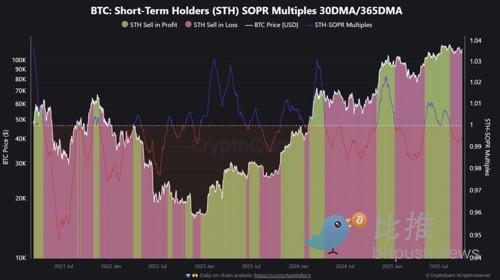

链上数据:长期持币者卖压减弱,底部区间正在形成

根据Glassnode数据,短期持币者实现价值比(STH-RVT)自5月以来持续收缩,表明短线投机行为降温,市场进入「健康积累期」。

与此同时,长期持币者净仓位变化(LTH Net Position Change)转为中性区间,意味着大规模获利了结潮已接近尾声。

这两项数据共同指向一个结论:比特币正在$11.5万至$12万区间构筑新的结构性支撑,类似于今年3-4月的盘整阶段。

若当前供需结构维持稳定,市场极有可能在10月中旬迎来突破性行情。

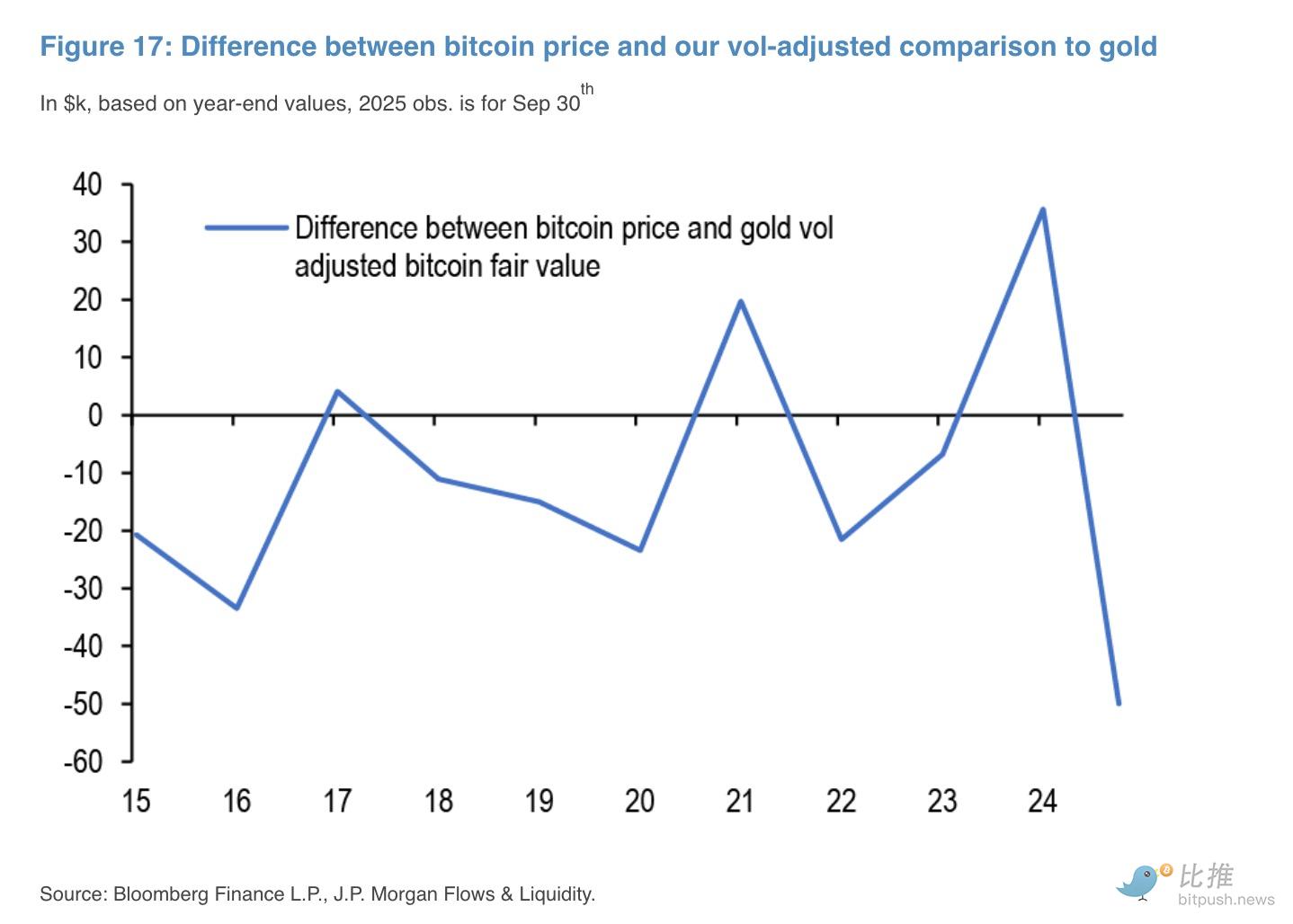

摩根大通喊单:比特币或指向16.5万美元

摩根大通最新报告指出,比特币目前相对黄金被严重低估。

报告测算:按波动率调整后的估值,比特币应有约42%的上行空间;这意味着其理论价格应在16.5万美元左右;若与黄金ETF、实物金投资持平,比特币总市值将达到约3.3万亿美元。

报告作者、摩根大通董事总经理Nikolaos Panigirtzoglou指出:「自2024年底以来,估值缺口已从比特币高估3.6万美元,转为低估4.6万美元。」

换言之,投资者正在重新拥抱「货币贬值交易」(Debasement Trade)——面对财政赤字、通胀与地缘风险,他们将资金投入黄金与比特币等稀缺资产。如果历史规律延续,十月行情往往是全年最具延续性的上涨窗口。随着供给侧压力缓解、资金回流与政策拐点叠加,比特币或正蓄势冲击16万至20万美元的新目标区间。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。