Due to the Federal Reserve's data management being trapped and the U.S. government shutdown being resolved, let's review the Bitcoin contracts from the past week.

The day after I completely closed my positions, I opened a new one. The logic behind that trade was clearly explained in the review; I was concerned that the H-1B visa situation would impact the market, but that was not the core game in the current market, so it would only lead to minor fluctuations. The upcoming interest rate cuts from the Federal Reserve were highly probable, so there was a good chance for a rebound.

As expected, after the interest rate meeting, the market felt that the Federal Reserve could actually have three rate cuts in 2025, which was already a positive sign, leading to a rebound. At that time, Bitcoin ($BTC) peaked at nearly $114,000. I was still hesitating about whether to sell, mainly because I didn't want to gamble on the data.

However, this hesitation caused me to miss the best exit time. I could have opened a second position around $110,000, but since I missed that opportunity, I had to continue betting on the data. Although the upcoming data was only half, there were still a lot of chaotic issues, such as the geopolitical conflict between NATO and Russia, hawkish comments from Federal Reserve officials, and the potential government shutdown, all of which negatively affected the market's reaction.

By Monday, the market had already begun to anticipate the shutdown. To be honest, I didn't understand why the shutdown would be good for the market; shouldn't it be bad? After all, previous shutdowns had always been short-term negatives for the market. It wasn't until Tuesday that I learned Trump intended to lay off workers, using the shutdown as an opportunity to pressure both the Federal Reserve and the Democrats. This was a clever two-birds-with-one-stone move.

At this point, I had already abandoned the idea that the shutdown was a negative factor. Not only was it not negative, but it was also a positive factor that increased expectations for a rate cut in October by the Federal Reserve. So, even though the price of $BTC was around $114,500 at that time, I still didn't reduce my position. I was waiting to see if the shutdown would actually happen. If it didn't, I would quickly liquidate my positions because that positive factor would lose its significance.

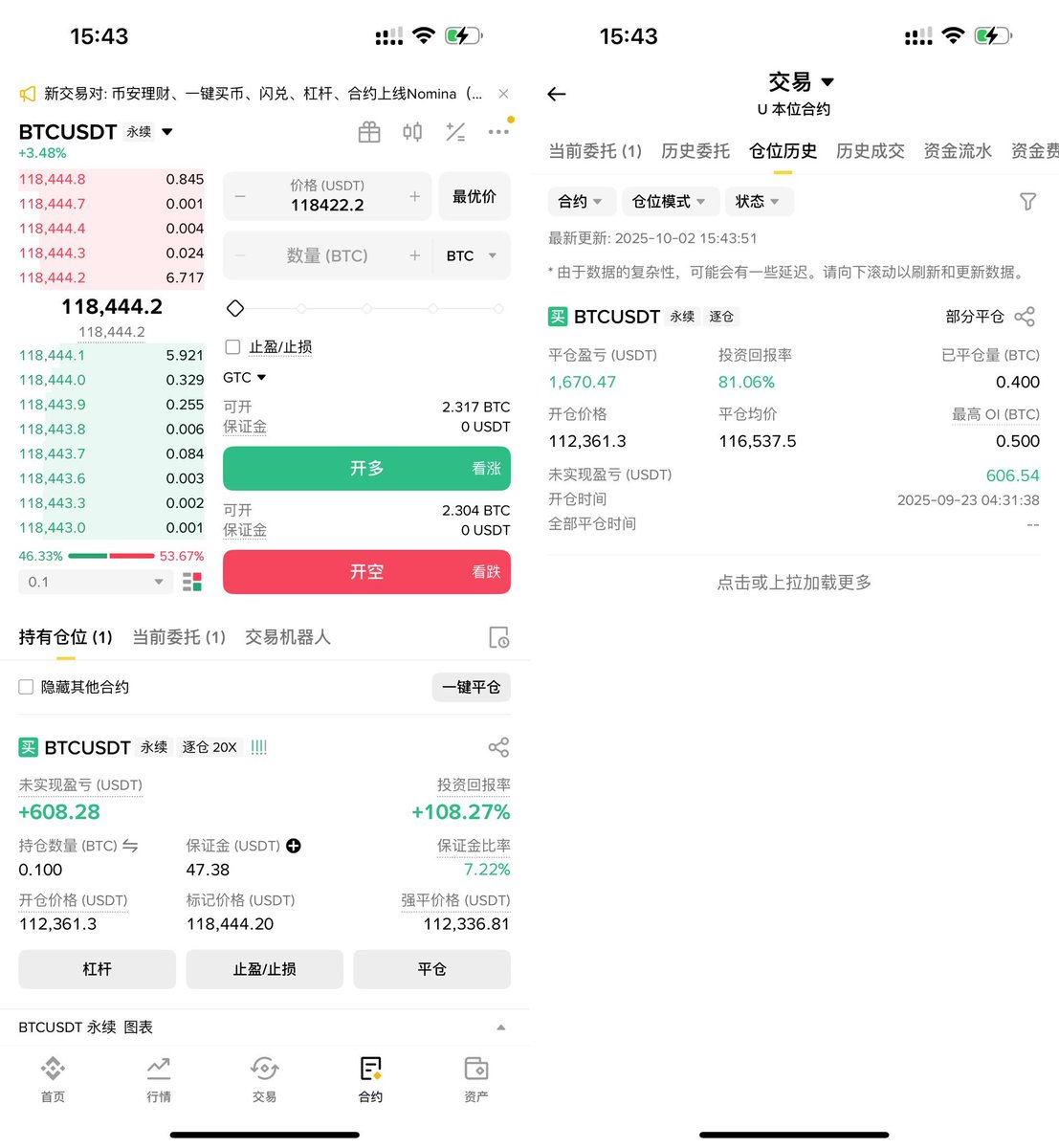

On October 1, when the shutdown was confirmed, the market rose as expected, confirming that my judgment was correct. The market also believed that this shutdown was a positive factor. That night, the price of BTC surged to $116,500. To be shameless, although I closed part of my position, I truly believed that BTC's price would continue to rise because the market's expectations were not yet fulfilled.

However, due to the overwhelming activities at Token 2049 and fearing that I would miss the opportunity, I closed 80% of my position during dinner.

Friends who often follow my reviews know that my fixed trading method starts with 0.5 BTC. When closing positions, if I believe there is still potential for further gains, I will only close 80% and keep the remaining 20%. As a result, holding onto that 20% has now doubled in value, so I withdrew all my margin.

This profit was relatively smooth. Although I haven't completely overcome greed, my expectations for the market have been quite accurate. This money is what I should have earned. I'm not in a hurry about the remaining 20%; I will probably wait until Monday to see how the U.S. stock market reacts after a weekend. After all, it is already pure profit, and even if there is some pullback, it won't be a big issue.

As of now, the paper profit on this position has exceeded 90%. I'm quite happy to have made money, even if it's not much, as it represents my judgment of the market. I've always said to @CatoCryptoM and @DLW59 that the essence of analysis is to assist trading. If it can't be applied to trading, the analysis loses its meaning. That's what I say and what I do. Although my position is relatively small, I take it very seriously.

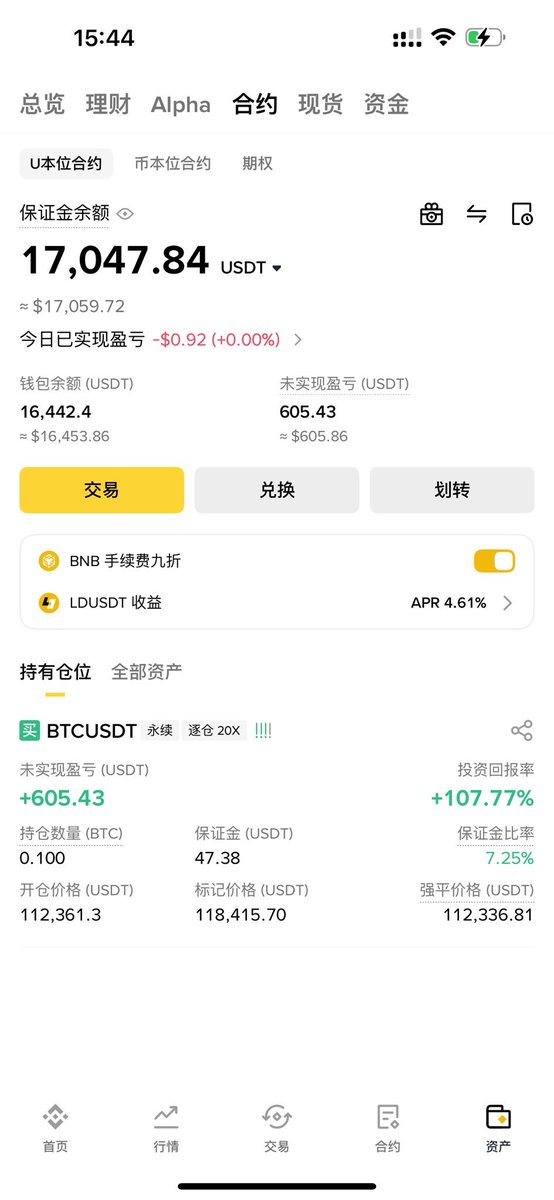

Currently, my total profit has exceeded $16,400, which is more than eight times my initial capital. Although it's slow, averaging about two trades a month, it took me half a year to gradually accumulate this. But as I mentioned earlier, this is a consideration of my own understanding. My personal judgment is the main idea behind my operations, and maintaining my position is the same.

That's about it. I'll talk more after I close the last 20%.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。