The U.S. Federal government machinery came to a grinding halt at midnight on Wednesday after Senate Republicans and Democrats failed to pass a temporary spending bill to fund government services. To add insult to injury, human resources firm ADP caught economists off guard with a dire report showing a record decline in private sector employment. Surprisingly, both bitcoin and stocks jumped on the news, perhaps due to investors anticipating a stronger likelihood of an interest rate cut later in the month.

Republicans and Democrats continued their bickering over tax credits related to Obama-era health insurance and recent cuts to Medicaid by the Trump administration. Democrats want the tax credits extended, and the Medicaid cuts reversed, but Republicans claim it’s all a ploy to give free healthcare to illegal aliens.

“Democrats are about to shut down the government because they demand we fund healthcare for illegal aliens,” wrote U.S. Vice President JD Vance on X last week.

And while many were focused on the government closure, ADP published its monthly private sector employment numbers showing a loss of 32,000 private sector jobs at a time when economists expected a 45,000 gain. The decline is the largest since March 2023.

(ADP reported that the US private sector lost 32,000 jobs in September / ADP data via RTT News)

“Despite the strong economic growth we saw in the second quarter, this month’s release further validates what we’ve been seeing in the labor market, that U.S. employers have been cautious with hiring,” said ADP Chief Economist Nela Richardson.

The unexpected drop was mostly due to new benchmarking by ADP based on the full-year 2024 Quarterly Census of Employment and Wages (QCEW) data published by the Bureau of Labor Statistics.

“This recalibration resulted in a reduction of 43,000 jobs in the September 2025 ADP National Employment Report,” ADP states. “The number of jobs created in August 2025 was revised from 54,000 to -3,000.”

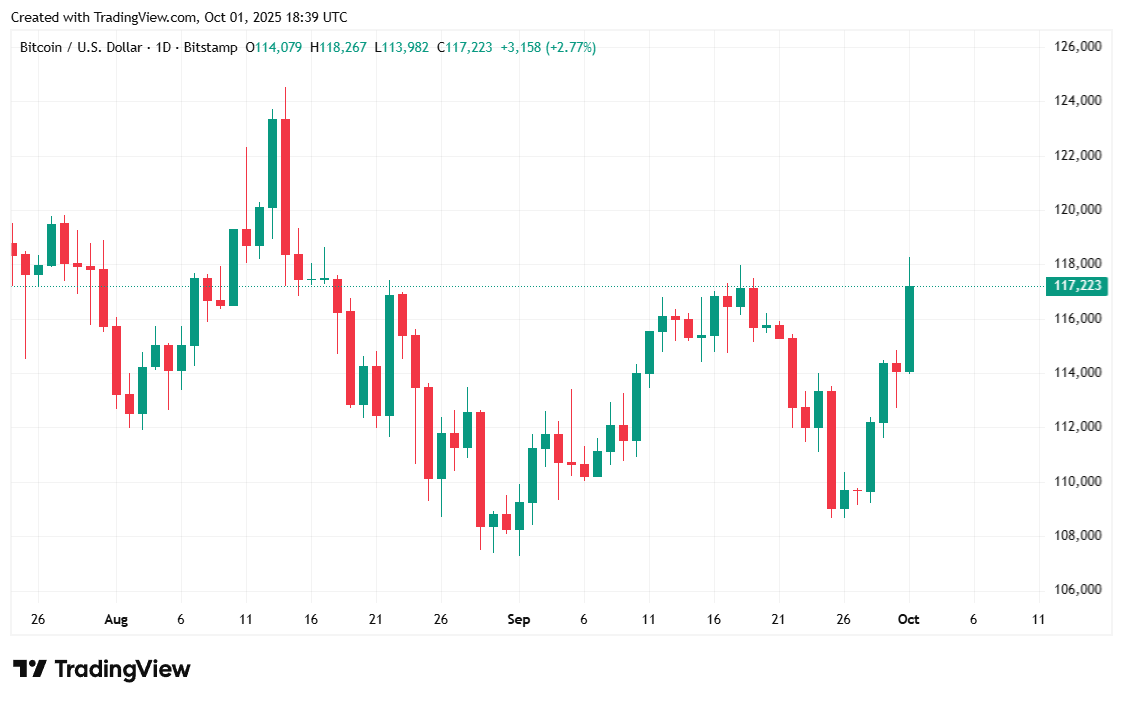

Bitcoin was trading at $117,145.84 at the time of reporting, up 3.25% since yesterday and 3.07% for the week, according Coinmarketcap. The cryptocurrency fluctuated between $113,705.27 and $118,168.80 over the past 24 hours.

( BTC price / Trading View)

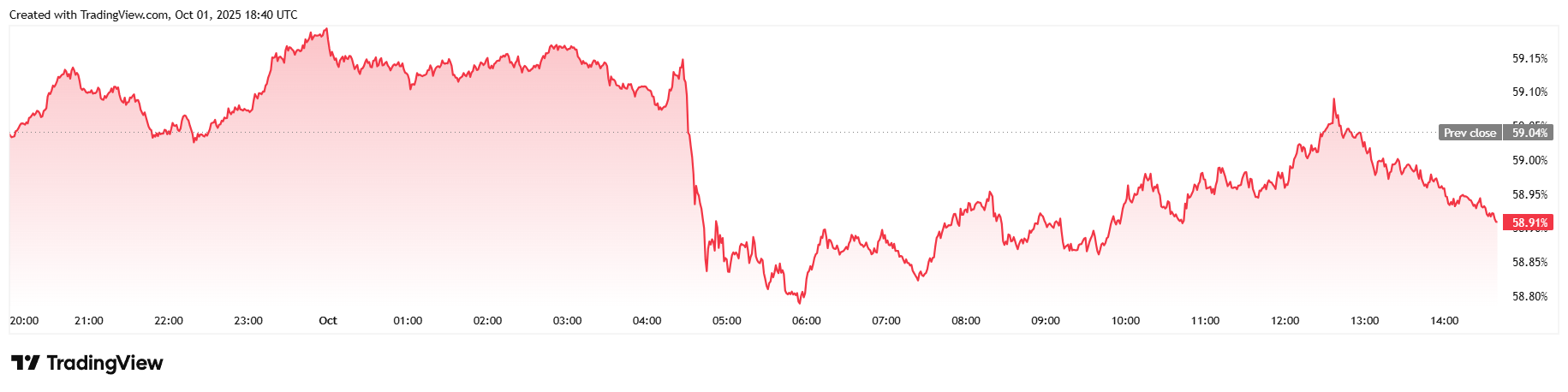

Trading volume rose 25.09% for the day, reaching $71 billion at the time of writing. Market capitalization climbed 3.32% to $2.33 trillion in line with the increase in price. Bitcoin dominance dipped 0.23% to 58.91%, suggesting increased competition from altcoins.

( BTC dominance / Trading View)

Total bitcoin futures open interest jumped 6.72% over 24 hours to $85.34 billion, according to data from Coinglass. Bitcoin liquidations have climbed to $204.35 million since yesterday, mostly due to a $182.44 million surge in short liquidations, coupled with a smaller increase of $21.91 million in longs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。