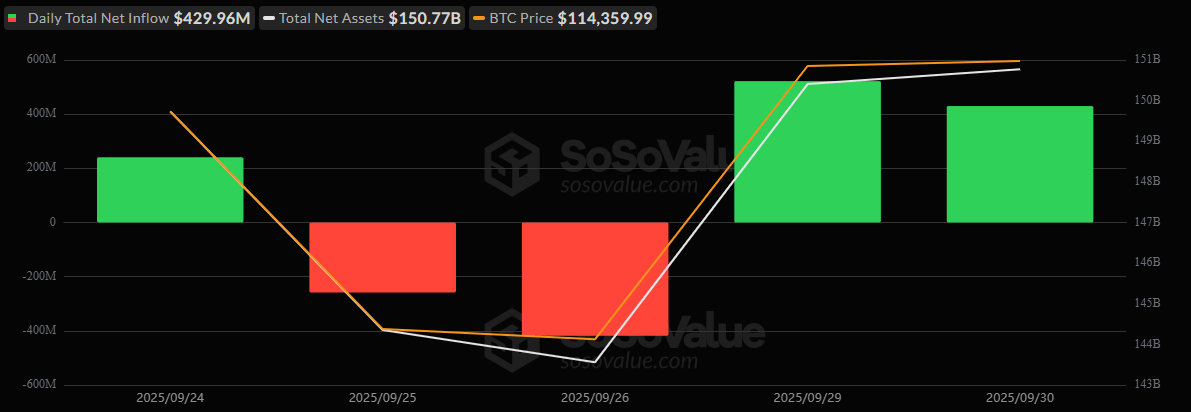

Momentum is building in crypto ETFs. After Monday’s billion-dollar rebound, both bitcoin and ether funds continued their climb on Tuesday, Sept. 30, locking in another wave of institutional inflows. The buying spree suggests confidence is firming after last week’s turbulence.

Bitcoin ETFs drew $429.96 million in fresh capital, with inflows spread across four major funds. Blackrock’s IBIT led the pack, pulling in $199.43 million, while Ark 21shares’ ARKB followed with $105.74 million. Bitwise’s BITB contributed $70.09 million, and Fidelity’s FBTC rounded out the surge with $54.70 million.

Importantly, no outflows were recorded across any bitcoin ETF, a strong signal of broad-based support. Trading activity was healthy at $3.26 billion, with net assets holding steady at $150.77 billion.

Bitcoin ETFs are making a big comeback with strong inflow momentum. Source: Sosovalue

Ether ETFs kept pace with another green session, though inflows were concentrated in a single fund. Blackrock’s ETHA delivered the entirety of the day’s $127.47 million inflow, extending the asset class’s recovery streak. Total trading volume stood at $1.46 billion, with ether ETF net assets steady at $27.40 billion.

With two straight days of strong inflows across both bitcoin and ether, the market appears to be stabilizing after a sharp bout of outflows the previous week. If the trend holds, October could begin on a decisively strong note for institutional crypto products.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。