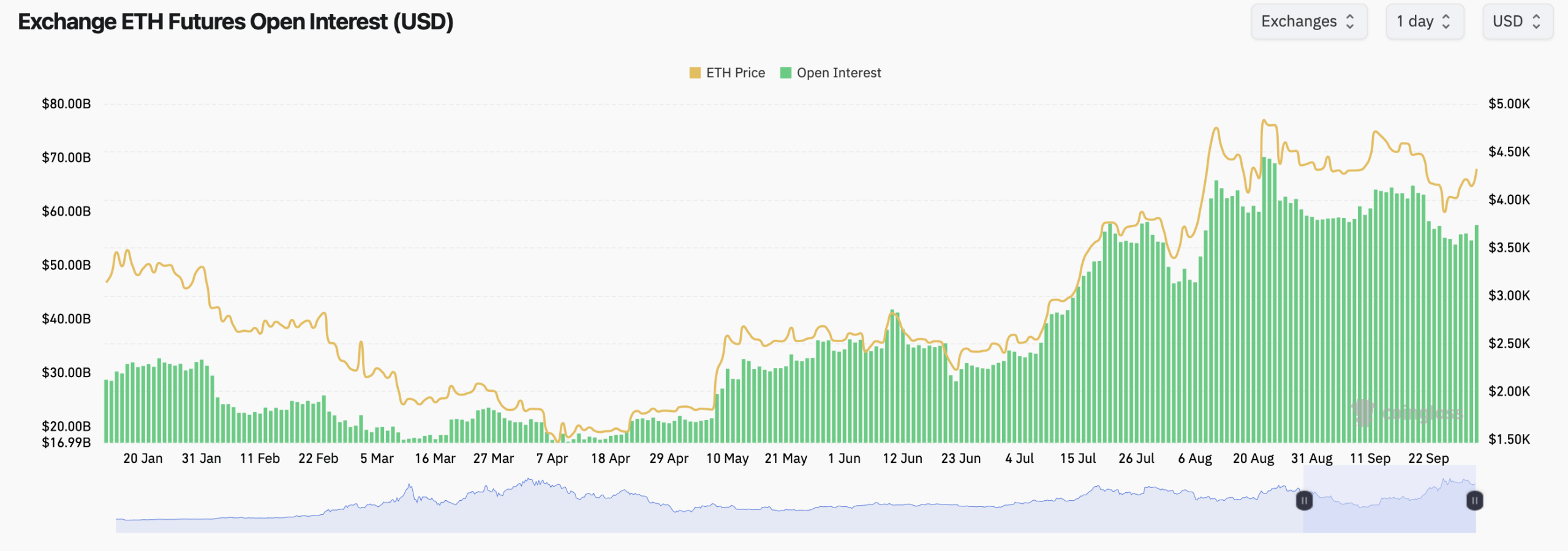

Coinglass figures show exchange ETH futures open interest in the high-$50 billion after peaking above $70 billion in late August. Across venues, open interest totals 13.28 million ETH ($57.43 billion), a muscular backdrop that keeps funding and liquidations relevant to every uptick.

By exchange, Binance leads with 2.60 million ETH in open interest ($11.25 billion), followed by CME at 2.17 million ETH ($9.39 billion) and Bitget at 1.51 million ETH ($6.54 billion). Gate posts 1.17 million ETH ($5.07 billion), Bybit 1.15 million ETH ($4.99 billion), and OKX 785,800 ETH ($3.40 billion).

Source: Coinglass on Oct. 1, 2025.

Data further shows WhiteBIT at 474,870 ETH ($2.06 billion), MEXC at 473,150 ETH ($2.05 billion), BingX at 319,870 ETH ($1.38 billion) and Kucoin with 95,420 ETH ($413.12 million). Momentum tilted bullish over the past day: Binance open interest rose 5.97%, Bitget 6.46%, WhiteBIT 6.74%, CME 6.41% and OKX 4.65%, while Bybit edged 2.24%.

A few venues lagged, with BingX down 3.08% and Kucoin slipping 0.71%. Options positioning leans call-heavy by open interest: 1,797,705.6 ETH in calls versus 1,051,944.81 ETH in puts, a 63.09% to 36.91% split. Flows, however, were almost even over 24 hours, with 198,205.08 ETH in call volume and 203,428.87 ETH in put volume, a tiny put advantage that hints at hedging into the pop.

Deribit’s leaderboard shows where traders are piling in. The Dec. 26, 2025, 6,000-strike call leads with 92,651 ETH in open interest. Other big levels include the 4,000-strike call (76,101 ETH), 7,000-strike call (61,212 ETH), and 5,000-strike call (56,764 ETH). Bulls are also stacked at the 3,000-strike call (43,483 ETH) and 2,000-strike call (37,054 ETH), while the 7,500-strike call still attracts 31,395 ETH. In nearer-dated action, the Oct. 31, 2025, 5,000-strike call sits at 28,528 ETH.

Volume paints another picture. The busiest contracts today include Bybit’s March 27, 2026, 500-put (29,691.3 ETH), Deribit’s Oct. 3, 2025, 4,000-put (8,985 ETH), and Bybit’s Oct. 17, 2025, 2,000-put (6,128.1 ETH). Other active plays include Deribit’s Oct. 31, 2025, 5,500-call (5,918 ETH), Nov. 28, 2025, 3,400-put (4,601 ETH) and 4,200-call (3,992 ETH), plus Binance’s Oct. 2, 2025, 4,400-call (3,785.9 ETH).

Max-pain analysis puts ether’s “pain point” in the low-to-mid $4,000s through early October, with a dip near late-September expiries before sliding back toward $3,900–$4,000 into late October.

Bottom line: with futures stacked, calls dominant, and spot pushing up, ether rewards momentum—but the slight put-volume edge and that max-pain valley argue against complacency. Keep a hand on the ripcord and an eye on market data closely.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。