US Government Shutdown 2025: Important Fact and Untold Truth

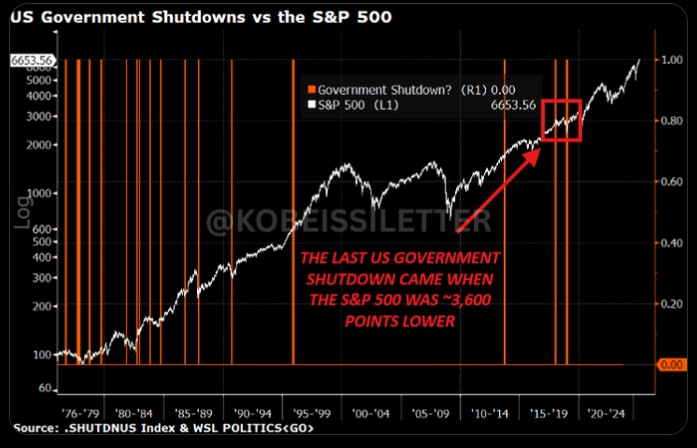

The US government is about to shut down due to Congress's failure to pass a funding bill. This historic step may impact hundreds of thousands of federal employees, create volatility in the market, and change the economic trends in the weeks to come.

US Government Shutdown 2025 News

Unless a funding agreement is achieved before 12:01 AM ET on October 1, the US government will officially shut down. Approximately 750,000 federal employees may be put on furlough every day, and it would cost about 400 million a day in deferred compensation.

Source: The Kobeissi Letter

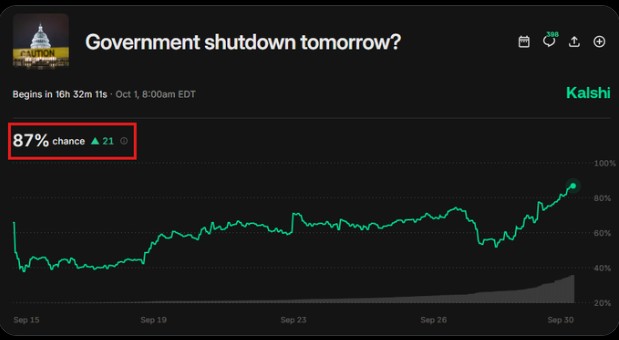

Critical services, including law enforcement and emergency operations, will still take place, but most government operations will go on hiatus. Prediction markets currently indicate an 87% probability of a shutdown within the next nine hours and a 90% likelihood of a shutdown before the year 2025, a record. Employees are already getting ready, and job vacancies have fallen by 87% this week.

Source: X

Impacts of the US Government Shutdown in 2025

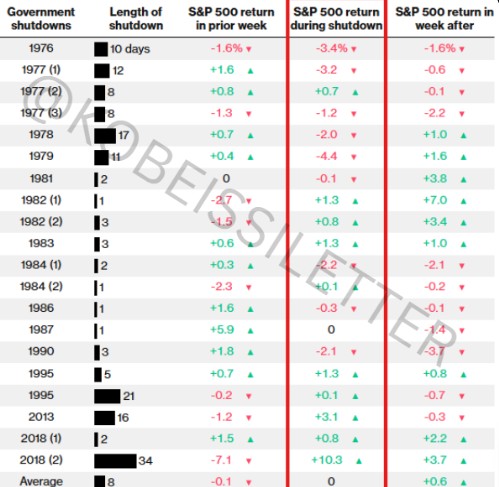

Although there are short-term market volatility, there is little long-term harm as observed in the past. S&P 500 can go down during the shutdown but has a tendency to rebound, as 86% of the shutdowns in the past have recorded gains within one year. Gold prices have shot up, gaining 45% YTD, due to investor caution due to uncertainty.

US dollar is depreciating drastically, which can be a source of inflation. In the meantime, the volatility positioning is elevated, so any surge in the $VIX will result in massive short-covering, producing unexpected market trends.

Important Facts and Untold Truth That Media Didn’t Yet Covered

Government shutdowns usually appear threatening, yet there are a lot of significant details that are disregarded.

Source: X

-

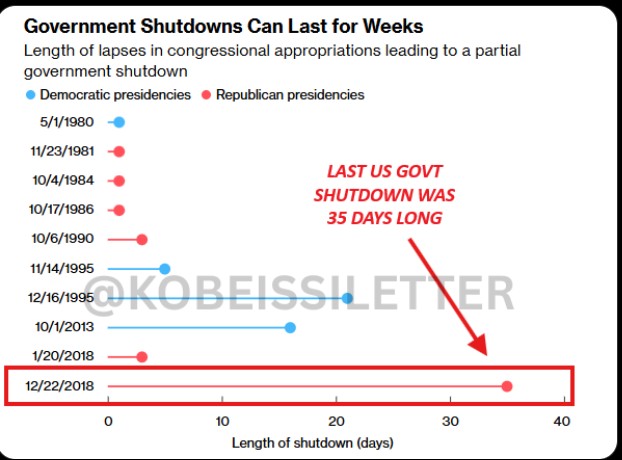

The median length of shut down is only eight days, much less than media coverage would suggest. Much longer shutdowns, such as the 35-day shut down in December 2018, had less long-term effects on the market.

-

The S&P 500 actually soared 11% and historically, the index rises higher one year following a shutdown in 86% of times and averages 13%.

-

Shutdowns also have a short term effect of cutting government spending, postponing the payment of payrolls of about 400 million dollars per day.

-

This break can relieve the fiscal strains a little. Besides, the Federal Reserve is more likely to be in a more dovish position when key economic data releases are suspended, which may have a positive impact on markets.

-

Markets usually stabilize within a short period of time and investors tend to respond violently in the short-term.

-

Gold often does well as an insurance against uncertainty, as it did in 2025, when it hit its 39th all-time high and registered a 45 percent year-to-date return. The shock is absorbed by markets, gold and policy reactions, and long-term recovery is often rapid and even positive.

-

Markets have historically adapted even in the face of increasing inflation concerns and shutdowns seldom bring the larger economy down. Simply put, media reports can increase fear, but shutdowns are not usually a crisis, but a short-time inconvenience.

Source: X

Previous US Shutdown and Its Impact

The most recent major US shutdown took place in December 2018 and lasted 35 days, the longest ever. At the time, about 800,000 federal employees were put on furlough, but the S&P 500 rose 11% indicating strength.

Short-run effects were increased volatility, temporary federal service disruptions, and delayed economic data releases. Traditionally, the S&P 500 has ended up higher in all shutdowns since 1995, though there are some instances of the shut down in the 1970s and 1980s that resulted in brief declines.

Source: X

In the long run, the overall economy is not severely affected, and the markets usually rebound in a few months, and the federal spending trends resume their usual levels, once the agreements are achieved.

Final Upbringing

Although the US Trump shutdown in 2025 will likely lead to short-term market volatility and economic uncertainty, the past has shown that markets and the overall economy usually absorb the resulting shock. Thus, these decisions are more of a disruption than a crisis.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。