Regulators are intensifying oversight of volatile equities tied to cryptocurrency ventures, underscoring growing concern about manipulation in digital asset-related stocks. The U.S. Securities and Exchange Commission (SEC) announced on Sept. 26, 2025, that it suspended trading in QMMM Holdings Ltd. after shares of the Hong Kong-based digital media advertising and virtual technology company surged nearly 1,000% in under three weeks. The rally followed QMMM’s Sept. 9 disclosure of a $100 million cryptocurrency treasury targeting bitcoin, ethereum, and solana.

The SEC explained its decision:

It appears to the Securities and Exchange Commission that the public interest and the protection of investors require a suspension in the trading of the securities of QMMM Holdings Limited (QMMM).

“Because of potential manipulation in the securities of QMMM effectuated through recommendations, made to investors by unknown persons via social media to purchase the securities of QMMM, which appear to be designed to artificially inflate the price and volume of the securities of QMMM,” the SEC clarified. The agency added: “Therefore, it is ordered, pursuant to Section 12(k) of the Exchange Act, that trading in the securities of the above-listed company is suspended for the period from 4:00 AM ET on September 29, 2025, through 11:59 PM ET on October 10, 2025.”

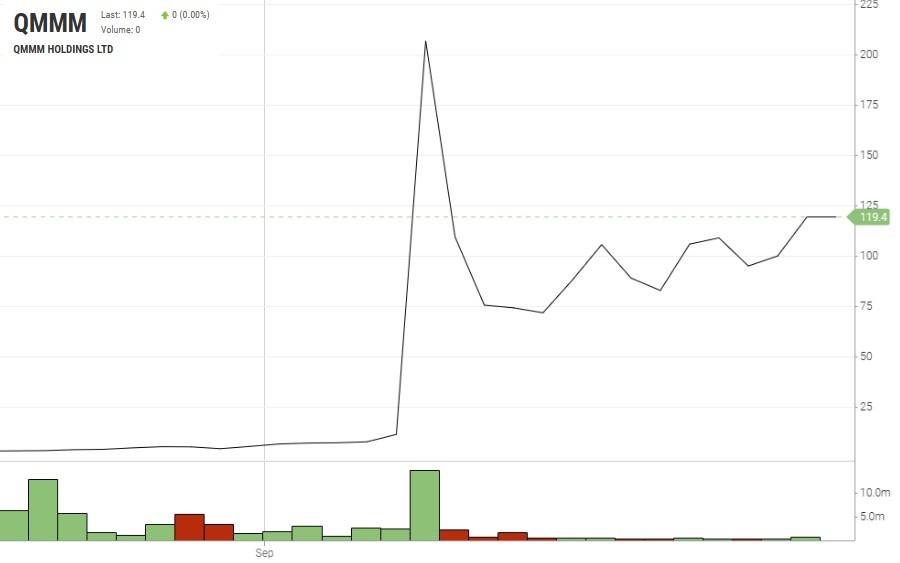

QMMM price chart. Source: Nasdaq

The stock rose from $11.27 on Sept. 8 to $207 on Sept. 9, a 1,737% gain. Trading was halted on Sept. 9 at $119.40, representing a 959.45% increase from the Sept. 8 close.

The company’s Sept. 9 press release described its “strategic entry into the cryptocurrency sector” as part of a broader plan to integrate artificial intelligence and blockchain technology. QMMM said it would build a decentralized data marketplace and crypto-autonomous ecosystem, while its diversified crypto treasury would allocate to leading tokens, Web3 infrastructure, and select equity assets. The company explained:

In tandem with this initiative, QMMM plans to establish a diversified cryptocurrency treasury initially targeting bitcoin, ethereum, and solana ( SOL). The treasury, which is expected to reach an initial scale of US$100 million, will serve as a foundation for both stability and transparency.

Chief Executive Officer Bun Kwai stated: “The global adoption of digital assets and blockchain technology is accelerating at an unprecedented pace. QMMM’s entry into this space reflects our commitment to technological innovation and our vision to bridge the digital economy with real-world applications.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。