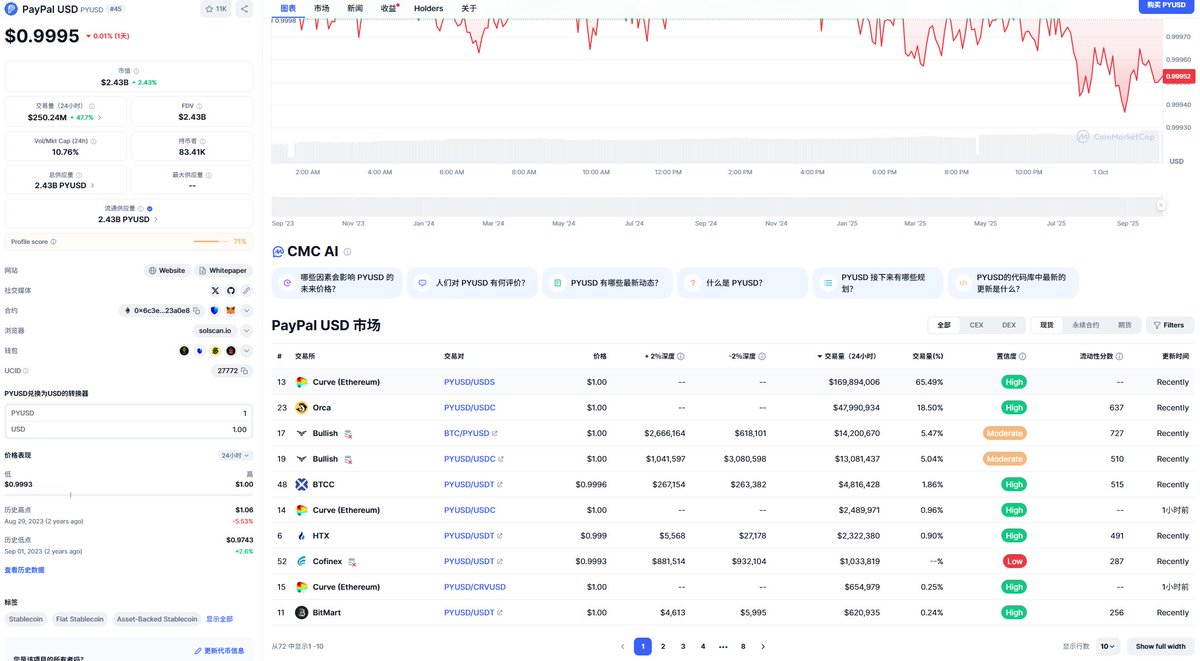

Following up on AB @_FORAB's comments, I would like to add a few points regarding the current development of PYUSD and its relationship with the cryptocurrency sector, or rather its connection with trading-oriented stablecoins, which is not very significant. From the perspective of trading volume, over 65% of the volume comes from the trading pairs of PYUSD and USDS on Curve. Many may not be familiar with USDS, but it becomes clear when I mention that its predecessor is DAI.

This substantial trading volume, in my view, seems to be driven by stablecoin arbitrage rather than any practical use. Even in the few supported exchanges, the main trading volume is primarily between PYUSD and USDT, with even less usage in DeFi. PYUSD is mainly focused on payments, particularly on PayPal, and even in the e-commerce sector, PYUSD has not yet become a major player for PayPal.

The news on PayPal's official website mentions that through a public API, PayPal or Shopify merchants can choose to join Kite's Agent App Store, making them discoverable by AI shopping agents. Transactions are settled on-chain using stablecoins. I am curious why they would create a new stablecoin instead of using the existing PYUSD, especially since PayPal does not have a strong foundation in stablecoins, and PYUSD is issued by Paxos.

From various observations, I do not believe that Kite will create its own stablecoin; if they do, I would actually find that concerning.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。