Author: J.A.E, PANews

With the expertise of the renowned market maker DWF team and the backing of the Trump family's investment project World Liberty Financial, the synthetic dollar protocol Falcon Finance has attracted significant market attention since its inception. In a recent public offering, the project set an astonishing record with over 28 times the subscription amount, generating immense community enthusiasm. However, on the first day of its listing on several mainstream exchanges, the token's price experienced a sharp decline. What are the underlying reasons for this polarization?

Utilizing a Synthetic Dollar Dual-Token Model, USDf Surpasses $1 Billion in Circulation in Four Months

Falcon Finance aims to convert digital currencies, fiat-backed assets, and RWA (real-world assets) into on-chain liquidity pegged to the dollar. By linking on-chain and off-chain financial systems, the protocol provides a stable and yield-generating method for institutions, protocols, and capital allocators, thereby unlocking the liquidity of their held assets.

At the core of Falcon Finance is its synthetic dollar dual-token model, where USDf and sUSDf serve the functions of infrastructure and yield strategy, respectively, offering high capital efficiency and institutional-level returns.

USDf is a synthetic dollar based on an over-collateralization mechanism, with the advantage of accepting a wider range of collateral. Users can deposit eligible assets to mint USDf, including mainstream stablecoins, blue-chip cryptocurrencies (such as BTC, ETH, etc.), and designated altcoins. To mitigate potential risks from price fluctuations of collateral assets, the USDf protocol enforces and maintains an over-collateralization rate of 115% to 116%, which also serves as a necessary buffer against the risks of the "universal collateral" mechanism (i.e., accepting more volatile assets).

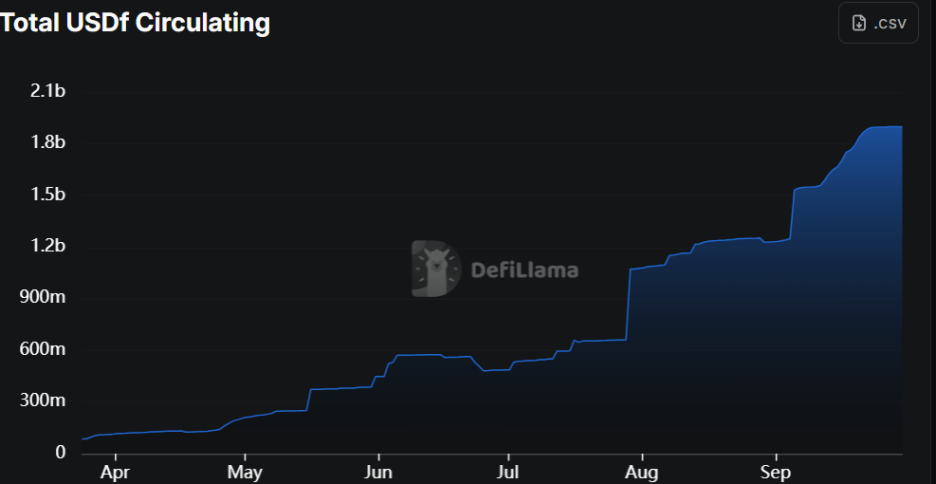

Since Falcon Finance first issued USDf in April 2025, its circulating supply has surpassed $1 billion in just four months, with explosive growth quickly positioning it as a strong competitor in the stablecoin space.

Another key component of the Falcon Finance ecosystem is the yield-bearing token sUSDf, which users can mint by staking USDf, allowing them to participate in the protocol's profit distribution.

Compared to other synthetic dollar protocols, Falcon Finance's differentiated features lie in the diversity and complexity of its yield strategies. The official claim is that it is not limited to traditional strategies such as blue-chip basis arbitrage and funding rate arbitrage, but integrates institutional-level yield strategies, including Delta-Neutral and liquidity allocation strategies. To maintain stable and competitive yields even under poor market conditions, all strategies are supported by a team of quantitative engineers.

The sustainability of sUSDf's high yield is a focal point of community concern. If the volatility of the crypto market decreases or the basis arbitrage opportunities narrow, maintaining high yields will face challenges. If high yields cannot be sustained, it could lead to users withdrawing liquidity, further impacting the protocol's TVL and the long-term value capture of $FF.

Nearly 60% of Tokens Allocated to Ecosystem and Foundation, Public Offering Achieves 28 Times Oversubscription

As the governance and utility token of the Falcon Finance ecosystem, $FF has a total fixed supply of 10 billion tokens. In the TGE (Token Generation Event), approximately 2.34 billion tokens entered circulation.

The utility mechanism of $FF focuses on incentivizing long-term participation and capital efficiency of the protocol: 1) Governance and voting rights: Holders can vote on proposals regarding protocol upgrades, collateral acceptance standards, and ecosystem development; 2) More favorable economic terms: $FF stakers enjoy better economic treatment, including increased capital efficiency for minting USDf, reduced collateral conversion ratios, and lower transaction fees; 3) Yield enhancement: Stakers can receive yield boosts, such as increased staking rewards for USDf/sUSDf, effectively converting users' speculative demand into long-term liquidity for the protocol.

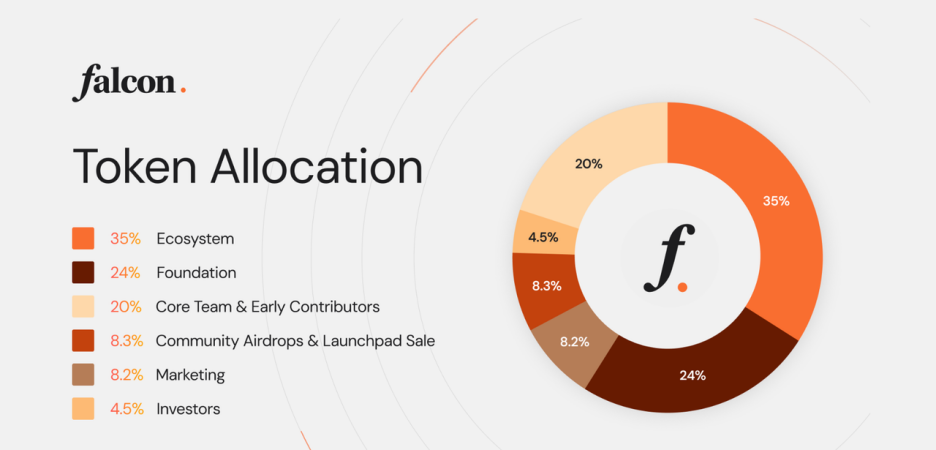

In terms of token distribution, the largest shares are allocated to the ecosystem (35%) and the foundation (24%), for key areas such as RWA integration, cross-chain integration, liquidity provision, and CEX collaboration. Additionally, 8.3% of tokens are allocated for community airdrops and Launchpad public sales to reward early supporters of the protocol.

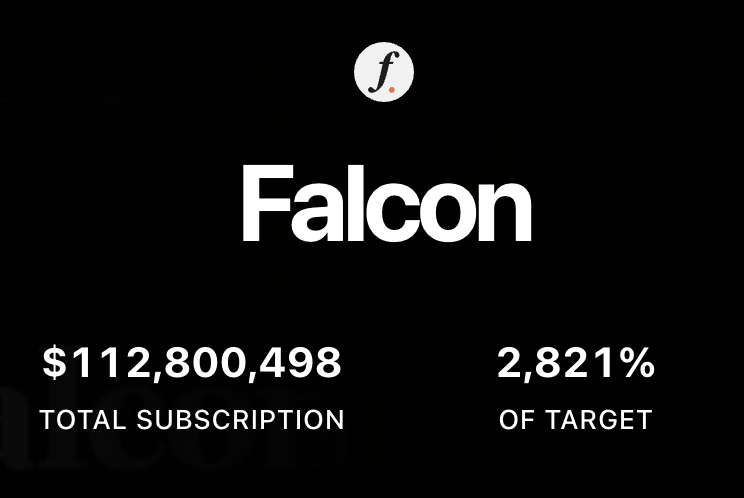

It is worth mentioning that the community public sale of Falcon Finance before the $FF TGE generated a frenzy in the market. On September 24, on Buidlpad, its original financing target of $4 million attracted $112.8 million, achieving an oversubscription of up to 28 times.

Amidst the high market enthusiasm, the FDV (Fully Diluted Valuation) of Falcon Finance's token $FF is anchored between $350 million and $450 million. Furthermore, the protocol offers subscription discounts valued at $350 million for investors meeting specific staking requirements (such as locking at least $3,000 USDf/sUSDf in Boosted Yield), with its differentiated pricing combined with the Falcon Miles Program points system converting short-term speculative interest into locked liquidity for its stablecoin ecosystem, laying the foundation for the protocol's TVL.

Implementing a Siege-style Listing Strategy, Token Price Halves on First Day

To maximize market exposure and initial liquidity, Falcon Finance adopted a "siege-style" listing strategy. On September 29, $FF was simultaneously listed for spot trading on several leading global CEXs.

Among them, the most strategically significant was the support from Binance. $FF was selected as the 46th airdrop project for Binance HODLer and was listed on the spot market, supporting multiple trading pairs including USDT, USDC, FDUSD, BNB, and TRY. Binance's official endorsement and HODLer incentives provided $FF with high market recognition and liquidity depth.

On the same day, Bybit and Bitget also announced the listing of the FF/USDT trading pair and launched a Launchpool event, incentivizing users to stake $FF, $MNT, $BGB, or $USDT, providing a total prize pool of 13.54 million $FF. Falcon Finance effectively leveraged the vast liquidity of the CEX ecosystem to efficiently complete the cold start of $FF.

Additionally, CEXs such as HTX, Gate, KuCoin, and MEXC also announced the listing of $FF around the same time. Falcon Finance's strategy of multiple simultaneous listings ensured that $FF could achieve maximum exposure and trading depth in the secondary market.

It is important to note that despite the extremely enthusiastic market sentiment during the community public sale, the price of $FF experienced significant volatility after its listing. CMC data shows that its price peaked at $0.67 but then quickly declined, with a nearly 50% drop in the last 24 hours, indicating that the market is digesting the selling pressure from Launchpad participants and airdrops.

Thus, it can be seen that the long-term price trend of $FF is unlikely to sustain the initial listing enthusiasm, but rather depends on the protocol's ability to generate sustainable income through its institutional-level yield strategies to support its starting valuation of $350 million FDV.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。