Author: White55, Mars Finance

If U.S. lawmakers fail to reach a budget agreement before the fiscal year deadline (September 30), the federal government will face a partial shutdown, leading to the suspension of several non-essential administrative operations, with many federal employees being forced into unpaid leave or temporary layoffs.

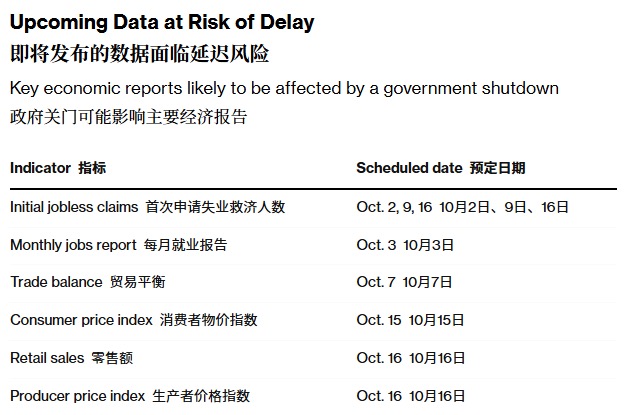

One of the chain reactions of this shutdown is the forced interruption of the release schedule for key U.S. economic data. According to the latest emergency plan, the Bureau of Labor Statistics (BLS), as the core agency for releasing "gold standard" economic indicators, will completely halt data collection and processing work. The non-farm payroll report for September, originally scheduled for release on October 3, may be delayed, and subsequent key data such as the Consumer Price Index (CPI), retail sales, and new residential construction also face risks of delay. In the current context of high uncertainty regarding the Trump administration's policy direction, employment, inflation, and spending indicators are crucial for assessing economic trends. If these data cannot be released on time, the Federal Reserve, market investors, and business decision-makers will lose important reference points, potentially affecting their next policy adjustments.

For example, whether the Federal Reserve will continue to cut interest rates at the October meeting will face a more complex judgment environment due to the lack of data. Gregory Daco, Chief Economist at EY, pointed out: "Decision-makers are reluctant to fly blind in a foggy environment."

1. Specific Impacts on the Economic Data Release Mechanism

As the core agency of the U.S. economic data system, the employment report and CPI released by the Bureau of Labor Statistics are widely regarded as authoritative indicators of economic health.

Once the government shuts down, the agency will suspend all business activities as planned, including data collection, statistical analysis, and report preparation. Although the Department of Labor estimates that the overall shutdown process will only take half a day to complete, the operations related to system backup and data preservation at the Bureau of Labor Statistics may take up to three days. This delay will directly disrupt several economic schedules originally set for release in early October. During the 2013 government shutdown, the Bureau of Labor Statistics was forced to delay the release of the September employment report and CPI data. The 2018-2019 shutdown did not affect data releases due to prior funding reserves, but the current situation is more severe. The first to be affected is the non-farm payroll report scheduled for release on October 3, followed by the CPI data on October 10, as well as retail sales and new housing starts statistics managed by the Census Bureau. The absence of this data will make it difficult for the market to assess consumer momentum, inflationary pressures, and real-time dynamics in the real estate sector.

2. The Auxiliary Role and Limitations of Third-Party Data Sources

Although government data releases are paused, some economic indicators provided by third-party institutions can still offer references, such as the private sector employment report from ADP and existing home sales data from the National Association of Realtors. However, these data typically have limited coverage, and their methodologies differ from official statistics, making their authority and comprehensiveness difficult to replace government reports. Stephen Stanley, Chief U.S. Economist at Santander Capital Markets, emphasized that while the Federal Reserve can obtain localized information through surveys of business contacts, the lack of macro summary data will significantly increase the difficulty of decision-making. It is worth noting that third-party data often focuses on specific industries or regions, failing to create an accurate portrayal of the national economy. For example, the ADP employment report only covers the private sector, while the government-released non-farm data also includes government employees and key industry distributions, which are more instructive for policy-making.

3. Impact on Federal Reserve Policy and Market Expectations

The Federal Reserve implemented its first interest rate cut of the year at the September meeting, with its decision primarily based on signals of a cooling labor market and easing inflation.

If the latest employment and CPI data cannot be obtained before the October meeting, some officials may lean towards delaying further action to avoid the risk of misjudgment. Stanley noted: "Although there are alternative data sources, the lack of long-term reliable macro indicators will significantly increase the complexity of policy formulation." Additionally, business investment and consumer confidence may also become more conservative due to the data vacuum, further suppressing economic growth momentum. Neil Bradley, Chief Policy Officer of the U.S. Chamber of Commerce, believes that while a government shutdown may not directly lead to an economic recession, it will exacerbate uncertainty in the business environment. Businesses often rely on regularly released macro data as a reference when facing issues such as supply chain adjustments and investment planning; the absence of this data will extend decision-making cycles and may even trigger market volatility.

4. Historical Experience and Insights for Response Strategies

Historically, the impact of government shutdowns on the release of economic data is not unprecedented, but the challenges posed each time are different. During the 2013 shutdown, data delays led to significant deviations in quarterly economic assessments, forcing the Federal Reserve to rely on lagging indicators and survey data to fill information gaps. If the shutdown persists, economic analysis agencies may need to enhance monitoring of high-frequency data (such as weekly unemployment claims and credit card spending records) to construct a temporary judgment framework. To mitigate the impact of similar risks in the future, it is recommended to optimize emergency plans for data release mechanisms, such as backing up key datasets in advance, establishing inter-agency collaboration processes, or exploring simplified release models for certain indicators during shutdowns. Additionally, enhancing the complementarity of third-party data with official statistics can also help improve the resilience of the economic monitoring system.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。