Author: Tuo Luo Finance

The quiet market suddenly welcomed a revival today.

This morning, Bitcoin reclaimed the $110,000 mark, rising above $112,000, Ethereum returned to above $4,100, and BNB surged, breaking through $1,000 again. Just three days ago, the crypto market experienced a flash crash, with Bitcoin dipping to a low of $108,631, and ETH falling below the $4,000 warning line, briefly plunging to $3,815, causing ongoing panic in the market.

From the existing data, the reason for the revival seems quite interesting, likely stemming from a recent interview with Apple CEO Tim Cook.

Yesterday afternoon, a segment of Cook's interview went viral. In the interview, Cook was asked, "Do you hold cryptocurrencies like Bitcoin or Ethereum? Would you try them?" His response was, "It makes sense for individuals to hold cryptocurrencies as part of a diversified investment portfolio. By the way, this is not investment advice for anyone. I've been interested in crypto for a while and have been doing research. So, I think it's quite interesting."

In no time, social media quickly interpreted this statement as Apple supporting cryptocurrencies, with some even suggesting that Apple might accept cryptocurrencies for purchasing iPhones and Macs, and could follow a treasury strategy by investing company assets in Bitcoin. Of course, the first statement may have some basis. In May of this year, Apple updated its guidelines for the U.S. App Store, allowing apps to connect with external payment systems. At that time, this update was well-received by the crypto community, as it was believed that this move could save 30% in commissions for NFTs, wallets, and DeFi platforms. In June, a report from Fortune magazine indicated that Apple intended to enter the stablecoin market and was in preliminary talks with cryptocurrency companies about integrating stablecoins. Overall, while Apple has not implemented a cryptocurrency strategy, it has not opposed this emerging phenomenon either.

However, the latter statement is purely nonsensical. Firstly, Cook clearly stated in the interview that it is reasonable for individuals to hold cryptocurrencies for portfolio diversification, but he does not intend to invest Apple's $200 billion cash into Bitcoin or other crypto assets. He also emphasized, "I don't think people will buy Apple stock to have exposure to the risks of cryptocurrencies, and Apple will (temporarily) not accept cryptocurrency payments when selling products." More importantly, this interview, which several media outlets considered recent, was actually from 2021 during Cook's appearance at the New York Times DealBook Online Summit. In other words, this video is already four years old and has been misinterpreted by some media as a new interview. Furthermore, Cook did not directly state which cryptocurrencies he holds; the market merely speculated that he should hold Bitcoin.

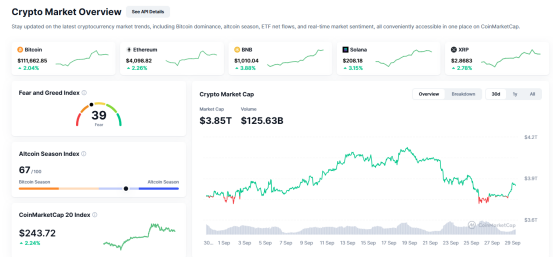

Although it is old news, it has been hyped up due to media effects. Today, the previously quiet crypto market was awakened again, with Bitcoin returning above $110,000, currently reported at $111,600, while the altcoin market led by ETH also saw some recovery, with ETH currently reported at $4,105. The total market capitalization of cryptocurrencies has risen to $3.85 trillion, and the fear index has increased from 28 to 39. While it is difficult to pinpoint the exact cause, observing the events, Cook's statement indeed seems to have had a positive impact on the market.

In fact, generally speaking, September has been a sluggish month for cryptocurrencies. Since its inception in 2010, Bitcoin has averaged a decline of over 4.5% in September, making it one of the only two months with negative average returns for Bitcoin. This year seems no exception. Despite the Federal Reserve finally restarting interest rate cuts after a year, successfully lowering rates by 25 basis points to between 4.00% and 4.25%, the market, accustomed to selling news, experienced even stronger fluctuations. After announcing the rate cut on the 18th, the crypto market plummeted on the 22nd, with a single-day liquidation amount reaching $1.7 billion, setting the largest liquidation record since December 2024.

In addition to the retreat following the news, the frequency of rate cuts and recession concerns have returned to the center of the debate. According to the dot plot released on September 18, there will be two more rate cuts by 2025. By the 22nd, Federal Reserve's Bostic stated that it makes no sense to continue cutting rates, suggesting that there might only be one rate cut this year. Powell also played hide-and-seek with the market, avoiding questions about the number of rate cuts in his speech, which led to uncertainty about the market's perception of his stance.

More importantly, recession data is not looking good. As of August 2025, the U.S. labor market remains weak, with the unemployment rate rising to 4.3%, the highest level since 2021; non-farm payrolls added only 22,000 jobs in August, far below expectations, and the average job growth over the past three months was only 29,000. Historical data has been significantly revised down, with a reduction of 911,000 jobs for 2024-2025, marking the largest revision in twenty years. The simultaneous decline in unemployment and employment rates has sounded the alarm for recession, with UBS even stating that the probability of an economic recession in the U.S. is 93%.

Inflation data is also not looking good. The latest data released by the U.S. Department of Commerce on the 26th shows that the personal consumption expenditure price index rose by 2.7% year-on-year in August, slightly higher than July's 2.6% increase. Excluding the volatile food and energy prices, the core personal consumption expenditure price index rose by 2.9% year-on-year in August, unchanged from the previous month's increase. Both data points exceed the Federal Reserve's 2% inflation target, posing new challenges for the Fed's policy-making. It is also worth noting that Trump's previous tariff policies have not yet fully transmitted to economic data, leaving more uncertainty in inflation data.

Against this backdrop, since the rate cuts, the crypto market has entered a garbage time. Institutions have instead taken the lead in chasing highs and killing lows. Since the 22nd, ETF outflows have significantly increased, with Bitcoin ETFs seeing outflows of $1.143 billion within five days, and Ethereum (ETH) experiencing continuous net outflows for five days, totaling $795 million.

Returning to the ideal scenario, although market expectations for a U.S. recession are rising, the current state suggests that the probability of a recession may not be as high as imagined. It has been previously mentioned that the resilience of the U.S. economy is quite strong, mainly reflected in the following points: first, there is a solid household balance sheet, with low leverage ratios for businesses and households, currently in a private sector balance sheet expansion cycle; second, there is investment in infrastructure projects driving growth, and the economy is in a technology innovation cycle led by AI; third, the initiation of a rate cut cycle, after several years of tightening, provides the Federal Reserve with considerable operational space, with a rate cut potential of up to 400 basis points, offering soft protection for asset prices. Recently, CME's "FedWatch" shows an 89.3% probability of a 25 basis point rate cut in October, while the probability of maintaining the current rate is 10.7%. In summary, the fundamental stability of the U.S. economy is better than expected, providing a basis for an upward cycle. Even from the data perspective, it is still too early to discuss a recession, as neither unemployment nor inflation has reached the full warning line level.

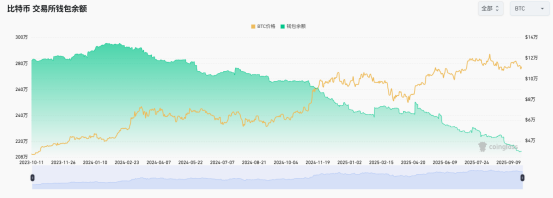

Perhaps it is precisely based on this that although the crypto market prices have declined, the overall performance remains strong. Especially Bitcoin, which is still trading in the $105,000-$110,000 range, showing effective support. Meanwhile, the supply of Bitcoin on exchanges has steadily decreased, currently at only 2.126 million coins, marking a new low in nearly two years, reflecting the long-term holding tendency of holders. Overall, while there is insufficient upward momentum, negative factors have not yet emerged.

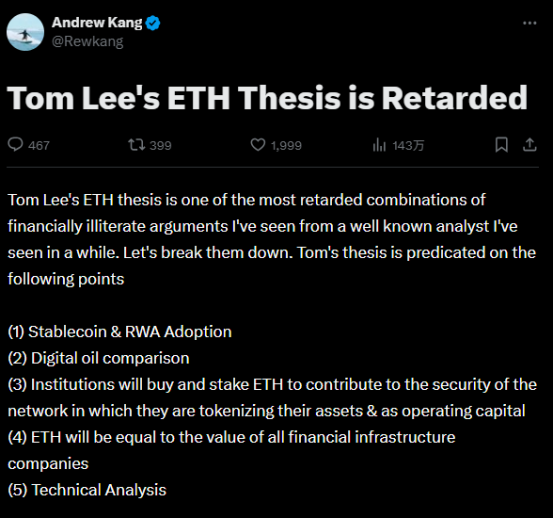

In comparison to Bitcoin, Ethereum faces even greater issues. Regarding Ethereum's price trend, there are constant divergences in the market. Recently, Andrew Kang, founder of crypto venture capital firm Mechanism Capital, and Tom Lee, CEO of Bitmine, the largest holder of ETH treasury, engaged in a price debate over ETH. In response to Tom Lee's five major visions for Ethereum's future, Andrew Kang countered each point, stating that the existence of stablecoin chains and the low liquidity of RWA make it difficult for stablecoins and RWA to bring sustained income to Ethereum. He also argued that institutional buying and staking are mere talk, as no major bank or asset management institution has announced plans to include ETH on their balance sheets. He further questioned Ethereum's positioning, suggesting that ETH is merely a cyclical asset, lacking the logical support for sustained long-term valuation increases, and refuted the vision of Ethereum as a global financial infrastructure.

Andrew Kang's assertions are just one perspective and should not be taken as absolute truth, especially since he previously claimed in April that ETH would drop below $1,000. However, his words reflect the market's distrust in Ethereum. This distrust has been longstanding; the once stable price has now seen little movement in the application market, and even the much-touted Ethereum treasury has been dampened by a recent joint investigation by the SEC and FINRA into treasury companies, which has further eroded investor confidence in Ethereum's price. This has led to the objective reality that even slight negative news tends to result in larger declines and more severe volatility for Ethereum. It is worth noting that the current ETH staking withdrawal queue has reached an astonishing 2.13 million coins, indicating significant withdrawal pressure.

Of course, while there is price pressure, being bearish on Ethereum should still be approached with caution, as it remains the most important cryptocurrency in the market after Bitcoin and is one of the only two cryptocurrencies that institutions are willing to hold in large quantities. However, considering its volatility and current fundamentals, operations should be more cautious than with BTC.

From the market perspective, potential short-term negative factors include the upcoming TOKEN2049 in October, with close observation needed to see if the "summit must fall" curse reappears. Additionally, new U.S. labor data and Federal Reserve movements also require high attention, as they will have a more profound impact on the market. Positive news is also on the way, as the next few weeks will be a concentrated approval period for altcoin ETFs, with the final deadline approaching, and the market predicts that the SEC will approve at least one type of ETF.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。