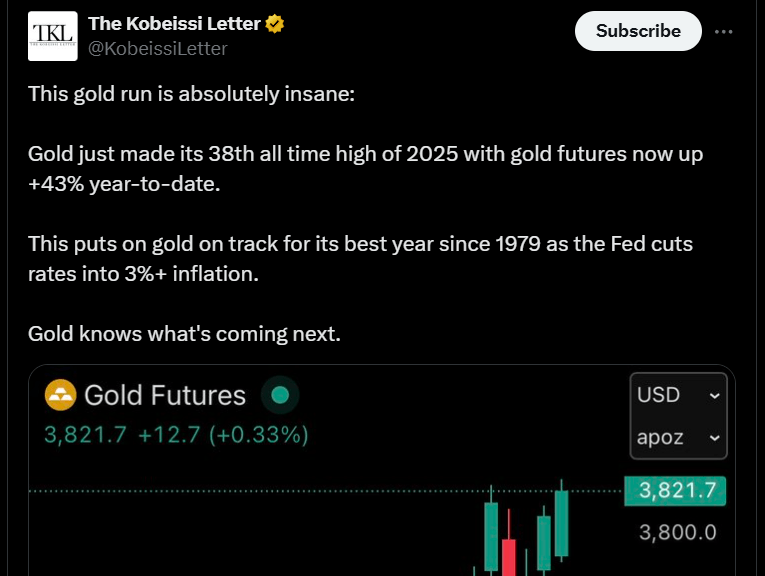

Gold reached yet another all-time high for the 38th time this year alone, according to the Kobeissi Letter, after climbing to $3,830 on Monday. Digital gold or bitcoin, also rallied, breaking $114K after a weekend in the doldrums, although that price is still roughly $10,000 below BTC’s record of $124,457.12 notched last month.

(Gold set its 38th record high price in 2025 on Monday / The Kobeissi Letter on X)

Gold’s rally comes in the wake of a weakening dollar and a potential shutdown of the U.S. Federal government as Republicans and Democrats bicker over the country’s finances. “These people are crazy, the Democrats, so if it has to shut down, it’ll have to shut down,” U.S. President Donald Trump told reporters at the White House. “But they’re the ones that are shutting [it] down.”

The U.S. federal debt has ballooned to a mind-bending $37.47 trillion, according to the government’s own website. The U.S. dollar index fell 0.23% over the past 24 hours. The index measures the relative strength of the U.S. dollar against other major currencies.

The state of the country’s finances, a weakening dollar, and the possibility of interest rate cuts in October and December have all spurred a flight to safety, leading to gold’s remarkable run and, to a lesser extent, a modest increase in the price of digital gold. Ironically, the bullion rally has pushed U.S. gold reserves, approximately 8,133.46 metric tons, over the $1 trillion mark.

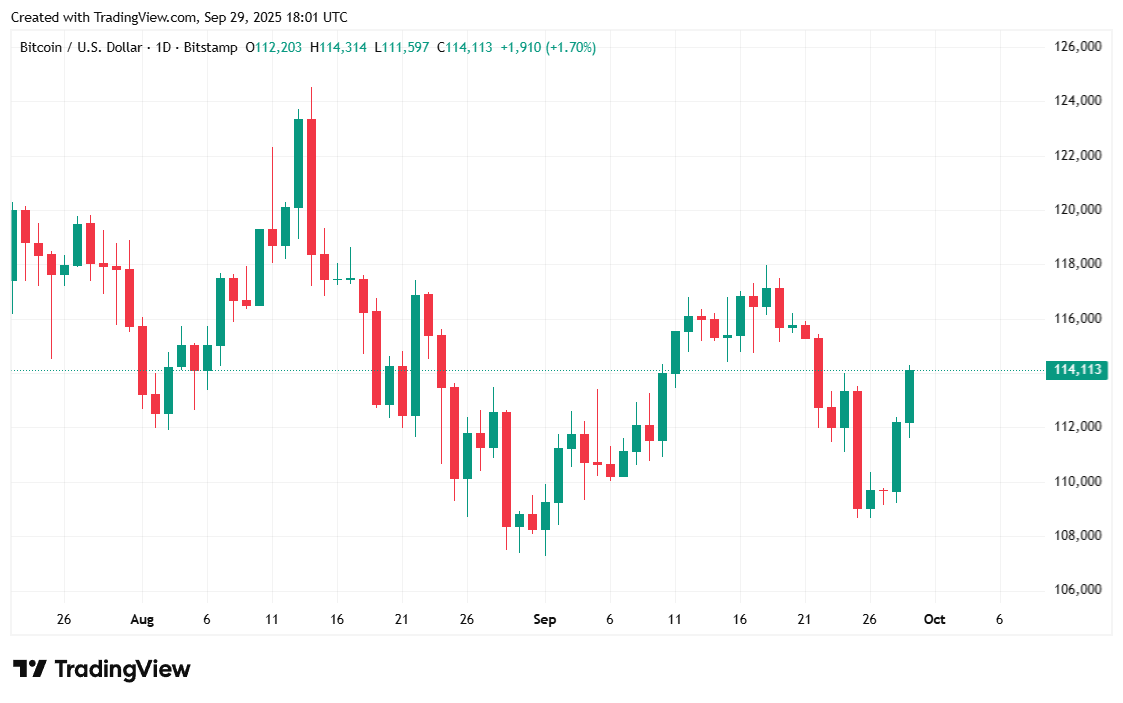

Bitcoin was trading at $114,190.59 at the time of writing, a 3.53% jump since yesterday, but a smaller 1.47% increase for the week, according to data from Coinmarketcap. The digital asset has been priced between $110,111.18 and $114,288.31 over the past 24 hours.

( BTC price / Trading View)

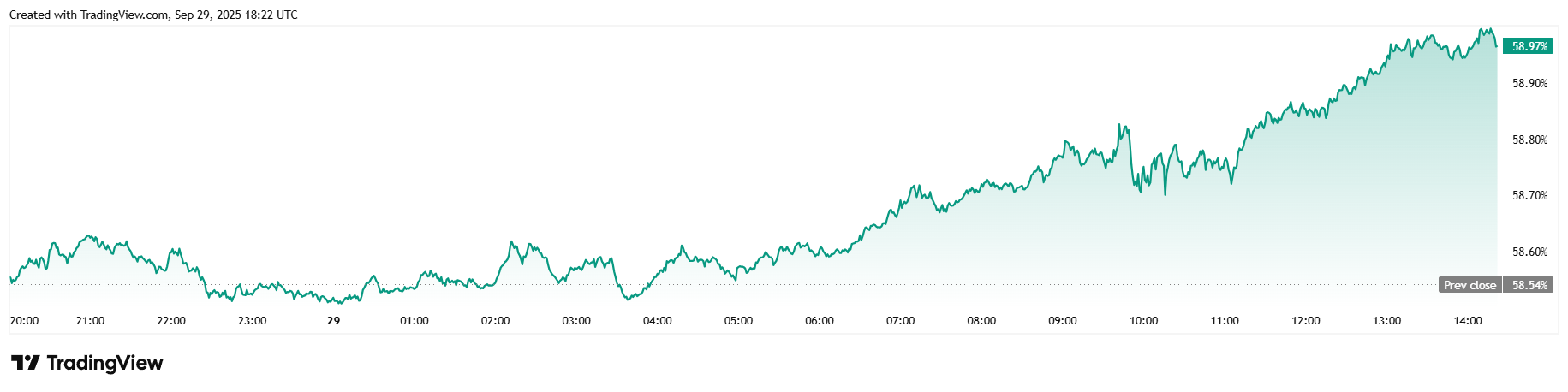

Trading volume for the day jumped 125.16% and stood at $59.18 billion, a large increase even after considering the expected post-weekend surge. Market capitalization, like price, was also up 3.55% at $2.27 trillion, and bitcoin dominance rose 0.71% over 24 hours and was sitting at 58.97% at the time of writing.

( BTC dominance / Trading View)

Total bitcoin futures open interest surged 6.59% to $82.76 billion over 24 hours, according to data from Coinglass. Bitcoin liquidations totaled $91.73 million for the day, a number dominated by $83.84 million in short liquidations. The remaining $7.88 million was made up of longs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。