Defi Newcomer Aster Captures $29 Million in Fees Amid Token Frenzy

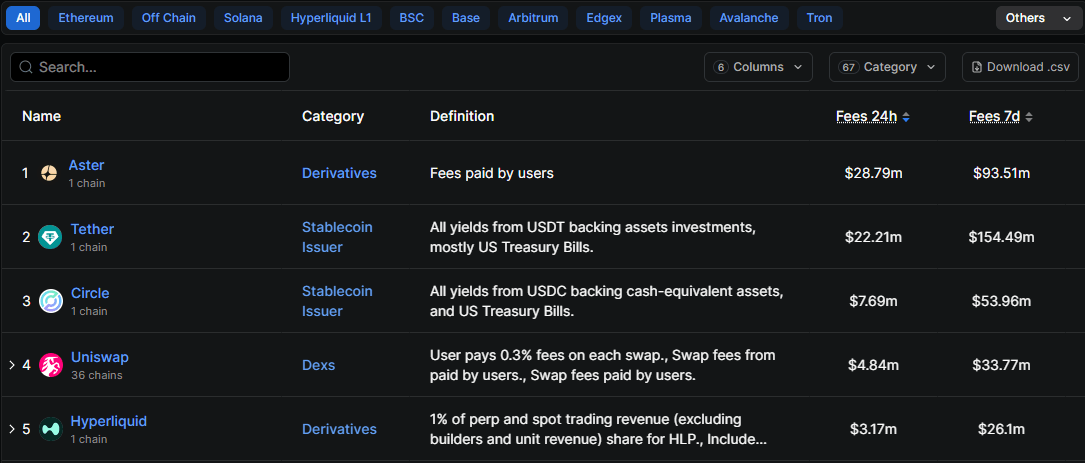

Aster, a decentralized exchange (DEX) specializing in high-frequency perpetuals trading, has surged to the top of the defi revenue charts. According to Defillama data, the protocol captured $28.79 million in fees over the past 24 hours, placing it first worldwide ahead of Tether, which recorded $22.21 million.

The milestone puts Aster ahead of major players like Circle and Uniswap, and nearly ten times above rival Hyperliquid. For a relatively new entrant, the scale of fee generation highlights both strong trading activity and the growing appeal of high-frequency decentralized markets.

The rapid rise comes on the heels of intense attention around Aster’s native token, ASTER. Since its September 17 launch at $0.02, the token skyrocketed over 7,000% to a peak of $2, briefly pushing its market cap above $3.3 billion. The rally was amplified by an endorsement from Binance founder Changpeng Zhao, prompting listings on Bitget, Bybit, and multiple decentralized exchanges.

However, controversy lingers. Analysts have flagged concerns over market manipulation, with claims of concentration of ASTER’s supply in just a few wallets. The combination of eye-popping fee generation and concentrated token ownership has put Aster under the microscope, even as it looks to cement itself as one of the most profitable protocols in defi.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。