Bitcoin Funds Lose $903 Million, Ether ETFs Shed $796 Million in Brutal Week

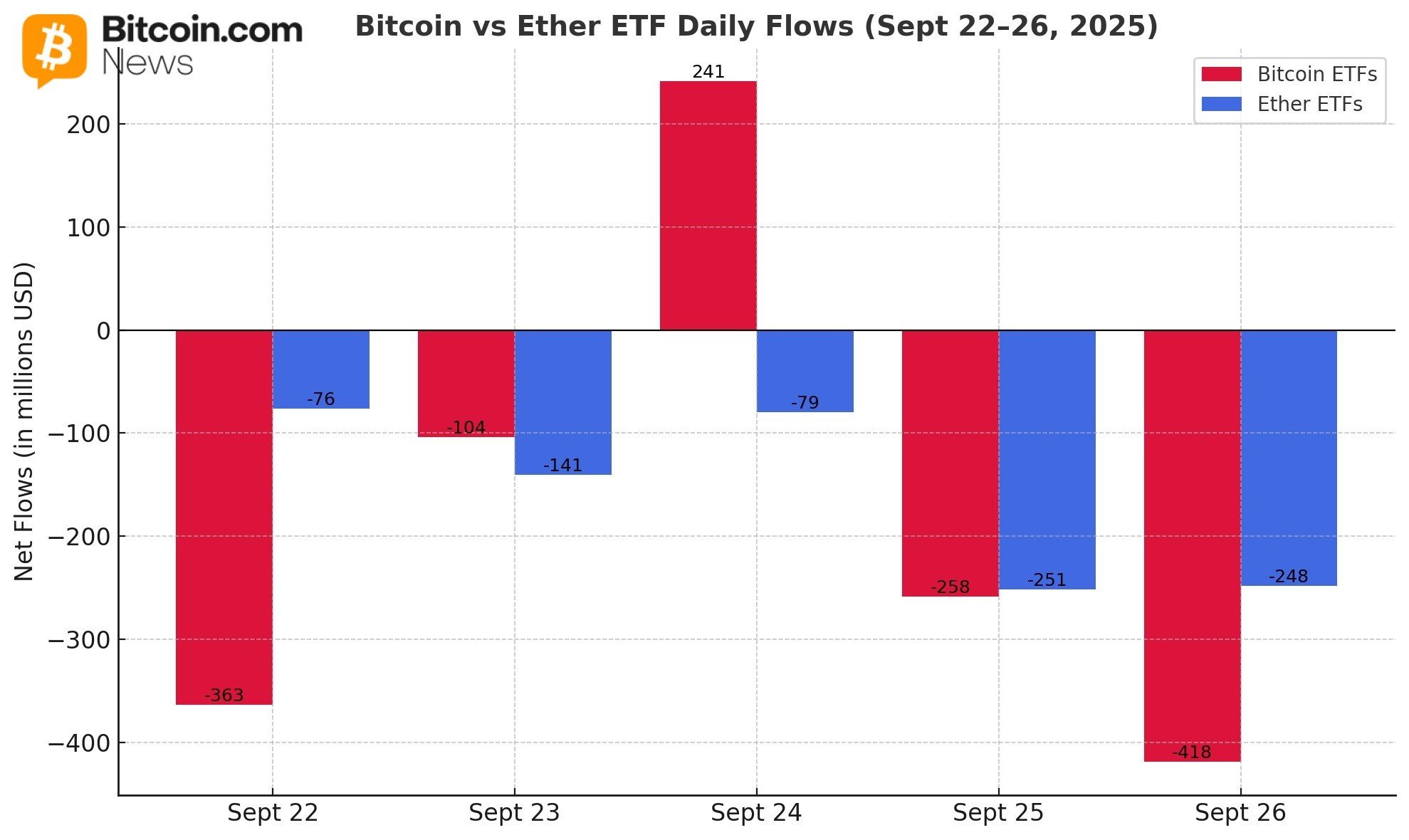

It was a bruising week for crypto exchange-traded funds (ETFs), one that will be remembered for its scale and persistence. Both bitcoin and ether funds faced relentless pressure, closing four out of five trading days in negative territory. Data from Sosovalue showed a combined exodus of $1.69 billion, underscoring a sharp shift in investor sentiment.

Bitcoin ETFs saw a cumulative $902.50 million outflow. Fidelity’s FBTC shouldered the heaviest burden, losing a staggering -$737.76 million over the week. Ark 21Shares’ ARKB lost -$123.28 million, while Bitwise’s BITB registered -$92.38 million in exits.

Grayscale’s GBTC fell by -$84.69 million, and its Bitcoin Mini Trust by another -$14.51 million. Vaneck’s HODL contributed with -$22.48 million in redemptions, while Franklin’s EZBC and Valkyrie’s BRRR saw lighter outflows of -$6.34 million and -$4.96 million, respectively.

The only bright spots were net weekly inflows of $173.88 million for institutional favorite Blackrock’s IBIT and $10.02 million for Invesco’s BTCO. Despite trading volumes topping $18.93 billion for the week, net assets fell back to $143.56 billion.

Daily bitcoin and ether ETFs for 22-26 Sept.

Ether ETFs were equally battered, logging $795.56 million in weekly outflows. Fidelity’s FETH was again the primary drag, bleeding -$362.25 million. Blackrock’s ETHA followed with a net exit of -$241.41 million, while Grayscale’s Ether Mini Trust and ETHE lost -$67.96 million and -$38.37 million each.

Bitwise’s ETHW posted -$78.26 million in redemptions, alongside smaller declines from Vaneck’s ETHV (-$1.44 million), Franklin’s EZET (-$2.98 million), Invesco’s QETH (-$2.34 million), and 21Shares’ TETH (-$550.35K). No ether ETF had a net inflow for the week, as it was all red across board. Total trading value for the week reached $10.01 billion, with net assets down to $26.01 billion.

This was no ordinary week. Bitcoin’s seven-day inflow streak earlier in the month now feels distant, as redemptions accelerated with force. Ether’s run of five straight daily outflows capped the rout. Investors appear to be pulling risk amid heightened uncertainty, and the data makes one thing clear: capital is retreating from crypto ETFs at scale. The question heading into this week is will the tide finally turn, or is more pain ahead?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。