Justin Sun once faced a fraud lawsuit from the U.S. SEC, but after spending $90 million to purchase two cryptocurrencies from the Trump family, he has now become a business partner of the presidential family.

Written by: Zeke Faux, Muyao Shen, Bloomberg

Translated by: Chopper, Foresight News

The Chinese-born cryptocurrency billionaire stepped off his Airbus A330, bent down, and placed his palm on the tarmac in Los Angeles, as if to personally confirm that he had indeed arrived in the United States. Then, he stood up and raised his fist in celebration. It was May 16, and the nationwide victory tour of President Donald Trump’s biggest cryptocurrency supporter had just begun.

Justin Sun's excitement is understandable. For years, he had avoided stepping foot in the U.S. due to a federal investigation that could jeopardize his business. Now, after spending over $90 million to purchase two cryptocurrencies from the Trump family, he returned to the U.S. as a guest and business partner of the president.

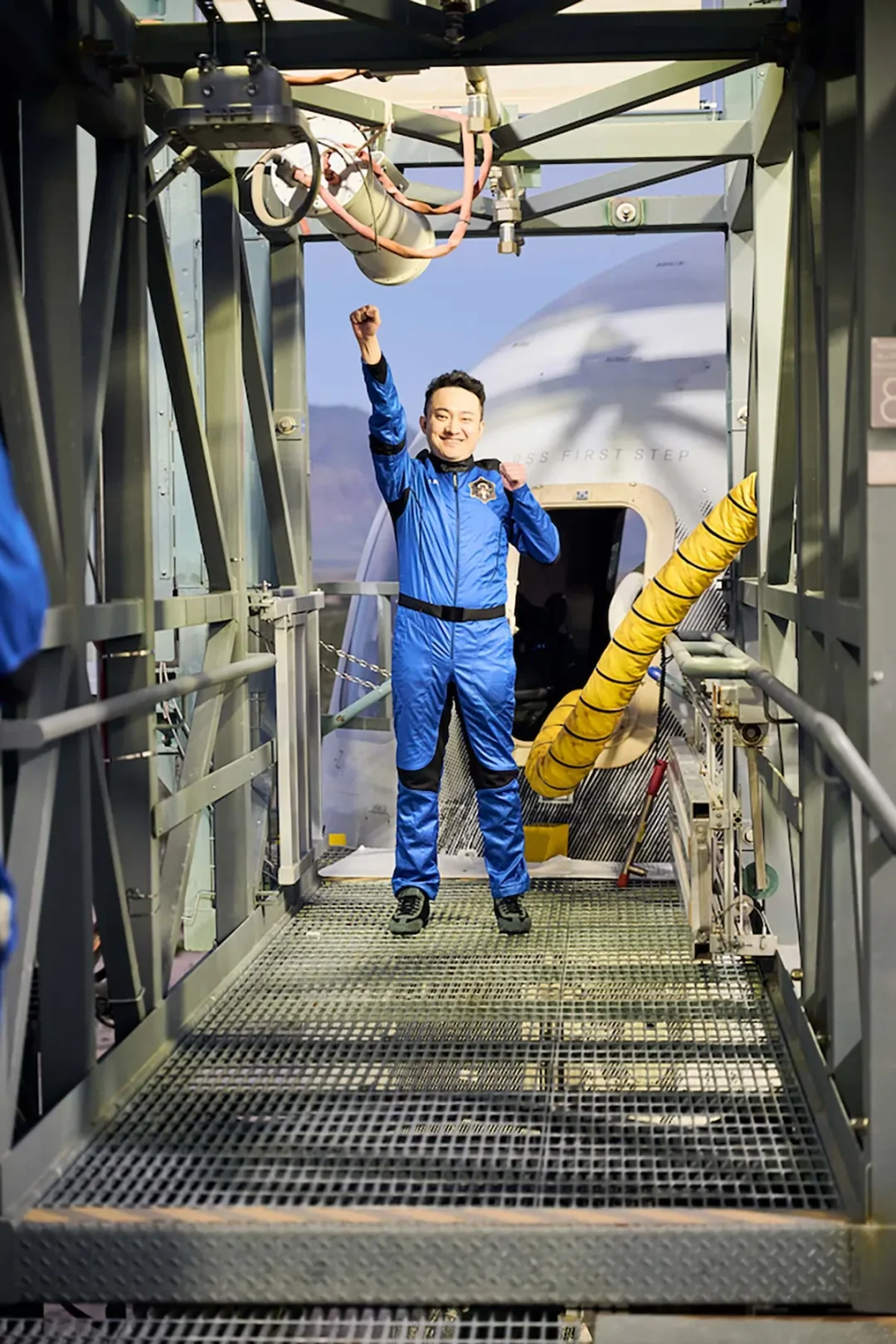

On August 3, Justin Sun embarked on his long-awaited space journey | Source: Blue Origin

His itinerary was packed with highlights. One stop was Blue Origin, the rocket company owned by Jeff Bezos. Four years ago, Sun bid $28 million for a chance to travel to space, and now he was finally preparing for liftoff. Another stop was the Bitcoin conference in Las Vegas, where he took photos with the president's son and a Tennessee federal senator responsible for pushing key cryptocurrency legislation. In Washington, he also visited a cryptocurrency advisor to Trump and presented a replica of a conceptual artwork—a banana taped to a wall. The original artwork was created by artist Maurizio Cattelan, which Sun had previously purchased for $6.2 million at Sotheby’s.

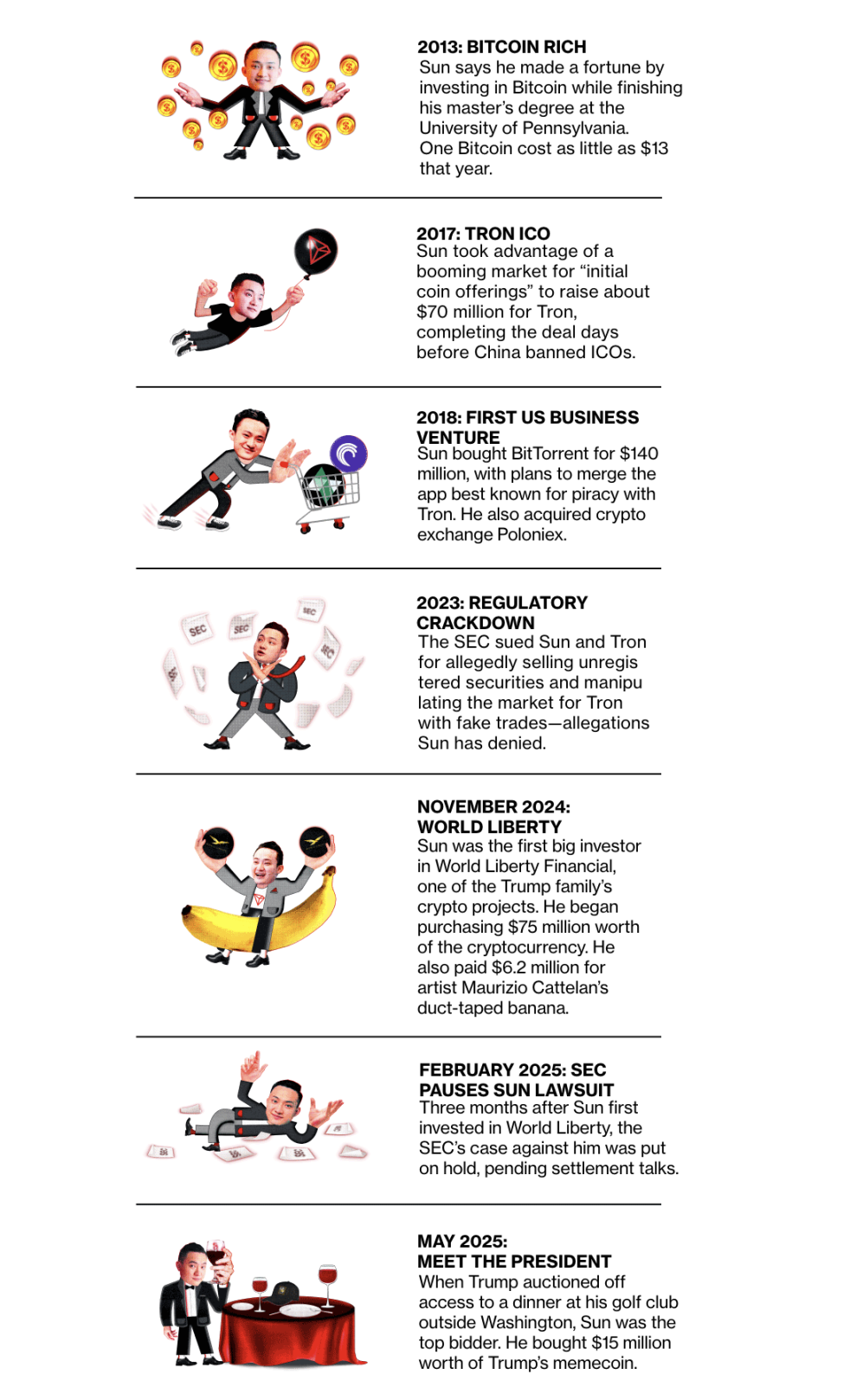

The climax of his trip was a dinner held at the Trump National Golf Club in Virginia. The dinner was hosted by the president himself, with entry qualifications determined by auction, where the rule was that whoever purchased the most Trump Meme coins would gain entry. Sun topped the list with a purchase amount of about $15 million. Outside the club, dozens of protesters braved the rain, holding signs, with some shouting, "Hope you choke on a steak!" Sun, wearing a bow tie and escorted by an assistant holding an umbrella, walked into the venue, followed by three photographers documenting the moment for social media promotion. His spoils included a Trump gold watch and the opportunity to speak after the president's remarks.

Facing over 200 formally dressed Meme coin investors, Sun stammered through a few minutes of speech on "Trump's support for the cryptocurrency industry." "About… 100 days ago, they were still chasing after people in the cryptocurrency industry," he said with an awkward smile, "Now I’m in the U.S., and soon everyone will be coming here."

Critics of Sun's relationship with Trump argue that this association is rife with corruption. White House spokesperson Anna Kelly responded that Trump "acts in the best interest of the American public, with no conflict of interest." However, Sun's very presence is like a living billboard, signaling to the outside world that the president sees no problem in accepting money from those looking to benefit from him.

Previously, Sun was facing a fraud lawsuit from the SEC. However, months after he began investing in Trump’s cryptocurrencies, the case was put on hold, awaiting the outcome of settlement negotiations (the SEC declined to comment on this article). Although both parties deny any wrongdoing, the act of an individual funneling large sums of money to a presidential family to gain favor is unprecedented in U.S. history. As a foreign citizen, he was prohibited from donating to U.S. political campaigns. Nevertheless, the revenue he generated for the Trump family through cryptocurrencies has already surpassed a year’s revenue of Mar-a-Lago. Additionally, he has pledged to purchase another $100 million worth of Trump Meme coins.

But Sun's ambitions do not stop there. The blockchain network he founded, Tron, has developed into a global payment network. With a dollar-pegged stablecoin, anyone can make low-cost, high-speed, and anonymous cross-border dollar transfers. Currently, Tron processes $600 billion in transactions monthly, more than four times that of PayPal. His new allies in Washington are pushing for regulatory revisions to pave the way for Tron's expansion in the U.S. The Trump family even plans to launch a dedicated stablecoin using the Tron network.

Until recently, Tron's operations remained in a regulatory gray area. Money laundering experts warn that Tron is becoming the preferred payment network for criminals, including terrorist organizations like Hamas, Russian entities evading sanctions, and Chinese crime syndicates involved in large-scale fraud. Sun claims he is assisting authorities in combating illegal activities on the Tron network, but simultaneously shirks responsibility by citing the network's decentralization and his lack of control over it.

In August 2025, a valuation from the Bloomberg Billionaires Index sparked controversy, even leading Sun to file a lawsuit. In February of this year, Sun provided the index with details of his personal wealth, including a $55 million art collection, a $200 million Airbus, and a list of cryptocurrency wallets that his representatives claimed belonged to him. Based on this data, the Bloomberg Billionaires Index calculated that Sun holds 60 billion Tron tokens, with a net worth of $12.5 billion.

Sun subsequently filed a lawsuit in federal court in Delaware, alleging that the report leaked "details that were promised to remain confidential." Bloomberg denied this claim in court documents. He argued that disclosing his cryptocurrency holdings "exposes him to the risk of hacking or kidnapping" and sought a restraining order to prevent the article's publication. The lawsuit also mentioned that the "asset list" provided to Bloomberg in February mistakenly included "ecosystem wallets and other wallets not owned by him." His lawyer stated that Sun does not hold "the majority of Tron tokens," but according to court documents submitted by Bloomberg, when asked which of the previously listed assets did not belong to Sun, the lawyer refused to answer. On September 22, the judge denied Sun's request and did not approve the restraining order; the case is still pending.

On a certain night at 11 PM, Sun called this publication. In a one-and-a-half-hour conversation, he spoke in Chinese about his career, the U.S. government investigation, and his dealings with the Trump family. He believes that the public should "trust him and Trump more," and critics should not rush to conclusions. "Even if Trump wants to help the poor, it could be twisted into 'buying public sentiment,'" he said, "Blockchain technology can also be misunderstood, as if the people behind it are using cryptocurrency projects for profit."

He stated that Tron is creating tremendous value for the world, and criticizing his endeavors "is like criticizing Spider-Man for using excessive force to fight bad guys." "Spider-Man goes to school during the day and protects the world at night, right?" Sun said, "We are essentially also guarding world peace, just without promoting it."

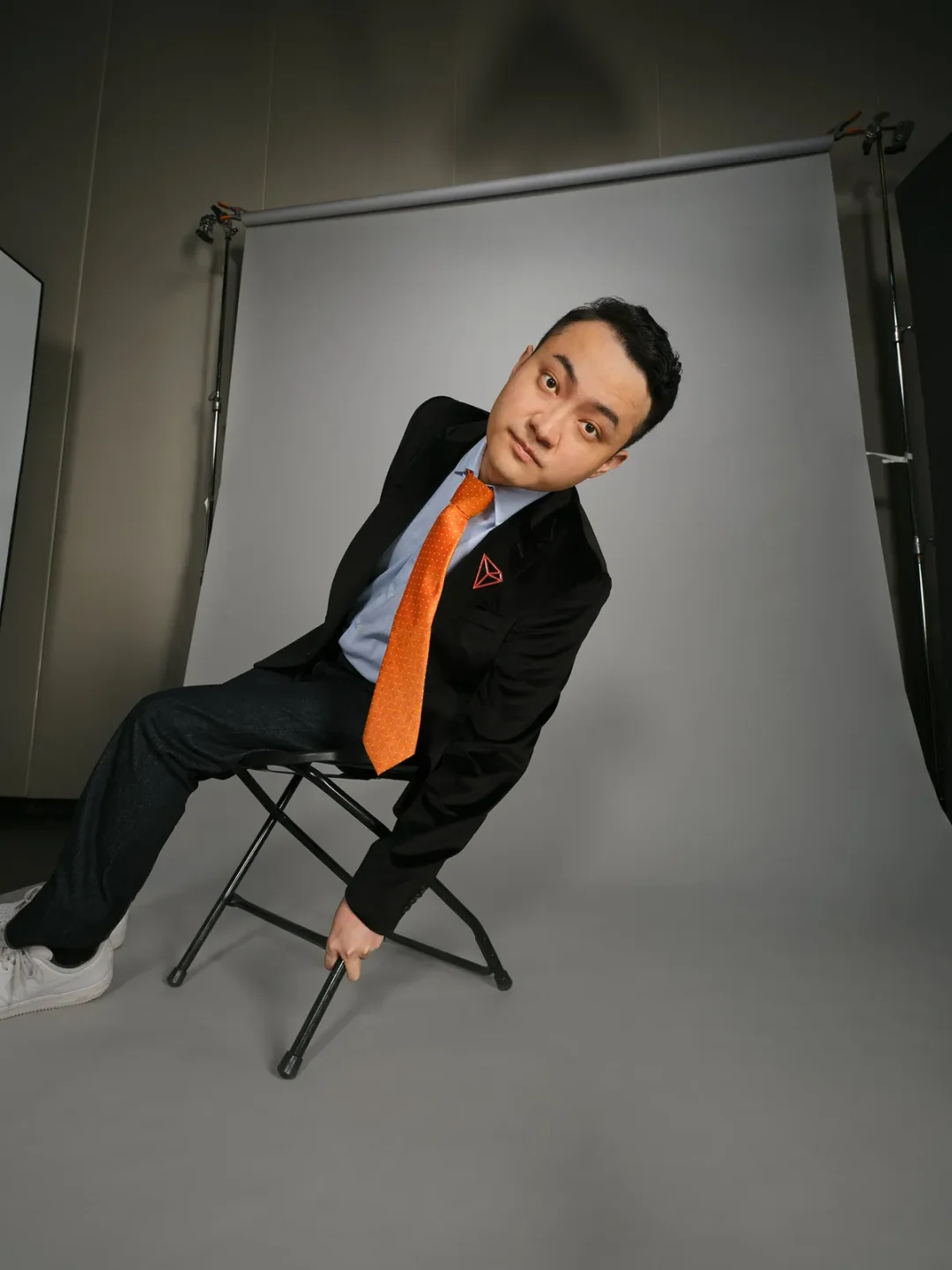

This has always been Sun's style. Despite being accused of plagiarism, fraud, and market manipulation, he has amassed a fortune through cryptocurrency. Just like his new presidential business partner, Trump pointed out the merits of "real exaggeration" in his book "The Art of the Deal."

Justin Sun's Rise

Early cryptocurrency investments paved the way for this future billionaire, allowing him to launch his own token and invest in the Trump family's cryptocurrency projects.

Top U.S. cryptocurrency companies Circle Internet Group Inc. and Coinbase Global Inc. both refused to collaborate with Sun. "Justin Sun has a bad reputation in the crypto community," a Coinbase lawyer wrote in a 2024 court document. Last year, a Chinese podcast host referred to Sun as a "scythe," implying his "ruthless trading style." Sun responded to the host, saying, "I don't think ruthlessness is a flaw; it's called efficiency."

According to descriptions from former employees in the lawsuit, Sun is arrogant and operates the company like a dictator from his favorite computer game, "Tropico." Two former employees accused Sun of slapping subordinates, and one claimed Sun sent him multiple texts saying "f*** you" (Sun denied all allegations in court documents). He also required employees to address him as "Your Excellency"—a title he received in 2021 when he was appointed "Ambassador to the World Trade Organization" by Grenada. It is reported that the island nation was selling diplomatic positions for $150,000 at the time (Sun's lawyer denied any wrongdoing). "Everyone fawned over him without restraint," said Cody Snider, a former engineer at one of Sun's companies, "He seemed like a king or a deity."

The Dual Nature of Tron: Convenience of Stablecoins vs. Tools for Crime

Sun is best known for his money-burning, attention-grabbing operations: including hiring Oscar-winning composer Hans Zimmer to create a theme song for Tron, spending $4.6 million to have lunch with Warren Buffett, and running for prime minister of the libertarian micronation Liberland (where he was ultimately elected). In November 2024, he held a press conference in Hong Kong, publicly eating the $6.2 million banana, claiming it "will become part of art history."

35-year-old Justin Sun was born in Xining, China. When he founded Tron in 2017, he was living in Beijing, hosting a podcast called "The Road to Financial Freedom," and had acquired a social audio startup called "Pei Wo," which focused on "user matching + voice chat/live streaming," but was criticized by China's official news agency Xinhua for "containing pornographic content."

But Sun was determined to become a tycoon like Jack Ma. "Like a devout missionary, I will not be afraid of the snow-capped mountains ahead, nor will I retreat because of ragged clothes," he wrote in his autobiography "Beautiful New World," published at age 26.

The birth of Tron relied on the then-booming "Initial Coin Offering (ICO)" model. These projects do not issue stocks but raise funds by selling new cryptocurrency tokens. At that time, as long as an idea touched on blockchain, even if it was full of loopholes, it could raise a significant amount of money through ICOs. The most absurd example was "Dental Coin," which claimed to be "the first blockchain concept for the global dental industry" but raised over $1 million.

Tron's positioning has always been vague. Sun sometimes referred to it as an "entertainment system," sometimes as an "app store," and at times described it as "the internet for the people." Some criticized it as a "copycat project," heavily borrowing content from other ICO projects. However, these controversies did not hinder fundraising; on September 2, 2017, Tron completed its ICO, raising $70 million; two days later, the Chinese government announced a ban on ICOs.

In 2019, cryptocurrency analytics firm DappReview revealed to CoinDesk that early activities on the Tron network were mostly "gambling applications," and a large number of users were "fake accounts." But with funds in hand, Sun first acquired the then-U.S.-based cryptocurrency exchange Poloniex, and later bought BitTorrent, known for "pirated file sharing," for $140 million, planning to integrate it with Tron.

In 2018, Justin Sun made a brief stop in San Francisco to oversee the newly acquired companies under his control; two years later, he moved to Singapore, followed by workplace abuse lawsuits from former employees. Although he attempted to claim immunity as a Grenadian diplomat, he was unsuccessful and ultimately reached a settlement with undisclosed terms. In interviews, Sun stated that all allegations were fabricated for extortion and expressed that he now realizes "this is quite common in the U.S."

In 2019, Sun found the core use case for Tron—stablecoins. These types of cryptocurrencies are pegged to the value of $1, with each token backed by $1 in hard assets as reserves. In March of the same year, he partnered with Tether, one of the earliest stablecoin issuers, enabling the Tron network to support the transfer of Tether stablecoins.

At that time, Tether was still small, operating in secrecy, and faced significant skepticism regarding the authenticity of its reserves. The founding team of this stablecoin was quite bizarre: it included a child star from "Duck Duck Goose" and an Italian plastic surgeon; meanwhile, Tether was under investigation by the New York Attorney General. The investigation later revealed that Tether's owners had "misappropriated reserves" to "plug holes" in their cryptocurrency exchange. In 2021, they repaid their debts and paid a $18.5 million fine to New York State, reaching a settlement.

Despite the ongoing controversies, stablecoins filled a gap in the cryptocurrency industry. Many companies wanted to settle cryptocurrency transactions in dollars but struggled to find partner banks due to offshore operations or legal uncertainties. Stablecoins, which are almost unregulated, became an ideal alternative. While other blockchains also supported Tether, Tron's advantages lay in its speed and low costs, allowing it to rise rapidly.

Today, Tron processes about $2 billion in stablecoin transfers daily, with each transaction requiring a small fee paid in Tron tokens. Stablecoins like Tether have become central to Sun's business, and he even describes Tron as a "digital dollar." Among Tron's users are ordinary people from high-inflation countries like Argentina and Nigeria, who use stablecoins to hedge against inflation; however, the ease of cross-border dollar transfers has also attracted the attention of criminal groups.

The United Nations Office on Drugs and Crime pointed out that money launderers, sanction evaders, and scammers were early users of Tron, which has become "the preferred tool for Asian criminal groups to transfer funds."

The appeal of Tron to criminals is evident. Dollars circulating through the U.S. banking system are subject to strict scrutiny by compliance officers, who must verify customer identities and report suspicious transactions to authorities; whereas, like other blockchains, Tron offers anonymity, with users identified only by "alphanumeric strings." With Tron, a drug dealer in London can send stablecoins to a cocaine supplier in Colombia without providing any personal identification. This system is comparable to PayPal, but accounts are identified only by numbers, much like the former anonymous accounts of Swiss banks. "There's a reason bad actors choose to use it," said Matt O'Neill, former head of cyber investigations for the U.S. Secret Service and now a security consultant, "They hardly have to worry about getting caught."

Brad Thorne seems to have no connection to the world of Tron experts. This bald detective with a white goatee worked for 19 years at the Boise Police Department in Idaho, a city with a population of about 250,000. He said he "investigates multiple fraud cases involving Tron every week," with common types including pig butchering: scammers lure victims through unsolicited text messages, using false friendship and high-return investment bait to trick them into transferring cryptocurrency. These scams are often controlled by Southeast Asian scam hubs. According to UN data, over 200,000 people are trapped in these hubs, forced to engage in fraudulent activities. Other scam tactics include "impersonating police for bribes," "pretending to be grandchildren asking for 'emergency bail money'," and "nude chat extortion." Thorne stated that cryptocurrency makes it easier for criminals to transfer stolen funds: "If the money goes through the banking system, I have a better chance of recovering it; banks are also more likely to detect warning signs and stop the transfer."

Typically, stablecoin issuers cooperate with law enforcement requests to freeze wallet assets linked to criminal activities. However, Thorne pointed out that the speed at which criminals open new wallets and transfer funds far exceeds the speed at which law enforcement can apply for court seizure orders. "The most frustrating thing for investigators is seeing the victim's money on the blockchain but being completely unable to recover it."

Rich Sanders is an independent cryptocurrency tracker who also provides volunteer support to the Ukrainian military and police. He believes that cryptocurrency companies "are not doing enough to screen and prevent the use of their products for criminal activities," as "it does not align with their economic interests." Sanders conducts independent investigations in Odessa and across Eastern Europe, claiming to have found that drug traffickers, saboteurs, sanctioned Russian companies, and terrorists are all using Tron to transfer funds, and tracking them is not difficult. In February 2025, he contacted Hamas using the email address chocolategoddezz@proton.me to inquire about donation methods, and they promptly replied with a 42-character Tron wallet address.

In the U.S., any entity providing electronic payment services is typically required to comply with strict regulations: they must collect user identity information and report suspicious transactions to authorities. However, decentralized blockchain networks largely evade these rules. Supporters argue that blockchains are neutral software tools, similar to internet protocols, and should not be held responsible for user behavior.

The Tron network claims to be community-controlled. The community is led by 27 representatives, elected through votes from token holders. However, the Bloomberg Billionaires Index analyzed data provided by Sun in February 2025 and found that he controls more than half of the Tron tokens, publicly releasing this conclusion. Sun subsequently sued Bloomberg, while Bloomberg defended its analysis in court documents.

The harshest criticism of Tron comes from cryptocurrency tracking company TRM Labs, whose tools are used by law enforcement agencies in multiple countries for investigations. In March 2024, TRM released a research report stating that "illegal cryptocurrency activities accounted for 45% of all activities on Tron, the highest among all blockchains," and pointed out that Sun's network was used by drug traffickers, North Korean hackers, and entities financing terrorism.

Six months after the report's release, Sun used his financial resources to turn critics into allies. He announced funding for a new initiative called the "T3 Financial Crimes Unit," hiring TRM to assist in combating criminal activities on the Tron network with the help of Tether. TRM's global policy director, Ali Redbord, stated that the initiative has helped law enforcement freeze "$260 million in illegal funds." In 2025, TRM released a new report praising Tron for "effectively clearing out illegal participants," but still noted that "more than half of the criminal activities tracked in the past year occurred on the Tron blockchain."

Redbord believes that "it is unfair to criticize Tron just because some people use it for crime": "It is just a blockchain, just infrastructure." A lawyer for Sun shares a similar view, writing in a letter: "Bad actors are everywhere; blockchain is just the latest neutral technology abused by bad actors, a situation that has been seen throughout the history of technology."

In an interview with Bloomberg Businessweek, Sun stated that Tron "does not facilitate crime," but rather "helps impoverished people around the world (especially in countries with volatile currencies) easily access dollars." "This world is already full of problems that need fixing," Sun said, "I feel like I have been working hard to solve various issues."

He likened the T3 initiative to "NATO," claiming its results are comparable to "the work of the Gates Foundation in Africa." He stated that the team has assisted in combating "money laundering, investment fraud, extortion, human trafficking, and North Korean terrorism financing," adding, "If these issues are left unchecked, they could lead to an atomic bomb capable of destroying all humanity, and we are the messengers of justice."

Sun's entanglement with the U.S. government began after the cryptocurrency bubble burst in 2022. At that time, the "scam case" led by the high-profile and arrogant engineer Do Kwon, which involved $40 billion, collapsed, triggering a chain of defaults and exposing the insolvency of several well-known figures in the industry. The "wonder kid" of the cryptocurrency industry, Sam Bankman-Fried, also saw his exchange FTX go bankrupt, and he was later sentenced to 25 years in prison for fraud.

Regulators, who had previously stood by during the bubble's expansion, finally took action. The SEC, led by Gary Gensler at the time, filed lawsuits against several leading companies in the industry, accusing them of "almost all publicly conducted cryptocurrency transactions being illegal."

Sun was one of the targeted individuals. In a 2023 lawsuit, the SEC accused Sun of "hiring at least five employees to open exchange accounts under other people's names and creating a false impression of popularity by buying and selling Tron tokens to himself."

The SEC also accused Sun of "violating disclosure regulations." He paid celebrities like rapper Soulja Boy, adult film actress Kendra Lust, and actress Lindsay Lohan to endorse Tron, but these celebrities did not disclose their endorsement fees.

In the Bloomberg Businessweek interview, Sun called Gensler "essentially a tyrant," claiming that "he completely fabricated charges to attack cryptocurrency companies." He speculated that Gensler "might want to advance his career through high-profile cases," stating, "He doesn't care whether these people are good or bad, just like spraying a machine gun around." Gensler did not respond to requests for comment.

The "returns" from investing in the Trump family

Concerns about "the illegal use of cryptocurrencies and stablecoins" have spread to the highest levels of the U.S. government. In 2024, former Ohio Democratic Senator Sherrod Brown stated at a Senate hearing: "Terrorist organizations like North Korea, Russia, and Hamas are turning to cryptocurrencies because it is easier to transfer funds in the shadows." Although he did not specifically mention Tron, his remarks pointed directly at the entire industry.

The U.S. crackdown on the cryptocurrency industry has become a "threat to the survival of the industry," and there are divisions within the industry on "how to respond." Sun's friend, Binance co-founder Changpeng Zhao, agreed to travel from the UAE to the U.S. to plead guilty to criminal charges related to "the illegal use of the exchange," and Binance also paid a $4 billion fine to reach a settlement. Companies like Coinbase chose to "lobby back," with one target being Brown, as the cryptocurrency industry spent over $40 million supporting his opponent, ultimately leading to Brown's defeat in re-election.

Amid this regulatory storm, Sun left Singapore in 2024 and moved to Hong Kong. He rented a penthouse in a seaside hotel while his lawyers battled the SEC in court (Sun's lawyers stated that his living and travel choices were based on personal preferences and not legal concerns). Just weeks before the U.S. presidential election, Trump opened a new door for "those hoping to get close to the powerful."

Trump had previously been skeptical of cryptocurrencies, stating in 2021: "They could be a scam; who knows what they are?" However, the situation changed after "a small group of Bitcoin investors donated about $20 million to his campaign team." In July 2024 (four months before the presidential election), Trump delivered a speech at the Nashville Bitcoin conference, promising to "fire SEC Chairman Gensler" and "ease regulations on the cryptocurrency industry." "If Bitcoin is going to 'to the moon,' I want the U.S. to be the leader." His words received applause from the audience.

A few weeks later, Trump began promoting his own cryptocurrency. His seriousness about the project was comparable to his promotion of "trinkets" like guitars and sneakers during his campaign—in other words, not very serious. The project was named "World Liberty Financial," and Eric Trump claimed it aimed to "promote financial independence," but the specific operational details remained vague. Trump's 18-year-old son, Barron Trump, who had just entered college, was listed as the company's "Chief DeFi Visionary," despite having no experience in decentralized finance.

The driving force behind the project were two long-time internet opportunists who met Trump through "the son of a Trump golf buddy." One of them, Chase Herro, had previously marketed "weight loss colon cleanse products" and "a $149 per month get-rich-quick course," and had referred to himself as an "internet jerk" in speeches, stating in a YouTube video that "regulators should kick people like me out." The other, Zachary Folkman, had operated a service called "Date Hotter Girls." Their only known other cryptocurrency project failed after being hacked.

The terms of the project's issuance were unappealing, initially facing widespread rejection from crypto investors. Even if the project turned a profit, token holders would not receive dividends; and once the fundraising reached $30 million, 75% of the funds would go to the Trump family. Essentially, investing in World Liberty Financial was equivalent to giving money to the Trump family.

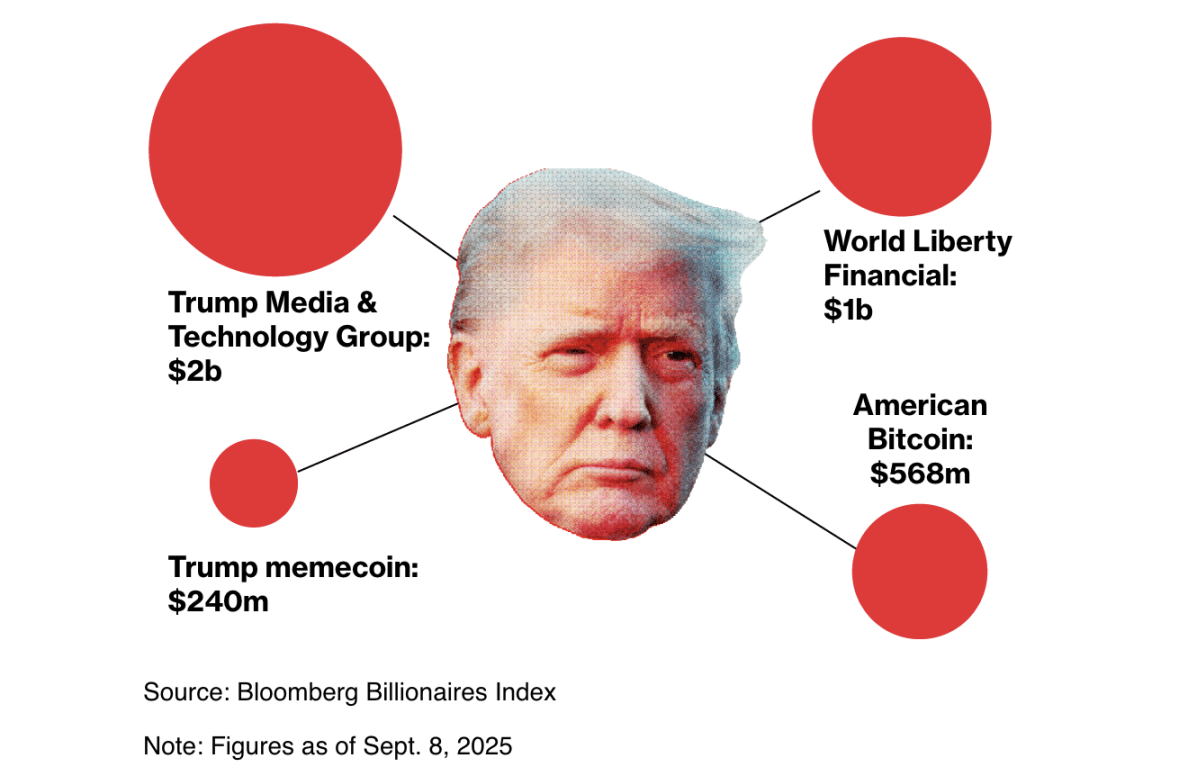

The Trump family planned to sell $300 million worth of World Liberty Financial tokens, but by mid-November 2024 (after Trump was elected president), only a few million dollars had been sold, far from the threshold needed to trigger payments to the family. At this point, Justin Sun stepped in. On November 25, he announced the purchase of $30 million in tokens for the project and was appointed as a "World Liberty Financial Advisor," later adding another $45 million investment. With his involvement, other investors began to follow suit, and ultimately the project sold all its tokens, totaling about $550 million. This meant the Trump family could potentially earn around $400 million.

Trump's cryptocurrency wealth, source: Bloomberg Billionaires Index, data as of September 8, 2025

"This gentleman (Justin Sun) saw opportunities that the vast majority of people could not see," said Folkman, co-founder of World Liberty Financial, pointing to Sun at the Hong Kong cryptocurrency conference in February 2025. "Once he made his move, everything started to snowball."

Sun claimed that he "did not seek or expect any benefits in exchange for funding," but he did have multiple opportunities to "articulate his demands." In December 2024, at the Abu Dhabi Bitcoin conference, he discussed the plans for World Liberty Financial with Trump's son Eric; he also met with Steve Witkoff—who was the golf buddy that introduced the World Liberty Financial project to Trump and had been appointed as the presidential envoy to the Middle East. Sun stated that Witkoff "had to end the meeting early due to handling a hostage situation," but the two "kept in touch to discuss U.S. crypto policy."

After Trump's inauguration, Sun and the entire cryptocurrency industry got what they wished for. In February 2025, the SEC dropped lawsuits against Coinbase and several other companies, and the attorney responsible for some of the cases was demoted to the SEC's IT department; the lawsuit against Tron was also shelved. Gensler's crypto policy advisor at the SEC, Corey Frayer, stated that the decision was puzzling because "the Tron case was one of the clearest cases he had seen during his time at the SEC."

Sun's lawyer stated that the SEC's decision "had nothing to do with this billionaire investing in a Trump family project." White House spokesperson Kelly stated in an email: "The president's actions are all about securing good deals for the American people, not for personal gain." Sun told Bloomberg Businessweek that the SEC's change in attitude made him feel satisfied: "It's fairer now, at least there's more respect. The enforcement agencies are doing much better than before."

For Tron, the more significant change was the U.S. government's complete shift in attitude towards stablecoins. Previously, senior U.S. officials viewed stablecoins as "a risk to financial stability"; however, the Trump administration saw them as "a tool for promoting the dollar globally" and also as "a business opportunity." In May 2025, Sun gifted a "tape banana" artwork to Bo Hines, the White House crypto policy advisor, who had resigned in August to join Tether. The Trump family also launched their own stablecoin, USD1, through World Liberty Financial. Sun claimed he led this initiative and stated that Tron and World Liberty Financial would join forces to challenge large banks.

"We can shape the world and completely change the financial system with World Liberty Financial," Sun stated at the Dubai conference in May 2025 (standing next to Eric Trump). "Those who do not join us will eventually be left far behind." Trump's son echoed this declaration: "If banks do not embrace cryptocurrency and seize the opportunity now, they will ultimately face extinction."

Justin Sun, World Liberty Financial co-founder Zach Witkoff, and Eric Trump attended the cryptocurrency conference in Dubai in May

In July 2025, with the support of the Trump administration, Congress passed a bill aimed at regulating stablecoins and encouraging their use. At the White House signing ceremony, several executives from the cryptocurrency industry, including Tether CEO Paolo Ardoino, were present. The president told them that stablecoins could "inject supercharged growth into the U.S. economy" and boasted that he had "solved many problems for the industry": "I helped you get out of too many predicaments."

There is currently no evidence that Trump "exchanged official interests for money or other benefits." This is the current legal definition of corruption as per the U.S. Supreme Court ruling. However, since Trump's election, those eager to please the Trump family have clearly been quick to create wealth for them. The Trump family has earned billions through at least four cryptocurrency projects while the Trump administration simultaneously relaxed regulations on the cryptocurrency industry; additionally, the Trump family reached hotel development agreements with countries negotiating tariff issues with the U.S. When explaining "why he accepted a $400 million plane gifted by the Qatari government," Trump said, "I could say 'no, no, no,' or I could say 'thank you very much.'"

On July 24, 2025, Justin Sun rang the bell at Nasdaq

In June 2025, Sun's efforts to enter the U.S. market began to pay off. Dominari Securities—a small investment bank that listed Donald Trump Jr. and Eric Trump as advisors—assisted Sun in pushing Tron onto the Nasdaq exchange through complex maneuvers. According to estimates from the Bloomberg Billionaires Index, this operation could bring Sun about $1 billion in revenue (the Trump brothers did not respond to requests for comment; Eric denied involvement in the project but acknowledged that Sun is a friend).

On July 24, Sun arrived in New York to ring the bell at the Nasdaq television studio in Times Square. He wore a suit similar to what he had worn at the Trump Meme Coin dinner. Amid a shower of confetti celebrating the opening of the day's trading, he raised his fist in salute. Afterwards, he took photos in front of the electronic screen displaying Tron advertisements, then boarded a black van to attend a meeting downtown.

Sun brought his mother (who had been a journalist in China) along, appearing particularly relaxed. He asked his assistant "which photo to post on social media" and handed the "Trump gold watch" to a Bloomberg Businessweek reporter, laughing as he discussed "how the president is promoting industry development." Soon after, he would head to West Texas to board a Blue Origin rocket for a trip to space. "I love America," Sun said, "I have never loved America this much."

But Sun quickly learned an "old lesson": the Trump family could swiftly turn against allies. In September 2025, rumors circulated online that "Justin Sun was dumping World Liberty Financial tokens," and the company promptly prohibited him from trading, freezing his "tokens worth $75 million." Sun denied the selling behavior, calling the decision "unfair and contrary to the decentralized spirit of cryptocurrency." However, due to the lack of regulation in the cryptocurrency field, he had no recourse and could only seek help on social media, promising to "invest more in the Trump family's project." "I not only invested money but also trust and support," Sun wrote, "Let's work together to advance World Liberty Financial to success." The Trump family did not respond to this.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。