The idea that non-consensus investment is where alpha lies is actually quite dangerous in the early stages, as subsequent capital tends to become increasingly consensus-driven.

a16z has become a very unique entity in the VC industry, but it has drifted somewhat away from traditional VC. Its scale has grown larger, and after raising $7.2 billion in funds last year, they plan to raise another $20 billion this year, focusing on AI.

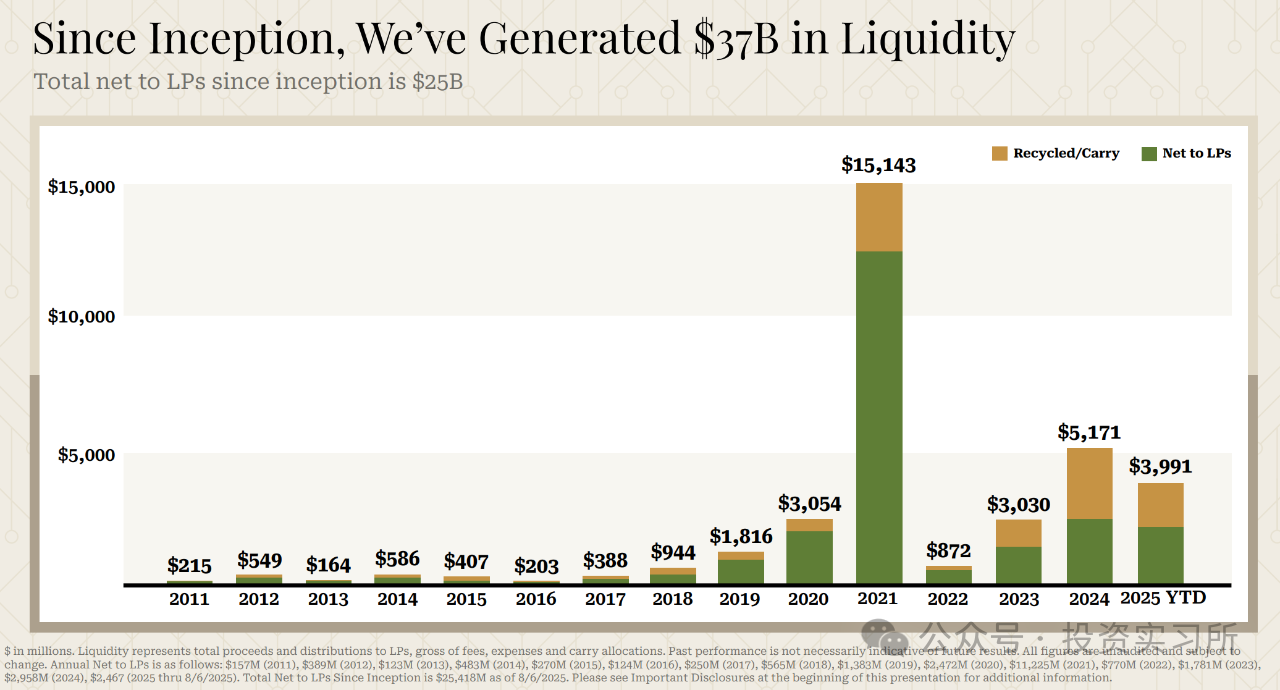

A recently leaked PPT shows that since its establishment in 2009, a16z has achieved a net return of $25 billion for LPs, with $11.2 billion in 2021 alone. 2021 was the peak of the SaaS wave, and unexpectedly, a16z became the biggest winner of that bubble.

I did a quick check, and in 2021, a16z's largest exits included:

Coinbase went public, with a16z leading the Series B round (about $20 million) at the end of 2013 and participating in several subsequent funding rounds. At the time of the IPO, the company's market value was about $85.8 billion. a16z held about 25% of Coinbase's Class A shares and about 14.8% of Class B shares, cashing out about $4.475 billion after the IPO (still holding about 7%), making a profit of over $7 billion.

Robinhood went public, with a16z participating in Robinhood's seed round financing as early as 2013 (co-investing $16 million with Ribbit and others).

Roblox went public, with a market value of about $42.6 billion at the time of the IPO. In February 2020, a16z led a $150 million Series G funding round for Roblox, holding about 5% of the shares.

Marqeta (a payment card issuing platform) went public, with a company valuation of about $15 billion at the time of the IPO. a16z participated in multiple funding rounds.

Stack Overflow was acquired by Prosus for about $1.8 billion; a16z led Stack Overflow's Series D funding round in 2015.

Affirm went public, with a market value of about $11.7 billion at the time of the IPO. a16z participated in Affirm's $100 million Series D funding round in April 2016.

A GP named Leslie Feinzaig calculated that if you add up all the fees from a16z's funds, based on industry standard terms (2% management fee and 20% carry), their management fees alone this year would reach $700 million, and it would be even more when including carry.

However, according to former TechCrunch editor Erick Schonfeld, the fee cap that a16z charges is not 2% and 20%, but rather 3% and 30%, which means their fees are significantly higher.

Leslie Feinzaig believes that these large VCs are no longer true VCs. Firstly, from a legal standpoint, firms like a16z, Sequoia, Insight, General Catalyst, Thrive Capital, and Lightspeed are not purely VCs; they are registered investment advisors (RIAs).

Secondly, their investment strategies are very different from those of true VCs. Historically, true VCs have always pursued early-stage companies with alpha potential—high risk, high return, emphasizing non-consensus contrarian investments.

But firms like a16z have completely changed their investment approach. Martin Casado, a GP partner responsible for AI at a16z, recently tweeted something that sparked a lot of discussion: large funds no longer choose contrarian investments but rather consensus investments. In early-stage investing, having the courage for "non-consensus" is not enough; one must also have the foresight to judge whether this "non-consensus" point can lead to market "consensus" in the future:

The idea that non-consensus investment is where alpha lies is actually quite dangerous in the early stages, as follow-on capital tends to become increasingly consensus-driven.

Turner Novak, founder of Banana Capital, has a very vivid metaphor, but it also reflects the current market reality: the influx of capital into leading companies has already indicated the problem.

Looking beyond large models like OpenAI or Anthropic, even AI applications like Cursor are reportedly raising a new round of financing, with a starting valuation of $20 billion, as some early investors in Cursor have already realized partial exits at a $20 billion price in the secondary market.

Leslie Feinzaig refers to giant VCs like a16z as consensus capital, characterized by:

Focusing solely on massive returns—forget about unicorns; they are pursuing trillion-dollar returns;

People believe that only one type of founder can achieve such enormous results—these can be called "consensus" founders;

For this type of founder, they are completely insensitive to price and are willing to pay high prices very early on;

These funds are very large and can invest substantial amounts in early-stage funding rounds—tens of millions or even hundreds of millions.

Consensus capital flows to founders with very unique, predictable backgrounds. They graduate from a few select schools, have worked at a few startups, or have made contributions in a few AI labs. They are easily identifiable—you can really find an AI agent before they raise funds. Leslie Feinzaig says many consensus investors do just that.

If you are one of these founders, then raising funds from consensus capital should be very easy. Different funds compete fiercely, driving up your company's price, effectively erasing alpha returns in their own portfolios.

If you are not this type of founder, it may be more difficult. However, there are still plenty of early investors pursuing alpha—true VCs, and as your business gradually takes shape, consensus capital will follow.

For ordinary developers, targeting those extremely simple needs can also yield good returns. Recently, I saw several extremely simple, seemingly unremarkable products that actually generated very good returns; some product use cases provided me with a lot of inspiration. They do not have complex algorithms or large teams, but they precisely solve…

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。