Today's ETH trend can be described as a "textbook comeback." After a strong rise from the previous low of 3822, it directly broke through the 4100 mark, causing many bearish traders to "slap their thighs" in disbelief! What exactly drove this rebound? Will ETH soar to new heights or face resistance and pull back? Let's break it down from the technical, news, and on-chain data perspectives, clearly marking the key pressure and support levels for you.

1. Technical Analysis: Rebound Signals "Flashing," These Indicators Reveal Bullish Ambitions

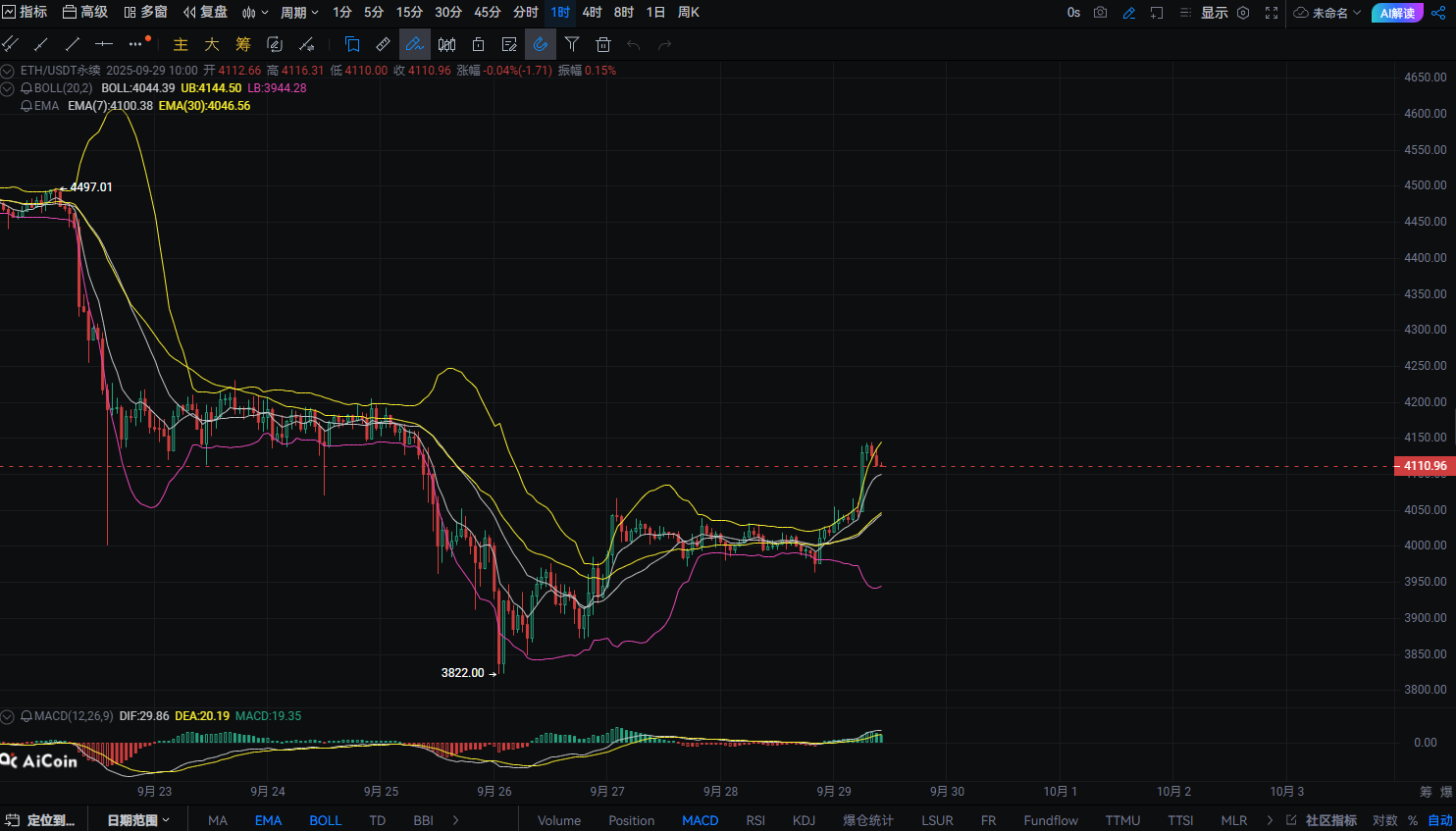

Switching to the 1-hour candlestick chart, the strong rebound of ETH is all in the details:

Bollinger Bands (BOLL): After the price "squat" near the lower band (3942.61), it directly broke through the middle band (4038.96) and is currently approaching the upper band (4135.30), showing signs of a gradually expanding opening, a typical "rebound acceleration" signal.

Moving Average System: The short-term EMA7 (4096.34) has been easily surpassed, and EMA30 (4041.99) has transformed from a "resistance level" to a "support level," with the moving averages quickly shifting from a bearish arrangement to a "bullish attack pattern."

MACD Indicator: The DIF (29.08) and DEA (17.74) have formed a golden cross, and the MACD energy bars continue to expand positively, indicating strong bullish momentum and a clear short-term upward trend.

2. Key Pressure & Support: The "Target Bullseye" and "Safety Net" for Bullish Attacks

Combining trading strategies and market signals, the nodes of the long-short game for ETH are clearly visible:

Support Levels:

The core support focuses on the 3980 - 4000 range (this is the "stop-loss zone" in the strategy, and also the key accumulation platform for the previous rebound; if it pulls back to this range, the bulls are likely to exert force again).

Resistance Levels:

The first resistance targets the 4150 - 4170 range (the "first phase target" of the short-term rebound; breaking through will open up upward space);

The second resistance closely watches the 4200 - 4220 range (an important threshold for the mid-term rebound; if effectively broken, ETH is expected to challenge higher positions).

3. News: These "Invisible Drivers" Are Igniting ETH's Market

The market surge is never "water without a source," and the "invisible drivers" in the news are crucial:

Macroeconomic Expectations Shift: The expectation of interest rate hikes by the Federal Reserve has cooled, U.S. Treasury yields have pulled back, and risk asset sentiment has been ignited, benefiting ETH as a "core asset" in the crypto market.

Intensive Ecological Benefits: The staking volume of Ethereum continues to rise, user activity on Layer 2 networks (such as Arbitrum and Base) has surged, and the locked value in DeFi protocols is warming up, all sending signals to the market that "the ETH ecosystem is still vibrant."

Institutional Movements: The application process for ETH ETFs is steadily advancing, adjustments in ETH holdings by institutions like Grayscale, and the "quiet layout" of traditional financial giants in crypto assets are all providing "long-term support" for ETH's rebound.

4. On-Chain Data: Peering into ETH's "Capital Bottom Line"

To predict whether ETH can maintain its strength, on-chain data serves as a "truth mirror":

Staking Volume Dimension: In Ethereum's staking contracts, the staking volume is still slowly increasing, indicating that long-term investors have sufficient "locking confidence" in ETH, with low selling pressure risk.

Exchange Flow Dimension: Recently, there has been a clear trend of "net outflow" of ETH from centralized exchanges, with chips concentrating from short-term traders to long-term holders, which is a typical "bullish signal" (capital is more willing to hold rather than sell in the short term).

Gas Fee Dimension: Ethereum's gas fees remain in a relatively "comfortable range," neither surging due to excessive congestion nor dropping to freezing points due to a lack of ecosystem activity, indicating that the "activity level" of DeFi, NFTs, and other ecological applications is "moderate," providing stable support for ETH demand.

Want to Accurately Time ETH's Ups and Downs? Don't Miss This Public Account!

ETH's short-term rebound momentum is strong, but key resistance levels are just ahead. Will it break through in one go or consolidate? If you want to get the "precise buy and sell points" for ETH, "exclusive interpretations" of news, and "real-time tracking" of on-chain data, quickly search for and follow the public account "Mu Zhou Talks Coins"! Here, we will continuously analyze opportunities in the crypto market, helping you seize profit rhythms amid volatility!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。