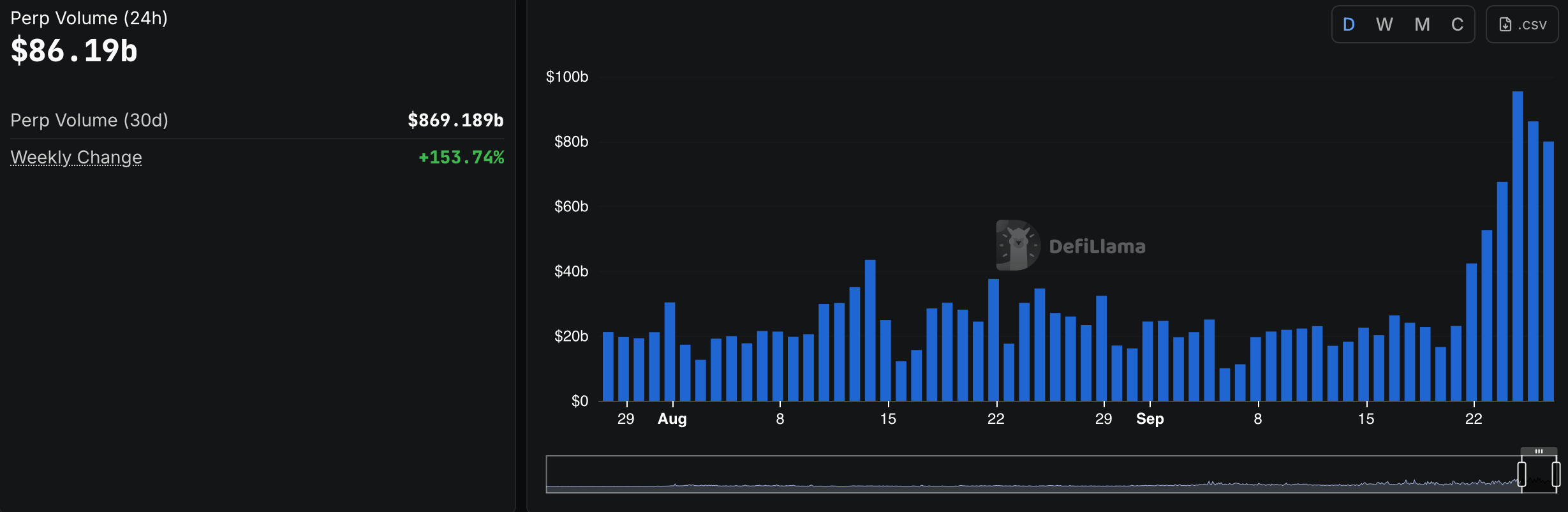

Perp DEXs are the current obsession, and two DEX contenders in particular have been hogging the spotlight in crypto’s nonstop drama. Over the past 30 days, defillama.com shows perp desks racked up a hefty $869.189 billion in action — but the real kicker came this week, with volume rocketing 153.74%.

A perpetuals decentralized exchange (perp DEX) is basically Wall Street without the closing bell—traders swap perpetual contracts, which are derivatives with no expiration date, all powered by smart contracts on blockchains. Aster, Orderly, and Aden run a hybrid setup, pushing order matching and trade math off-chain for speed but sealing the deal onchain for trust.

Perp volume according to defillama.com metrics.

Settlement for all three stays fully onchain, ensuring transparency and security. Unlike the buttoned-up world of centralized exchanges (CEXs), perp DEXs don’t play nanny with your assets—you call the shots, cut out the middleman, and trade peer-to-peer (P2P) with trust stitched straight into the code.

Since Sept. 20, when $16.59 billion zipped through 168 protocols, perp trading has been on a steady climb. The following day saw $23.10 billion, and each day has increased since then up until Sept. 25, when perp DEX volume hit $95.437 billion. Metrics tallied on Sept. 27 clock in at $86.19 billion, keeping the perp DEX frenzy rolling.

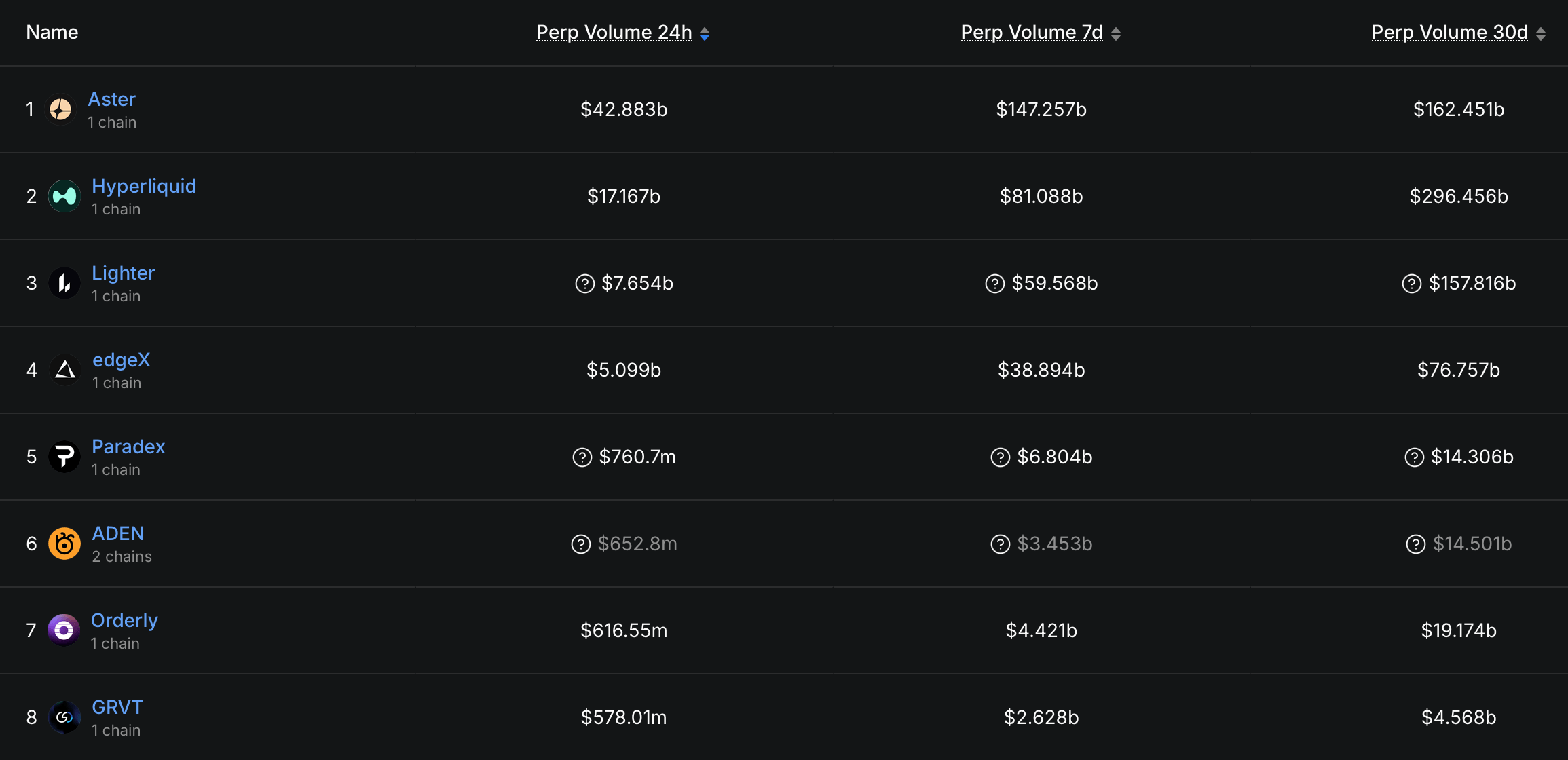

The heavyweight chart-toppers: the top eight perp DEX brawlers ranked by volume over the past day, week, and full 30-day slugfest from Aug. 27 to Sept. 27, 2025, according to defillama.com stats.

Aster and Hyperliquid are dominating the pack as Aster is now the leading perp DEX in terms of volume over the last seven days and 24 hours. Aster strutted in on Saturday with $42.883 billion, while Hyperliquid pocketed $17.167 billion—together flexing 69.67% of the day’s action. Stretch that out over seven days, and it’s the same power duo.

Aster stacked $147.257 billion, and Hyperliquid bagged $81.088 billion this week, leaving the rest of the pack fighting for scraps. But zoom out to the 30-day view and the grip loosens—Aster and Hyperliquid together only commanded 52.80% of the $869.189 billion flowing through perp DEXs. Aster hauled in $162.451 billion during that span, while Hyperliquid snatched a beefier $296.456 billion.

Beyond the Aster-Hyperliquid show, the supporting cast of perp DEXs has been busy stacking their own chips. Between Aug. 27 and Sept. 27, Lighter lit things up with $157.816 billion, while EdgeX hustled $76.757 billion. Pardex notched $14.306 billion, Aden came close with $14.501 billion, and Orderly kept things tidy at $19.174 billion. GRVT, meanwhile, squeezed out around $4.568 billion.

Perp DEXs have turned into crypto’s main event, with billions flying across screens faster than traders can sip their coffee. Several of these platforms may be hogging headlines, but the wider cast isn’t exactly slacking. With onchain settlement, hybrid speed hacks, and traders firmly in control, the perp DEX craze shows no signs of cooling—only who’s ruling.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。