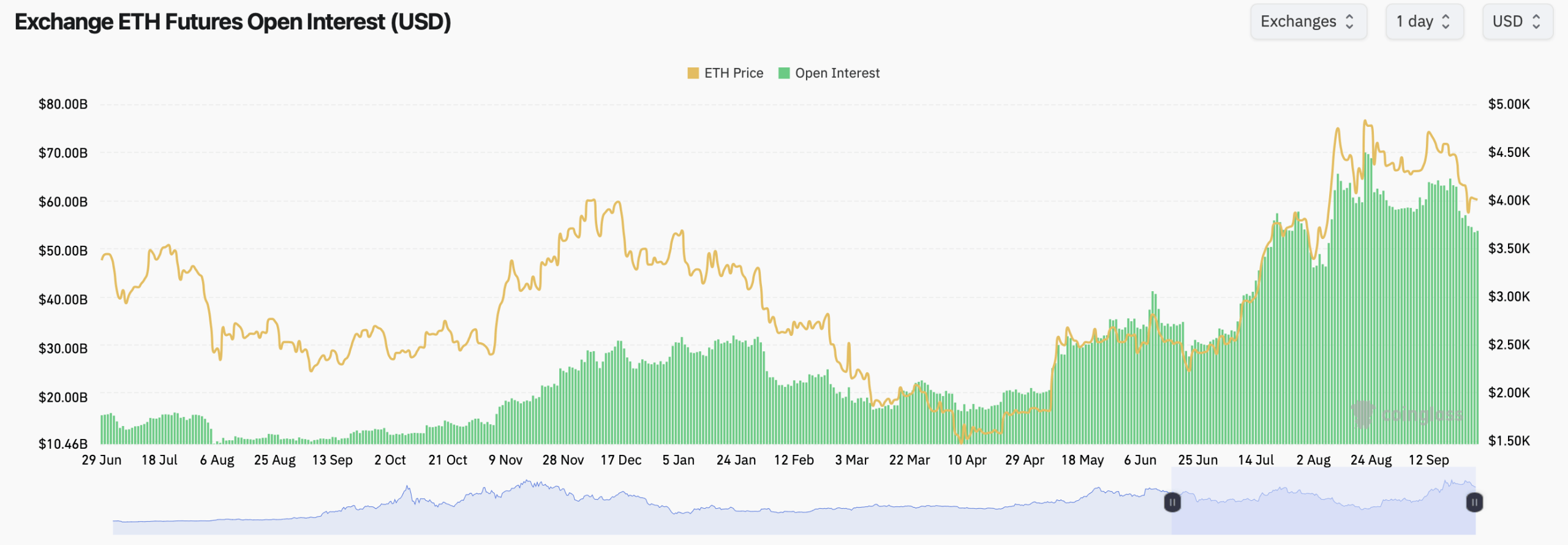

Futures positioning stayed lively. Coinglass figures show exchange ether open interest (OI) elevated versus early summer, peaking in August and easing into late September, even as price cooled from the recent push above $4,500 back toward the low $4,000s and below that range.

Futures exchange leaderboards are crowded ahead of the upcoming week. CME shows 2.19 million ETH in open interest (~$8.76 billion), Binance lists 2.65 million ETH (~$10.62 billion), and OKX carries about 820,500 ETH (~$3.29 billion). Bybit sits near 1.21 million ETH, Bitget at 1.46 million, Gate around 1.20 million, MEXC at 538,000, WhiteBIT 484,000, BingX 202,000, and Kucoin 111,000.

Intraday flows have been mixed. One-hour OI ticks were green across most venues, yet 24-hour changes showed red at CME, Binance, OKX, Kucoin, WhiteBIT, BingX, and MEXC, while Bybit, Gate, and Bitget notched small positives. Ratios of OI to 24-hour volume skewed high at WhiteBIT and Bitget and lean at OKX and BingX.

ETH options traders have also kept the board quite busy. This weekend, data shows that calls hold 63.49% of open interest, equal to 1,645,409 ETH, while puts make up 36.51%, or 946,368 ETH. But the last day’s tape favored protection: puts took 62.11% of volume, versus 37.89% for calls, roughly 87,280 ETH to 53,241 ETH.

Most bets are aimed at year-end. On Deribit, traders hold the most call options (bets on higher prices) for late December: the $6,000 strike has about 92,738 ETH in open interest, followed by $4,000 (76,104 ETH), $7,000 (60,682 ETH), and $5,000 (55,058 ETH). There are also solid stacks at $3,000 and $2,000.

Today’s heaviest trading leaned protective. Bybit saw big volume in puts (downside hedges): the Oct. 17 $2,000 put traded about 29,019 ETH, and the March 27, 2026 $500 put traded about 10,967 ETH. On the upside, Deribit’s Oct. 31 $6,000 call moved ~3,502 ETH, while OKX’s Sept. 29 $4,100 call and Binance’s Sept. 29 $3,750 put are also active.

“Max pain” — the price where the most options expire worthless — sits near $4,000 in the near term. It dips toward roughly $2,500 around the Mar. 27, 2026 expiry, then bends back toward $4,000 into late June and early fall 2026, suggesting traders are hedging for some choppy, range-bound action.

Put simply, leverage prefers higher strikes by December while flows hedge the belly. That mix hints at range-respect near $4,000 with fatter tails both ways as macro and exchange-traded fund (ETF) headlines rotate through the calendar.

With ethereum parked around $4,014, futures and options together say patience pays. Bulls have the open-interest stack, bears have the fresh volume, and both sides have plenty of exits marked around $4,000. Volatility sellers may lean in if rallies fade into resistance soon.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。