The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome everyone's attention and likes, and refuse any market smoke screens!

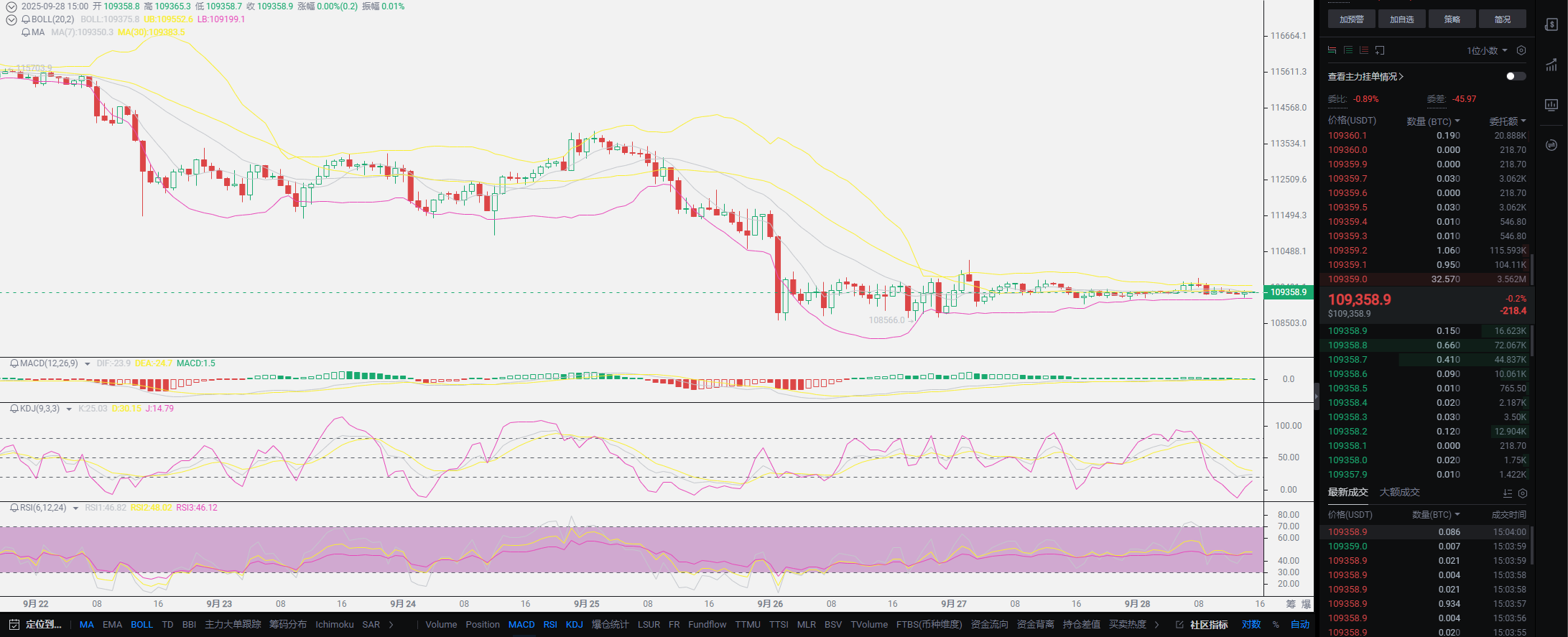

It has been a long time since I have analyzed the short-term trends in detail. Most of the time, I have only provided an answer. Today, I will discuss it in detail with you. A wave of decline has left both spot and contract users in a state of panic, and a large number of users do not understand Lao Cui's approach. Clearly choosing to be bearish in the short term, yet not taking any measures to salvage the situation, the answer to this question is very straightforward and helpless, because Lao Cui himself cannot predict the arrival of the turning point. The heavy positions are almost all in SOL and OKB, with Ethereum only being an earlier position. Among these three coins, none have fallen below the entry value, so for Lao Cui, maintaining the status quo is the best choice. We cannot only have confidence in these coins when we are making profits; a decline is when our faith is tested. This is also Lao Cui's own thinking; there is no need for too much operation, after all, spot trading is more about the recognition of value. Of course, even with the same choices in investment, there can be different results. Many friends have chosen to exit, which is not a major mistake, and even compared to recent trends, it is a wise choice.

For users who choose to exit, the remaining operation is just a test of whether you still have the courage to continue entering the market? The probability of interest rate cuts in October has reached over 87%. This round of interest rate cuts is different from the expectations in September; this year's interest rate cut basis is already above 75 basis points. The continuous interest rate cuts in October basically meet the expectation of 50 basis points in September. Therefore, the market's activation is likely to occur around the interest rate cuts in October, or even at the beginning of October, as this will attract the funds that flowed out earlier back into the crypto market. As long as there is a return of funds, returning to the peak period should not be a problem, but Bitcoin is no longer worth your investment choice. The current Bitcoin is only suitable for contract users' operations; a large amount of invested capital will not bring you significant returns. Even if it breaks through the historical high and reaches a price of 150,000, it is not as valuable as SOL breaking through the high of 300. Of course, Bitcoin is still the most stable coin, suitable for everyone to try contracts.

I also remind everyone that the year 2026 may not necessarily continue the bull market trend; it is more likely to stabilize. If your judgment of a bull market is based on the occurrence of a doubling situation, then Lao Cui can say frankly that there is no possibility of doubling in 2026. The growth trend will continue, but the growth space of mainstream coins will be extremely limited. Even during the interest rate cut cycle, it will only drive a few hundred billion in capital inflow, not reaching a trillion scale. Therefore, the problems currently facing the crypto market are also very obvious: how to use a few hundred billion in funds to make the crypto market more competitive? You can also intuitively feel that the coins hitting new highs every month will be different; this is the problem caused by the shortage of funds, and the impact can only be chosen by individual coins. Although, in the short term, platform tokens like OKB and BNB have played a leading role in attracting funds, it does not conceal the overall downward trend of the crypto market. The outstanding performance of a very few coins can only be viewed as indicators.

The upward trend of these very few coins can be seen as a wind vane. Taking BNB as an example, as long as there is no large-scale escape phenomenon from these leading coins, the overall crypto market will not have the possibility of turning from bull to bear. These particularly strong coins can be used as a reference; the premise is that you cannot look for worthless coins as a reference. They must have their value system in the crypto market. For example, newly launched coins do not have the ability to be referenced. Even in a bear market, the listing of small coins will mainly see exponential growth due to the need for capital intervention. These coins are purely held by issuers with a large number of chips; even if they grow a hundred times, the returns for them are greater than the costs. BNB belongs to the category that has its own value system, not only supported by the Binance platform but also possessing a listing license and borrowing channels for various issued coins. The entire coin's value is generated by the establishment of the system, which can represent the investment attributes of the crypto market. As long as BNB does not collapse, the overall downward depth of the coins will not be too deep.

The most intuitive feeling is the overall market value. The peak market value of the entire crypto market reached around 4 trillion, and it still maintains a quota of over 3 trillion at this stage. However, Bitcoin itself has not experienced a large-scale escape, which further indicates that it seems to be brewing a big market trend. After saying all this, I want to report to you that during this wave of decline, Lao Cui himself did not choose to short; I am still holding spot positions, and the contracts are also in a loss state. The only supporting belief is the certainty that future growth will exceed previous values. There is no need for everyone to speculate too much about Lao Cui's actions; after all, Lao Cui is not on the issuer's side. Lao Cui, like you, hopes to seize opportunities in a difficult situation and seek a glimmer of hope. There is no contradiction between the article being bearish and personal actions being bullish. Regarding this trend, Lao Cui explained it to you on Tuesday. Perhaps it was not so detailed on the original platform, and I am doing a retrospective now.

In previous predictions, Bitcoin was hovering around 110,000 down to 2,000 points, Ethereum was at 3,800, and there was a certain deviation in the prediction for SOL, which was estimated at 195, but the actual price reached 190. OKB was around 180 plus or minus 20 points. Overall, there was no deviation. The impact of small coins' deviations is not too significant. Even with such predictions, there was no shorting phenomenon, and overall returns are still maintaining a positive state. As long as there are no losses, Lao Cui will not adjust positions. Of course, this decline, in Lao Cui's eyes, is an opportunity for those who have not yet entered the market. If you still have interested users in hand, you can try to make your first position or add to your position. If there are users with losses, try to use contracts to recover some losses; do not hold on stubbornly. For spot users, still base your earnings on the market from November to December, and do not engage in meaningless operations. For contracts, do not over-leverage; at this stage, contract users can only base their earnings on daily fluctuations, and remember not to hold positions overnight.

Original content by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trend, not focusing on individual pieces or positions, aiming for the final victory. The novice, on the other hand, fights for every inch of ground, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trade at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。