Crypto mining firm TeraWulf (WULF) is planning to raise $3 billion in debt to expand its data center operations in a deal supported by Google, as the AI infrastructure arms race intensifies.

The company, Bloomberg reports citing TeraWulf CEO Patrick Fleury, is working with Morgan Stanley to arrange the funding, which could launch as early as next month through high-yield bonds or leveraged loans.

Credit rating agencies are evaluating the deal, and Google’s support may help it secure a stronger credit rating than would be typical for the firm.

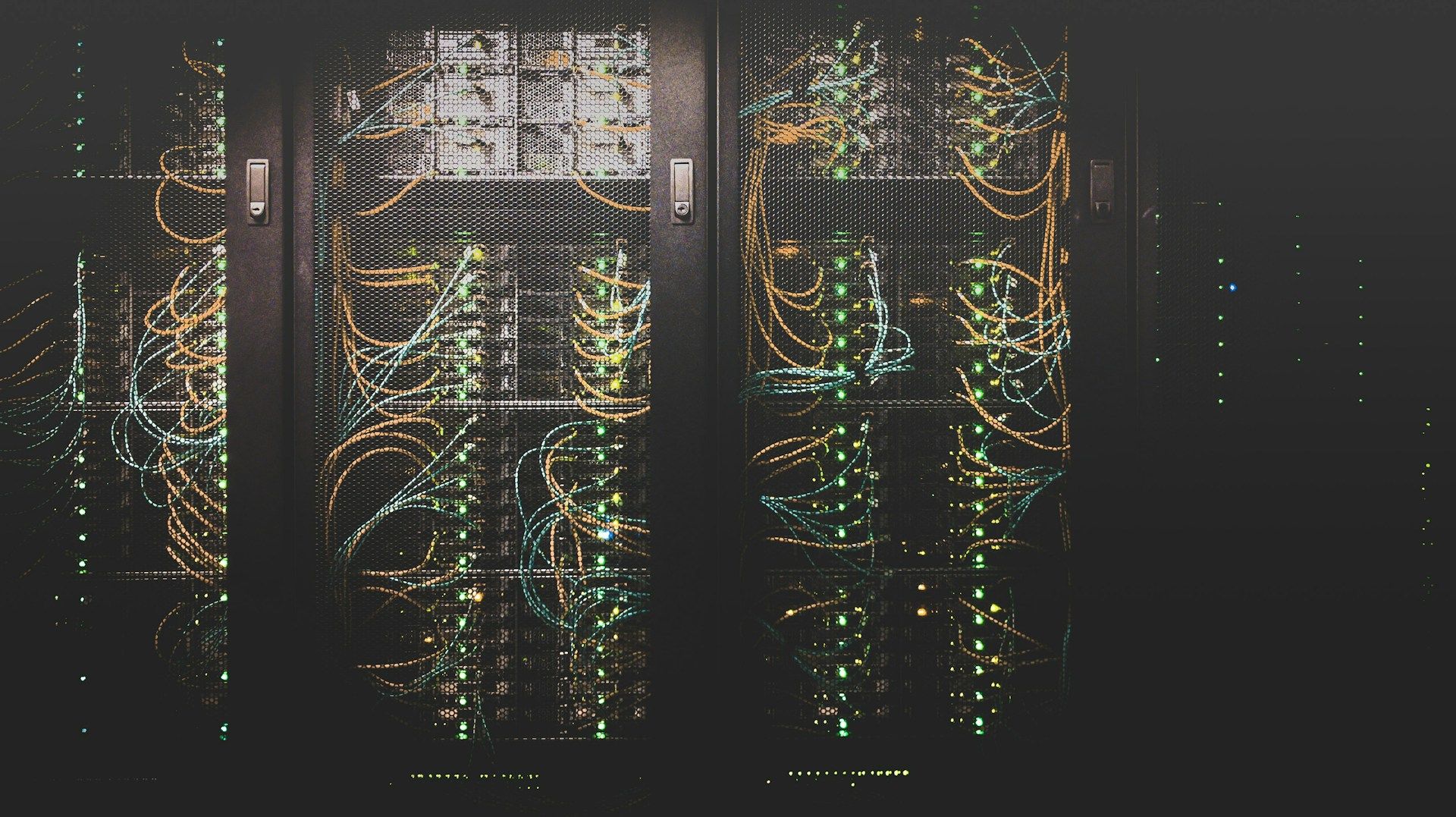

The AI industry’s hunger for data center space, chips, and electricity has attracted crypto miners unlikely partners, which already control power-intensive infrastructure that can be repurposed for AI workloads.

Google, which recently increased its backstop for TeraWulf to $3.2 billion, now holds a 14% stake in the company. That support helped AI cloud platform Fluidstack expand its use of a TeraWulf-run data center in New York in August.

Other crypto-native firms are following suit. Cipher Mining struck a similar agreement with Google and Fluidstack this week. Google will also backstop $1.4 billion in obligations tied to that deal and take an equity stake in Cipher.

TeraWulf shares dropped around 1.3% in Friday’s trading session and were unchanged in after-hours trading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。