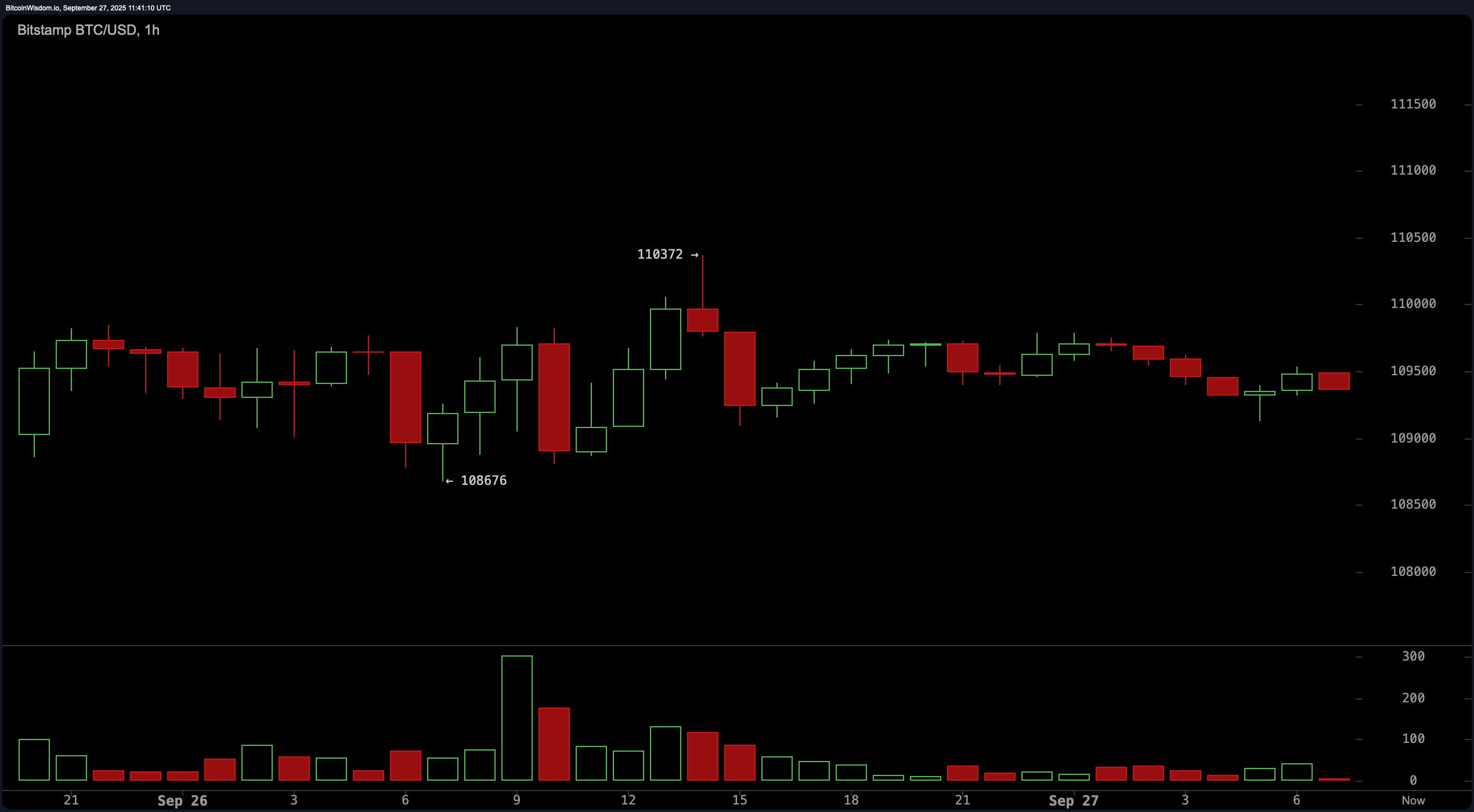

The 1-hour bitcoin chart paints a hesitant picture, with bitcoin crawling upward from its $108,676 low in what can only be described as a half-hearted micro uptrend. Despite this limp attempt at bullish recovery, the price continues to get rejected near $110,000, forming lower highs—a classic signal of weakening bullish momentum.

Volume, meanwhile, is quietly tiptoeing downward, hinting that bulls may be losing steam faster than a bargain-bin altcoin. Intraday, the strategy leans toward caution: a breakout above $110,400 with a confirmed retest as support might justify a long position, while failure to hold $109,200 opens the door for a quick short toward $108,700.

BTC/USD 1-hour chart via Bitstamp on Sept. 27, 2025.

On the 4-hour bitcoin chart, consolidation is the name of the game following a steep fall from $115,822 to $108,652. Price action is coiling within a narrow channel between $108,500 and $110,000, and while a green volume bar in the midst of a downtrend could suggest buyer absorption, there’s little follow-through to back it up. The trend is stuck in limbo, with a clear breakout above $110,500 required to tip the bias bullish. Conversely, dropping below $108,500 likely means a revisit to the $107,000 support zone—and no, that’s not a level you want to test without a helmet.

BTC/USD 4-hour chart via Bitstamp on Sept. 27, 2025.

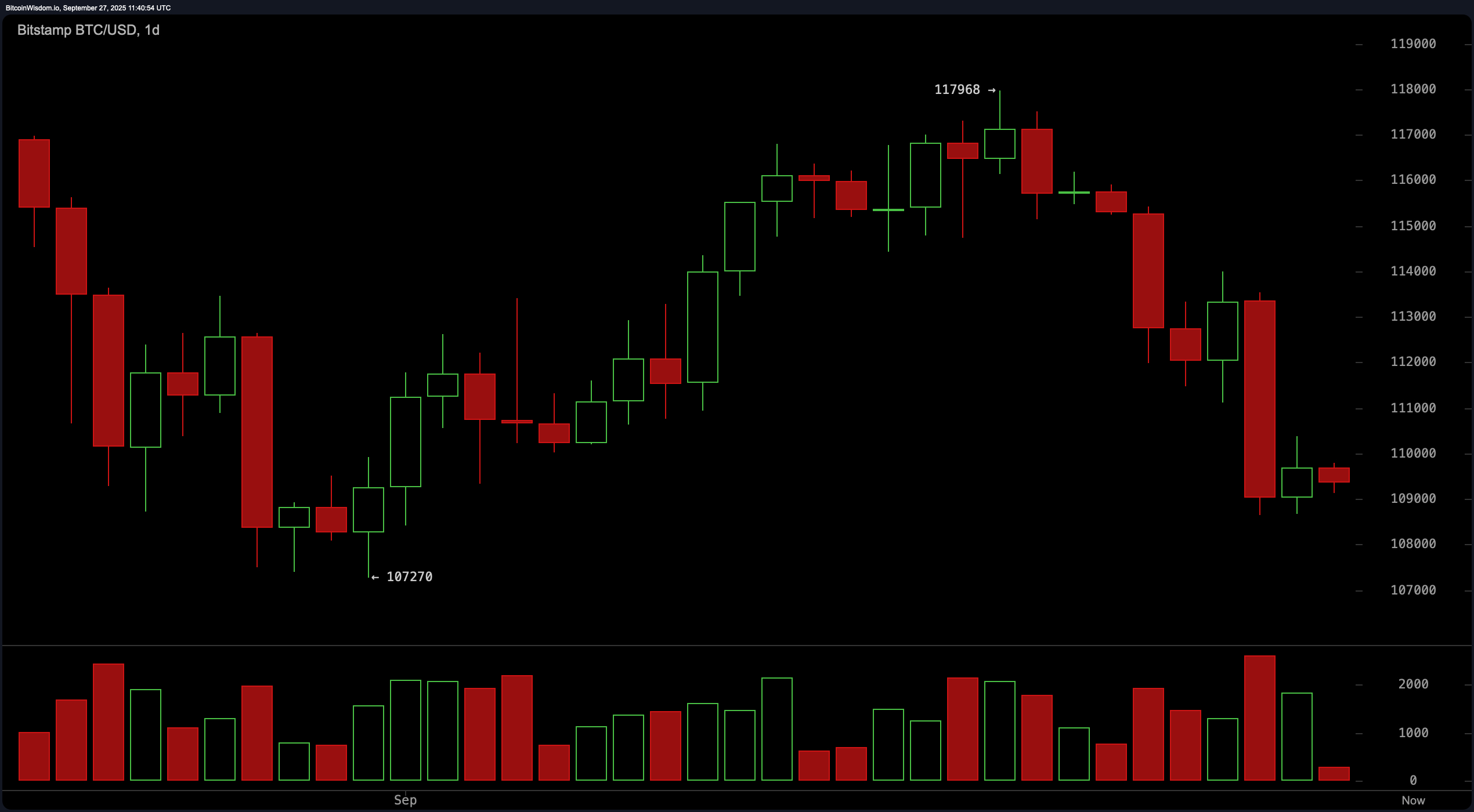

The daily bitcoin chart delivers the most sobering outlook: bitcoin recently broke down after a rejection from its $117,968 peak, slipping into a bearish structure of lower highs and lower lows. Red volume bars surged during the sell-off, suggesting liquidation panic rather than casual profit-taking. Short-term support appears to be gelling around the $108,000–$109,000 region, but until a bullish reversal pattern emerges—preferably a bullish engulfing candle on high volume near $107,270—this market remains under bear control.

BTC/USD 1-day chart via Bitstamp on Sept. 27, 2025.

A glance at the oscillators delivers mixed signals that only further complicate the landscape. The relative strength index (RSI) stands at 38, showing neutral momentum, while the Stochastic oscillator is barely hanging in at 8—also neutral, but dangerously close to oversold territory. The commodity channel index (CCI) at -144 and the momentum reading of -7,114 flash bullish signals, suggesting a possible reversal is brewing. Yet, the moving average convergence divergence (MACD) level at -773 delivers a solid bearish signal, throwing a wet towel on any premature optimism. And let’s be honest, the MACD doesn’t usually bluff.

Moving averages (MAs) are singing a chorus of “not just yet.” The exponential moving averages (EMA) and simple moving averages (SMA) across the 10, 20, 30, 50, and 100-period intervals are all screaming bearish. Only the 200-period EMA and SMA offer a whisper of hope with a bullish signal, hinting that long-term structure might still be intact. But in the short to medium term, the trend is about as friendly as a parking ticket on payday.

In summary, bitcoin’s technical profile on Saturday, Sept. 27, 2025, is a cautious tale of bullish dreams deferred. While support levels are holding (for now), momentum is lacking, and volume remains suspect. Any bullish bets should be measured, closely tied to confirmed breakouts and supported by volume, not hope. And as always in crypto—never trust a breakout without a second look.

Bull Verdict:

A bullish reversal is not off the table, but it’s walking on thin ice. If bitcoin can reclaim $110,500 with conviction—meaning strong volume and confirmation candles—there’s a shot at retesting $113,000 or higher. Support near $107,270 is showing signs of resilience, and buy signals from the commodity channel index (CCI) and momentum indicators hint at potential upside if buyers step up.

Bear Verdict:

The dominant trend remains bearish across most timeframes, with price action forming lower highs and lower lows, weak volume, and nearly all key moving averages flashing sell signals. Failure to hold above $109,200 could lead to another leg down, targeting the $107,000 support region—or worse. Until volume confirms otherwise, the bears still have the keys to the kingdom.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。