On September 25, the market's attention was drawn to the launch of the Plasma native token XPL, which surged to $1.6 shortly after opening. In addition to those who participated in the presale, early depositors also received a significant amount of airdrop rewards. Coupled with airdrop activities from major trading platforms, even the Binance Alpha airdrop allowed users to claim about $220 worth of $XPL, making it a bright opportunity for many.

Almost immediately after its launch, Plasma initiated a large-scale liquidity incentive program lasting 7 days, until October 2, covering mainstream protocols including Aave, Euler, Fluid, Curve, and Veda. Users can deposit stablecoins into these protocols or hold related tokens to earn XPL rewards.

If you missed the deposits, the presale, and the on-chain arbitrage opportunities, you cannot miss the chance to take advantage of the rewards. Rhythm BlockBeats has compiled five mainstream mining pools, some of which have an APR exceeding 35%.

Preparation Before Mining

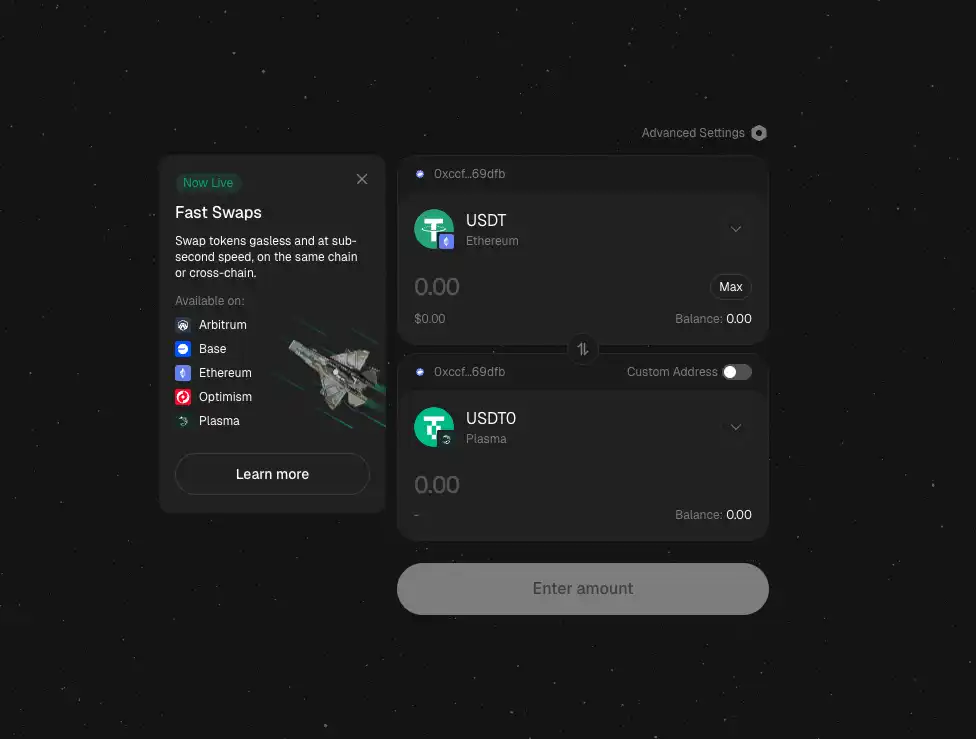

Before mining begins, asset preparation is required. Some protocols require cross-chain transfer of mainnet USDT to Plasma via Stargate to obtain an equivalent amount of USDT0; a small amount of XPL is also needed as transaction gas fees (most EVM chains are compatible).

Plasma's current activities are primarily in collaboration with Merkl. Users can log into Merkl Dashboard at any time to track their rewards. The Merkl platform automatically calculates rewards based on the user's deposit size and duration, and users only need to manually claim them periodically.

Which Pools Are Good for Mining?

==========

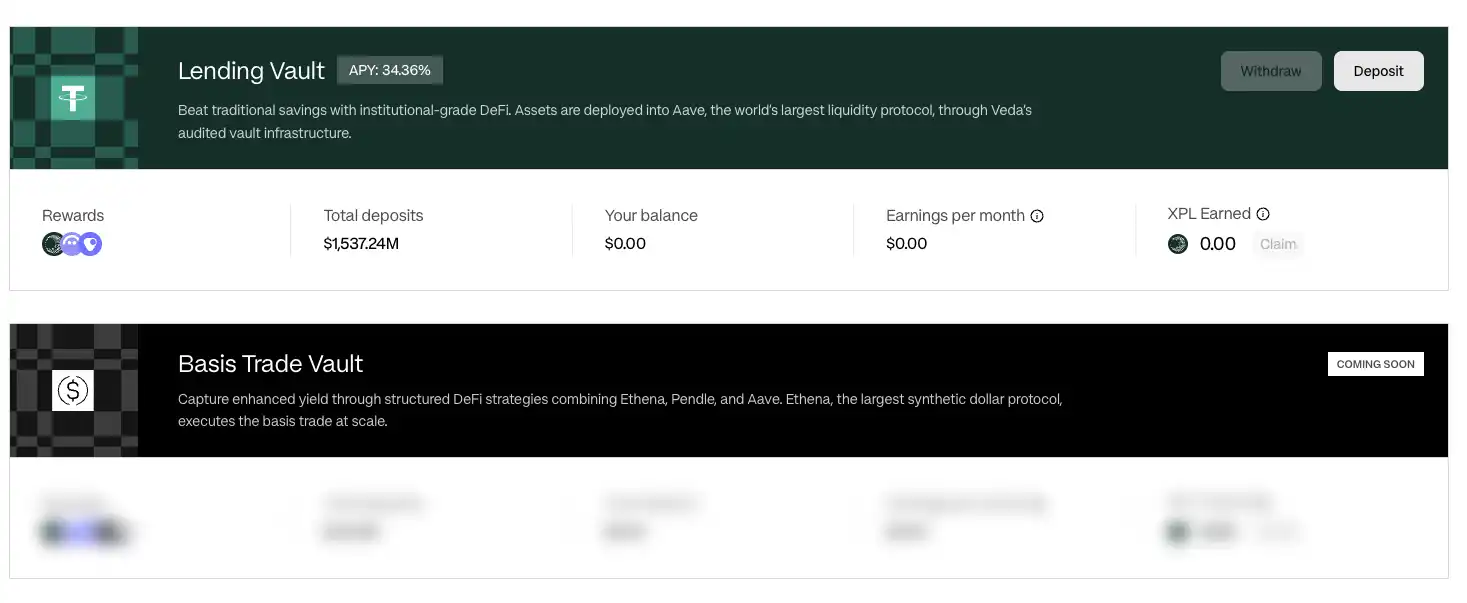

PlasmaUSD Vault

This activity is initiated by Plasma, where the PlasmaUSD Vault under the Veda protocol distributes WXPL in the form of token mining. Currently, only the Lending Vault is open, with the Basis Trade Vault expected to open in the future.

The operation is quite simple; just click Deposit to put in USDT0/USDT. By holding shares of this Vault, users can earn WXPL rewards whether on the mainnet or Plasma chain, which can be claimed every 8 hours. However, USDT0 borrowed has a 48-hour withdrawal cooldown.

The current annualized yield is approximately 34.36%, with daily rewards reaching up to $1.4 million. It is worth noting that the main prize pool of $1 million will only last for 3 days, ending on September 29, and it is unclear whether the official will continue the incentives afterward.

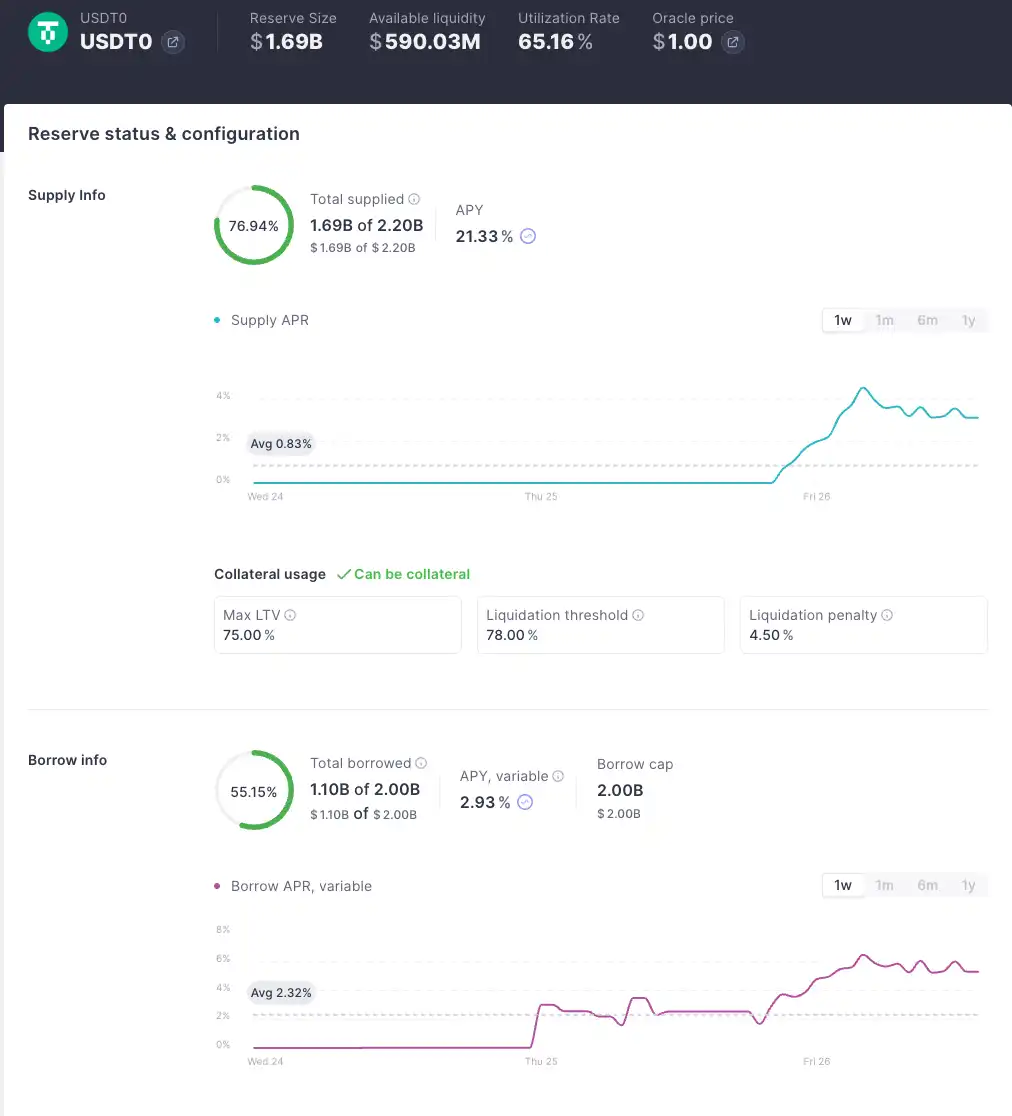

Aave USDT0

Similar to Plasma's lending Vault, depositing USDT0 on Aave also allows users to earn WXPL rewards. Currently, $1.7 billion has been deposited in the protocol, with an annualized yield of about 21.33% (the protocol's APY is approximately 3.19%, and WXPL's APY is 18.15%), with daily rewards amounting to about $700,000 worth of XPL.

Compared to Plasma, its advantage is that users can withdraw at any time, but they need to provide USDT0 without holding any USDT0 or USDe debt, meaning they cannot perform circular loans to enhance utilization.

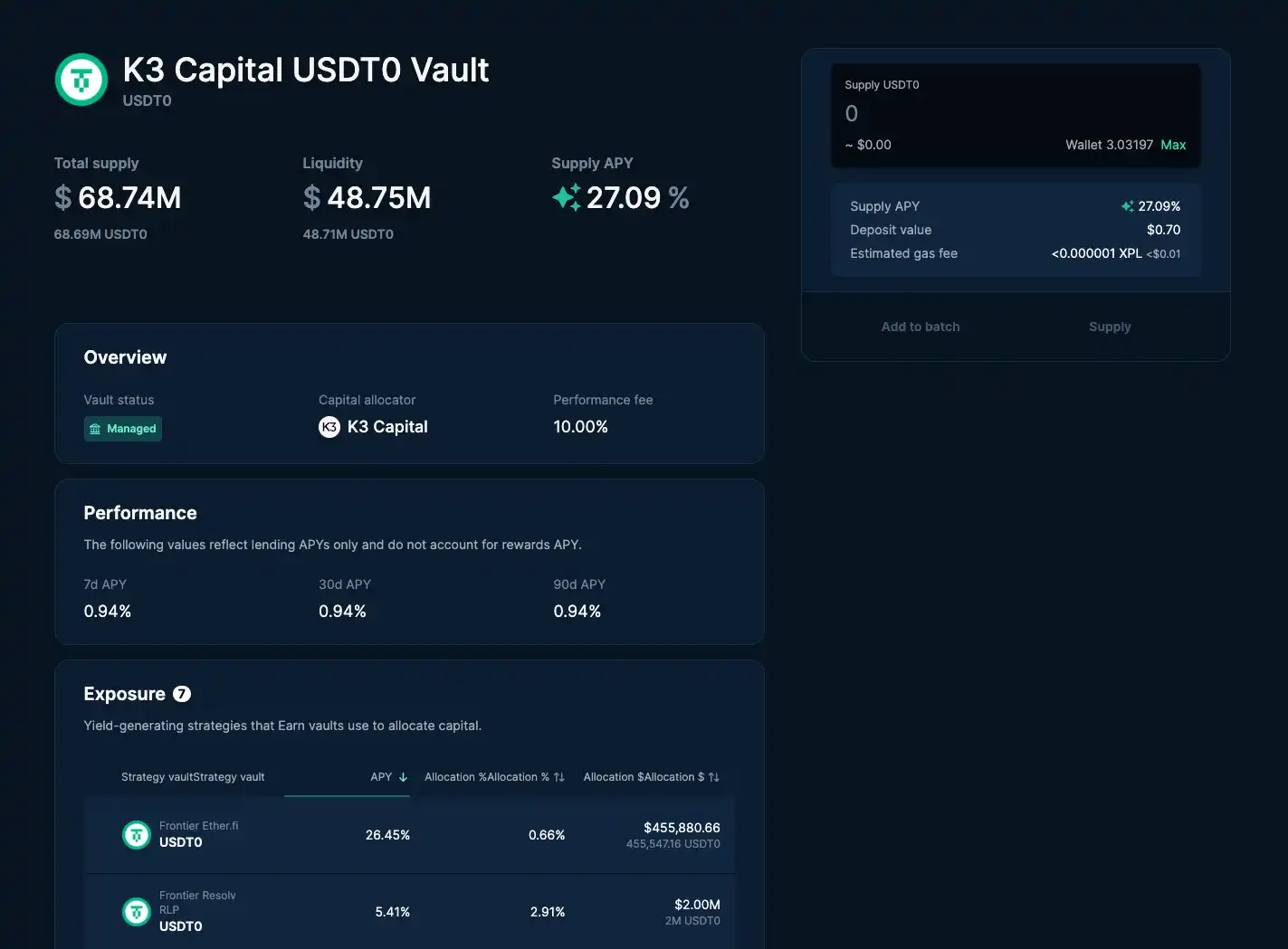

Euler K3 Capital USDT0 Vault

In Plasma's Euler protocol, the USDT0 Vault managed by K3 Capital currently has an annualized yield of about 27%, with daily incentive distribution of approximately $55,000 worth of WXPL.

Users only need to deposit USDT0 on the Plasma mainnet into this Vault to start mining.

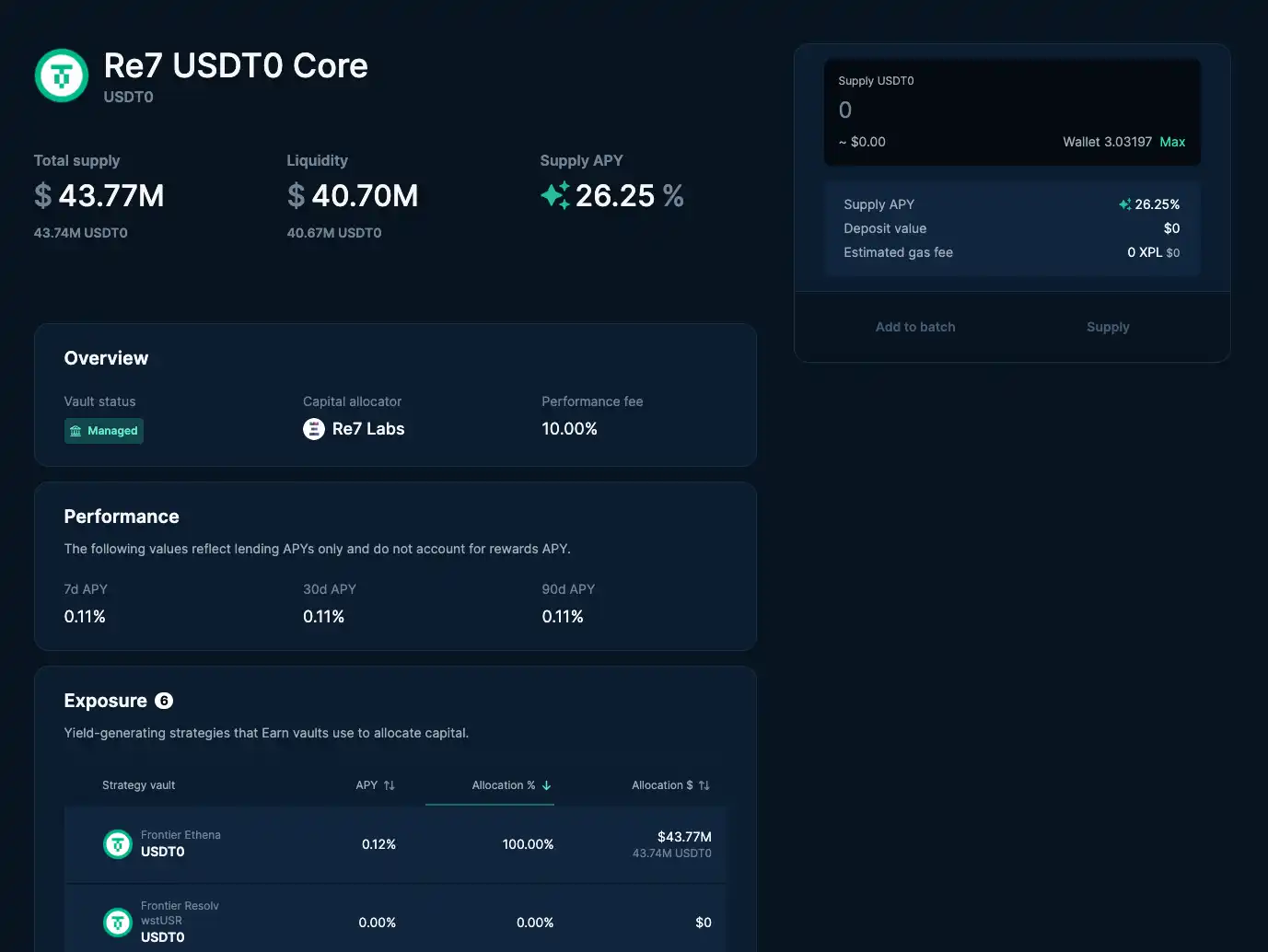

Euler Re7 Core USDT0 Vault

Also under the Euler protocol, the Re7 Core USDT0 Vault adopts a lossless flexible lending model, allowing users to participate by depositing USDT0 into this Vault. The current annualized yield is about 30.43%, with daily rewards of approximately $35,000 worth of XPL. Although Euler's pool has a relatively low TVL, the yield and reward levels are still considerable, making it suitable for retail investors to diversify their allocations.

Fluid fUSDT0 Vault

The Fluid protocol's fUSDT0 Vault offers rewards for users depositing USDT0, USDe, and ETH into the lending Vault, as well as rewards for borrowing USDT0 using USDai and USDTO as collateral, meaning users can first collateralize USDai and USDT0 to borrow USDT0, achieving an annualized yield of about 24%.

Then, using USDT0 to provide liquidity to the lending pool, the current annualized yield is about 25%.

It is worth noting that most of the APR for borrowing USDT0 activities is provided by Plasma's activities. Currently, the actual borrowing interest rate is around 3%, and if borrowing demand rises, the interest rate may quickly increase, squeezing your net returns.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。