It's better to be straightforward, here are a few reasons to participate in @yieldbasis:

First, this is the first project launched in collaboration between @legiondotcc and the established exchange @krakenfx.

Second, Yield Basis is the "second venture" of Curve founder Michael Egorov.

Initial Offering Schedule (Important):

Presale - September 29 at Legion

Public Sale - October 1 at Legion and Kraken

Let's continue to dig deeper.

1/ Background

Legion

Legion is incubated by Delphi Labs and has completed a $5 million seed round financing:

Led by VanEck and Brevan Howard

Participated by Kraken, Coinbase Ventures, GSR, and others

Lead investor VanEck, as a major asset management giant, currently manages approximately $135.9 billion in assets and is one of the main issuers of Bitcoin ETFs; the other lead investor, Brevan Howard Digital, is the digital asset division of Brevan Howard, one of Europe's largest hedge funds.

Kraken

As an established exchange founded in 2021, Kraken currently ranks 7th in global trading volume and serves over 11 million users.

In recent months, Kraken has been very active. First, it acquired the retail futures trading platform NinjaTrader for $1.5 billion, and then it acquired the proprietary trading firm Breakout. There are rumors that it is preparing for a future IPO.

Kraken urgently needs benchmark projects to prove its strength and attract more users.

Michael Egorov

Founder of Curve, a DeFi pioneer

Inventor of ve token economics, influencing the entire DeFi ecosystem.

2/ Vision

YieldBasis aims to tackle the most troublesome issue in DeFi: impermanent loss.

Simply put, previously if you wanted to earn yield on Bitcoin, you could only choose:

Either hold it purely and wait for appreciation

Or take the risk of liquidity mining, facing impermanent loss

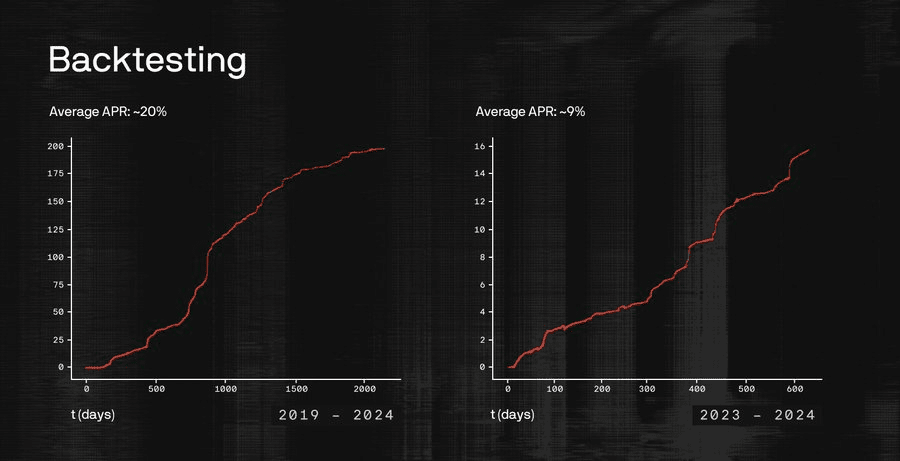

Now there is a third option: earn real yield through volatility mining while eliminating impermanent loss.

The operational mechanism of YieldBasis is as follows:

Utilizes Curve's crypto pools, applying 2x compound leverage to liquidity positions

Automatically rebalances to a 50% loan-to-value ratio, ensuring Bitcoin deposits match borrowed stablecoins

More importantly, this mechanism is not only applicable to Bitcoin but can be expanded to any major asset in the future.

YieldBasis also has an innovation - the YB governance token.

Traditional DeFi projects attract liquidity by distributing governance tokens for free, resulting in tokens being ruthlessly sold to zero.

In YieldBasis, each liquidity provider must choose:

Receive BTC earnings from transaction fees

Or forgo transaction fees in exchange for YB token emissions

This gives each YB token intrinsic value - acquiring each YB token has an indirect cost. Even better, users can lock YB to obtain veYB, sharing the BTC-valued fees generated by the protocol proportionally.

3/ Conclusion

If YieldBasis succeeds, it will unlock billions of dollars of idle Bitcoin, shifting from passive storage to active yield generation. This is not only an advancement in DeFi but also a significant upgrade for the Bitcoin ecosystem.

Of course, I must say in the end: DYOR (Do Your Own Research)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。