In the context of a rate-cutting cycle and insufficient market liquidity, Binance Alpha continues to showcase a "one-sided market": some unfamiliar small projects can often achieve several times their increase in a short period.

This article attempts to dissect the market-making logic of Alpha assets + perpetual contracts from the perspective of market makers, helping you understand the core gameplay of "dancing with the whales."

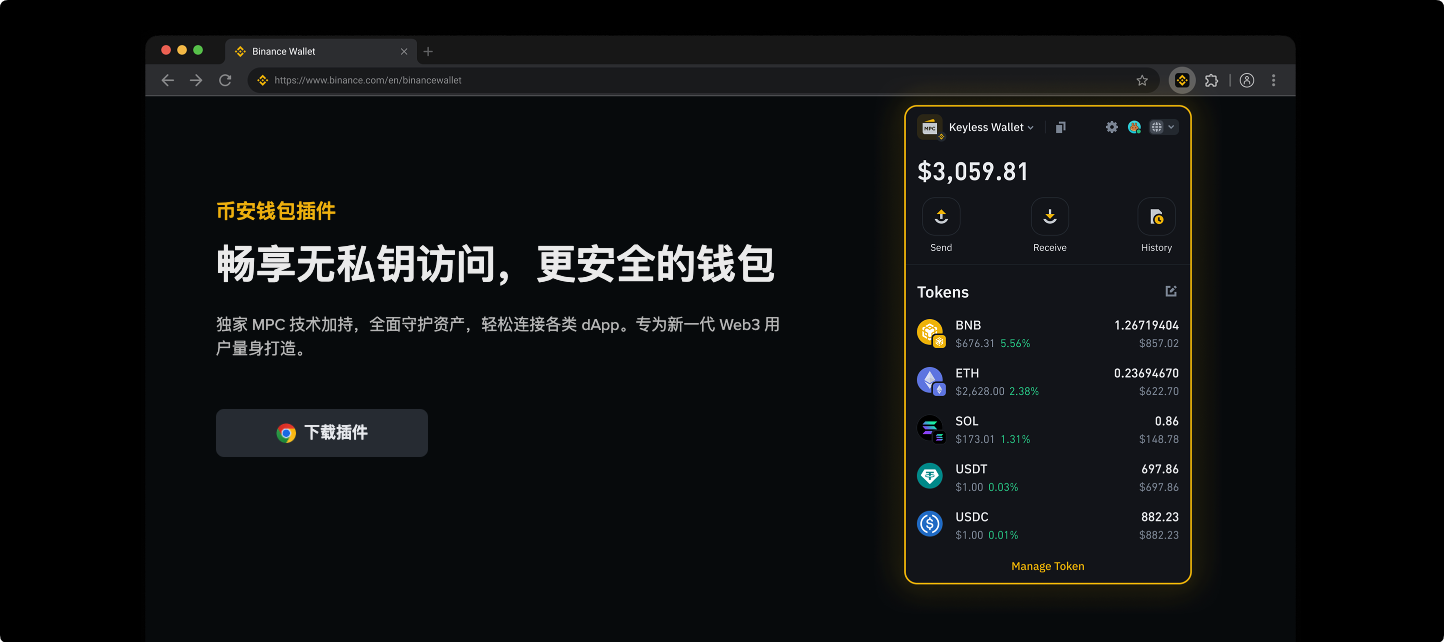

【AiCoin Exclusive Benefits】 As long as you complete a single transaction of ≥ $50 on the Binance wallet (web version) from September 19 to October 03, you will receive an additional 5 Binance Alpha points! Each person can only receive this extra point once.

👉 Exclusive link: https://web3.binance.com/referral?ref=SEPRFR9Q

Role Positioning of Alpha Assets

Binance Alpha acts as a natural liquidity pool. On the launch day, attention and retail traffic are concentrated and released, and native Alpha users will also participate in trading, with some selling off and others buying in.

- From the perspective of the project party/market makers: a cost of 1–2% in chips has already been incurred;

- The project party incurs additional costs to open perpetual contracts;

- The probability of abandonment decreases.

Thus, the "Alpha On-chain Bull Market" emerges. The spot market struggles to distribute, and market makers need to leverage perpetual contracts to continuously raise token prices, turning trading into a "gambling table." The logic of current projects has shifted from the past "narrative-driven" approach to a completely capital-driven one: whoever has thicker chips can pull off a stronger market; as long as there are enough gamblers entering the market, market makers can continuously create volatility and profit from it.

Core Logic:

- Alpha assets provide users and attention base;

- Perpetual contracts provide token and traffic amplifiers.

Market-Making Logic on Launch Day

- Alpha assets go live: accumulation + position building;

- Perpetual contracts go live: price increase + distribution.

Example: Alpha assets launch at 8:00 UTC, Prep starts at 10:30 UTC. The 2.5-hour window is the market makers' acquisition period.

- Most proactive market makers operate with a scale of $3–5 million, with almost "unlimited bullets" on the spot side.

Perp Phase Trading Techniques

- The key to perpetual contracts is not just hedging but creating attention and participation. Market makers push up the token while coordinating with: KOL promotions;

- Listings / positive PR;

- Creating market hotspots.

Funding rates become an important reference:

For example, from 9/12 to 9/15: tokens continuously increased, and funding rates soared.

- Peak: 0.3–0.4% / 4h (annualized 270–360%);

- Average: 0.1–0.2% / 4h (annualized 90–180%).

Market Maker Strategy: Spot acquisition + contract short hedging, profiting from funding rate arbitrage, forming stable cash flow.

Selling and Profit

On 9/16, tokens were at a high, with severe long position accumulation. Price: 0.058 → 0.035, a drop of about 40%;

Cost range: 0.015–0.02;

Average selling price: 0.045–0.05;

Single transaction profit margin: 150–200%.

(On-chain pool earnings are not included, and different market maker strategies may vary slightly.)

Key Points of Dancing with Whales

Projects with early control and community FUD are more worthy of attention;

Alpha assets + perpetual contracts launching on the same day provide more liquidity;

Deduce the profit logic of the whales to understand their mindset;

Pay attention to Pancake V3 pricing at the opening of Alpha assets to avoid initial overvaluation and wait for a pullback.

The ecological flywheel of Binance Alpha: Alpha assets provide traffic and launch base; perpetual contracts amplify depth and volatility. As long as the cycle can be maintained, the Alpha bull market can continue.

【Limited-Time Benefits】 Start your Web3 earning journey and first get a "Savings Buff"!

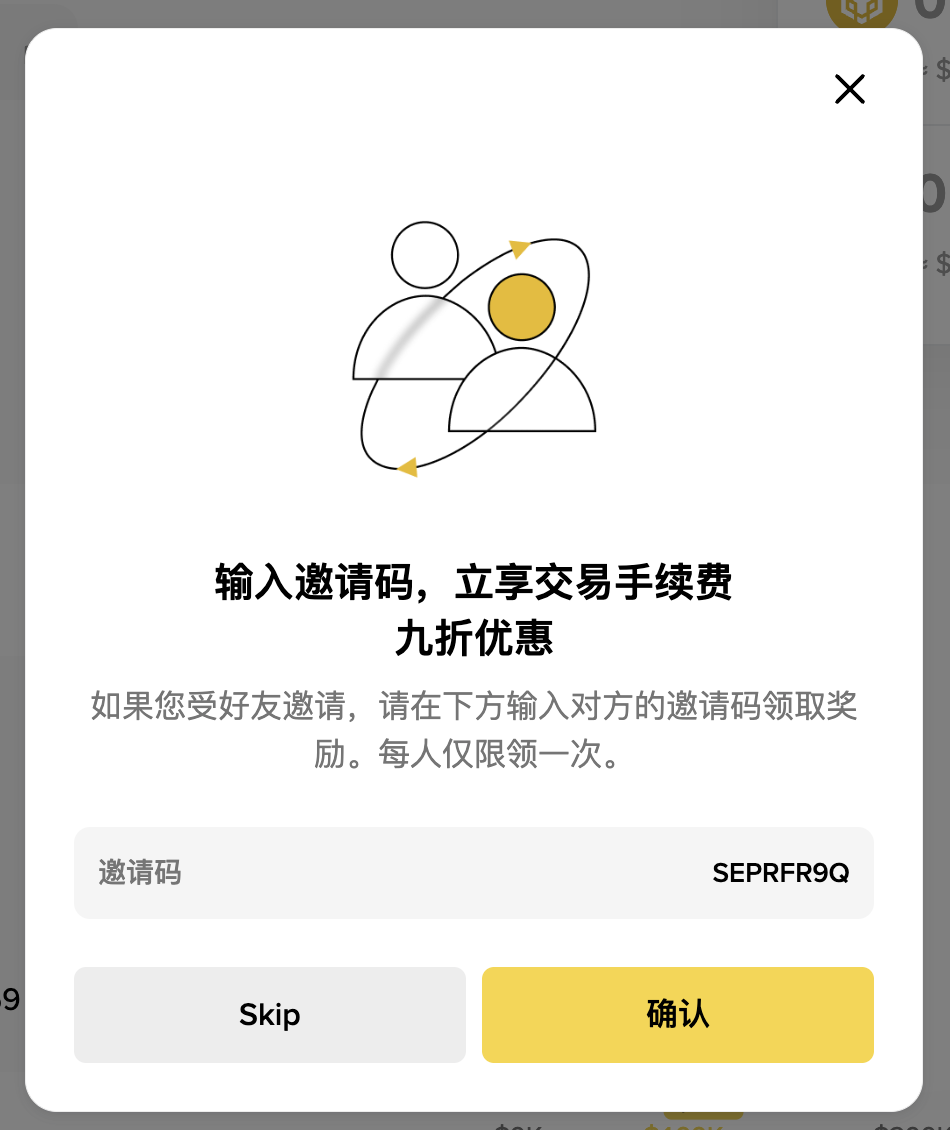

By binding the invitation code SEPRFR9Q through the exclusive link below, you will receive:

✅ 10% permanent fee rebate! This means that for every transaction you make on DEX, you can save 10% on fees compared to others. Over time, this is a significant wealth!

✅ Qualification to join our VIP benefits group! The group will periodically share wealth codes, airdrop tutorials, and whale movement analysis to keep you ahead.

📌 Investing in Binance DEX is very simple:

🟢 Click the exclusive link:

https://web3.binance.com/referral?ref=SEPRFR9Q

(Invitation code auto-filled)

🟢 Simple operation with the wallet: When completing creation or import, confirm the invitation code is SEPRFR9Q

🟢 Effective immediately: After binding, you can enjoy exclusive benefits such as fee rebates and VIP community qualifications!

Join our community, let's discuss and become stronger together!

Official Telegram community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

Binance benefits group: https://aicoin.com/link/chat?cid=7JmRjnl3w

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。