Written by: Yueqi Yang

Translated by: Block unicorn

Introduction

In the past four months, cryptocurrency has swept through the traditional financial system, penetrating deeper into banks and stock markets than ever before. These dizzying changes have created billions of dollars in profits for the industry while also bringing more risks for investors and regulators.

The changes have come so quickly that it is hard to keep up. We review the past few months to help readers understand the four major trends driving the cryptocurrency boom. We will also tell you what to watch for in the remaining months of this year. Will stablecoins thrive or collapse? Will there be more cryptocurrency trading on the stock market? Will stocks be traded on cryptocurrency exchanges? Can the good times continue?

The biggest factor driving these four trends is President Donald Trump's support for cryptocurrency. He transformed regulators from opponents of cryptocurrency into friends and pushed Congress to pass the first cryptocurrency legislation in history.

The result has been an explosive growth in cryptocurrency products, trading, and strategies. This shift has resonated strongly in the stock market, banking, and fintech industries. Here’s what has specifically happened.

Stablecoin Legislation

Event Review: In July of this year, President Trump signed legislation regarding stablecoins. Stablecoins are blockchain-based currencies used as cash in the cryptocurrency market. They are the category of cryptocurrency most closely linked to the mainstream financial system. These tokens are pegged to the US dollar on a one-to-one basis, maintaining their price by holding liquid assets such as cash and short-term government bonds. They are similar to money market funds but typically do not pay interest to investors. Today, cryptocurrency traders primarily use stablecoins to store funds on the blockchain as collateral or for international payments.

Importance: The new law legalizes stablecoins and is expected to promote their use. This has caught the attention of banks, fintech, and payment companies, which are exploring whether stablecoins can make transactions faster and cheaper than traditional wire transfers. In emerging markets, individuals and businesses are already using dollar-backed stablecoins to hedge against inflation, cope with local currency fluctuations, and receive remittances from family members working abroad.

The new rules may increase demand for government bonds that back stablecoins. The increased use of stablecoins may reduce the deposits investors keep in banks, potentially decreasing the funds available for banks to lend.

What’s Next: In the coming months, regulators will negotiate the details of stablecoin regulation amid intense lobbying from the cryptocurrency and financial industries. One point of contention is whether cryptocurrency platforms can pay yields to investors holding stablecoins. Banking industry groups oppose this, claiming it threatens bank deposits, while cryptocurrency groups support it, stating that it is necessary to offer competitive products.

Another cryptocurrency bill called the "Clarity Act" will be submitted to Congress, which will establish a regulatory framework for cryptocurrency and may impact stablecoin rules.

Surge of New Stablecoins

Event Review: Until recently, there were only two major stablecoins: Tether's USDT, with a circulation of $171 billion, and Circle's USDC, valued at $74 billion. Now, more stablecoins have emerged, with others in development. Startups, banks, and fintech companies are rushing to launch their own dollar-backed stablecoins or integrate with existing stablecoins.

Payment giant Stripe has announced it will launch a blockchain called Tempo, focusing on transactions involving stablecoins in areas such as payroll and remittances. Banks like BNY and Morgan Stanley are offering asset management services for stablecoin-backed assets, while JPMorgan provides deposit tokens representing users' bank deposits on the blockchain.

Stablecoins are primarily issued by cryptocurrency exchanges, giving them the power to choose winners and losers. Recently, the burgeoning startup crypto exchange Hyperliquid has stirred the industry by launching a bidding process that allows users to vote on stablecoin issuers. This has also sparked a race to the bottom, potentially erasing profits for stablecoin providers.

Importance: The widespread acceptance of stablecoins means these tokens can be used for payments to merchants and suppliers, fund management for multinational companies, and interbank settlements. Small lenders like Cross River Bank are considering accepting stablecoins directly from their fintech clients.

The surge in stablecoins increases the risk of cryptocurrency volatility spilling over into the traditional financial system. If one stablecoin collapses, it could lead to a loss of confidence among investors and a sell-off of other stablecoins. This could result in a sell-off of US government bonds that support the market and the US economy.

What’s Next: Tether and Circle are facing pressure from new competitors to maintain their market dominance. Tether is launching a US token that complies with new stablecoin legislation. The details of stablecoin rules and the terms of cooperation between platforms and issuers will determine whether the industry remains profitable or shifts to a commoditized business where only the largest companies profit.

Cryptocurrency IPOs

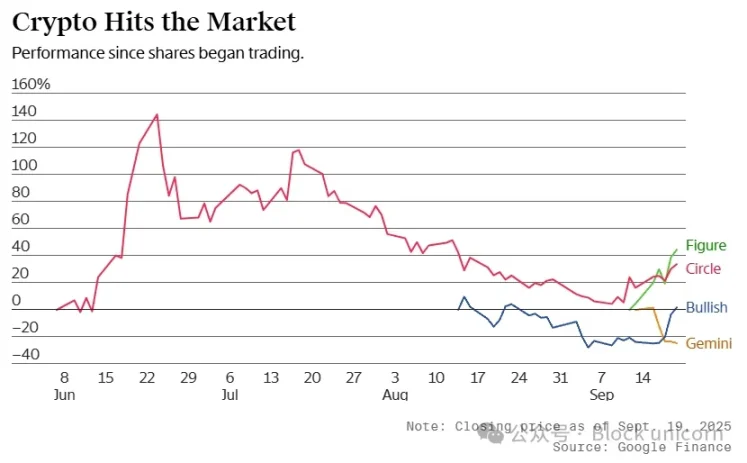

Event Review: Cryptocurrency companies are going public and achieving significant gains. Stablecoin issuer Circle, blockchain lending institution Figure, and cryptocurrency platforms Gemini and Bullish all saw substantial increases on their first day of trading.

Lawyers say part of the reason is that the US Securities and Exchange Commission, under Trump's leadership, has taken a friendly stance toward cryptocurrency, now giving the green light to cryptocurrency companies seeking IPOs.

Importance: The enthusiasm of the public market for these companies has even surprised insiders in the cryptocurrency industry. Circle's stock price soared 358% from its IPO price in June. Even smaller, unprofitable exchanges like Gemini saw their stock prices rise, although the company's stock has since fallen below its IPO price.

Many of these companies are essentially betting on cryptocurrency trading volumes, which are highly volatile, transferring some of the industry's risks to the stock exchanges. Less than three years ago, the collapse of cryptocurrency exchange FTX seemed to have been forgotten by investors.

What’s Next: More IPOs are on the horizon. Cryptocurrency exchanges Kraken and OKX, custody firm BitGo, and asset management company Grayscale are preparing to go public, with some expected as early as this year.

While IPOs will bring crypto companies to the stock exchanges, the next goal for the cryptocurrency industry is to have stocks traded on cryptocurrency exchanges. They aim to put stocks on the blockchain through crypto tokens that represent investments in companies like Tesla, Nvidia, and Circle. Companies like Robinhood, Kraken, and Galaxy Digital are working to promote the adoption of tokenized stocks, especially among overseas cryptocurrency users who may not have access to the US market.

Stocks Flooding into Cryptocurrency

Event Review: The most astonishing development is the fusion of meme stocks with speculative cryptocurrencies. This began with Strategy (formerly Microstrategy), a publicly traded software manufacturer that bought $75 billion worth of Bitcoin, positioning itself as a cryptocurrency proxy in the stock market.

This strategy has spread to small stocks, which are competing to become vehicles for various tokens, including Ethereum, Solana, Dogecoin, and the Trump family's World Liberty token.

According to data from cryptocurrency consulting firm Architect Partners, over 130 US-listed companies have announced plans to raise more than $137 billion to purchase cryptocurrencies this year.

Importance: This means more cryptocurrency-related stock issuances, many of which are set up through complex private financing deals. These stocks often rise at the start of trading, allowing holders of crypto tokens to sell them at high prices to stock market investors.

This is not good news for investors. Among the 35 such stocks tracked by Architect, their average return since announcing cryptocurrency purchase plans has been -2.9%. On the first trading day after the announcement, these stocks fell by 20.6%.

What’s Next: Many of these crypto stocks, especially Strategy, have market capitalizations far exceeding the value of the cryptocurrencies they hold, primarily due to investors chasing the meme coin craze. Investor demand allows these companies to efficiently raise funds and purchase more cryptocurrencies.

The market capitalization of these companies relative to the value of their held cryptocurrencies is beginning to decline. This makes it difficult for them to raise funds and may force them to stop purchasing cryptocurrencies. The factors driving stock prices up may begin to reverse.

Meanwhile, Nasdaq is tightening its scrutiny of these issuances, in some cases requiring shareholder approval.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。