After the Federal Reserve announced a rate cut, the crypto market did not experience the expected continuous rise; instead, it saw severe fluctuations on September 22, with a single-day liquidation amount reaching as high as $1.7 billion, setting a record for the largest liquidation since December 2024, with ETH liquidations nearing $500 million. However, amidst the market's despair, Tom Lee, a prominent figure who frequently supported ETH during this bull market, continued to express bullish sentiments on social media, even setting a long-term price target of $60,000 and claiming that it would not fall below key levels of $4,300 and $4,000 in the short term, only to see those levels subsequently breached.

On September 24, Andrew Kang, founder of the crypto venture capital firm Mechanism Capital, spoke out against Lee, bluntly stating that Lee's theories about ETH were "like a fool" and presented five major points to refute them, stirring quite a ripple in the industry.

Andrew Kang's Counterattack

1. The Popularization of Stablecoins and RWAs Will Not Bring the Expected Returns

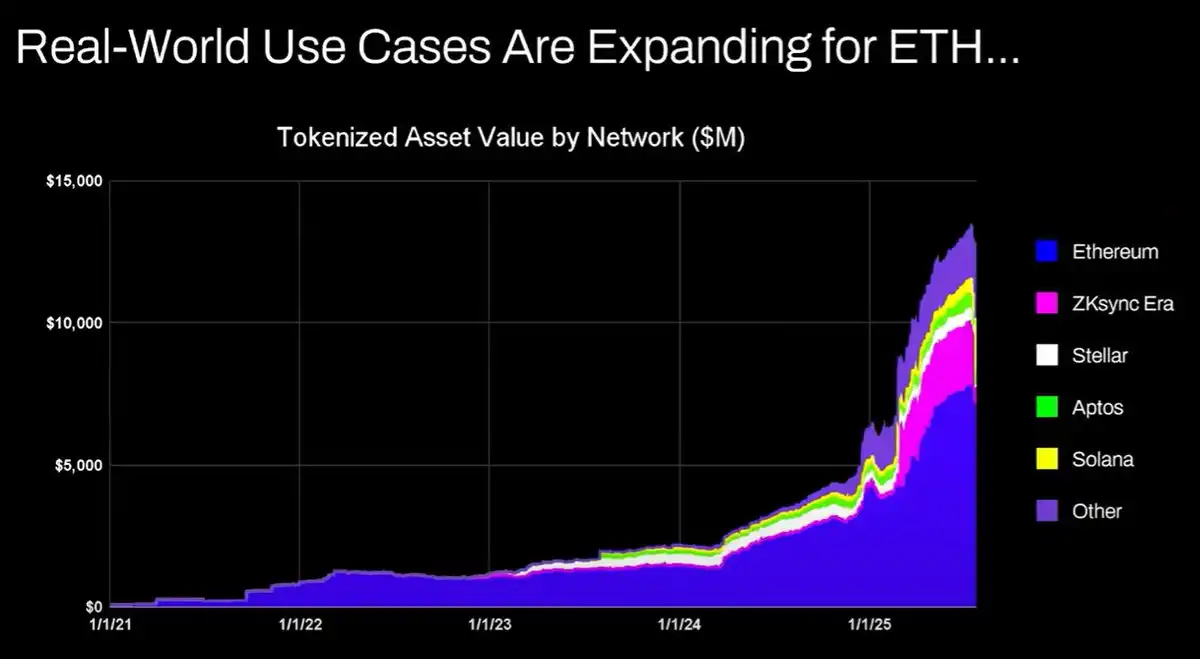

One of Tom Lee's core arguments is that with the continuous growth of stablecoins and tokenized assets (RWAs), Ethereum, as the underlying settlement layer, will benefit from increased trading volume, leading to more fee income, thus giving ETH long-term upward potential.

This logic sounds reasonable at first glance, but a little investigation reveals the opposite. Despite the trading volume of stablecoins and the scale of tokenized assets expanding by hundreds of times since 2020, the transaction fee income of the Ethereum network has hardly increased. The reason is not complicated: network upgrades have improved processing efficiency, reducing the cost per transaction; a significant amount of stablecoin activity is flowing to other public chains.

The fundamental issue is that most financial assets being tokenized are "lying still," and their low-frequency circulation cannot contribute sufficient income to the ETH network. You can record trillions of dollars in bonds on-chain, but if they only trade once a year, that value is less than a single USDT transfer.

The imagined "asset on-chain = ETH appreciation" is being eroded in reality by chains like Solana, Arbitrum, and Tempo, with Tether even building its own Plasma and Stable chains, keeping trading volume within its own ecosystem. All of this indicates that ETH's positioning as a "financial base" is facing substantial challenges.

2. The Metaphor of "Digital Oil" Is Not Accurate

Tom attempts to liken ETH to "digital oil," presumably to create a narrative of an indispensable, steadily growing resource. However, anyone familiar with commodity markets knows that oil prices, adjusted for inflation, have essentially fluctuated within a wide range for over a hundred years. Its increases are often due to short-term disturbances like geopolitical conflicts and supply-demand mismatches, followed by rapid declines.

So if ETH is indeed a digital commodity, from an investment perspective, it resembles a cyclical asset, with no logical support for sustained long-term appreciation. This metaphor does not bolster Tom's bullish argument; rather, it exposes his lack of deep thought regarding "analogies."

3. Institutional Buying and Staking of ETH? Pure Fantasy

Tom also claims that future financial institutions will buy large amounts of ETH for staking, thereby enhancing the chain's security and serving as some form of operating capital. This statement sounds grand but is starkly unrealistic.

So far, no major bank or asset management institution has announced plans to include ETH on their balance sheets, nor has anyone suggested doing so. Let alone the completely unrealistic notion of using ETH as "operating capital." Would banks hoard gasoline due to constantly paying energy costs? No, they only pay when needed. Would banks buy stocks of the asset custodians they use? No. Therefore, the logic of institutional buying ETH does not hold.

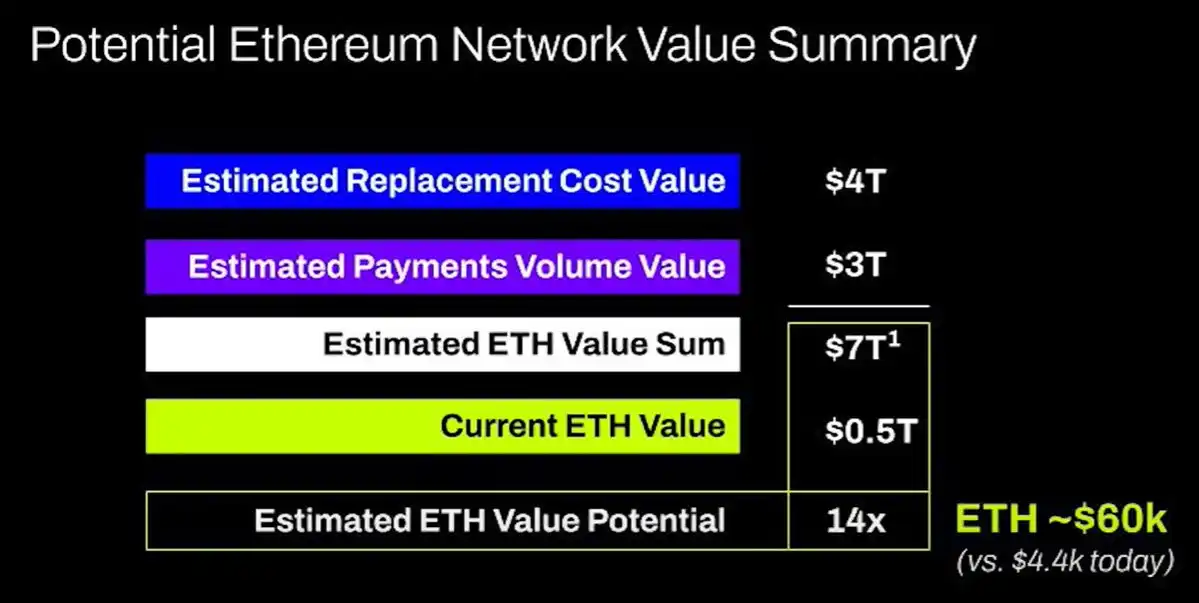

4. ETH Equals the Total Value of All Financial Infrastructure Companies? Absurd

Tom's valuation model can almost be described as "absurd." He claims that the value of ETH will ultimately equal the sum of all financial infrastructure companies. This statement is completely detached from the reality of value capture logic.

5. Technical Analysis

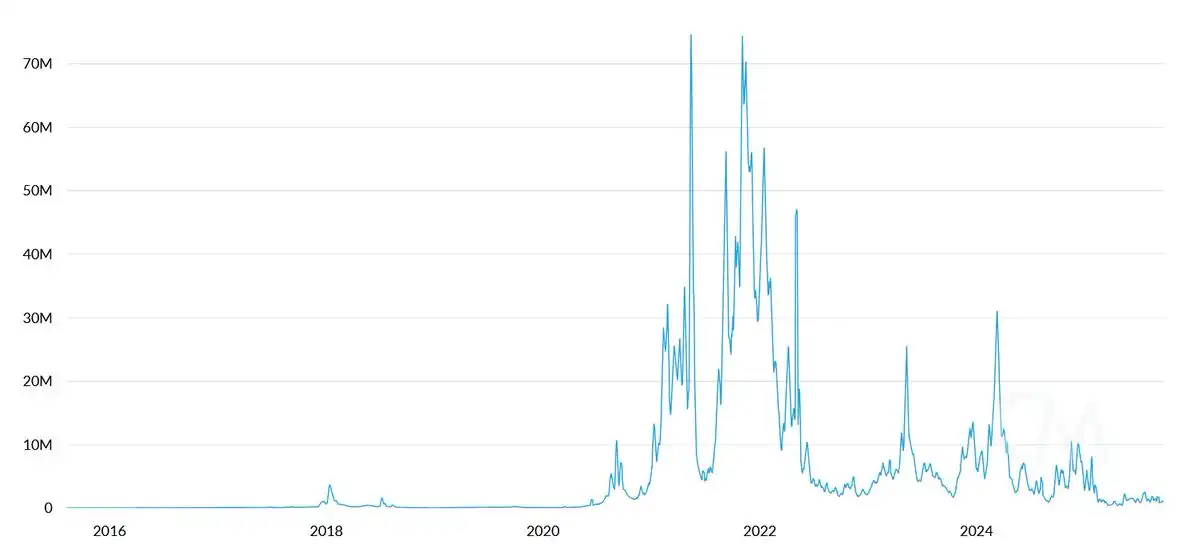

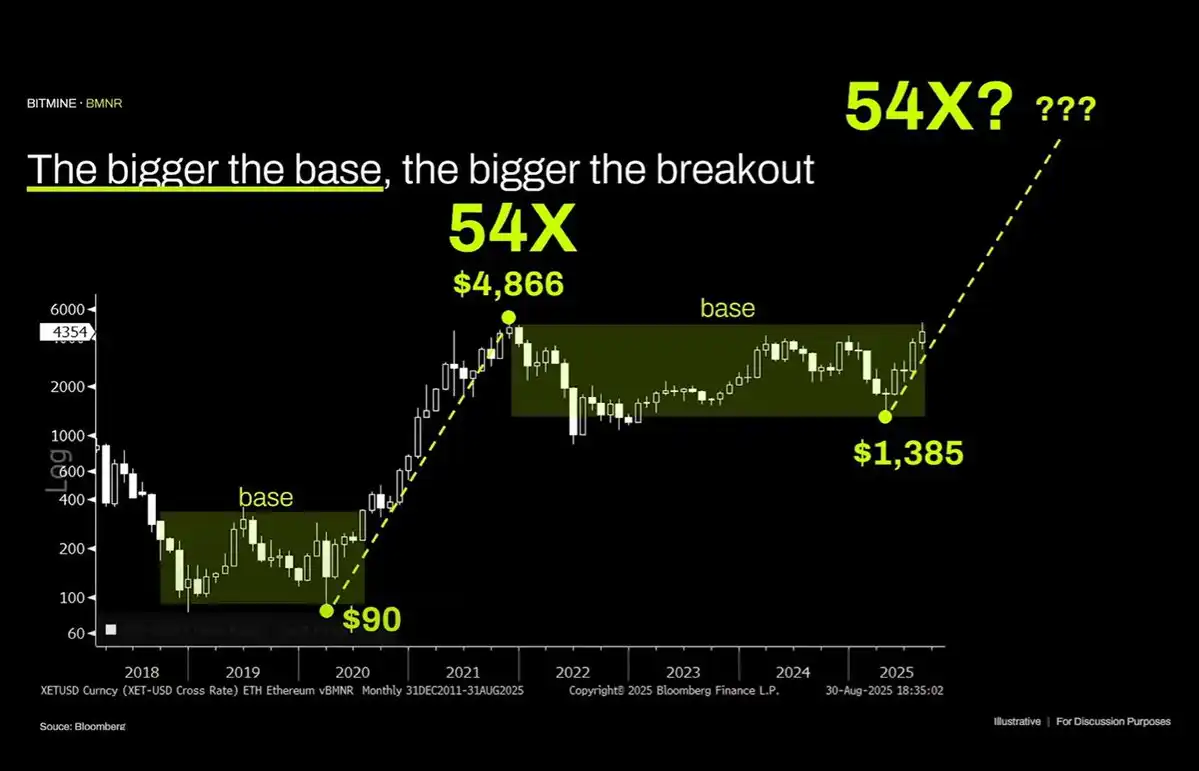

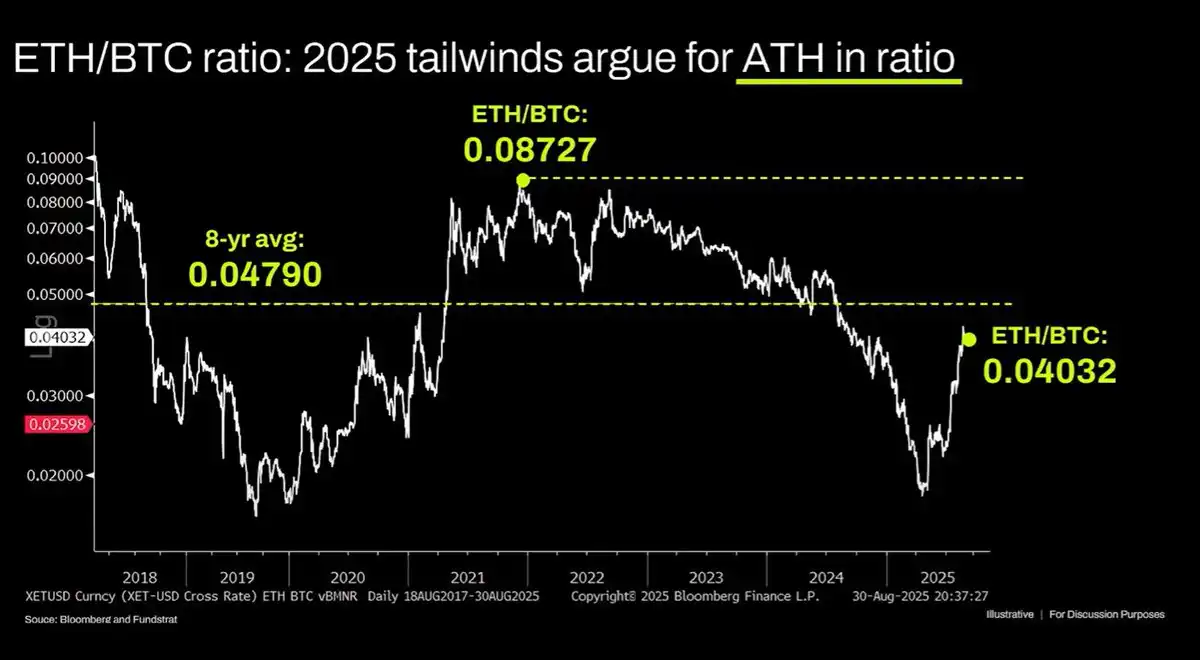

Finally, Tom presented technical analysis (TA) to endorse ETH, attempting to use trend lines and breakout signals to demonstrate its upward potential. However, from a structural perspective, ETH is clearly still within a multi-year sideways range, and the most recent rise was ruthlessly pushed back after reaching the upper boundary. This is no different from the wide-ranging fluctuations of oil prices over the past thirty years—merely in a range-bound oscillation, with recent attempts to break through resistance failing after reaching the upper range. From a technical standpoint, ETH is showing bearish signals, and the possibility of it oscillating in the long term within the $1,000 - $4,800 range cannot be ruled out.

The occurrence of a parabolic rise in the past for an asset does not mean that such a trend will continue indefinitely.

If this means anything, it can only indicate that ETH is falling into a "wide-ranging oscillation fate" similar to oil. Over the past three years, the relative price of ETH/BTC has actually been on a downward trend, with only a brief rebound near long-term support recently. The fundamental reason has not changed: Ethereum's core narrative has become saturated, and there has not been enough new structural force to support a valuation breakthrough. If ETH's high valuation comes from somewhere, it is more a bubble built on the frenzy of financial illiteracy. This bubble may expand for a long time, just as XRP once did, but it ultimately cannot escape the return of value laws forever.

How to View This Debate

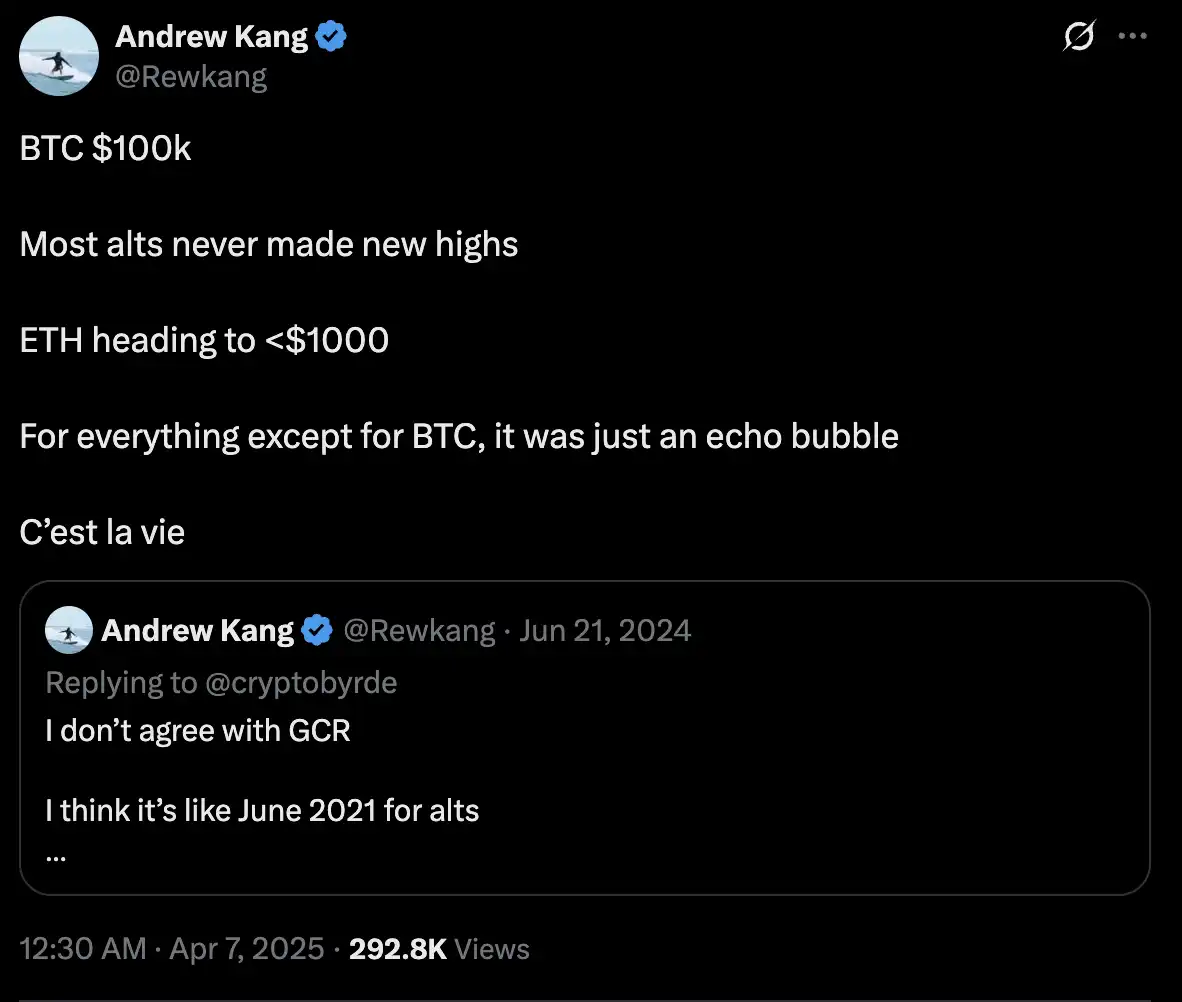

Andrew Kang's points are indeed quite persuasive in the current fragile market sentiment, especially his questioning of ETH's value capture ability, which strikes at the anxiety of many investors. However, it should not be taken at face value—looking back to April, when ETH was still at a low, Kang boldly predicted it would fall below $1,000, while in this bull market, ETH once broke through $5,000, far from his initial pessimistic prediction.

However, this debate surrounding the logic of ETH's value has transcended the price dispute itself and will have far-reaching implications for the future trajectory of the entire crypto market. During the three months of ETH's rise, the "Wall Street faction" represented by Tom Lee dominated the discourse and even the pricing power of ETH—he attracted a large number of institutions and retail investors with grand narratives like "digital oil" and "global financial infrastructure." In contrast, the counterattack led by Andrew Kang, a native crypto figure, attempts to awaken the market's awareness of another dimension: Are we holding overly high fantasies about ETH's future?

If Andrew Kang's arguments resonate with the market, the biggest beneficiaries will be high-throughput, low-fee public chains represented by Solana, or Ethereum Layer 2 solutions represented by Arbitrum. Even stablecoin issuers like Tether have launched public chains like Plasma for USDT value capture. Projects that have achieved multi-chain deployment or are exploring cross-chain ecosystems will also gain an advantage in the multi-chain future due to their flexibility. If ETH's performance continues to deviate from the grand goals set by Tom Lee, then his reputation and the valuation and balance sheet of his "ETH Micro Strategy" Bitmine will face certain challenges.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。