原文标题:《Base 再陷争议:从 L2 算不算交易所到排序器中心化的激辩》

原文作者:Eric,Foresight News

有「加密妈妈」之称的美国证券交易委员会(SEC)委员 Hester Peirce 在《The Gwart Show》中表示,依赖中心化排序器的 L2 可能符合 SEC 对交易平台的定义,因此运营者必须在 SEC 注册并遵守相关规定。

Hester Peirce 表示做出这种判断的关键并非技术而是实际的功能,若存在单一运营方掌握撮合引擎,那么就与交易平台相似。某种程度上,这就意味着只要存在对 L2 有交易控制权限的中心化组织,该组织就需要接受 SEC 的监管。

起初这个观点并没有引发广泛的讨论,但在不断的发酵下,很多人开始担心如果「加密友好」的 SEC 尚且会得出这样的结论,那么 L2 的发展可能会受到阻碍。集合了交易平台与 L2 两个要素的 Base 首当其冲成为了众矢之的。

随着 FUD 的声音越来越大,Coinbase 首席法律官 Paul Grewal 率先站出来发声,他表示,SEC 将交易平台定义为一个连接证券买卖双方的市场,但 L2 是作为基础设施运行的通用区块链可以为链上的交易平台提供服务,就像 AWS 为交易平台提供基础设施,但不能说 AWS 是交易平台一样。Paul Grewal 认为如果为排序器贴上了错误的标签可能会使得 L2 在可扩展性方面的作用被忽视。

之后,Base 负责人 Jesse Pollak 也在 X 上对排序器进行了解释,其表示排序器会收集用户交易后按照先进先出原则排序并计算结果状态变化,最终再将交易集中到 L1 上进行结算,就像交通管制员确保道路畅通。Jesse Pollak 辩称,排序器并不会去匹配订单交易,对交易的匹配发生在智能合约层面,排序器仅仅是确保这些交易以一致、有序的方式进行。

以太坊联创 Vitalik Buterin 在 Jesse Pollak 之后也加入了讨论,Vitalik 认为 Base 就是单纯的运行在以太坊之上的 L2,通过中心化功能提供更强大的用户体验,同时仍然与以太坊的去中心化基础层紧密结合,以确保安全。Vitalik 强调,Base 的资金是「非托管」的,意味着 L2 上的资金最终是由 L1 控制,不会被 L2 运营商窃取。

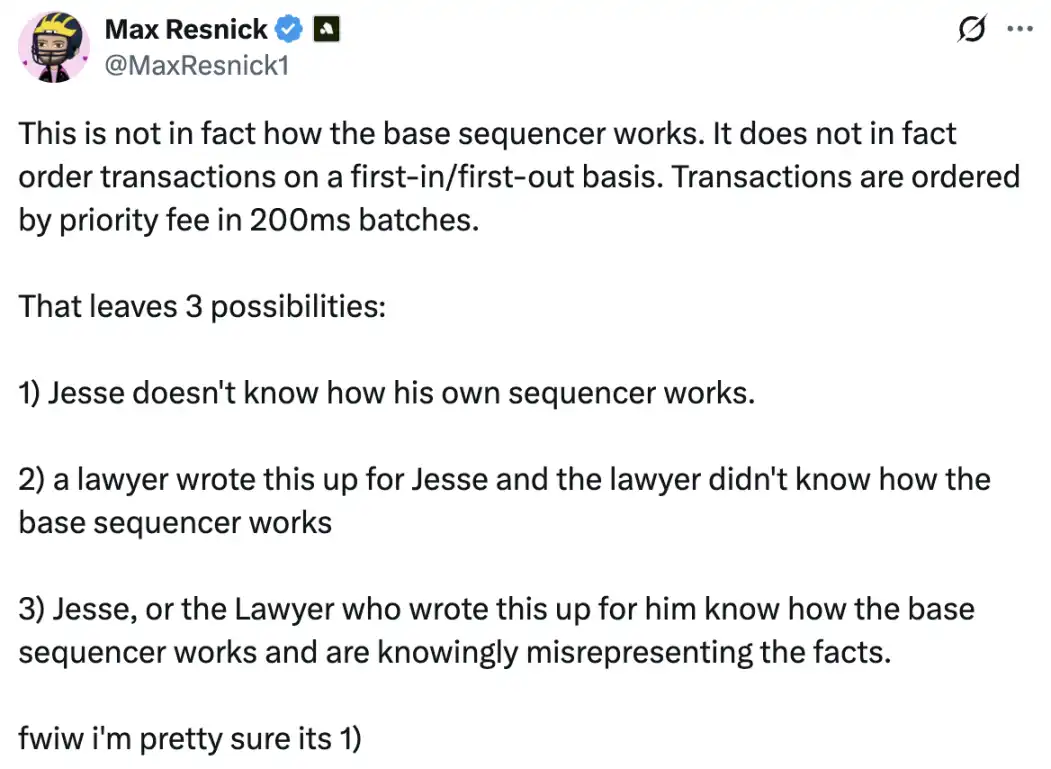

专注于 Solana 的研发公司 Anza 的首席经济学家 Max Resnick 就针对 Jesse Pollak 的说法提出了质疑,Max Resnick 表示 Base 的排序器是以 200 毫秒为单位以优先级费用对交易进行排序,并非是遵循先进先出原则。虽然之后 Jesse Pollak 对此进行了解释,但很明显 Max Resnick 想要表达的关键点就是排序器是可以按照某些规则对交易重新排序的,直指排序器中心化的问题。

对于类似 Base 这样的 L2 算不算一个交易平台的讨论其实不会产生太多的不同观点,SEC 委员出现「L2 是交易平台」的观点可能是因为其对 L2 架构的了解并不清楚。行业内的讨论也更多地出于监管担忧而不是是非问题。但 Base 利益相关方和 Vitalik 的观点却引发了另一层的讨论:Base 排序器的中心化是否应该改变?

从监管问题到排序器中心化的争论

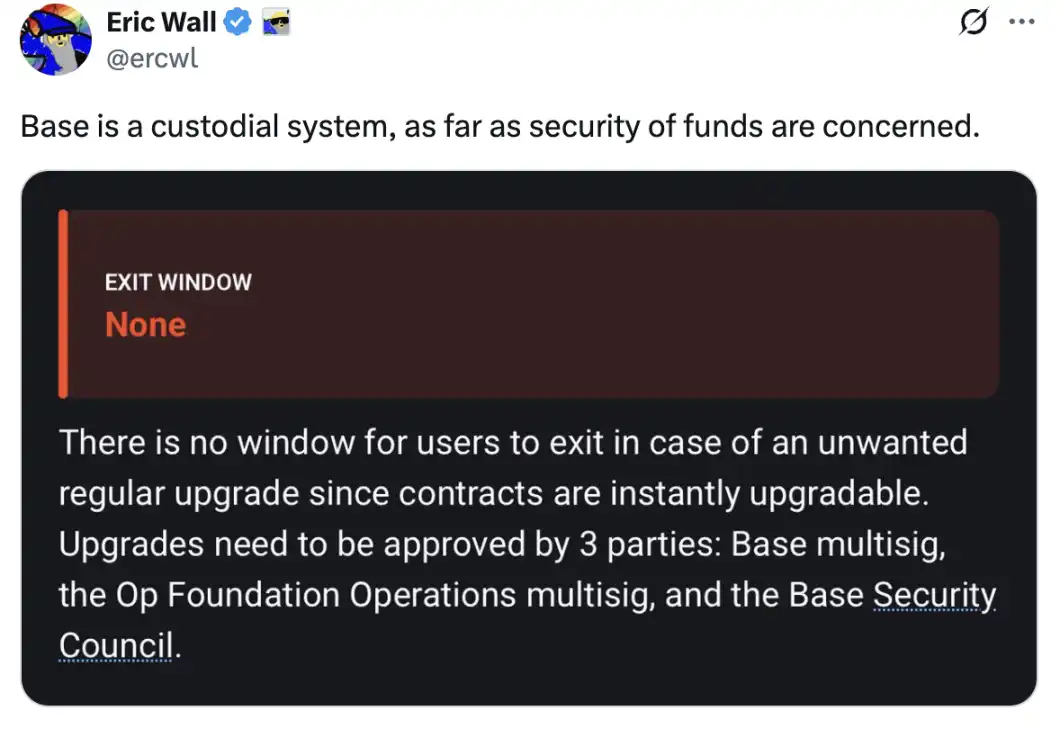

Vitalik 观点中认为 Base 中心化排序器是为了可扩展性和用户体验也引发了大量的争议。Taproot Wizards 联合创始人 Eric Wall 表示,就资金安全而言,Base 就是一个托管系统,并指出 Base 的合约仍然可以通过治理进行升级,这意味着运营商及其相关实体(通过安全委员会)保留了相当大的自由裁量权。在他看来,这使得 Base 在功能上更接近于托管系统,而不是完全信任最小化的以太坊扩展。Eric Wall 还在评论区表示,Vitalik 发表观点的措辞会让读者认为即使出现密钥泄漏也不会导致资金损失,如此表达很不负责任。

前以太坊核心开发者 Lane Rettig 则表示,虽然 Coinbase 本身不会恶意盗取用户资金,但这并不代表着 Coinbase 不会在政府的压力下作出不利于用户的行为。

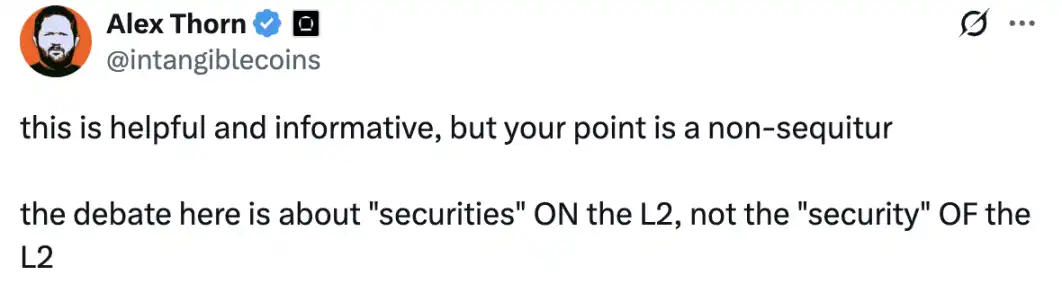

Galaxy 研究主管 Alex Thorn 认为 Vitalik 的观点并没有切中要点,其表示,讨论的重点应是 L2 上的证券(securities),而不是 L2 的安全性(security)。虽然 Alex Thorn 没有明示,但其观点却指向了一个非常致命的问题:L2 本身并非交易平台,但如果 L2 上的交易平台是建立在一个非常中心化的链上,那么这些交易平台是否还能被称为 DEX 以及是否应该受到监管?

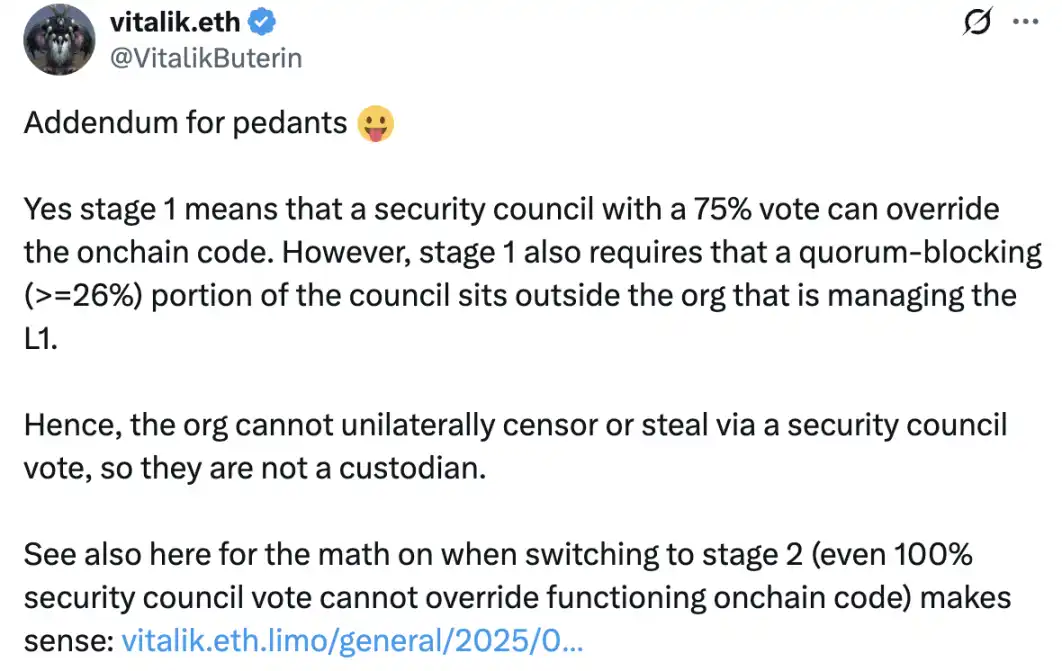

针对越来越多对 Base 中心化的诟病,Vitalik 再次表示,Base 目前确实处在一个中心化的阶段,即安全委员会的绝对多数投票可以升级合约,但他指出,法定人数阻止规则阻止 Coinbase 单方面审查或盗取资金。此外,即使 100% 的安全委员会投票也无法更改正在运行的链上代码的第二阶段也在规划之中。

正在开发 Cardano L2 Midgard 的 Anastasia Labs 创始人在 Vitalik 的补充评论下犀利地发表了「解读」:将「安全委员会」理解为「多重签名」;将「75% 投票」理解为「7 个私钥」;将「要求委员会中可以通过大于 26% 投票权否决提案的个人独立于管理 L2 的组织之外」理解为「要求该组织使用空壳公司、朋友的公司、经过混淆的子公司或合作伙伴公司来持有多重签名所需的 3 个私钥」。

评论区有很多支持 Anastasia Labs 创始人观点的用户,他们都认为虽然规则如此制定,但想要绕过规则来实现对 Base 的完全控制非常简单,治理的不透明化让这些透明的规则显得非常不可信。

Web3 基础设施的监管难题

Base 作为 L2 过于中心化曾多次引发讨论,此次 SEC 委员所表达的观点看似略显「荒谬」,但也直指问题的核心:如果 L2 上的交易排序可以被随意操控,那么这个 L2 就应该受到监管。当然,将 L2 作为交易平台进行监管表面上看那缺乏依据,但如果 L2 的运营方通过对排序器的控制将 MEV 收益收入囊中影响交易执行价格等,那么 L2 某种程度上确实扮演着类似券商的角色。

对于监管机构而言,如何判定基础设施的「去中心化」是一个难题,即使排序器实现了去中心化,但这些维护排序器网络的实体之间是否有利益相关等问题很难在短时间内弄清楚。担心因缺乏监管而导致 FTX 悲剧重演的 SEC,虽然在美国新任总统任期内一定程度放松了监管,但其本身也难掩对于监管放松而产生重大风险的担忧。近期美国监管机构推出了针对 DeFi 的一些豁免条款,但对于基础设施应该如何定义和审查,还是一个需要研究的问题。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。