Original Title: "Are Traditional Banks Facing Their 'Deadline'? Tether's $500 Billion Valuation Challenges OpenAI!"

Original Source: BitpushNews

A financing announcement from stablecoin giant Tether is enough to make the entire traditional financial sector hold its breath.

According to Bloomberg, this "central bank of the crypto world," which manages nearly $173 billion in USDT, is seeking to raise $15-20 billion in a round of private financing at a valuation of up to $500 billion.

What does this number mean? It means that Tether's scale will directly rival global top tech unicorns like OpenAI and SpaceX, and its staggering $4.9 billion in net profit for a single quarter puts many established financial institutions to shame. This is not just financing; it is a value declaration from an "invisible giant" that has risen from the crypto world, officially challenging the traditional financial system.

$500 Billion Valuation: A Bold Number Game

Tether's audacity in proposing such a bold valuation stems from its unshakeable core advantages:

· Absolute Market Dominance: Tether's USDT, with a market cap of approximately $172.8 billion, firmly holds the top position in the stablecoin market and serves as the de facto settlement currency in the crypto world. Its daily trading volume easily surpasses hundreds of billions of dollars, creating the deepest liquidity moat.

· Astonishing Profitability: In the second quarter of 2025, Tether reported a net profit of $4.9 billion, with reserve assets reaching $162.5 billion, exceeding liabilities of $157.1 billion, showcasing a robust financial condition. This massive profit largely comes from its holdings of high-yield U.S. Treasury bonds.

Behind the Frenzy: A Zero-Sum Game

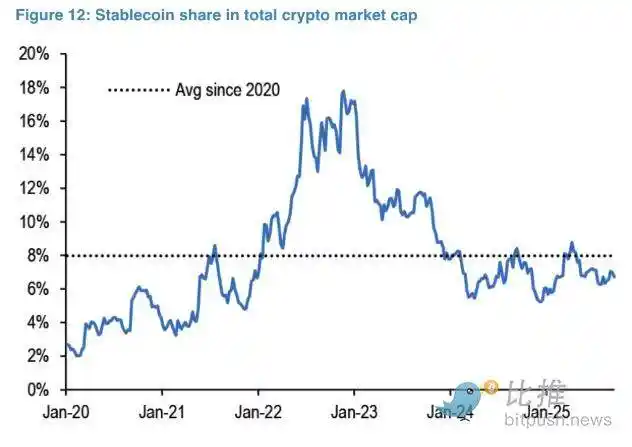

Despite Tether's dominance in scale and profitability, competition in the stablecoin space is unprecedentedly fierce. A report from JPMorgan analysts indicates that the total market cap of stablecoins is growing in tandem with the overall crypto market cap, suggesting that this is a "zero-sum game"—the primary task of issuers is to compete for market share rather than expand the overall pie.

This "arms race" is unfolding across multiple dimensions, with challengers attempting to carve out a share from Tether and Circle's dominance.

Tether's Strategic Adjustment: USAT Compliance Counterattack

In response to regulatory and competitive threats, Tether is undergoing a strategic adjustment. It plans to launch a new stablecoin called USAT, aimed at fully complying with the recently passed U.S. "GENIUS Act." This differs from Tether's existing USDT, of which about 80% of reserves meet the act's requirements.

· Anchoring Compliance: The reserves of USAT will be held by institutions like Anchorage Digital, which holds a banking license, helping Tether build institutional trust, reduce reliance on third-party banks, and avoid risks similar to those Circle faced during the 2023 Silicon Valley Bank crisis.

· Key Personnel Additions: Tether has appointed Bo Hines, the executive director of Trump's "Digital Assets Advisory Committee," as its CEO for U.S. operations. Hines was a key figure in cryptocurrency policy during the Trump administration, helping to push through the "GENIUS Act," which provides a new regulatory framework for stablecoins, directly related to Tether's plan to launch the compliant stablecoin USAT.

· Close Ties with Trump Allies: Tether's main reserve asset custodian is Cantor Fitzgerald, whose former CEO Howard Lutnick is the current U.S. Secretary of Commerce. This endorsement at the highest political level provides Tether with a significant trust advantage in expanding its presence in the U.S. market.

· Profit Maximization: By directly managing the reserves of USAT, Tether aims to retain more interest income, thereby enhancing profit margins and further strengthening its business model.

These initiatives indicate that Tether is shifting from a strategy of "regulatory evasion" to one of "actively embracing" and even "shaping" regulation. If Tether can successfully operate under U.S. regulation, it would not only eliminate its biggest valuation obstacle but also bring substantial credibility, attracting a broader range of institutional funds.

Actions from Other Competitors

In the face of multiple challenges, Tether's main competitor Circle is also not sitting idle. It is building a dedicated stablecoin blockchain called Arc, aimed at firmly locking USDC at the center of the crypto ecosystem by optimizing speed, security, and interoperability. It has partnered with payment giants like Visa to explore using USDC for merchant payments on blockchains like Solana.

Fintech giants have also recognized the enormous potential of the stablecoin market and are entering the fray. Companies like Robinhood and Revolut are reportedly developing their own stablecoins, attempting to leverage their large user bases and established financial infrastructures to directly challenge existing stablecoin issuers.

The decentralized finance (DeFi) sector is also launching a challenge against stablecoin hegemony. As one of the most popular DeFi protocols, Hyperliquid is preparing to launch its native stablecoin USDH to reduce reliance on Circle's USDC. J.P. Morgan analysts note that Hyperliquid's perpetual contract exchange currently accounts for 7.5% of the total USDC usage. Once USDH successfully launches and establishes liquidity, this market share could shift directly from USDC, posing a significant threat to Circle.

Conclusion: A Bold Gamble or a New Financial Giant?

As Tether's $500 billion valuation rivals that of AI giant OpenAI, what we see is not just the rise of a company, but a revolution in the financial paradigm. The intermediary model that traditional banks rely on for survival is being completely disrupted by the global instant settlement capabilities of stablecoins.

This is no longer simple competition; it is a dimensional strike. Tether declares to the world with its actual valuation: the future of finance does not belong to concrete and steel bank buildings, but to a globally liquid network built on code. Banking services no longer need branches; they only require a crypto wallet.

Just as the internet allowed information to flow freely, the stablecoins represented by Tether are enabling value to flow freely. When financial infrastructure becomes as simple as sending an email, how much survival space is left for traditional banks? The answer may be hidden within Tether's astonishing valuation.

This silent financial revolution has arrived, not in the future tense, but in the present continuous tense.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。