Since its establishment in 2017, OpenSea has been the core platform of the NFT market. It offers basic functions such as minting, trading, and auctions, and has gradually expanded into token trading, cross-chain interactions, and AI tools. As one of the earliest comprehensive NFT trading platforms, OpenSea not only carries most of the NFT traffic but also has formed an early reference framework for fee models and market rules, with its data performance seen as an important indicator for observing NFT development trends.

Currently, the heat of the NFT market has significantly cooled down. By early 2025, OpenSea's monthly trading volume was approximately $195 million, a reduction of about 96% from the nearly $5 billion peak in early 2022. Against the backdrop of declining liquidity and user activity, OpenSea will announce the TGE details of its native token SEA in early October 2025. This move not only marks a new phase in the platform's development but is also seen as an important attempt to rebuild user stickiness and market vitality through tokenization incentives during a downturn. In the following text, the CoinW Research Institute will analyze OpenSea's final incentive mechanism and on-chain data performance before the TGE.

- Pre-TGE Incentive Plan

1.1 Final Reward Activity Details

Starting from September 15, OpenSea launched the final reward phase, injecting 50% of all platform trading fees into the reward pool, which includes a 1% NFT trading fee and a 0.85% token trading fee. This means that the platform's revenue is directly linked to the size of the reward pool; the more active the trading, the higher the potential earnings distributed to users. At the same time, the official has additionally invested an equivalent of $1 million in Optimism (OP) and Arbitrum (ARB) into the vault.

In terms of specific participation methods, a treasure chest upgrade mechanism is adopted, where users start from level 1 chests and accumulate experience points through cross-chain trading, daily tasks, and supply collection, with a maximum upgrade to level 12. The higher the level, the larger the share of rewards. Through task-based and tiered design, the platform can concentrate and amplify trading and community activity in the short term. This incentive activity can enhance initial liquidity and strengthen users' long-term expectations for token distribution.

1.2 Other Major Updates Before TGE

Alongside the launch of the final reward plan, OpenSea has recently undertaken a series of strategic layouts and product updates to prepare for the upcoming token issuance.

① Acquisition of Rally and Focus on Trading Functions

In July, OpenSea completed the acquisition of mobile wallet company Rally, marking its transformation from a single NFT marketplace to a comprehensive on-chain asset trading platform. This acquisition brought more complete token trading tools, including portfolio tracking, candlestick charts, and faster price updates. OpenSea stated that these updates are part of an overall strategy, with the future goal of allowing users to complete both NFT and token trading on the platform, gradually creating a one-stop entry for on-chain assets.

Source:@chrismaddern

② Launch of Mobile Application and AI Tools

To align with its expansion strategy, OpenSea launched a new mobile application in early September, allowing users to manage wallets and asset portfolios in a single interface. The mobile application also integrates AI-driven portfolio analysis and trading assistance tools, which can provide real-time market data, strategy suggestions, and asset insights, helping newcomers lower the operational threshold while providing deeper data support for professional traders.

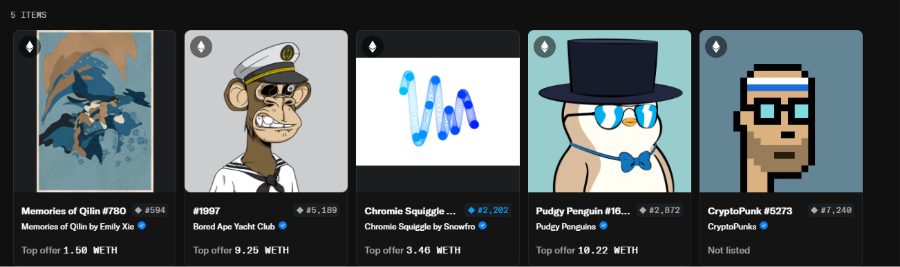

③ Creation of Flagship NFT Series

OpenSea simultaneously announced the establishment of a flagship NFT series with a budget of over $1 million, aimed at acquiring NFTs with historical significance and cultural value. So far, acquired collectibles include CryptoPunk #5273, Pudgy Penguin #1647, Memories of Qilin #780, Chromie Squiggle, and Bored Ape Yacht Club #1997. This series serves both as a preservation of Web3 cultural heritage and as a long-term commitment released by the platform during a downturn.

Source:opensea

- On-Chain Data of the Platform

2.1 User Participation

Since the launch of the reward activity, the activity level on the OpenSea platform has indeed rebounded, but the overall participating group still mainly consists of existing NFT users and airdrop participants, without attracting a significant number of new users. A large number of loyal users are actively accumulating points (XP) through trading and tasks, hoping to gain a larger share of rewards when the SEA token is issued. From the task completion situation, most active users have completed at least one round of tasks and have upgraded their treasure chest levels to 7-9 during the mid-activity phase.

From the XP data distribution, it can be observed that approximately 698,400 wallets have accumulated XP, with total points exceeding 2.1 billion, averaging about 3,052 XP per wallet, with a median of about 1,750 XP. In terms of distribution structure, users with lower points account for an absolute majority, with 28.5% of users having points below 500 XP. This indicates that most users are only engaging in basic tasks or light interactions, with the truly deeply engaged group being relatively limited. Unlike the airdrop frenzy seen with Blur in previous years, this activity has not triggered a large-scale volume manipulation, partly because OpenSea has linked the reward mechanism to long-term loyalty, suppressing short-term arbitrage behavior; on the other hand, the overall downturn in the NFT market has kept speculative funds cautious, leading users to prefer completing small, frequent tasks.

Source:projectxbuild

2.2 On-Chain Trading Volume

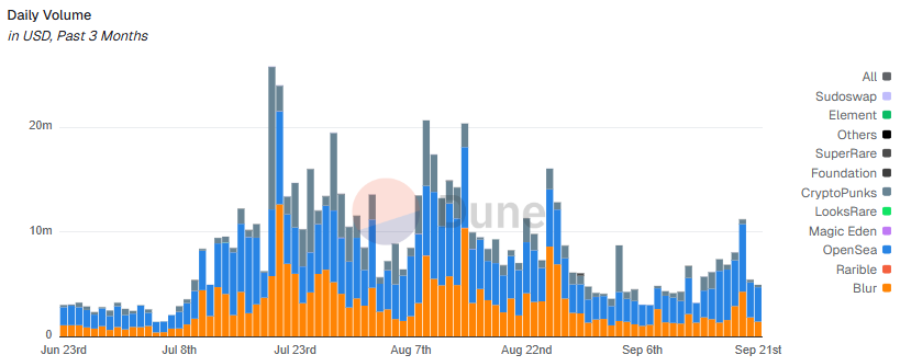

From on-chain data, OpenSea still holds about 62% of the market share. Since the launch of the final TGE pre-incentive activity, while the platform's trading volume has seen some rebound, the overall extent is limited, and no significant breakthroughs have occurred. To ensure that the TGE can generate strong momentum, OpenSea still needs to convert this limited rebound into more substantial and sustained trading growth and user participation.

Source:Dune

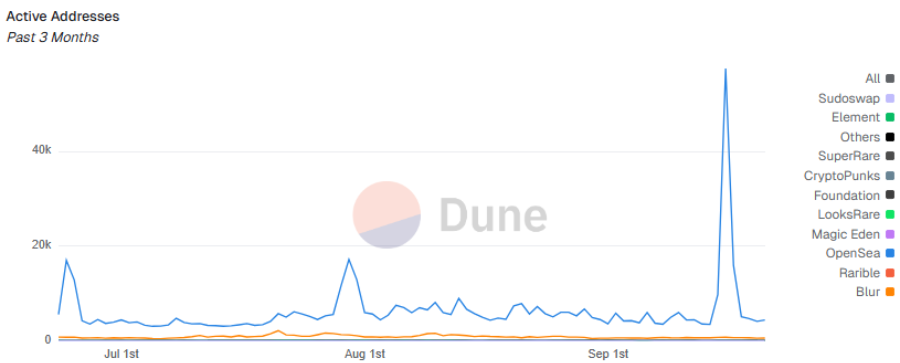

From the daily active address data, OpenSea saw a peak of nearly three months on September 16, the day after the incentive activity announcement, with the number of active addresses reaching 57,536, while the second-ranked Blur had only 730 active addresses that day, showing a stark contrast. However, this peak did not continue, and the enthusiasm quickly receded after the activity started, with OpenSea's daily active addresses currently down to about 5,000.

Source:Dune

- Main Focus Points of the SEA Token

3.1 Profit Game Under Airdrop Rewards

As a leader in the NFT field, the potential value of OpenSea's token airdrop has sparked countless imaginations among users. In fact, since the platform hinted at issuing tokens in early 2025, many users have begun actively trading and interacting in hopes of qualifying for future airdrops. With the launch of the final reward phase, user participation enthusiasm has been concentrated, with many users enhancing their treasure chest levels by completing tasks, waiting for the official distribution plan to be revealed. However, behind this enthusiasm, participants also have to face hidden costs, including transaction gas fees and service charges.

On the other hand, OpenSea's pre-TGE activity adopts a seasonal competition mechanism, with the first phase continuing until mid-October, and more seasons to follow. This airdrop activity reflects the psychological game between the platform and the market. Loyal users hope to gain higher weight through long-term interactions, while short-term arbitrageurs are looking for low-cost volume manipulation opportunities. OpenSea has introduced tiered tasks in its mechanism design to suppress short-term speculative behavior, but this also raises the participation threshold for genuine users. A deeper risk lies in the possibility of a trust crisis among users if the later reward distribution is not transparent or deviates too much, further weakening the platform's cohesion during a downturn.

3.2 OpenSea's Value Chain Reconstruction

The launch of SEA marks OpenSea's attempt to reconstruct its value chain, with its core role being to connect the platform's fee distribution, user incentives, and product matrix into a closed-loop mechanism. Users earn SEA tokens as rewards for trading, which can then be used to offset transaction fees, thereby continuously reinforcing users' motivation to use the platform in the cycle of trading, incentivizing, and re-trading. Therefore, SEA is no longer merely a subsidy but an embedded incentive mechanism in the trading cycle, aimed at driving user retention and activity.

However, this shift also breaks OpenSea's low-fee positioning. Since the launch of OS2 in May 2025, its transaction fee has been only 0.5%, lower than competitors like Blur, and is seen as a competitive pricing system. But currently, to expand the prize pool, its NFT and token trading fees have been raised to 1% and 0.85%, significantly increasing user costs during a market downturn. However, whether users will continue to bear higher fees in the future hinges on whether they can obtain more tangible returns through SEA. In the long run, the true test for SEA is whether it can genuinely activate the currently sluggish NFT market through adjustments in the profit mechanism and ecological linkage, reshaping OpenSea's user stickiness and market voice; otherwise, the current price increase strategy will only accelerate user attrition. This also means that the value assessment of SEA is not limited to the competition between NFT platforms but is about whether OpenSea can reconstruct its value chain during a market downturn and become a new engine driving the recovery of the NFT market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。